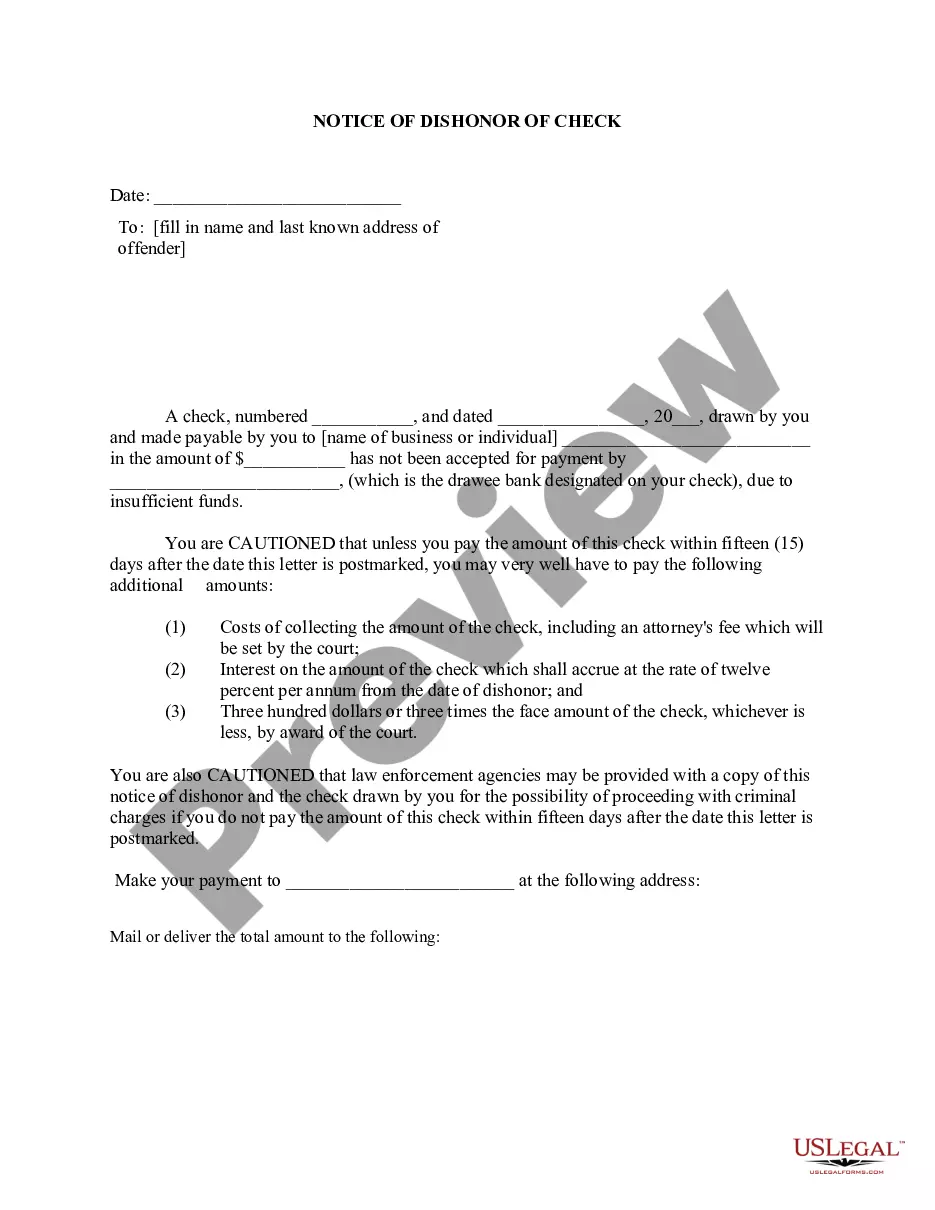

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding the King Washington Notice of Dishonored Check — Civil Introduction: The King Washington Notice of Dishonored Check — Civil is a legal document issued by the state of Washington when a check is returned unpaid due to insufficient funds or other reasons. This notice serves as a warning to the check issuer, informing them of the consequences and remedies associated with writing a bad or bounced check. In this article, we will delve into the details of what a bad check is, reasons for its dishonor, and the repercussions it may entail. Types of Dishonored Checks: 1. Insufficient Fund Check: This type occurs when there are not enough funds available in the check issuer's account to cover the payment amount. It is the most common reason for a check to be dishonored. 2. Closed Account Check: This type occurs when the check issuer has closed their bank account before the recipient attempts to deposit or cash the check. 3. Post-Dated Check: A post-dated check bears a future date instead of the current date. If such a check is presented for payment earlier than the indicated date, it will be considered a dishonored check. 4. Stolen or Forgery Check: This type refers to checks that have been stolen or forged without the knowledge or consent of the account holder. If discovered, such checks are considered dishonored. Detailed Description: A bad check, also known as a bounced check, is a check that cannot be processed or honored by the bank on which it is drawn. When a check bounces, it means that it cannot be cleared because the bank account linked to it does not have adequate funds to cover the payment. In King Washington, a person who receives a dishonored check may file a Notice of Dishonored Check — Civil to address the matter legally. The Notice of Dishonored Check — Civil is the first step in the legal process of seeking remedies for a bad check. It serves as an official warning and provides information on the consequences the check issuer may face if the situation is not resolved promptly. The notice also outlines the steps the recipient can take to seek restitution or pursue legal action. When a recipient receives a dishonored check, they can send a Notice of Dishonored Check — Civil to the check issuer. The notice typically includes important details such as the check number, date, amount, and the reason provided by the bank for dishonoring the check. It also mentions the legal consequences if the check issuer fails to resolve the issue within a set timeframe. The consequences of writing a bad check in King Washington can be severe. They may include criminal charges, civil liability, monetary penalties, and damage to the check issuer's credit rating. The recipient has the right to seek restitution for the face value of the dishonored check, any bank fees incurred, and legal expenses. In conclusion, the King Washington Notice of Dishonored Check — Civil plays a crucial role in alerting check issuers about the dishonored check and its accompanying consequences. By understanding the implications and taking prompt action to rectify the situation, individuals can mitigate the potential legal and financial repercussions associated with issuing a bad or bounced check.Title: Understanding the King Washington Notice of Dishonored Check — Civil Introduction: The King Washington Notice of Dishonored Check — Civil is a legal document issued by the state of Washington when a check is returned unpaid due to insufficient funds or other reasons. This notice serves as a warning to the check issuer, informing them of the consequences and remedies associated with writing a bad or bounced check. In this article, we will delve into the details of what a bad check is, reasons for its dishonor, and the repercussions it may entail. Types of Dishonored Checks: 1. Insufficient Fund Check: This type occurs when there are not enough funds available in the check issuer's account to cover the payment amount. It is the most common reason for a check to be dishonored. 2. Closed Account Check: This type occurs when the check issuer has closed their bank account before the recipient attempts to deposit or cash the check. 3. Post-Dated Check: A post-dated check bears a future date instead of the current date. If such a check is presented for payment earlier than the indicated date, it will be considered a dishonored check. 4. Stolen or Forgery Check: This type refers to checks that have been stolen or forged without the knowledge or consent of the account holder. If discovered, such checks are considered dishonored. Detailed Description: A bad check, also known as a bounced check, is a check that cannot be processed or honored by the bank on which it is drawn. When a check bounces, it means that it cannot be cleared because the bank account linked to it does not have adequate funds to cover the payment. In King Washington, a person who receives a dishonored check may file a Notice of Dishonored Check — Civil to address the matter legally. The Notice of Dishonored Check — Civil is the first step in the legal process of seeking remedies for a bad check. It serves as an official warning and provides information on the consequences the check issuer may face if the situation is not resolved promptly. The notice also outlines the steps the recipient can take to seek restitution or pursue legal action. When a recipient receives a dishonored check, they can send a Notice of Dishonored Check — Civil to the check issuer. The notice typically includes important details such as the check number, date, amount, and the reason provided by the bank for dishonoring the check. It also mentions the legal consequences if the check issuer fails to resolve the issue within a set timeframe. The consequences of writing a bad check in King Washington can be severe. They may include criminal charges, civil liability, monetary penalties, and damage to the check issuer's credit rating. The recipient has the right to seek restitution for the face value of the dishonored check, any bank fees incurred, and legal expenses. In conclusion, the King Washington Notice of Dishonored Check — Civil plays a crucial role in alerting check issuers about the dishonored check and its accompanying consequences. By understanding the implications and taking prompt action to rectify the situation, individuals can mitigate the potential legal and financial repercussions associated with issuing a bad or bounced check.