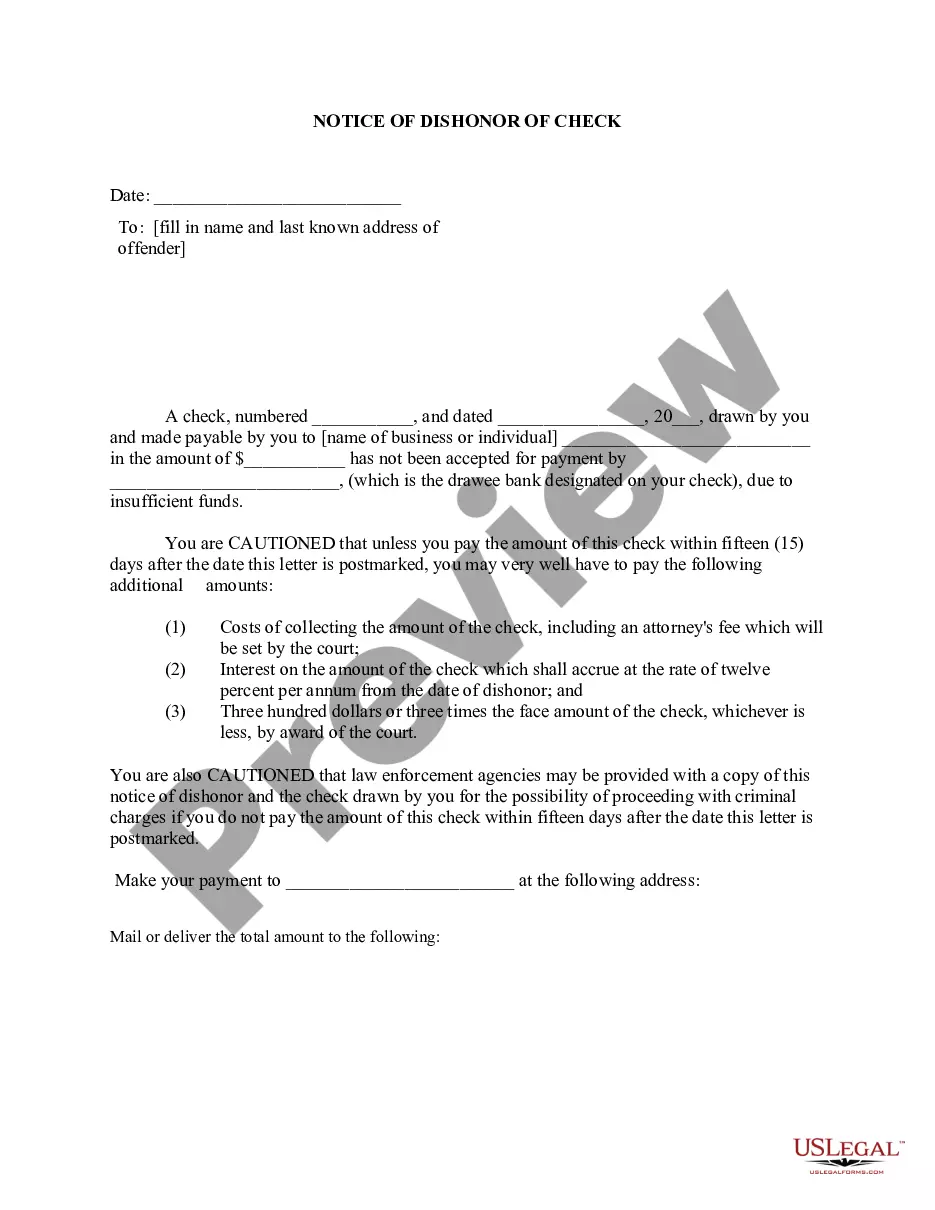

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Spokane Valley Washington Notice of Dishonored Check — Civil A bad check or bounced check is a significant concern for both individuals and businesses. When a check is dishonored, it indicates that there are insufficient funds or other issues that prevent the payment from being fulfilled. In Spokane Valley, Washington, the legal system provides a mechanism to address this problem through the Notice of Dishonored Check — Civil. A Notice of DishonoreCheckec— - Civil in Spokane Valley is a legal document that notifies the recipient (also known as the payee) that a check they received has been returned unpaid due to insufficient funds, a closed account, or other reasons. This notice serves as an official warning to the check writer (also known as the drawer) that they must rectify the situation promptly. Different types of bad checks can lead to a Notice of Dishonored Check — Civil in Spokane Valley, Washington. Understanding these categories assists recipients in taking appropriate action to resolve the issue. Some common types of bad checks include: 1. Insufficient Funds Checks: Issued when the check writer does not have enough money in their bank account to cover the check amount. 2. Account Closed Checks: Occur when the check writer closes their account before the recipient deposits the check. 3. Stop Payment Checks: Issued when the check writer contacts their bank and instructs them to cancel or "stop" the payment of a specific check. This action can be taken intentionally or by mistake, causing inconvenience to the recipient. Upon receiving a Notice of Dishonored Check — Civil in Spokane Valley, the payee should take prompt action. The notice typically provides detailed instructions on how to proceed, including crucial deadlines for resolving the situation. If the check writer fails to respond or make arrangements to satisfy the outstanding payment, the payee may pursue legal remedies. Dealing with bad checks can be time-consuming and frustrating for the recipient. However, the Spokane Valley Notice of Dishonored Check — Civil process provides a legal framework to address this issue and seek appropriate restitution. By following the necessary steps outlined in the notice, recipients can assert their rights and ensure that individuals or businesses fulfill their financial obligations. In conclusion, the Spokane Valley Washington Notice of Dishonored Check — Civil serves as a formal warning to check writers who issue bad checks. It facilitates a systematic approach for payees to address the problem and seek resolution. Understanding the different types of bad checks and their consequences helps recipients take appropriate action and protect their financial interests.Spokane Valley Washington Notice of Dishonored Check — Civil A bad check or bounced check is a significant concern for both individuals and businesses. When a check is dishonored, it indicates that there are insufficient funds or other issues that prevent the payment from being fulfilled. In Spokane Valley, Washington, the legal system provides a mechanism to address this problem through the Notice of Dishonored Check — Civil. A Notice of DishonoreCheckec— - Civil in Spokane Valley is a legal document that notifies the recipient (also known as the payee) that a check they received has been returned unpaid due to insufficient funds, a closed account, or other reasons. This notice serves as an official warning to the check writer (also known as the drawer) that they must rectify the situation promptly. Different types of bad checks can lead to a Notice of Dishonored Check — Civil in Spokane Valley, Washington. Understanding these categories assists recipients in taking appropriate action to resolve the issue. Some common types of bad checks include: 1. Insufficient Funds Checks: Issued when the check writer does not have enough money in their bank account to cover the check amount. 2. Account Closed Checks: Occur when the check writer closes their account before the recipient deposits the check. 3. Stop Payment Checks: Issued when the check writer contacts their bank and instructs them to cancel or "stop" the payment of a specific check. This action can be taken intentionally or by mistake, causing inconvenience to the recipient. Upon receiving a Notice of Dishonored Check — Civil in Spokane Valley, the payee should take prompt action. The notice typically provides detailed instructions on how to proceed, including crucial deadlines for resolving the situation. If the check writer fails to respond or make arrangements to satisfy the outstanding payment, the payee may pursue legal remedies. Dealing with bad checks can be time-consuming and frustrating for the recipient. However, the Spokane Valley Notice of Dishonored Check — Civil process provides a legal framework to address this issue and seek appropriate restitution. By following the necessary steps outlined in the notice, recipients can assert their rights and ensure that individuals or businesses fulfill their financial obligations. In conclusion, the Spokane Valley Washington Notice of Dishonored Check — Civil serves as a formal warning to check writers who issue bad checks. It facilitates a systematic approach for payees to address the problem and seek resolution. Understanding the different types of bad checks and their consequences helps recipients take appropriate action and protect their financial interests.