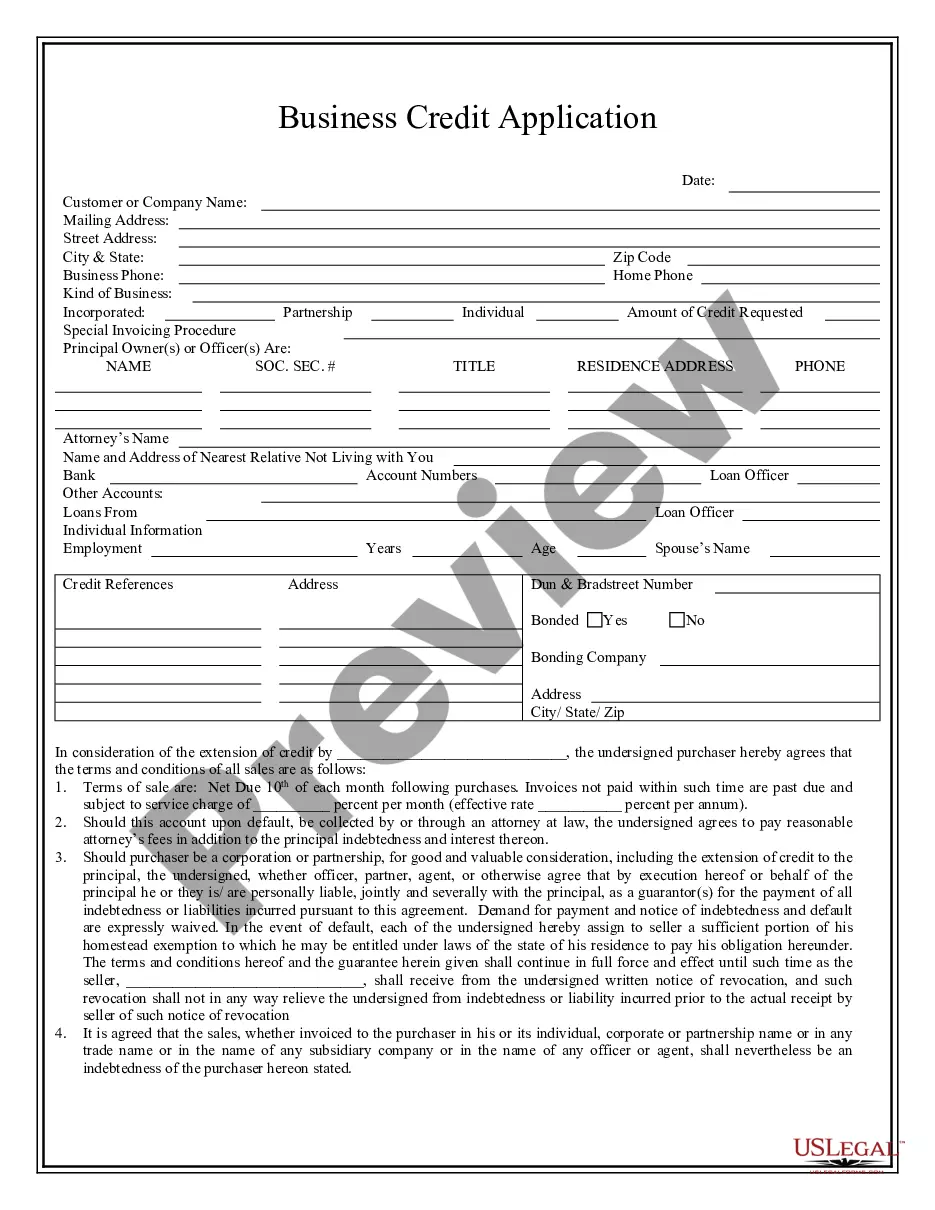

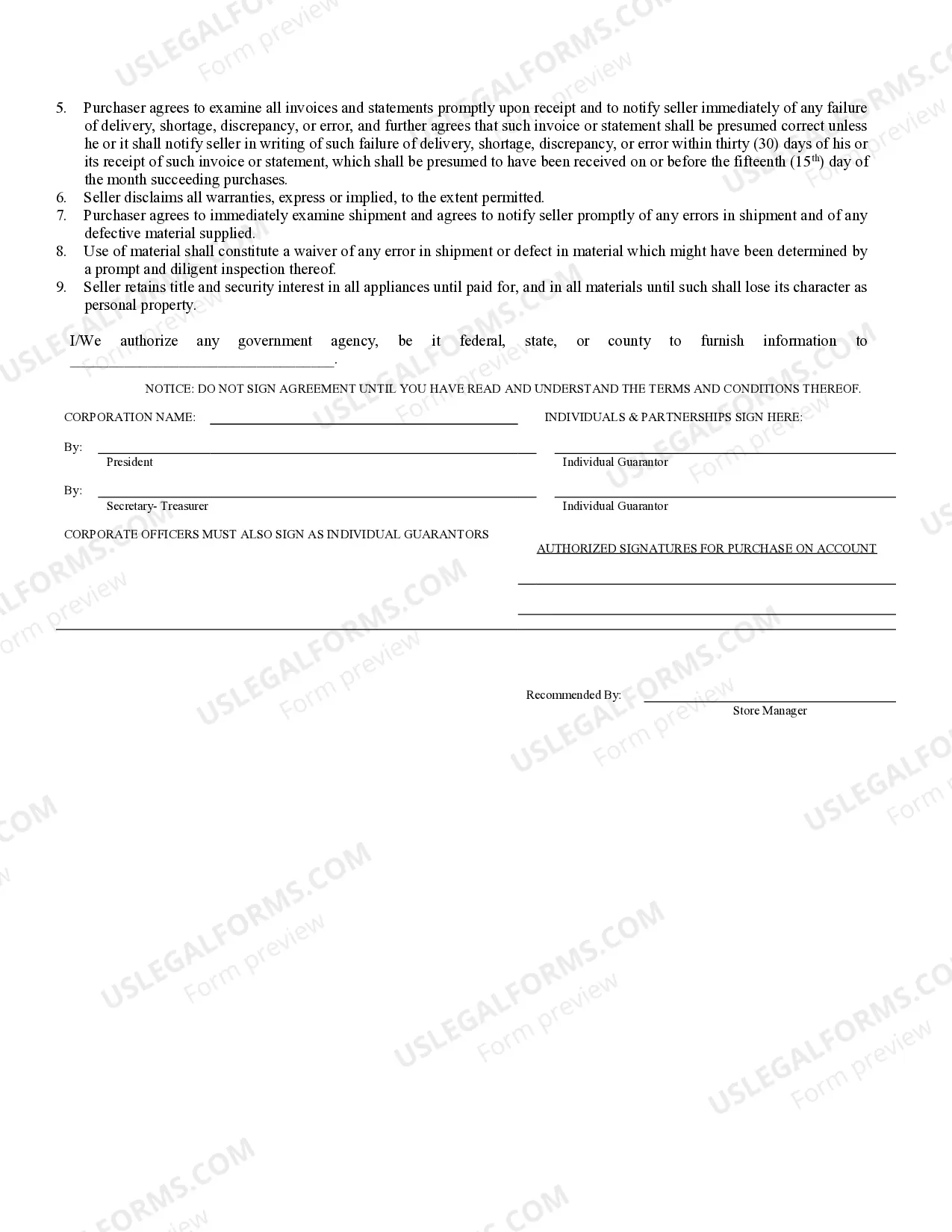

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Tacoma Washington Business Credit Application is a comprehensive form used by businesses in Tacoma, Washington to apply for credit options and financial services. This application is specifically designed to provide detailed information about the business, its financial history, and credit requirements to potential lenders or financial institutions. The Tacoma Washington Business Credit Application serves as a crucial tool for businesses seeking financial assistance, enabling them to present a well-documented application to increase the chances of securing credit. While the specific layout and sections may vary among different institutions, the main components generally remain similar. The application typically starts with basic business information, including the legal name, trade name, address, and contact details. Following this, businesses are required to provide the nature of their business, ownership structure, and the duration of operation. Additionally, any relevant licensing or permits held by the business are specified. The financial section of the Tacoma Washington Business Credit Application typically demands complete transparency about the company's financial statements. Information related to revenue and sales projections, profit margins, assets, liabilities, and equity is required to assess the business's financial health accurately. This section allows lenders to evaluate a company's creditworthiness and determine the potential risk associated with lending. Furthermore, the Tacoma Washington Business Credit Application includes details about the desired credit amount, purpose of the credit, and how the funds will be used. This section is crucial to understand the specific credit needs of the business and establish the appropriateness of the credit request. Depending on the lender or financial institution, there might be additional sections within the application tailored to specific credit products or services. For instance, a business applying for a business line of credit or a business loan may have to provide specific collateral information or proposal details outlining the utilization of the funds. Different types of Tacoma Washington Business Credit Applications may vary based on the credit product or service a business is applying for. Some common variations include: 1. Business Line of Credit Application: This type of application focuses on businesses seeking revolving credit options, offering flexibility in borrowing and repayments. 2. Small Business Loan Application: Specifically designed for small businesses, this application helps owners secure loans to support their operations, expansion, or acquisition plans. 3. Commercial Real Estate Loan Application: Geared towards businesses looking to purchase or refinance commercial properties, this application includes specific details about the property being financed. 4. Equipment Financing Application: Meant for businesses requiring funding for purchasing or leasing equipment, this application highlights information related to the equipment, its value, and expected usage. In conclusion, the Tacoma Washington Business Credit Application is an essential document for businesses in the region seeking financial assistance. By providing comprehensive information about the company, its financial history, and credit requirements, this application maximizes the chances of successfully obtaining credit. Various types of credit applications cater to different financial needs, ensuring that businesses can access the specific credit option that aligns with their goals and requirements.