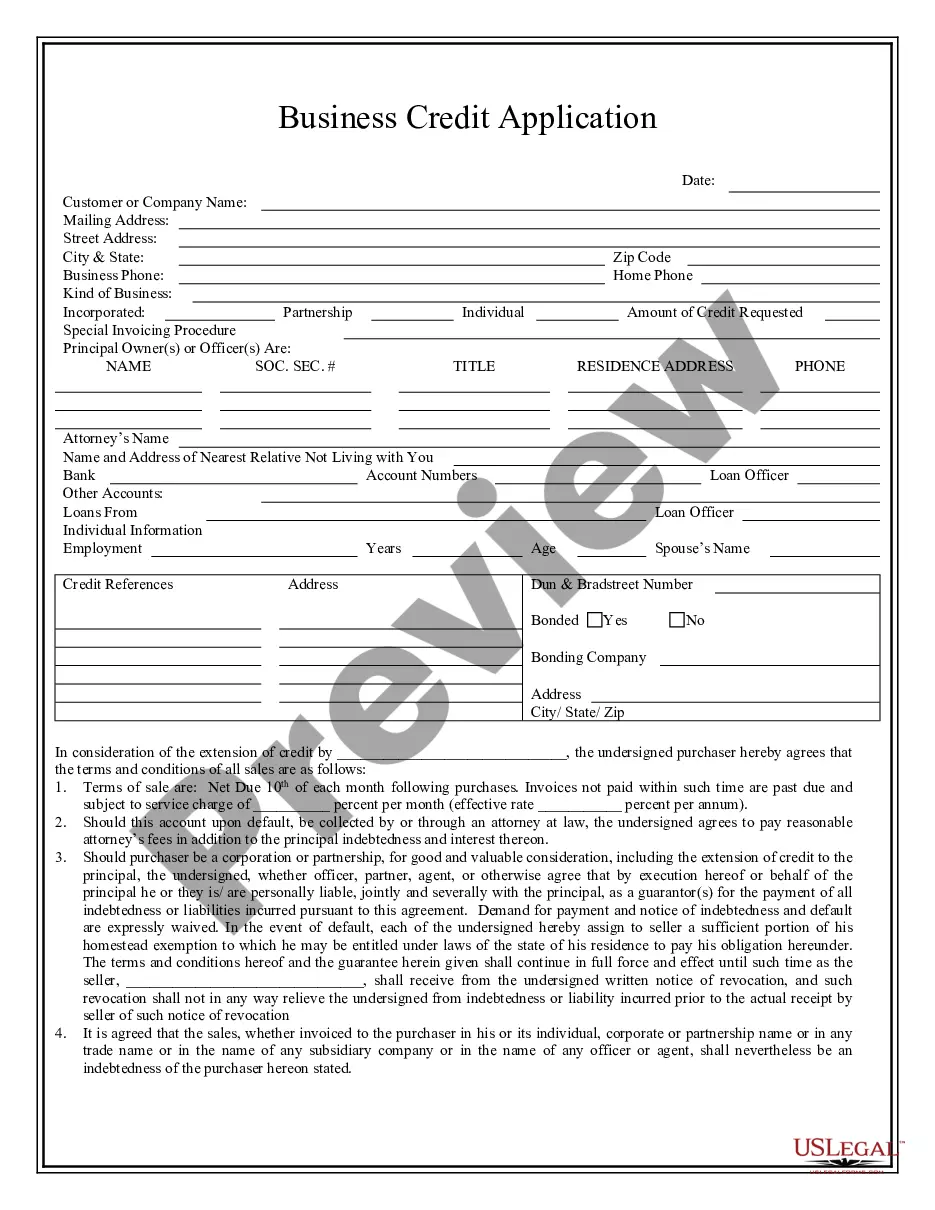

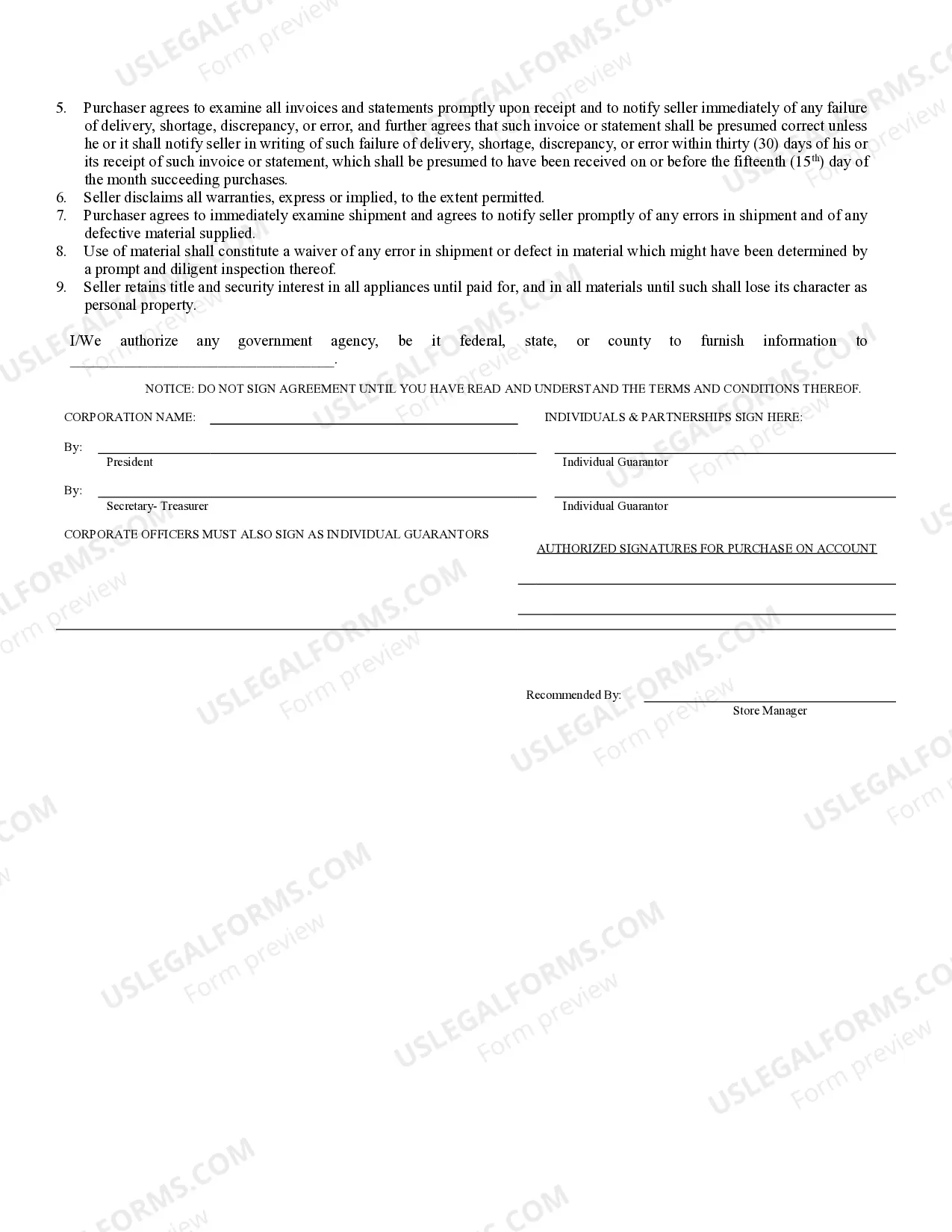

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

King Washington Business Credit Application is a comprehensive and user-friendly tool designed to help businesses acquire credit for their financial needs. This application provides a streamlined process for businesses to submit their credit requests and undergo a thorough evaluation to determine their eligibility. The main objective of the King Washington Business Credit Application is to assess the creditworthiness of businesses and ensure that they meet the necessary criteria to receive credit. By gathering relevant information about the applying organization, this application evaluates the business's financial health, stability, and potential to repay the credit. The different types of King Washington Business Credit Application include: 1. Standard Business Credit Application: This is the most common type of credit application offered by King Washington. It caters to a wide range of businesses, including startups, small enterprises, and established companies. The application requires businesses to provide details about their financial statements, tax returns, business plans, and personal guarantees. 2. Small Business Administration (SBA) Credit Application: King Washington also offers SBA credit applications specifically tailored for small businesses. These applications adhere to the guidelines set by the Small Business Administration and require additional documentation related to the SBA loan program. 3. Equipment Financing Credit Application: Businesses seeking credit solely for the purpose of financing new equipment can utilize the Equipment Financing Credit Application. This specialized application considers the equipment's value, depreciation, and potential resale value while determining the creditworthiness of the applicant. 4. Real Estate Financing Credit Application: For businesses looking to secure credit for real estate investments, King Washington provides a dedicated Real Estate Financing Credit Application. This application focuses on assessing the viability of the real estate project, including its location, potential returns, and repayment plan. Regardless of the type, the King Washington Business Credit Application generally requires businesses to provide details such as their company name, contact information, financial statements, business industry, years in operation, number of employees, ownership structure, and banking history. Additionally, businesses may need to submit supporting documents, including tax returns, legal documents, and business plans, depending on the specific type of application. By utilizing the King Washington Business Credit Application, businesses can streamline the credit application process and increase their chances of securing the financial support they need to grow and thrive.King Washington Business Credit Application is a comprehensive and user-friendly tool designed to help businesses acquire credit for their financial needs. This application provides a streamlined process for businesses to submit their credit requests and undergo a thorough evaluation to determine their eligibility. The main objective of the King Washington Business Credit Application is to assess the creditworthiness of businesses and ensure that they meet the necessary criteria to receive credit. By gathering relevant information about the applying organization, this application evaluates the business's financial health, stability, and potential to repay the credit. The different types of King Washington Business Credit Application include: 1. Standard Business Credit Application: This is the most common type of credit application offered by King Washington. It caters to a wide range of businesses, including startups, small enterprises, and established companies. The application requires businesses to provide details about their financial statements, tax returns, business plans, and personal guarantees. 2. Small Business Administration (SBA) Credit Application: King Washington also offers SBA credit applications specifically tailored for small businesses. These applications adhere to the guidelines set by the Small Business Administration and require additional documentation related to the SBA loan program. 3. Equipment Financing Credit Application: Businesses seeking credit solely for the purpose of financing new equipment can utilize the Equipment Financing Credit Application. This specialized application considers the equipment's value, depreciation, and potential resale value while determining the creditworthiness of the applicant. 4. Real Estate Financing Credit Application: For businesses looking to secure credit for real estate investments, King Washington provides a dedicated Real Estate Financing Credit Application. This application focuses on assessing the viability of the real estate project, including its location, potential returns, and repayment plan. Regardless of the type, the King Washington Business Credit Application generally requires businesses to provide details such as their company name, contact information, financial statements, business industry, years in operation, number of employees, ownership structure, and banking history. Additionally, businesses may need to submit supporting documents, including tax returns, legal documents, and business plans, depending on the specific type of application. By utilizing the King Washington Business Credit Application, businesses can streamline the credit application process and increase their chances of securing the financial support they need to grow and thrive.