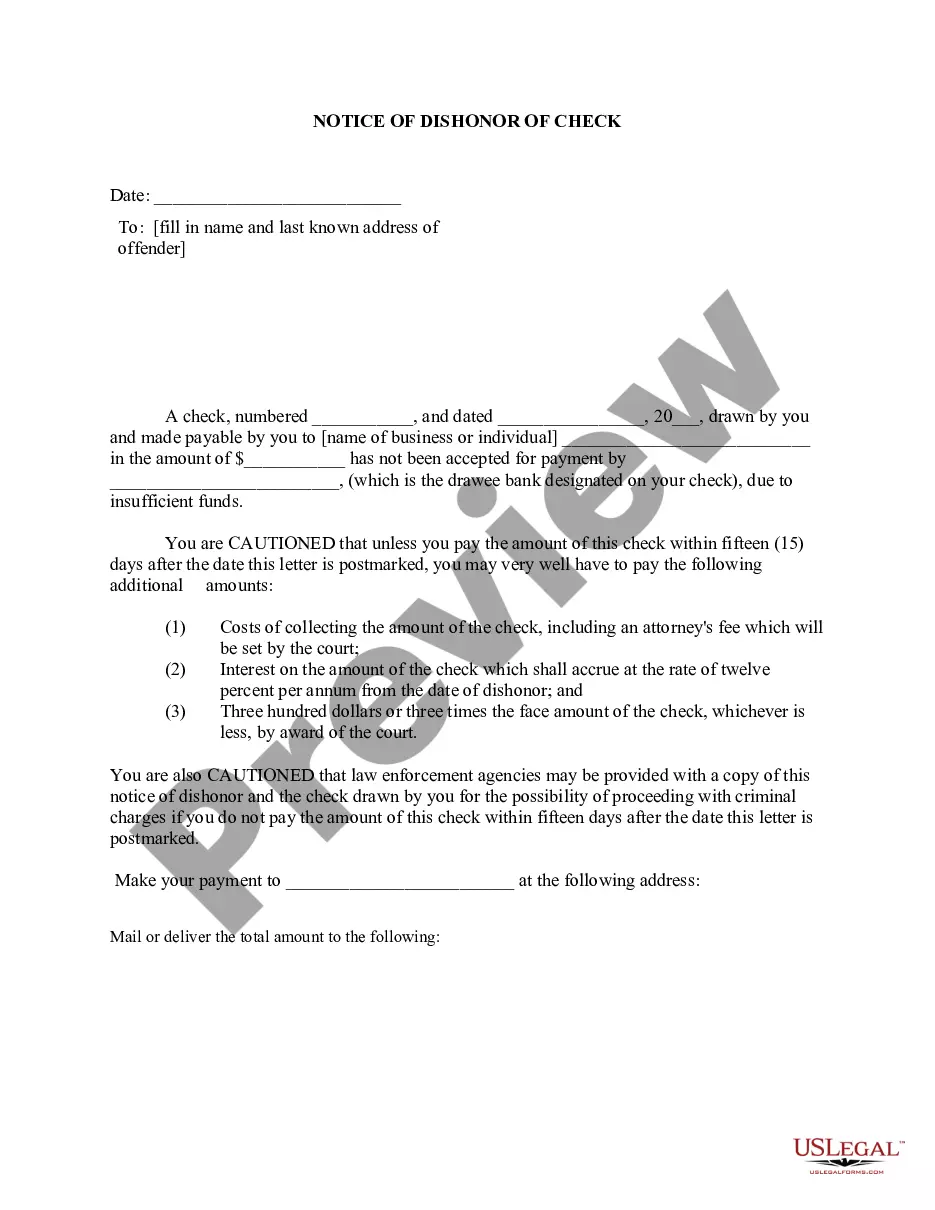

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Renton Washington Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check A bad check or bounced check, as commonly referred to in Renton, Washington, occurs when a check written by an individual or business is not honored by their bank due to insufficient funds or other related reasons. In such cases, the recipient of the check is legally entitled to pursue certain actions to recover the owed funds. Renton Washington Notice of Dishonored Check — Civil is the official document used in Renton to notify the check issuer about the dishonored check and the consequences they may face if they fail to rectify the situation promptly. The Renton Washington Notice of Dishonored Check — Civil serves as a formal communication to inform the check issuer that their check has been dishonored and demands the immediate payment of the original amount of the check, along with any additional fees, penalties, or interest incurred due to the dishonored check. This notice acts as a warning to the check issuer, notifying them of potential legal consequences if they fail to pay the owed amount within a specified period. Renton Washington recognizes different types of dishonored checks, which include: 1. Insufficient Funds Check: This type of dishonored check occurs when the issuer's bank account balance is insufficient to cover the amount specified on the check. It indicates that the account does not have enough funds to honor the payment. 2. Closed Account Check: A closed account check refers to a dishonored check issued from an account that has been closed by the issuer. This may happen due to various reasons, such as account closure, fraudulent activity, or account inactivity. 3. Stopped Payment Check: A stopped payment check occurs when the check issuer deliberately requests their bank to refuse payment on a specific check. This situation may arise if the issuer suspects fraud or wishes to cancel the payment for any reason. 4. Frozen Account Check: A frozen account check is one that gets dishonored due to the issuer's bank account being frozen by legal authorities or as a result of a court order. It implies that the funds in the account cannot be accessed or withdrawn until the issue causing the freeze is resolved. When a recipient of a dishonored check in Renton, Washington, sends out a Notice of Dishonored Check — Civil, it is a significant step towards resolving the matter without resorting to legal measures. By notifying the check issuer of the dishonored check and the consequences involved, the recipient encourages the prompt payment of the owed amount and attempts to settle the matter amicably. However, if the check issuer fails to comply with the notice or neglects to make the required payment within the specified time frame, legal actions, such as filing a civil lawsuit, can be pursued to recover the funds owed.Renton Washington Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check A bad check or bounced check, as commonly referred to in Renton, Washington, occurs when a check written by an individual or business is not honored by their bank due to insufficient funds or other related reasons. In such cases, the recipient of the check is legally entitled to pursue certain actions to recover the owed funds. Renton Washington Notice of Dishonored Check — Civil is the official document used in Renton to notify the check issuer about the dishonored check and the consequences they may face if they fail to rectify the situation promptly. The Renton Washington Notice of Dishonored Check — Civil serves as a formal communication to inform the check issuer that their check has been dishonored and demands the immediate payment of the original amount of the check, along with any additional fees, penalties, or interest incurred due to the dishonored check. This notice acts as a warning to the check issuer, notifying them of potential legal consequences if they fail to pay the owed amount within a specified period. Renton Washington recognizes different types of dishonored checks, which include: 1. Insufficient Funds Check: This type of dishonored check occurs when the issuer's bank account balance is insufficient to cover the amount specified on the check. It indicates that the account does not have enough funds to honor the payment. 2. Closed Account Check: A closed account check refers to a dishonored check issued from an account that has been closed by the issuer. This may happen due to various reasons, such as account closure, fraudulent activity, or account inactivity. 3. Stopped Payment Check: A stopped payment check occurs when the check issuer deliberately requests their bank to refuse payment on a specific check. This situation may arise if the issuer suspects fraud or wishes to cancel the payment for any reason. 4. Frozen Account Check: A frozen account check is one that gets dishonored due to the issuer's bank account being frozen by legal authorities or as a result of a court order. It implies that the funds in the account cannot be accessed or withdrawn until the issue causing the freeze is resolved. When a recipient of a dishonored check in Renton, Washington, sends out a Notice of Dishonored Check — Civil, it is a significant step towards resolving the matter without resorting to legal measures. By notifying the check issuer of the dishonored check and the consequences involved, the recipient encourages the prompt payment of the owed amount and attempts to settle the matter amicably. However, if the check issuer fails to comply with the notice or neglects to make the required payment within the specified time frame, legal actions, such as filing a civil lawsuit, can be pursued to recover the funds owed.