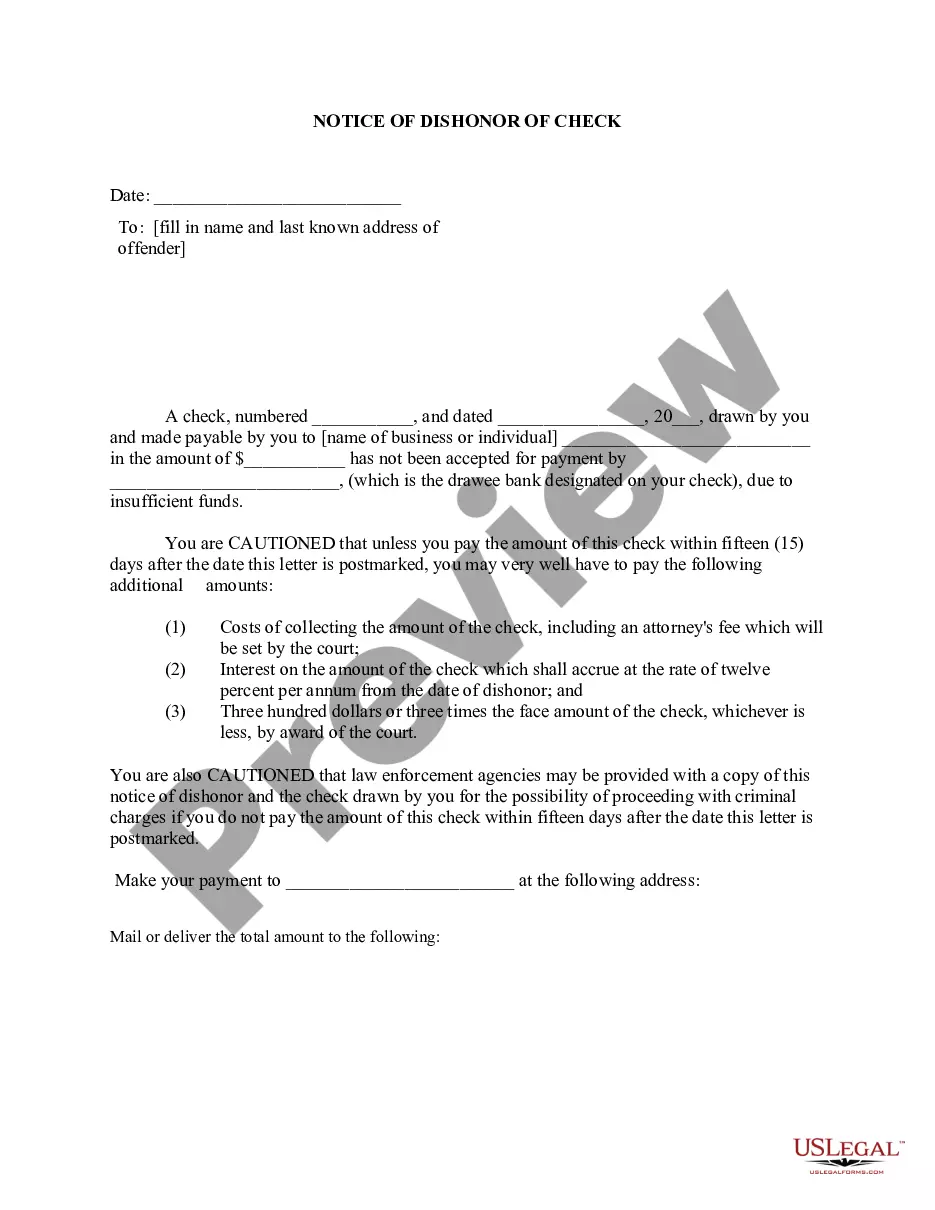

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Everett Washington Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check In Everett, Washington, the Notice of Dishonored Check — Civil is a legal document that addresses the issue of a bad or bounced check. This notice serves as an official warning to individuals who have issued a check that was not honored by their bank due to various reasons such as insufficient funds or a closed account. A bad check, also known as a bounced check, occurs when the check writer does not have enough funds in their account to cover the amount specified on the check. This can be unintentional due to miscalculations or unforeseen financial hardships, or it can be an intentional act of fraud. The Notice of Dishonored Check — Civil is typically sent by the payee, the individual or business who received the bounced check, as a means to recover the owed funds. The notice informs the check writer about the situation, provides details of the bounced check, and demands payment for the face value of the check along with any associated fees or penalties. While the Notice of Dishonored Check — Civil generally encompasses all types of bad checks, there are variations depending on the specific circumstances. Here are a few different types that can be encountered in Everett: 1. Insufficient funds: This is the most common reason for a check to bounce. When someone writes a check without having enough money in their account, it leads to an insufficient fund bounced check. This can be due to oversight or an inability to manage finances effectively. 2. Closed account: If a check is issued from an account that has been closed, it will be considered a bounced check due to a closed account. This could happen when an individual or business decides to close their bank account without notifying the payee. 3. Forgery or fraudulent checks: In some cases, individuals may deliberately write checks on accounts that do not belong to them, or they may create counterfeit checks. This type of check bouncing falls under the category of fraud, and the consequences can be even more severe. Regardless of the specific type of bounced check, the Notice of Dishonored Check — Civil aims to prompt the check writer to rectify the situation promptly. The notice often includes details such as the name and contact information of the payee, check number, date, and amount of the original check, as well as any additional fees or penalties imposed. It is important for both the payee and the check writer to adhere to the legal responsibilities associated with bad checks. Failing to address the issue may result in further legal actions, such as a civil lawsuit, damage to the check writer's credit rating, or even criminal charges in cases of intentional fraud. Sending a Notice of Dishonored Check — Civil is an essential step in resolving the matter of a bad or bounced check in Everett, Washington. It serves as a means to communicate the problem, demand reimbursement, and potentially avoid more severe consequences for both parties involved.Everett Washington Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check In Everett, Washington, the Notice of Dishonored Check — Civil is a legal document that addresses the issue of a bad or bounced check. This notice serves as an official warning to individuals who have issued a check that was not honored by their bank due to various reasons such as insufficient funds or a closed account. A bad check, also known as a bounced check, occurs when the check writer does not have enough funds in their account to cover the amount specified on the check. This can be unintentional due to miscalculations or unforeseen financial hardships, or it can be an intentional act of fraud. The Notice of Dishonored Check — Civil is typically sent by the payee, the individual or business who received the bounced check, as a means to recover the owed funds. The notice informs the check writer about the situation, provides details of the bounced check, and demands payment for the face value of the check along with any associated fees or penalties. While the Notice of Dishonored Check — Civil generally encompasses all types of bad checks, there are variations depending on the specific circumstances. Here are a few different types that can be encountered in Everett: 1. Insufficient funds: This is the most common reason for a check to bounce. When someone writes a check without having enough money in their account, it leads to an insufficient fund bounced check. This can be due to oversight or an inability to manage finances effectively. 2. Closed account: If a check is issued from an account that has been closed, it will be considered a bounced check due to a closed account. This could happen when an individual or business decides to close their bank account without notifying the payee. 3. Forgery or fraudulent checks: In some cases, individuals may deliberately write checks on accounts that do not belong to them, or they may create counterfeit checks. This type of check bouncing falls under the category of fraud, and the consequences can be even more severe. Regardless of the specific type of bounced check, the Notice of Dishonored Check — Civil aims to prompt the check writer to rectify the situation promptly. The notice often includes details such as the name and contact information of the payee, check number, date, and amount of the original check, as well as any additional fees or penalties imposed. It is important for both the payee and the check writer to adhere to the legal responsibilities associated with bad checks. Failing to address the issue may result in further legal actions, such as a civil lawsuit, damage to the check writer's credit rating, or even criminal charges in cases of intentional fraud. Sending a Notice of Dishonored Check — Civil is an essential step in resolving the matter of a bad or bounced check in Everett, Washington. It serves as a means to communicate the problem, demand reimbursement, and potentially avoid more severe consequences for both parties involved.