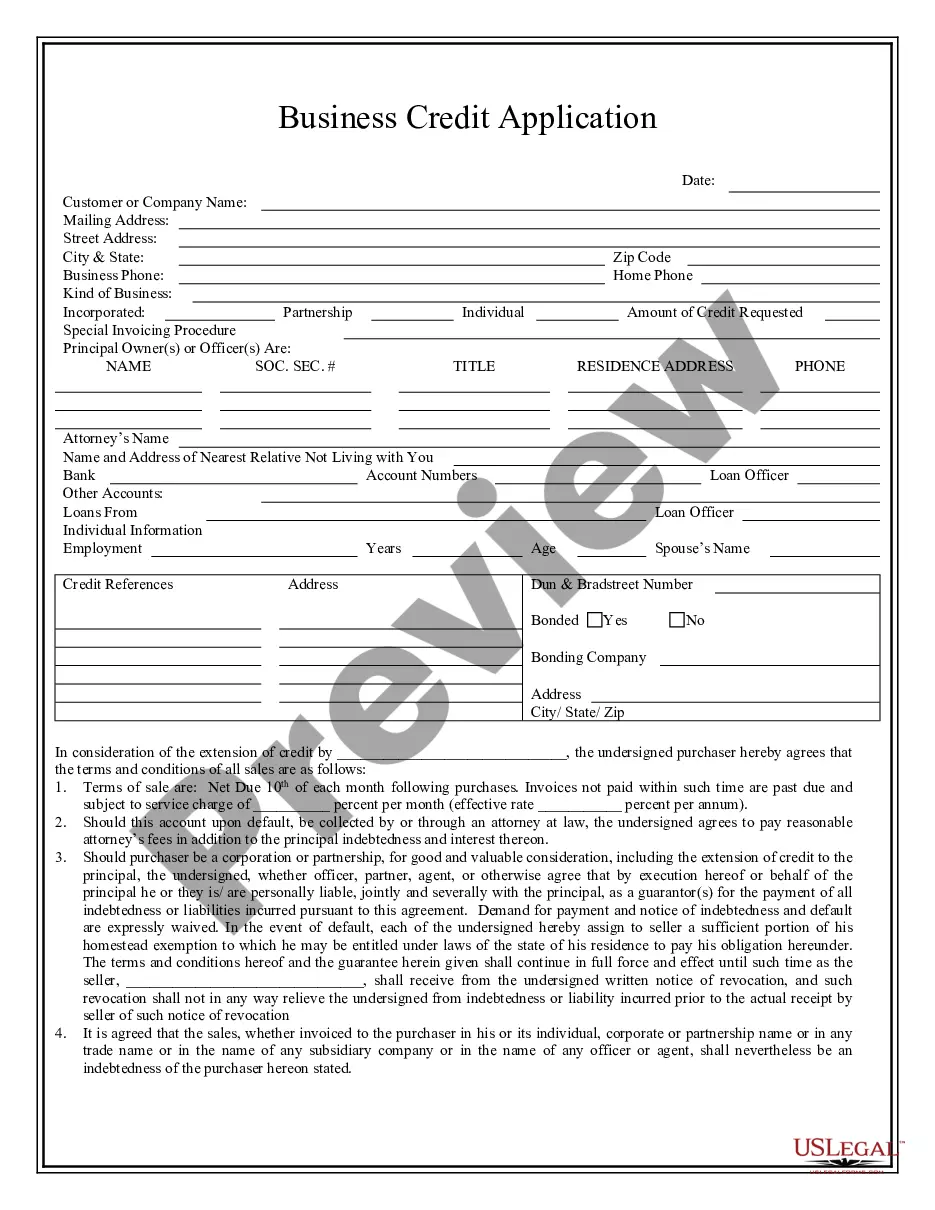

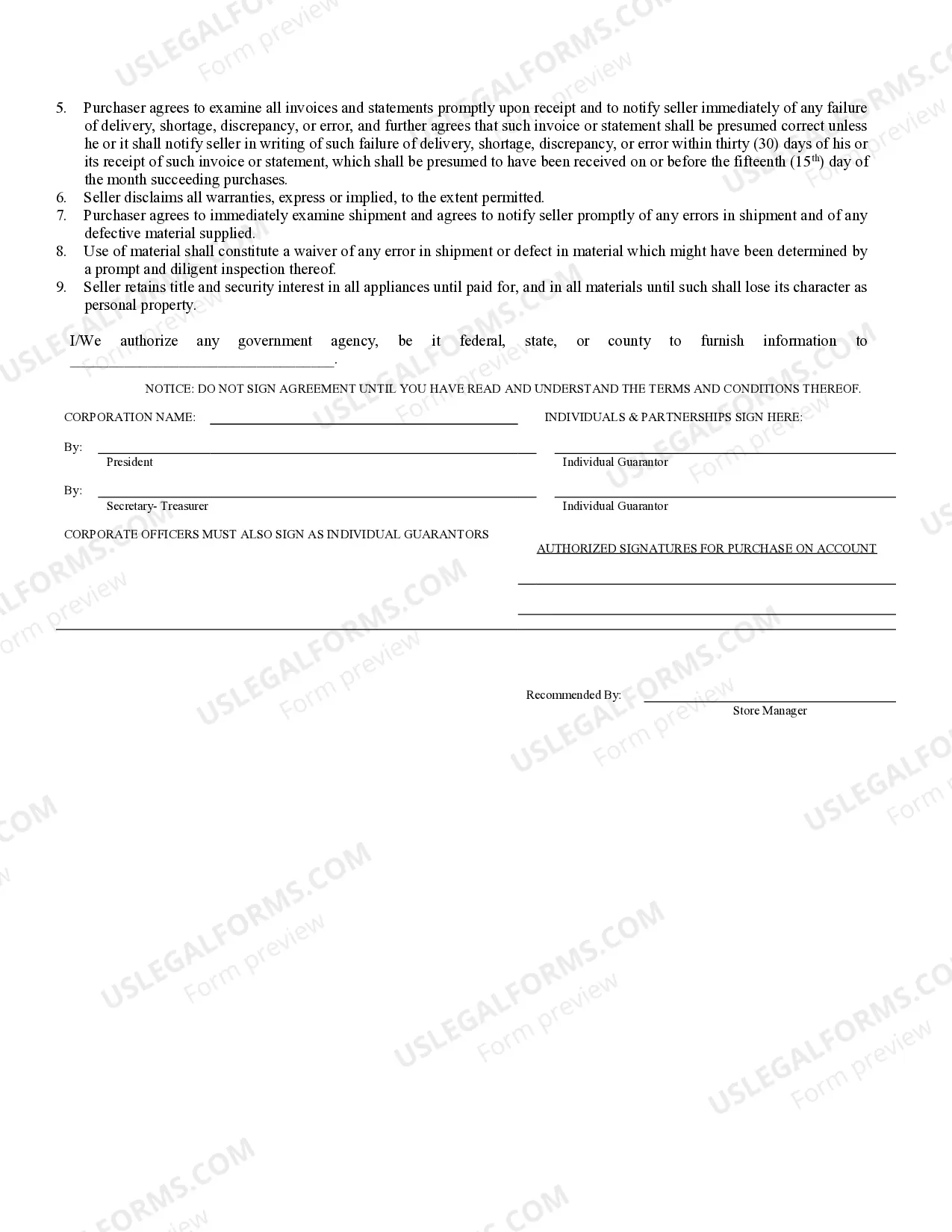

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Renton Washington Business Credit Application is a comprehensive form used by businesses located in Renton, Washington, to apply for lines of credit or loans from financial institutions or creditors. This application is the initial step in the process of obtaining credit and serves as a crucial document for assessing the creditworthiness and financial stability of a Renton-based business. The Renton Washington Business Credit Application typically requires the provision of detailed information about the applying company, its ownership structure, financial history, and other relevant data. Some vital details included in the application may encompass the legal name of the business, its address, contact information, tax identification number, industry type, and the number of years the company has been operating in Renton. To evaluate the creditworthiness of the business, the application often asks for financial statements, such as balance sheets, income statements, and cash flow statements. These documents provide insights into the company's current financial situation, profitability, and ability to manage debt. Additionally, businesses may need to disclose their accounts payable, accounts receivable, outstanding loans, existing lines of credit, and any other liabilities. Renton Washington Business Credit Application may vary based on the lender or creditor. Different institutions might have their own unique criteria and requirements to assess the creditworthiness of a business. Some specific types of Renton Washington Business Credit Applications include: 1. Small Business Line of Credit Application: This type of application is tailored for small businesses in Renton seeking a line of credit to cover short-term operational expenses or manage cash flow fluctuations. 2. Commercial Loan Application: For Renton-based businesses looking to secure a financial loan for long-term investments, expansion projects, or purchasing assets, a commercial loan application is provided by lending institutions. 3. Trade Credit Application: This application is commonly used by businesses to establish trade credit with suppliers and vendors. Renton's businesses can apply for trade credit to procure goods or services without making immediate payments. 4. Business Credit Card Application: Lenders offer credit cards specifically designed for businesses in Renton. The associated application seeks necessary information about the company, its owner(s), and financial history to assess eligibility for a business credit card. Renton Washington Business Credit Application is an essential tool for facilitating access to credit and financial resources for businesses operating in Renton. It allows lenders and creditors to carefully assess the financial health and creditworthiness of Renton-based businesses, enabling them to make informed decisions on extending credit or loans.Renton Washington Business Credit Application is a comprehensive form used by businesses located in Renton, Washington, to apply for lines of credit or loans from financial institutions or creditors. This application is the initial step in the process of obtaining credit and serves as a crucial document for assessing the creditworthiness and financial stability of a Renton-based business. The Renton Washington Business Credit Application typically requires the provision of detailed information about the applying company, its ownership structure, financial history, and other relevant data. Some vital details included in the application may encompass the legal name of the business, its address, contact information, tax identification number, industry type, and the number of years the company has been operating in Renton. To evaluate the creditworthiness of the business, the application often asks for financial statements, such as balance sheets, income statements, and cash flow statements. These documents provide insights into the company's current financial situation, profitability, and ability to manage debt. Additionally, businesses may need to disclose their accounts payable, accounts receivable, outstanding loans, existing lines of credit, and any other liabilities. Renton Washington Business Credit Application may vary based on the lender or creditor. Different institutions might have their own unique criteria and requirements to assess the creditworthiness of a business. Some specific types of Renton Washington Business Credit Applications include: 1. Small Business Line of Credit Application: This type of application is tailored for small businesses in Renton seeking a line of credit to cover short-term operational expenses or manage cash flow fluctuations. 2. Commercial Loan Application: For Renton-based businesses looking to secure a financial loan for long-term investments, expansion projects, or purchasing assets, a commercial loan application is provided by lending institutions. 3. Trade Credit Application: This application is commonly used by businesses to establish trade credit with suppliers and vendors. Renton's businesses can apply for trade credit to procure goods or services without making immediate payments. 4. Business Credit Card Application: Lenders offer credit cards specifically designed for businesses in Renton. The associated application seeks necessary information about the company, its owner(s), and financial history to assess eligibility for a business credit card. Renton Washington Business Credit Application is an essential tool for facilitating access to credit and financial resources for businesses operating in Renton. It allows lenders and creditors to carefully assess the financial health and creditworthiness of Renton-based businesses, enabling them to make informed decisions on extending credit or loans.