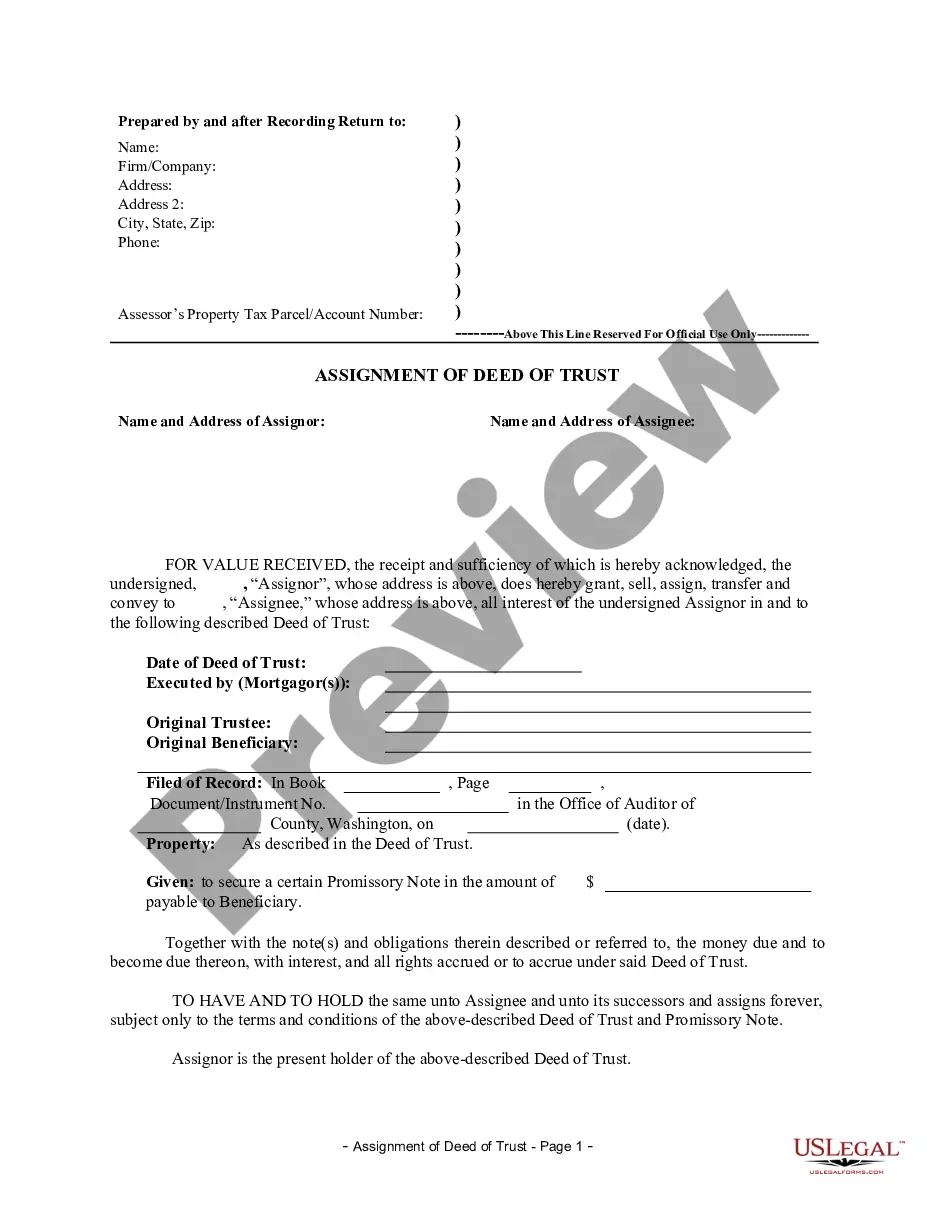

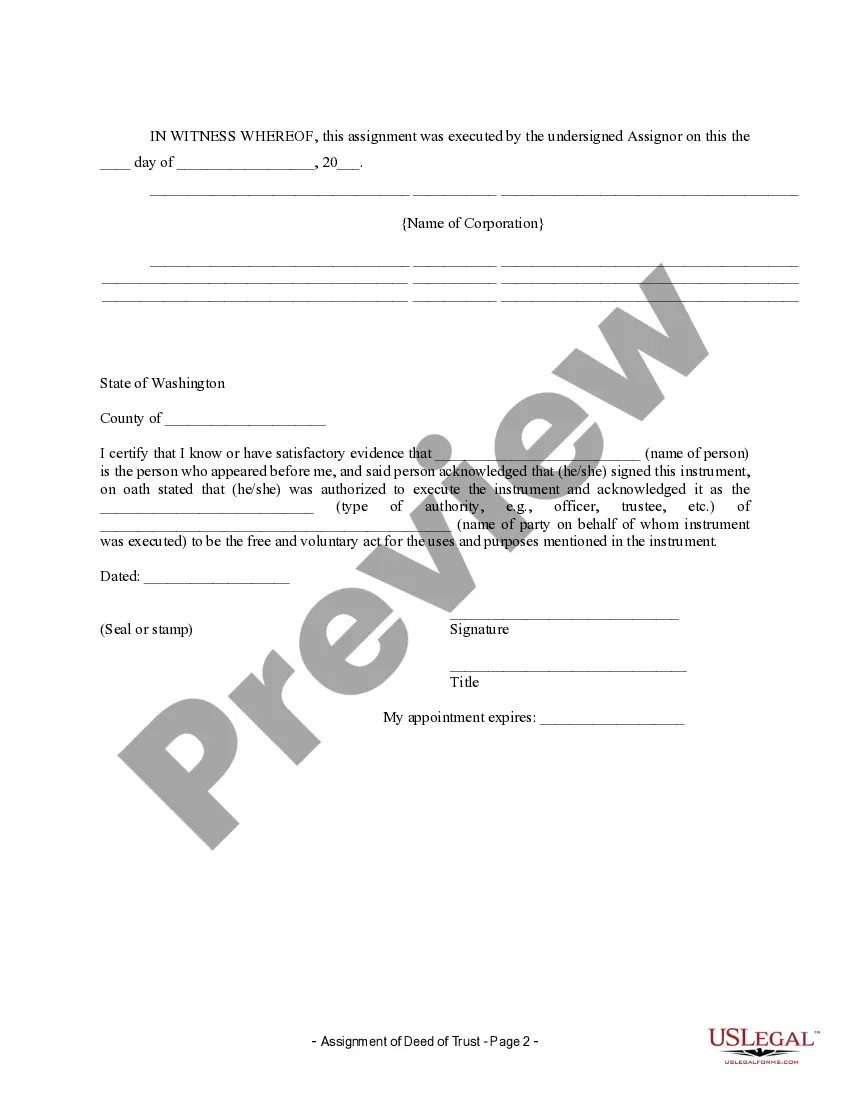

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Seattle Washington Assignment of Deed of Trust by Corporate Mortgage Holder refers to a legal document that transfers the rights and interest of a corporate mortgage holder to another party. This assignment typically occurs when a corporate mortgage holder wants to release their interest in a property by transferring their rights to a new owner or lender. Keywords: Seattle Washington, Assignment of Deed of Trust, Corporate Mortgage Holder, legal document, transfer rights, interest, property, new owner, new lender. In Seattle, Washington, the Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process governed by state laws. The document specifies the details of the assignment, such as the names of the parties involved, the property address, the outstanding loan balance, and the terms of the original mortgage. The corporate mortgage holder, which could be a company or a financial institution, is the entity that holds the mortgage on the property. By assigning the deed of trust, the corporate mortgage holder transfers their rights, title, and interest in the property to another party. There are various types of Assignment of Deed of Trust by Corporate Mortgage Holder in Seattle, Washington, depending on the specific circumstances: 1. Assignment to a new lender: This type of assignment occurs when the corporate mortgage holder decides to transfer the mortgage to a different lender. This often happens when the original lender wants to sell the mortgage to another financial institution or when the mortgage is refinanced. 2. Assignment to a new owner: In some cases, the corporate mortgage holder may assign the deed of trust to a new owner. This usually occurs during the sale or transfer of the property, where the new owner assumes the existing mortgage. 3. Assignment to a subordinate mortgage holder: If the corporate mortgage holder has multiple mortgage loans on the same property, they may assign the deed of trust to a subordinate mortgage holder. This could be another lender or a second lien holder who now has a claim on the property in case of default. It is important to note that the Assignment of Deed of Trust by Corporate Mortgage Holder must be formally recorded with the relevant county recorder's office in Seattle, Washington. This ensures that the transfer is legally binding and provides public notice of the new party having an interest in the property. In summary, the Seattle Washington Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document that allows a corporate mortgage holder to transfer their rights, title, and interest in a property to another party. Different types of assignments include transferring to a new lender, a new owner, or a subordinate mortgage holder. Proper recording of the assignment is essential to establish the new party's legal claim on the property.Seattle Washington Assignment of Deed of Trust by Corporate Mortgage Holder refers to a legal document that transfers the rights and interest of a corporate mortgage holder to another party. This assignment typically occurs when a corporate mortgage holder wants to release their interest in a property by transferring their rights to a new owner or lender. Keywords: Seattle Washington, Assignment of Deed of Trust, Corporate Mortgage Holder, legal document, transfer rights, interest, property, new owner, new lender. In Seattle, Washington, the Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process governed by state laws. The document specifies the details of the assignment, such as the names of the parties involved, the property address, the outstanding loan balance, and the terms of the original mortgage. The corporate mortgage holder, which could be a company or a financial institution, is the entity that holds the mortgage on the property. By assigning the deed of trust, the corporate mortgage holder transfers their rights, title, and interest in the property to another party. There are various types of Assignment of Deed of Trust by Corporate Mortgage Holder in Seattle, Washington, depending on the specific circumstances: 1. Assignment to a new lender: This type of assignment occurs when the corporate mortgage holder decides to transfer the mortgage to a different lender. This often happens when the original lender wants to sell the mortgage to another financial institution or when the mortgage is refinanced. 2. Assignment to a new owner: In some cases, the corporate mortgage holder may assign the deed of trust to a new owner. This usually occurs during the sale or transfer of the property, where the new owner assumes the existing mortgage. 3. Assignment to a subordinate mortgage holder: If the corporate mortgage holder has multiple mortgage loans on the same property, they may assign the deed of trust to a subordinate mortgage holder. This could be another lender or a second lien holder who now has a claim on the property in case of default. It is important to note that the Assignment of Deed of Trust by Corporate Mortgage Holder must be formally recorded with the relevant county recorder's office in Seattle, Washington. This ensures that the transfer is legally binding and provides public notice of the new party having an interest in the property. In summary, the Seattle Washington Assignment of Deed of Trust by Corporate Mortgage Holder is a legal document that allows a corporate mortgage holder to transfer their rights, title, and interest in a property to another party. Different types of assignments include transferring to a new lender, a new owner, or a subordinate mortgage holder. Proper recording of the assignment is essential to establish the new party's legal claim on the property.