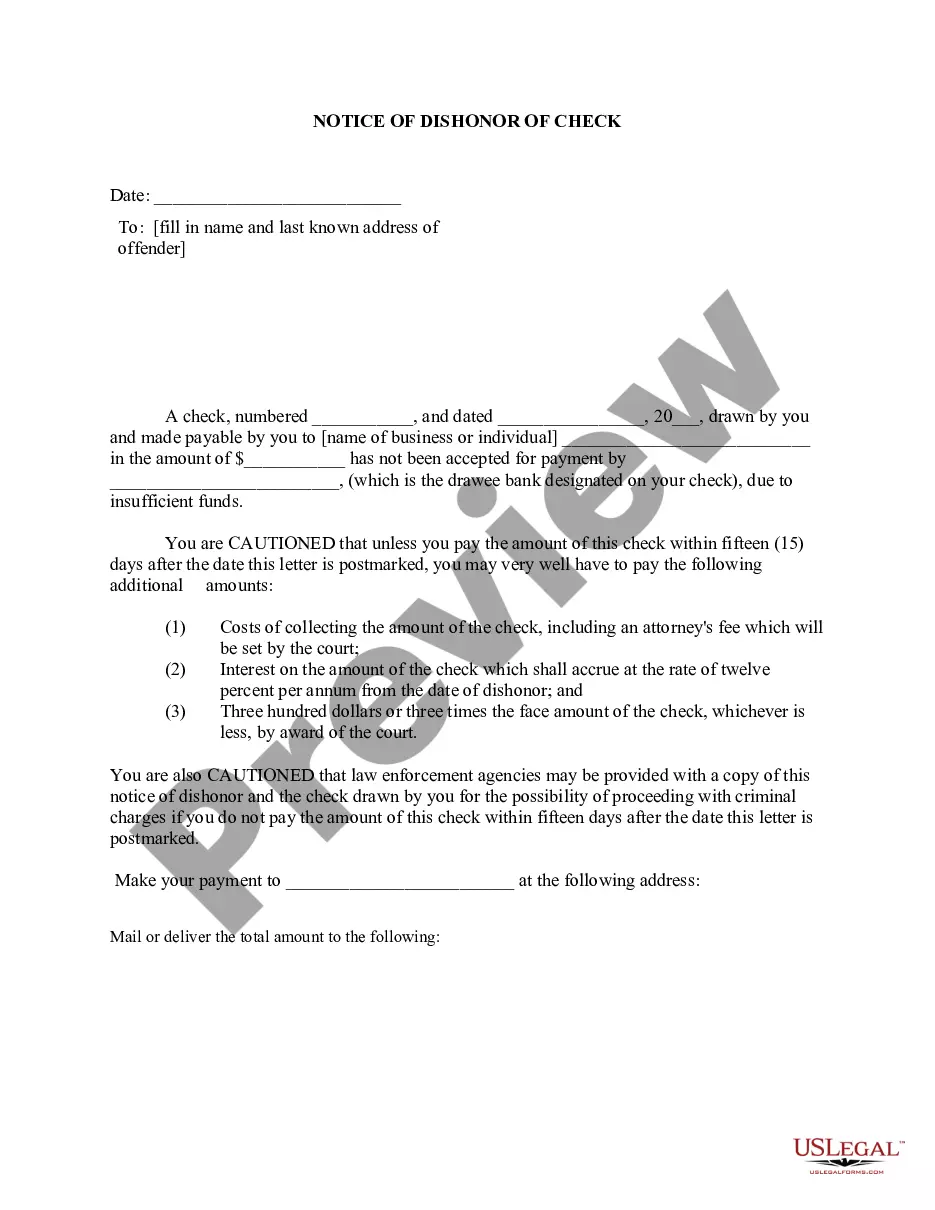

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Vancouver Washington Notice of Dishonored Check — Civil In Vancouver, Washington, when a check is returned due to insufficient funds or other reasons, it is considered a dishonored or bad check. This leads to the issuance of a Notice of Dishonored Check — Civil, which serves as an official notification to the check issuer regarding the bounced check. A bad check, also known as a dishonored check, is a check that has been presented for payment but cannot be processed due to insufficient funds in the issuer's account. This can happen unintentionally, such as through an oversight, or intentionally, as an act of fraud. When a check bounces in Vancouver, Washington, the recipient or the payee has the option to pursue legal action by filing a Notice of Dishonored Check — Civil. This notice acts as a formal document informing the check issuer of the dishonored check and the consequences that may follow. The Notice of Dishonored Check — Civil typically includes important details such as the date the check was issued, the amount, the check number, the financial institution involved, and the reason for dishonor (insufficient funds, closed account, etc.). It also states the legal actions that may be taken if the situation is not resolved promptly. There are various scenarios where a Notice of Dishonored Check — Civil can be issued, such as: 1. Insufficient Funds: This occurs when the check issuer does not have enough money in their account to cover the check amount. 2. Account Closed: If the check issuer has closed their account before the recipient attempts to cash the check, it will bounce. 3. Forgery or Fraud: In cases where the check is counterfeit or forged, it will dishonor upon verification. 4. Stop Payment: When the check issuer requests a stop payment on a check already issued, it will be considered dishonored if the recipient attempts to deposit or cash it. The Notice of Dishonored Check — Civil is a formal step that gives the check issuer an opportunity to rectify the situation before legal actions, such as fines or even criminal charges, are pursued. It provides a clear warning that non-payment or failure to resolve the issue may result in further legal consequences. In conclusion, a Vancouver Washington Notice of Dishonored Check — Civil serves as an official notice to individuals who have issued bad or bounced checks. It outlines the dishonored check's key details and alerts the issuer about the potential legal repercussions if the matter remains unresolved. Resolving such issues promptly is crucial to avoid further legal complications and uphold financial integrity.