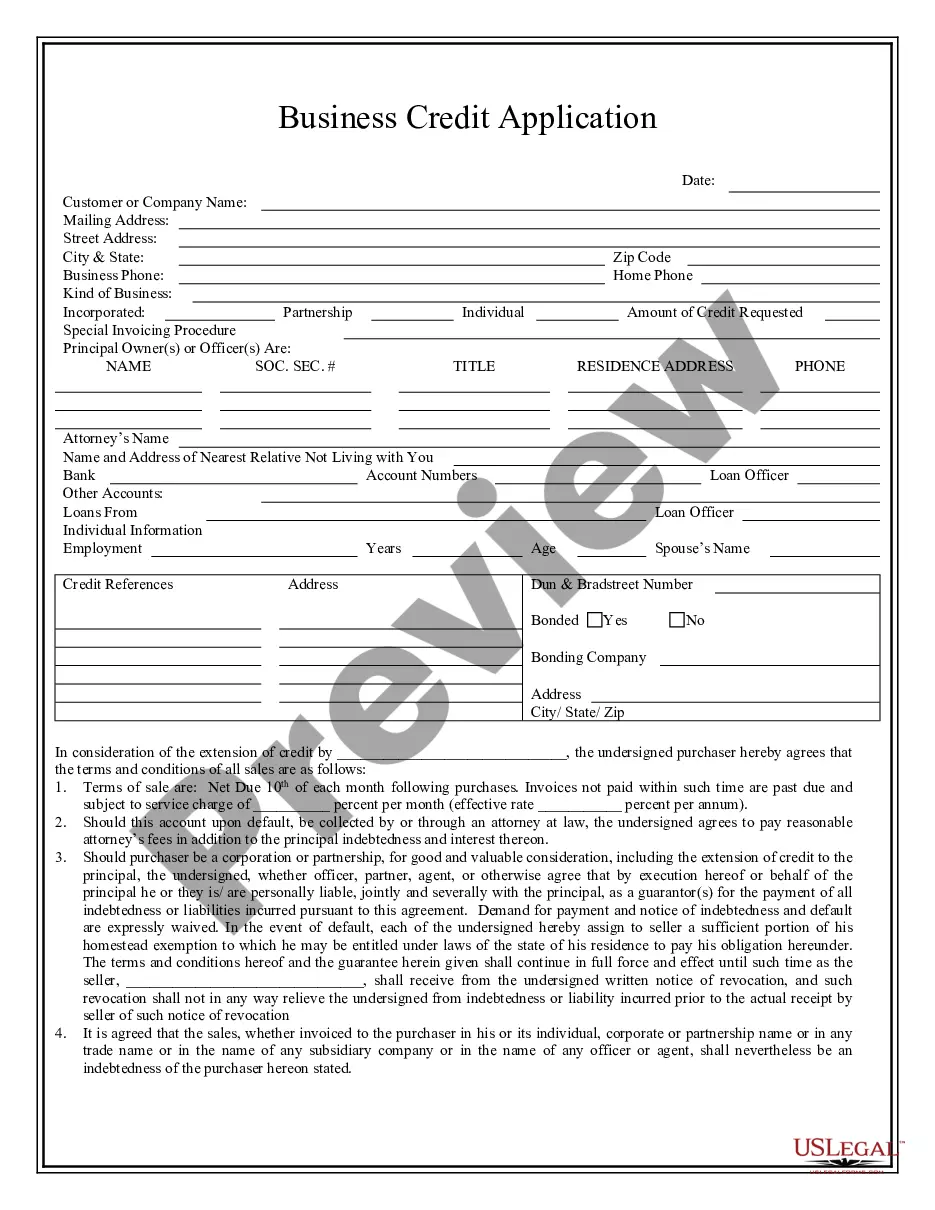

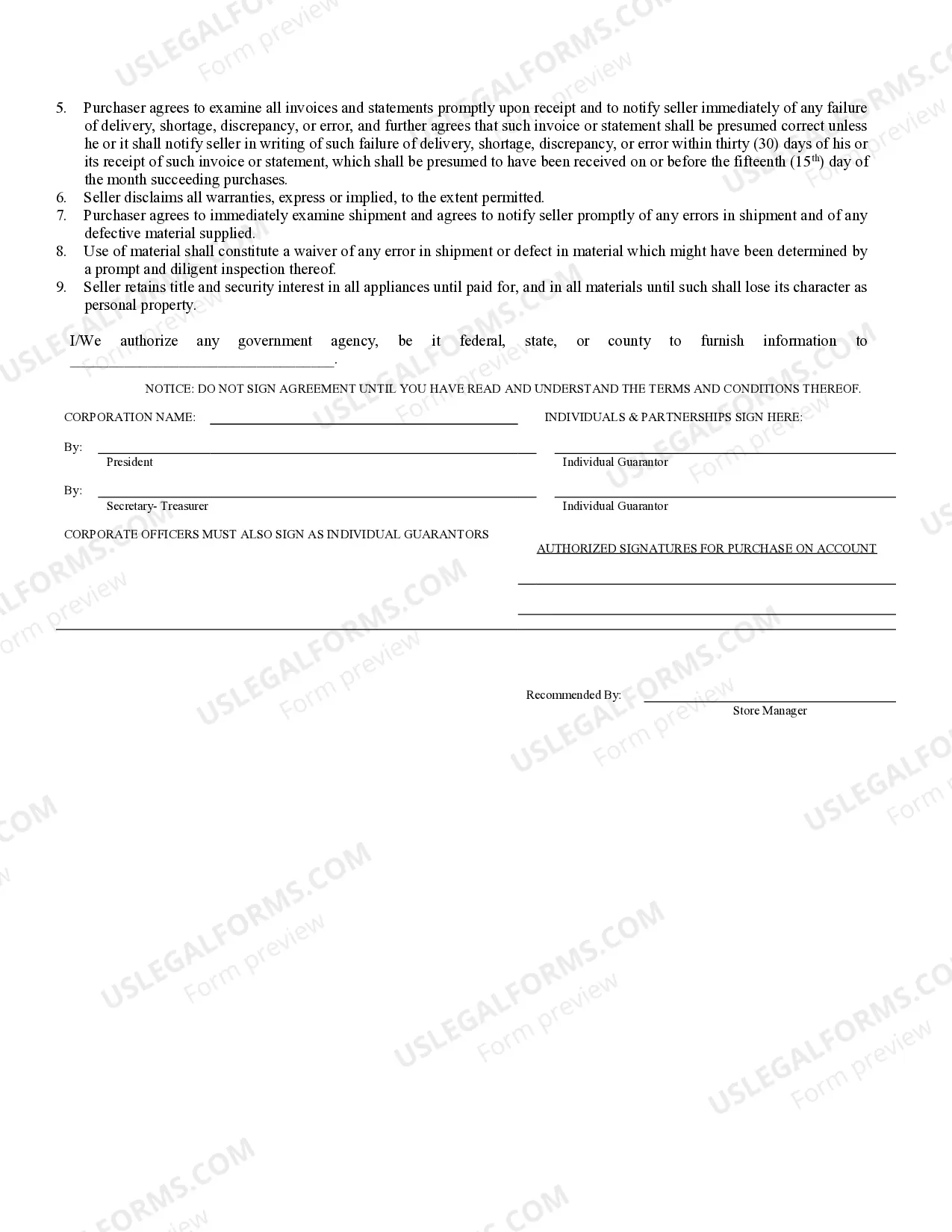

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Everett Washington Business Credit Application is a comprehensive document that local businesses in Everett, Washington utilize to apply for credit services. The application serves as a crucial step in establishing a credit relationship with financial institutions or other credit providers within the city. The Everett Washington Business Credit Application captures essential information about the business, enabling the credit provider to assess the creditworthiness and reliability of the applicant. It typically requests details such as the business name, legal structure, address, contact information, and tax identification number. Additionally, the application may ask for the number of years in operation, annual revenue, and industry or sector in which the business operates. Moreover, the Everett Washington Business Credit Application gathers data about the business owner(s) or principal(s), including their names, contact details, social security numbers, and ownership percentages. This information helps verify the identity and credibility of the applicants. In addition to basic business information, the credit application often requires an in-depth financial overview. This may encompass providing financial statements such as balance sheets, income statements, and cash flow statements. These statements offer insights into the business's financial health, stability, and ability to repay borrowed funds. Bank references, trade references, and information regarding outstanding loans or lines of credit may also be requested. As for the different types of Everett Washington Business Credit Applications, the specific variations may depend on the type of credit being sought. For instance, a business seeking a traditional business line of credit may use one type of application, whereas a business applying for a commercial loan might work with a different application format. Similarly, an application for a business credit card or trade credit may have its own distinctive characteristics. Furthermore, depending on the credit provider, there might be specific Everett Washington Business Credit Applications tailored to particular industries or sectors. These industry-specific applications may request additional information or documentation relevant to that specific line of business. In summary, the Everett Washington Business Credit Application plays a crucial role in the credit application process for local businesses in Everett, Washington. It allows credit providers to assess the creditworthiness of applicants and determine the terms and conditions under which credit may be extended. By carefully completing the application and providing accurate and detailed information, businesses increase their chances of securing the desired credit facilities.