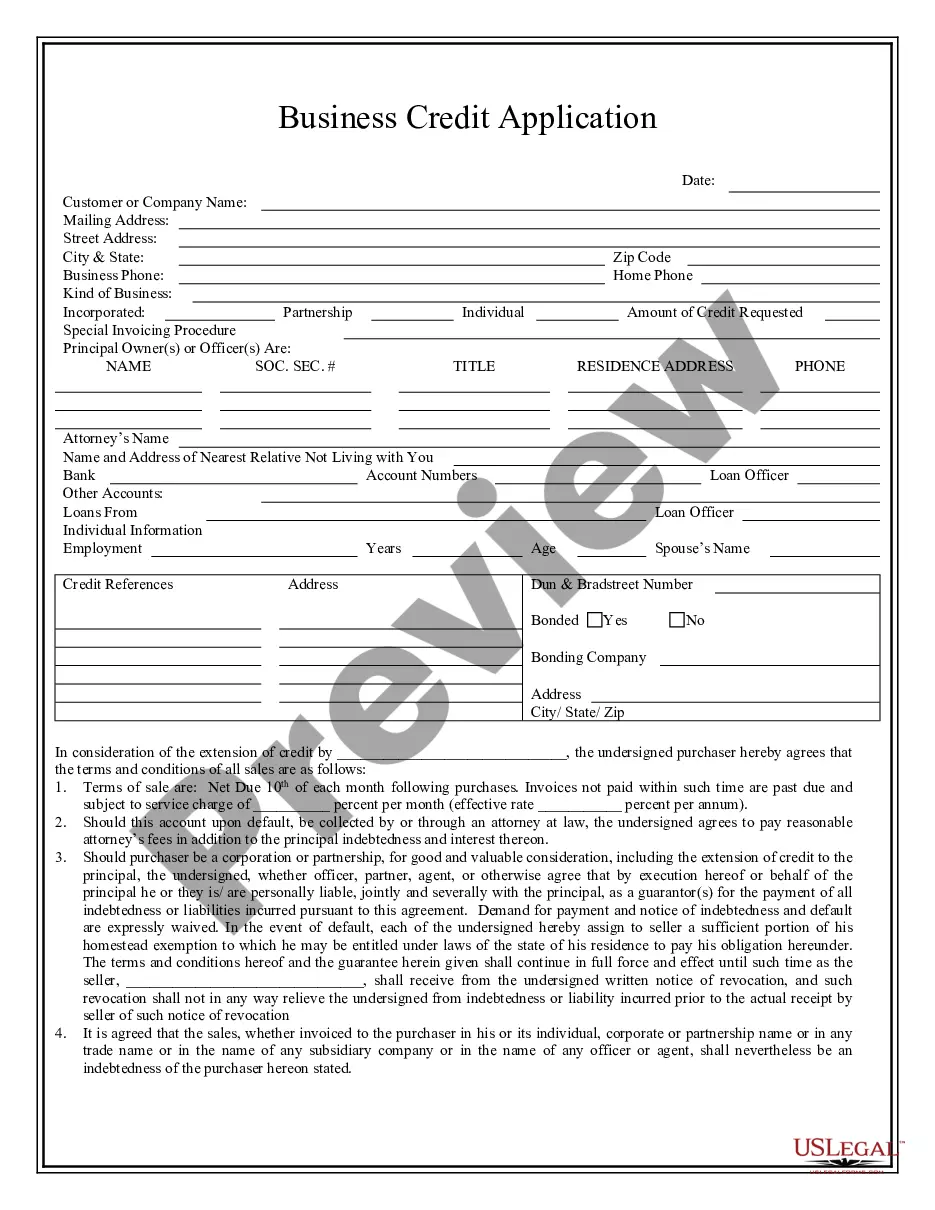

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Bellevue Washington Individual Credit Application

Description

How to fill out Washington Individual Credit Application?

We consistently aim to minimize or sidestep legal complications when managing intricate legal or financial matters.

To achieve this, we seek legal representation that typically comes with a high price tag.

However, not every legal issue is equally challenging. Many can be handled by ourselves.

US Legal Forms is an online repository of refreshed do-it-yourself legal documents covering everything from wills and power of attorney to business incorporation articles and dissolution petitions. Our platform empowers you to manage your affairs independently without resorting to an attorney.

If you misplace the document, you can easily download it again from the My documents section. The process is equally simple if you are unfamiliar with the platform! You can set up your account in a matter of minutes. Ensure that the Bellevue Washington Individual Credit Application adheres to the laws and regulations of your state and region. Additionally, it’s vital to review the form’s details (if available), and if you identify any inconsistencies with your initial requirements, look for an alternative form. Once you’ve confirmed that the Bellevue Washington Individual Credit Application is appropriate for your situation, you can select the subscription plan and proceed with the payment. You can then download the document in any compatible file format. Throughout our existence of over 24 years, we have assisted millions of individuals by providing ready-to-customize and current legal documents. Make the most of US Legal Forms now to conserve time and resources!

- We provide access to legal document templates that may not always be readily available.

- Our templates are specific to states and regions, which greatly simplifies the search.

- Utilize US Legal Forms whenever you need to obtain and download the Bellevue Washington Individual Credit Application or any other document swiftly and securely.

- Simply Log In to your account and click the Get button adjacent to it.

Form popularity

FAQ

Filling out a credit authorization form involves providing essential information such as your personal identification details, credit history, and consent for credit checks. Make sure to review all sections carefully for accuracy. If you are completing a Bellevue Washington Individual Credit Application, this form is a crucial step in the process to secure financing.

To calculate the WA B&O tax, start by determining your gross receipts. Then, apply the appropriate tax rate based on your business type. By accurately assessing this, you will be better prepared when filling out your Bellevue Washington Individual Credit Application, ensuring all financial aspects are accounted for.

The B&O tax rate in Bellevue varies depending on the type of business activity. Common rates include percentages based on gross income for retail, service, and manufacturing sectors. If you're preparing a Bellevue Washington Individual Credit Application, keeping this tax in mind will help you understand your overall financial liability.

The B&O tax, or Business and Occupation tax, is a gross receipts tax levied on businesses operating within Bellevue, Washington. This tax is calculated based on your gross income, regardless of profitability. For those seeking to understand their tax obligations as part of submitting a Bellevue Washington Individual Credit Application, knowing the B&O tax is essential.

Yes, Bellevue does have specific local taxes that residents must consider. These taxes can vary significantly, impacting your overall financial planning. To navigate these local requirements effectively, you may benefit from utilizing the Bellevue Washington Individual Credit Application to understand how potential credits could offset these taxes. Knowing your local tax obligations will help you manage your finances more effectively.

Washington state offers various tax credits aimed at supporting residents with lower incomes or specific needs. These credits can cover different areas, from education to healthcare expenses. The Bellevue Washington Individual Credit Application can provide insights into which specific credits you may qualify for and how to apply. Understanding these credits allows you to better manage your financial obligations while maximizing available benefits.

The $2000 tax credit is a specific financial incentive available to eligible taxpayers, potentially aimed at families or individuals meeting certain criteria. This credit, which can be claimed by completing the Bellevue Washington Individual Credit Application, reduces your tax bill directly. It's crucial to check your eligibility for this benefit, as it can lead to significant savings. Additionally, this credit often aims to alleviate financial pressures for residents.

Qualifying for a tax credit typically involves meeting certain income and expense criteria outlined by the tax authorities. For individuals in Bellevue, Washington, the Bellevue Washington Individual Credit Application can help you determine your eligibility based on your specific situation. Credits often apply to expenditures like education, healthcare, and home ownership. Ensuring you meet these requirements can lead to significant financial benefits.

The $1200 payment in Washington state refers to a financial assistance program intended to support individuals who apply for benefits. This payment may be available to those who meet specific criteria within the Bellevue Washington Individual Credit Application framework. It aims to help residents manage their financial needs during challenging times. To explore your eligibility, consider reviewing the application guidelines provided.

The difficulty of obtaining a personal line of credit can vary based on your financial profile. If you have a strong credit score and a reliable income, the process may be more straightforward. Using a Bellevue Washington Individual Credit Application can clarify your options and improve your chances of approval. Resources available on uslegalforms can guide you in completing your application efficiently.