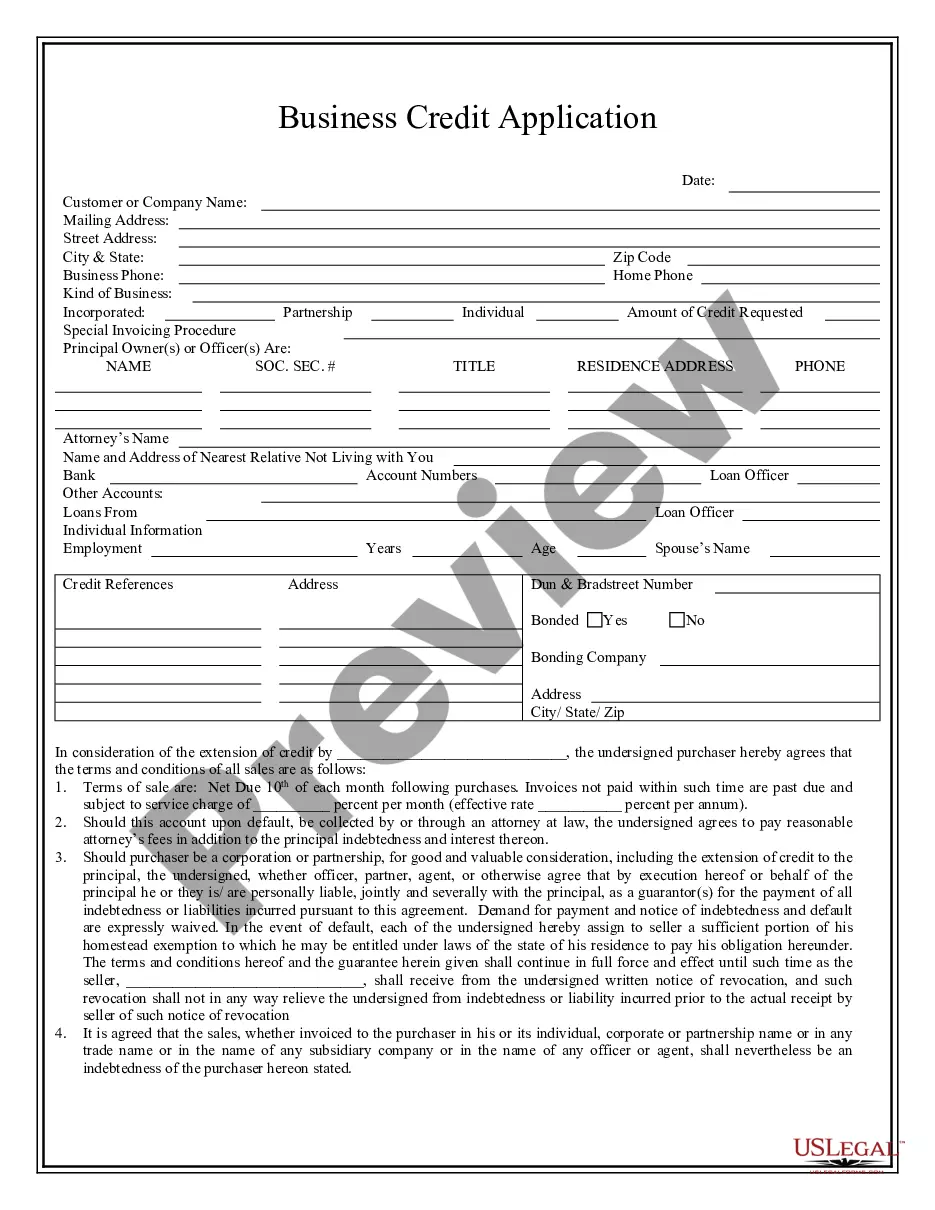

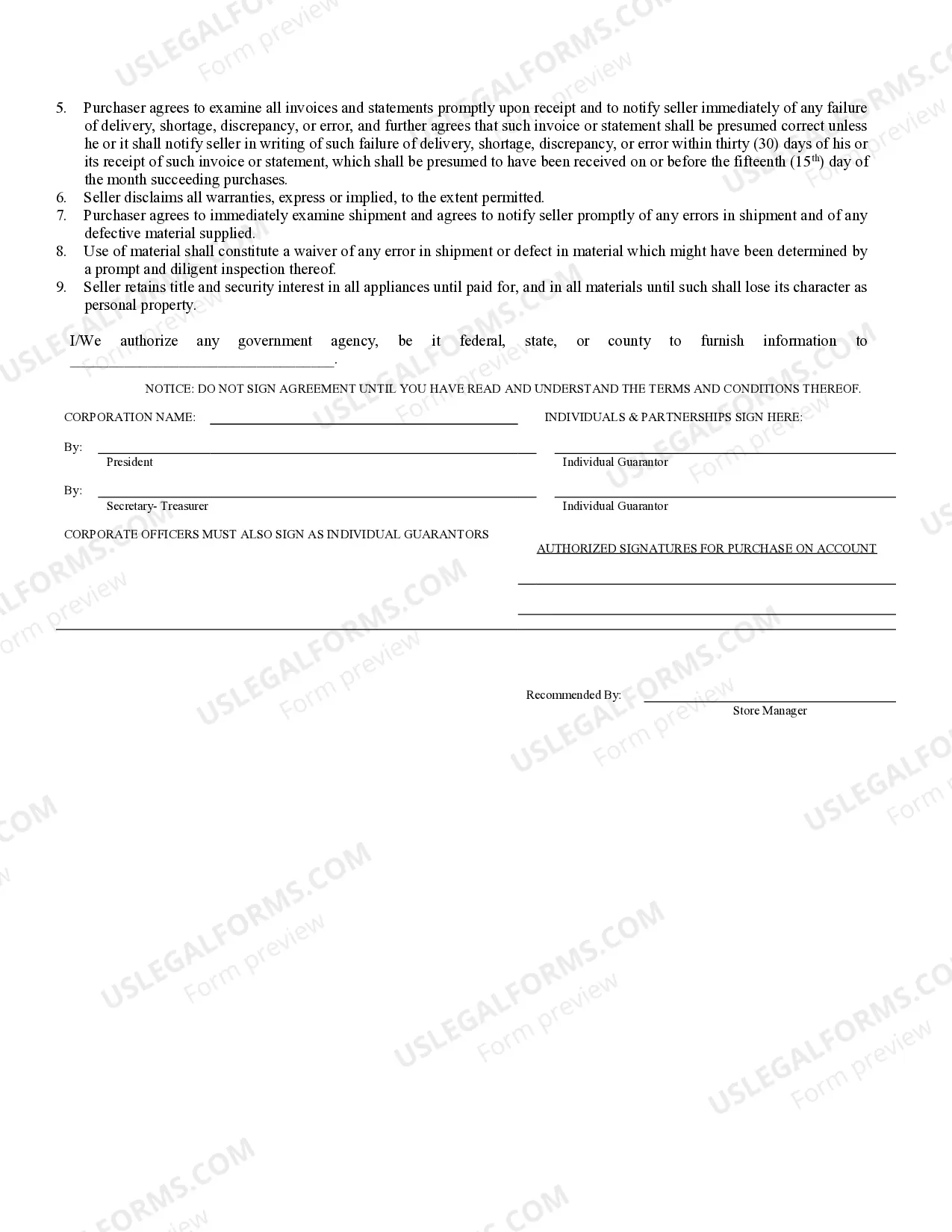

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Seattle Washington Business Credit Application is a formal document designed to allow businesses located in Seattle, Washington to apply for credit from financial institutions or other lenders. This application serves as an essential means for businesses to access funding and establish creditworthiness. The Seattle Washington Business Credit Application typically includes detailed information about the business, such as its legal name, contact information, and business structure. It also requests information about the nature of the business, including industry type, number of years in operation, and the purpose of the credit being sought. Additionally, the application usually asks the business to provide details about its financial standing. This may include providing financial statements, tax returns, bank statements, and other supporting documents to demonstrate the organization's financial stability and ability to repay the requested credit. The application may also require the business to disclose information about its owners or partners, including personal financial statements, credit history, and relevant experience in the industry. This helps lenders assess the overall risk associated with extending credit to the business. Furthermore, the Seattle Washington Business Credit Application may specify the amount of credit being sought, as well as the desired repayment terms, such as interest rate, installment payments, or other financial conditions. Different types of Seattle Washington Business Credit Applications may exist based on the specific financing needs of businesses. For example, there may be applications for general business loans, lines of credit, equipment financing, commercial real estate loans, or small business administration (SBA) loans, among others. Each type of credit application may have its own specific requirements and criteria based on the nature and purpose of the loan. Ultimately, the Seattle Washington Business Credit Application is an essential tool for businesses in Seattle, Washington, enabling them to access the necessary funds to expand operations, invest in growth opportunities, or manage day-to-day expenses. It facilitates the evaluation process for lenders and helps determine the creditworthiness and viability of businesses, allowing for informed lending decisions to be made.The Seattle Washington Business Credit Application is a formal document designed to allow businesses located in Seattle, Washington to apply for credit from financial institutions or other lenders. This application serves as an essential means for businesses to access funding and establish creditworthiness. The Seattle Washington Business Credit Application typically includes detailed information about the business, such as its legal name, contact information, and business structure. It also requests information about the nature of the business, including industry type, number of years in operation, and the purpose of the credit being sought. Additionally, the application usually asks the business to provide details about its financial standing. This may include providing financial statements, tax returns, bank statements, and other supporting documents to demonstrate the organization's financial stability and ability to repay the requested credit. The application may also require the business to disclose information about its owners or partners, including personal financial statements, credit history, and relevant experience in the industry. This helps lenders assess the overall risk associated with extending credit to the business. Furthermore, the Seattle Washington Business Credit Application may specify the amount of credit being sought, as well as the desired repayment terms, such as interest rate, installment payments, or other financial conditions. Different types of Seattle Washington Business Credit Applications may exist based on the specific financing needs of businesses. For example, there may be applications for general business loans, lines of credit, equipment financing, commercial real estate loans, or small business administration (SBA) loans, among others. Each type of credit application may have its own specific requirements and criteria based on the nature and purpose of the loan. Ultimately, the Seattle Washington Business Credit Application is an essential tool for businesses in Seattle, Washington, enabling them to access the necessary funds to expand operations, invest in growth opportunities, or manage day-to-day expenses. It facilitates the evaluation process for lenders and helps determine the creditworthiness and viability of businesses, allowing for informed lending decisions to be made.