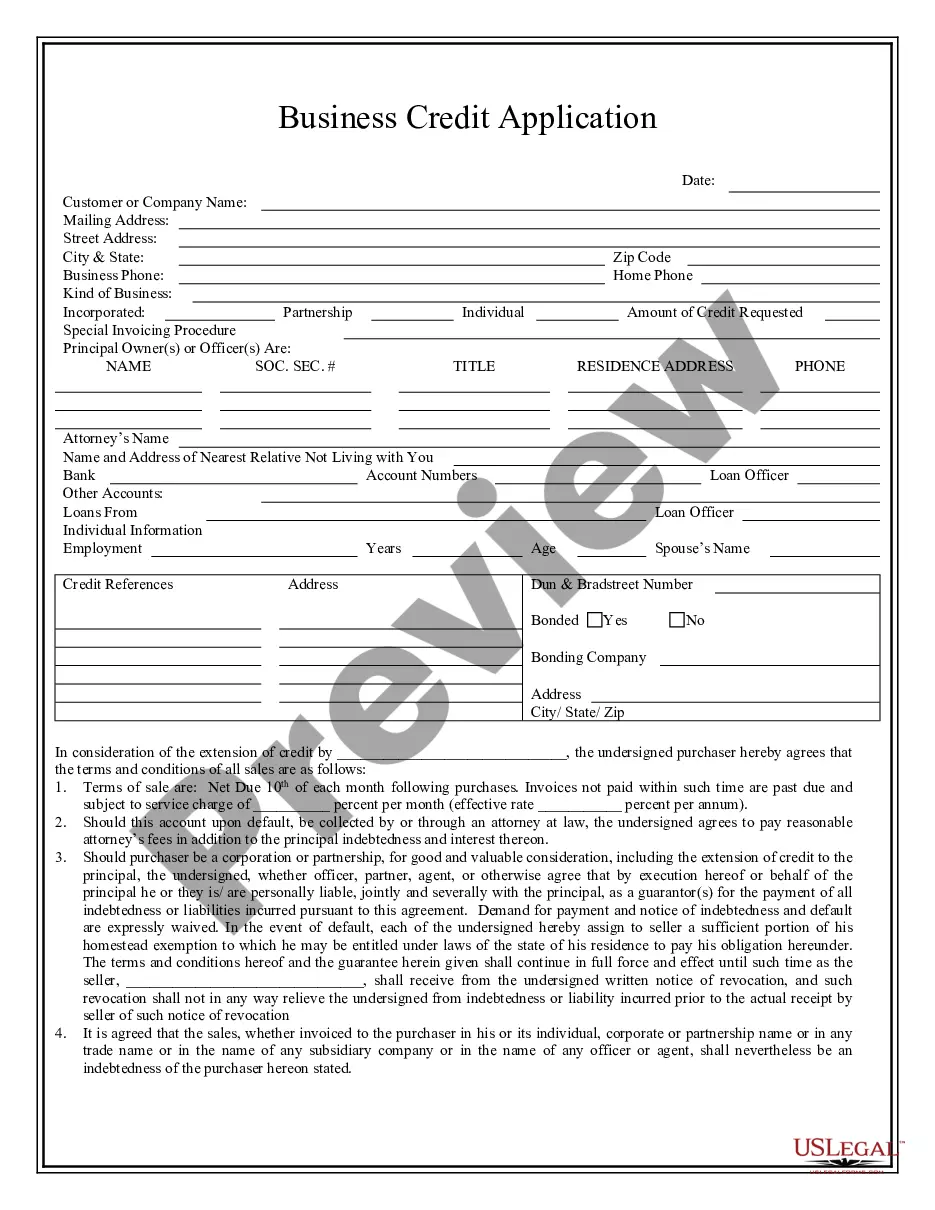

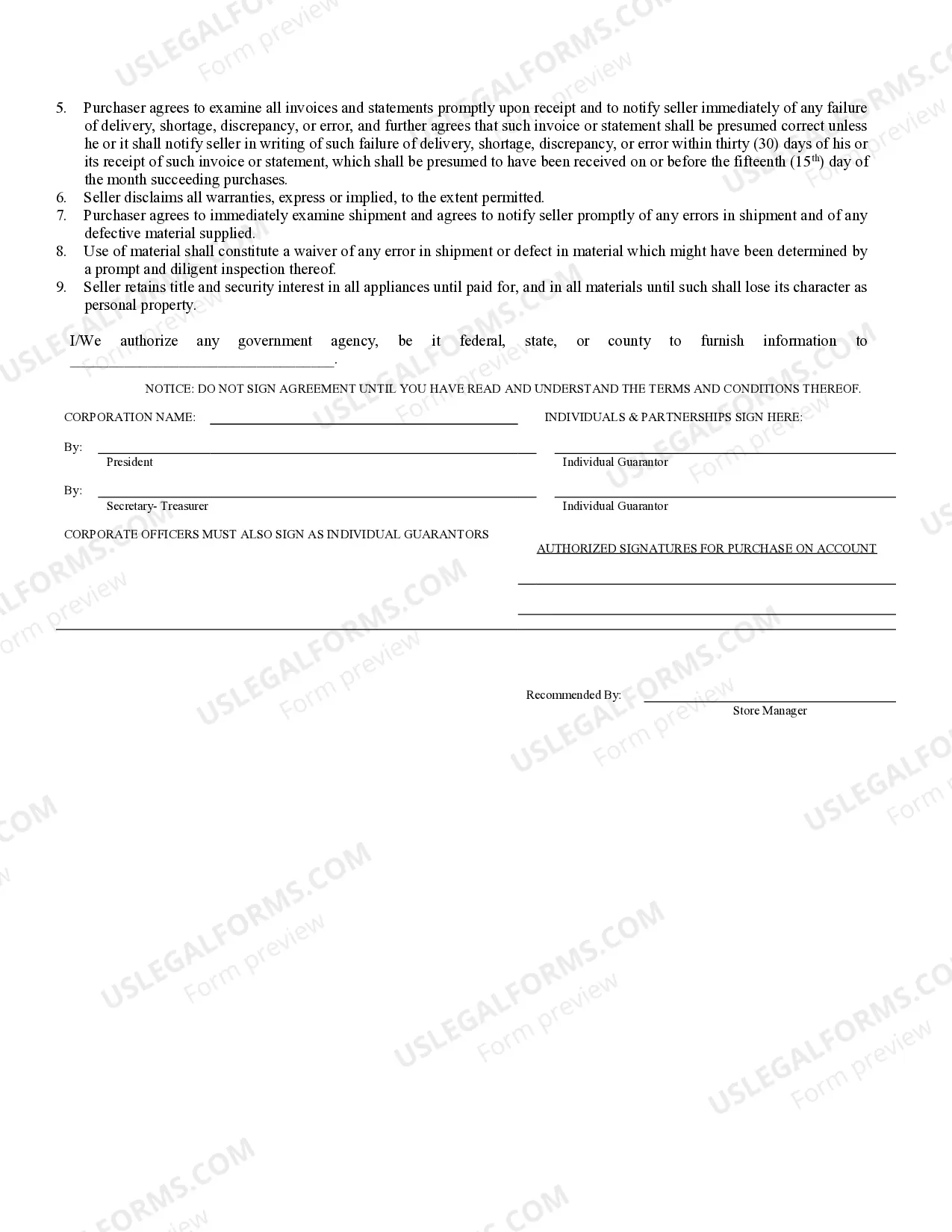

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Bellevue Washington Business Credit Application is a crucial document that enables businesses in Bellevue, Washington to apply for credit services. This application plays a significant role in establishing creditworthiness and facilitating financial transactions for businesses operating in the Bellevue area. Key factors in the Bellevue Washington Business Credit Application include detailed information about the applying business, such as the legal name, address, industry type, and contact details. The application usually requires essential financial data, including estimated annual revenue, assets, liabilities, and expenses. Additionally, businesses may need to provide information regarding their ownership structure, number of employees, and years in operation. The Bellevue Washington Business Credit Application allows businesses to request a specific credit amount or credit limit based on their needs. This credit can then be utilized to facilitate various financial operations, such as purchasing inventory, equipment, or raw materials, as well as covering operational expenses. Businesses in Bellevue, Washington can typically access different types of credit applications, depending on their specific requirements. Some common types of business credit applications in Bellevue include: 1. Bellevue Small Business Credit Application: This type of credit application is designed for small businesses operating in Bellevue, Washington. It usually caters to enterprises with limited revenue and fewer employees. 2. Bellevue Start-up Business Credit Application: Geared towards newly established businesses in Bellevue, this application is tailored to meet the unique financial needs of start-ups. It helps them secure the necessary funding to kick-start their operations. 3. Bellevue Corporate Credit Application: This type of credit application targets larger corporations and businesses in Bellevue, Washington, with significant revenue and a well-established financial track record. 4. Bellevue Retail Business Credit Application: Tailored specifically for businesses operating in the retail sector, this application takes into account the unique needs and challenges faced by retail establishments in Bellevue. By submitting a Bellevue Washington Business Credit Application, businesses can forge relationships with financial institutions, banks, or lenders who evaluate their creditworthiness and determine whether they qualify for the requested credit amount. Successful application approval can open doors to a wide range of financial opportunities, providing businesses with the necessary resources to thrive and expand their operations in Bellevue, Washington.Bellevue Washington Business Credit Application is a crucial document that enables businesses in Bellevue, Washington to apply for credit services. This application plays a significant role in establishing creditworthiness and facilitating financial transactions for businesses operating in the Bellevue area. Key factors in the Bellevue Washington Business Credit Application include detailed information about the applying business, such as the legal name, address, industry type, and contact details. The application usually requires essential financial data, including estimated annual revenue, assets, liabilities, and expenses. Additionally, businesses may need to provide information regarding their ownership structure, number of employees, and years in operation. The Bellevue Washington Business Credit Application allows businesses to request a specific credit amount or credit limit based on their needs. This credit can then be utilized to facilitate various financial operations, such as purchasing inventory, equipment, or raw materials, as well as covering operational expenses. Businesses in Bellevue, Washington can typically access different types of credit applications, depending on their specific requirements. Some common types of business credit applications in Bellevue include: 1. Bellevue Small Business Credit Application: This type of credit application is designed for small businesses operating in Bellevue, Washington. It usually caters to enterprises with limited revenue and fewer employees. 2. Bellevue Start-up Business Credit Application: Geared towards newly established businesses in Bellevue, this application is tailored to meet the unique financial needs of start-ups. It helps them secure the necessary funding to kick-start their operations. 3. Bellevue Corporate Credit Application: This type of credit application targets larger corporations and businesses in Bellevue, Washington, with significant revenue and a well-established financial track record. 4. Bellevue Retail Business Credit Application: Tailored specifically for businesses operating in the retail sector, this application takes into account the unique needs and challenges faced by retail establishments in Bellevue. By submitting a Bellevue Washington Business Credit Application, businesses can forge relationships with financial institutions, banks, or lenders who evaluate their creditworthiness and determine whether they qualify for the requested credit amount. Successful application approval can open doors to a wide range of financial opportunities, providing businesses with the necessary resources to thrive and expand their operations in Bellevue, Washington.