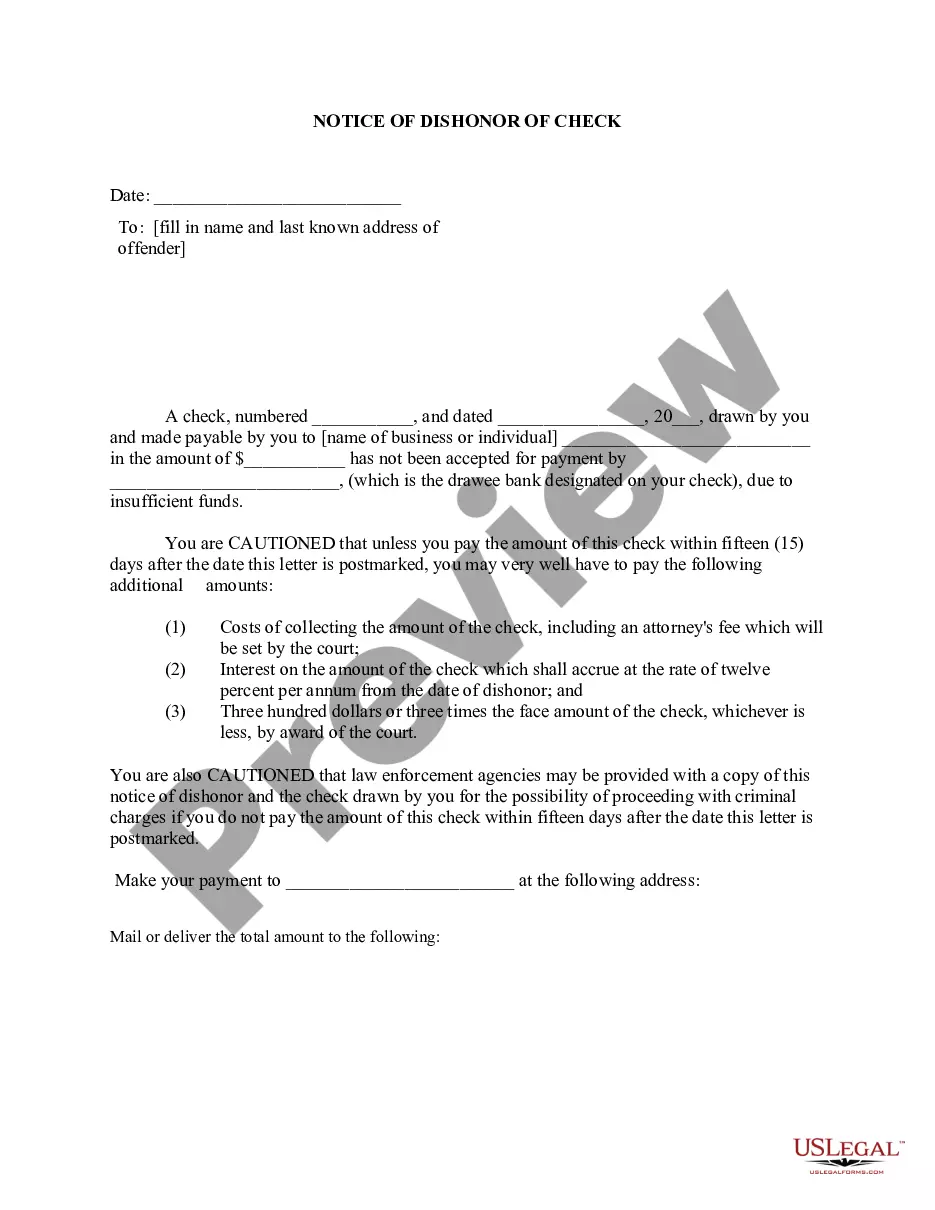

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Bellevue Washington Notice of Dishonored Check — Civil: What to Know about Bad/Bounced Check Issues Introduction: Whether intentionally or unintentionally, issuing a bad or bounced check can have legal consequences. In Bellevue, Washington, individuals or businesses who receive such checks can take action by issuing a Bellevue Washington Notice of Dishonored Check — Civil. This detailed description will clarify what a bad or bounced check signifies, the importance of the notice, and the potential outcomes if the issue is not resolved effectively. 1. Understanding Bad Checks: A bad check refers to a check that cannot be honored by the bank due to insufficient funds in the account or other account-related issues. This can occur when the account holder writes a check without having enough money to cover the amount stated. Issuing a bad check is considered a violation of civil law and can result in financial and legal consequences. 2. The Bellevue Washington Notice of Dishonored Check — Civil: The Bellevue Washington Notice of Dishonored Check — Civil is an official document that serves as a legal notice to the check issuer regarding the dishonoring of their check. The notice outlines the details of the dishonored check and informs the issuer about the potential legal actions that may be taken if the check remains unresolved. 3. Importance of the Notice: The Bellevue Washington Notice of Dishonored Check — Civil serves multiple purposes, including: a. Notification: The notice informs the issuer that their check was not honored, ensuring they are aware of the situation and have a chance to rectify it. b. Documentation: It provides documented evidence of the dishonored check, which can be crucial if legal action is pursued. c. Resolution Opportunity: The notice gives the issuer an opportunity to resolve the issue before further legal consequences are considered. 4. Potential Outcomes: Should the bad check issue remain unresolved, the recipient of the dishonored check may pursue legal actions, which can lead to various consequences: a. Financial Liabilities: The issuer may be required to pay the amount of the dishonored check, along with any additional fees or penalties associated with it. b. Legal Proceedings: If the case goes to court, the issuer may face legal charges and potentially be held responsible for the recipient's legal expenses. c. Damaged Credit: The issuer's credit score could be negatively affected due to the dishonored check, making it harder to secure credit or loans in the future. d. Loss of Trust: Businesses or individuals who frequently issue bad checks may experience a loss in trust and reputation, leading to strained relationships with banks, creditors, or other parties. Conclusion: Issuing a bad check can have serious consequences, both legally and financially. The Bellevue Washington Notice of Dishonored Check — Civil serves as an important tool for notifying the check issuer about their failure to honor their financial obligations. It provides an opportunity to resolve the issue before resorting to legal action. It is vital for individuals and businesses to understand the implications of bad checks, ensuring they maintain financial responsibility and avoid potential legal troubles. Keywords: Bellevue Washington, Notice of Dishonored Check, Civil, bad check, bounced check.Title: Bellevue Washington Notice of Dishonored Check — Civil: What to Know about Bad/Bounced Check Issues Introduction: Whether intentionally or unintentionally, issuing a bad or bounced check can have legal consequences. In Bellevue, Washington, individuals or businesses who receive such checks can take action by issuing a Bellevue Washington Notice of Dishonored Check — Civil. This detailed description will clarify what a bad or bounced check signifies, the importance of the notice, and the potential outcomes if the issue is not resolved effectively. 1. Understanding Bad Checks: A bad check refers to a check that cannot be honored by the bank due to insufficient funds in the account or other account-related issues. This can occur when the account holder writes a check without having enough money to cover the amount stated. Issuing a bad check is considered a violation of civil law and can result in financial and legal consequences. 2. The Bellevue Washington Notice of Dishonored Check — Civil: The Bellevue Washington Notice of Dishonored Check — Civil is an official document that serves as a legal notice to the check issuer regarding the dishonoring of their check. The notice outlines the details of the dishonored check and informs the issuer about the potential legal actions that may be taken if the check remains unresolved. 3. Importance of the Notice: The Bellevue Washington Notice of Dishonored Check — Civil serves multiple purposes, including: a. Notification: The notice informs the issuer that their check was not honored, ensuring they are aware of the situation and have a chance to rectify it. b. Documentation: It provides documented evidence of the dishonored check, which can be crucial if legal action is pursued. c. Resolution Opportunity: The notice gives the issuer an opportunity to resolve the issue before further legal consequences are considered. 4. Potential Outcomes: Should the bad check issue remain unresolved, the recipient of the dishonored check may pursue legal actions, which can lead to various consequences: a. Financial Liabilities: The issuer may be required to pay the amount of the dishonored check, along with any additional fees or penalties associated with it. b. Legal Proceedings: If the case goes to court, the issuer may face legal charges and potentially be held responsible for the recipient's legal expenses. c. Damaged Credit: The issuer's credit score could be negatively affected due to the dishonored check, making it harder to secure credit or loans in the future. d. Loss of Trust: Businesses or individuals who frequently issue bad checks may experience a loss in trust and reputation, leading to strained relationships with banks, creditors, or other parties. Conclusion: Issuing a bad check can have serious consequences, both legally and financially. The Bellevue Washington Notice of Dishonored Check — Civil serves as an important tool for notifying the check issuer about their failure to honor their financial obligations. It provides an opportunity to resolve the issue before resorting to legal action. It is vital for individuals and businesses to understand the implications of bad checks, ensuring they maintain financial responsibility and avoid potential legal troubles. Keywords: Bellevue Washington, Notice of Dishonored Check, Civil, bad check, bounced check.