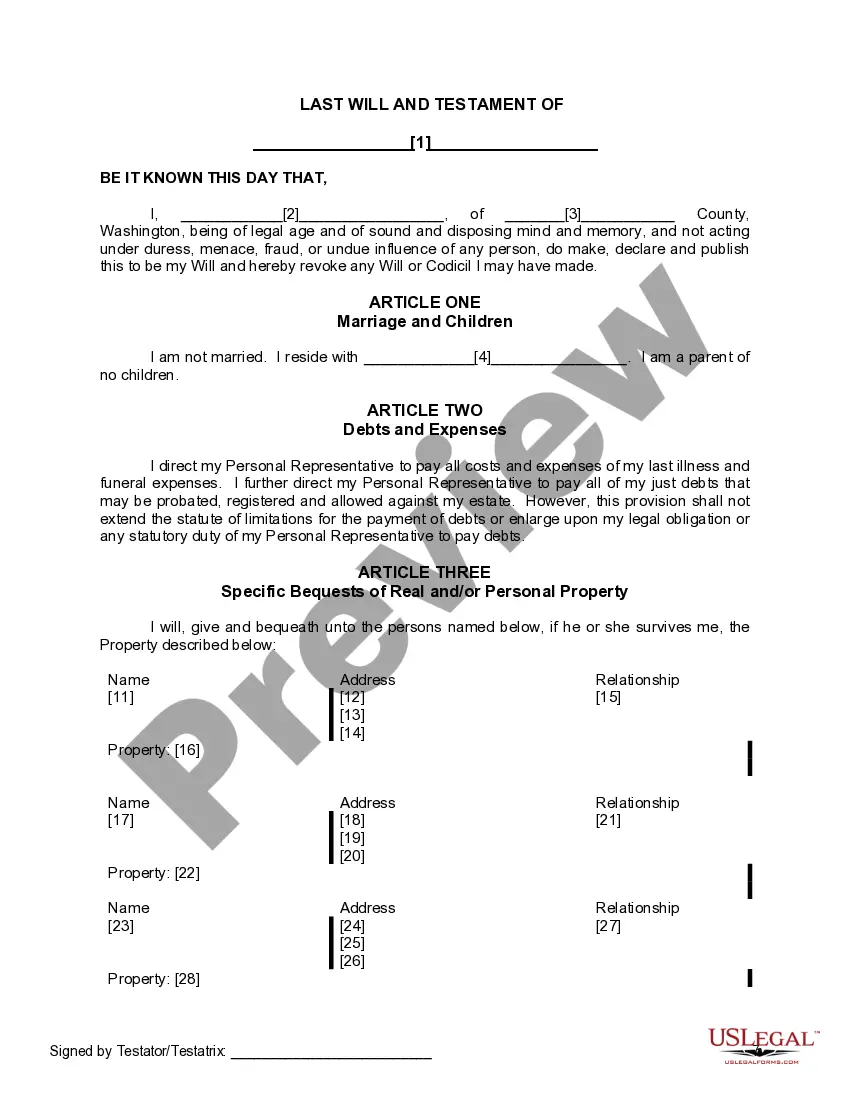

This will package contains two wills for a man and woman living together with no children. It is designed for persons that, although not married, desire to execute mutual wills leaving some of their property to the other. State specific instructions are also included.

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills.

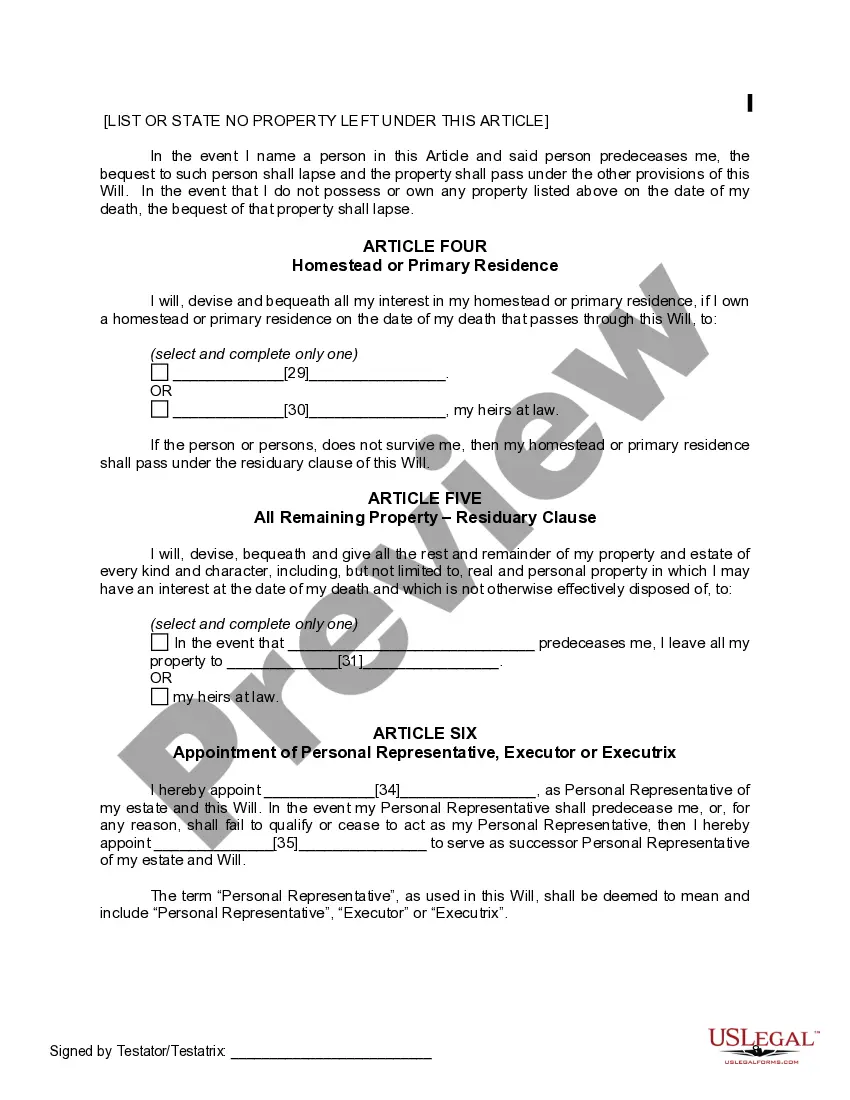

Vancouver Washington Mutual Wills for Unmarried Persons living together with No Children provide a comprehensive solution to ensure that the assets, properties, and final wishes of unmarried couples are protected and carried out according to their desires. These legal documents are specifically designed for unmarried individuals who are in committed relationships and do not have any children. A Vancouver Washington Mutual Will for Unmarried Persons living together with No Children serves as a crucial tool to outline how the couple's assets, including real estate, bank accounts, investments, and personal belongings, should be distributed upon the passing of either party. It allows the couple to dictate who will inherit their assets, specify any charitable donations they wish to make, and make provision for any dependents or pets they may have. This type of will also grants the power to appoint an executor who will be responsible for managing the estate and ensuring that the distribution of assets is carried out as per the terms stated within the document. Additionally, the will may contain provisions for funeral arrangements and burial or cremation preferences. Different variations of Vancouver Washington Mutual Wills for Unmarried Persons living together with No Children may include: 1. Basic Mutual Will: This type of will outline the distribution of assets between the couple, specifying the percentage or specific items each party will inherit. 2. Conditional Mutual Will: In this Will, the distribution of assets might be conditional based on specific events or situations, such as one partner remarrying or acquiring a new property. 3. Reciprocal Mutual Will: This type of will often is chosen by couples who wish to leave their assets to each other, and in the event of both partners passing away simultaneously or within a short span, their assets are then distributed to specified beneficiaries. 4. Testamentary Trust: Some couples may opt to create a testamentary trust within their Mutual Will to ensure that their assets are held in a trust for the benefit of a specific individual or organization, such as a sibling, a close friend, or a favorite charity. 5. Durable Power of Attorney: Although not technically a part of the will, including a durable power of attorney can be beneficial for unmarried couples. This document designates a trusted person to make financial or healthcare decisions on behalf of the individual in case of incapacitation. By utilizing Vancouver Washington Mutual Wills for Unmarried Persons living together with No Children, couples can gain peace of mind knowing that their wishes and intentions will be honored after their passing. Consulting with an experienced estate planning attorney is recommended to ensure that the will is comprehensive, legally binding, and tailored to their specific needs and circumstances.Vancouver Washington Mutual Wills for Unmarried Persons living together with No Children provide a comprehensive solution to ensure that the assets, properties, and final wishes of unmarried couples are protected and carried out according to their desires. These legal documents are specifically designed for unmarried individuals who are in committed relationships and do not have any children. A Vancouver Washington Mutual Will for Unmarried Persons living together with No Children serves as a crucial tool to outline how the couple's assets, including real estate, bank accounts, investments, and personal belongings, should be distributed upon the passing of either party. It allows the couple to dictate who will inherit their assets, specify any charitable donations they wish to make, and make provision for any dependents or pets they may have. This type of will also grants the power to appoint an executor who will be responsible for managing the estate and ensuring that the distribution of assets is carried out as per the terms stated within the document. Additionally, the will may contain provisions for funeral arrangements and burial or cremation preferences. Different variations of Vancouver Washington Mutual Wills for Unmarried Persons living together with No Children may include: 1. Basic Mutual Will: This type of will outline the distribution of assets between the couple, specifying the percentage or specific items each party will inherit. 2. Conditional Mutual Will: In this Will, the distribution of assets might be conditional based on specific events or situations, such as one partner remarrying or acquiring a new property. 3. Reciprocal Mutual Will: This type of will often is chosen by couples who wish to leave their assets to each other, and in the event of both partners passing away simultaneously or within a short span, their assets are then distributed to specified beneficiaries. 4. Testamentary Trust: Some couples may opt to create a testamentary trust within their Mutual Will to ensure that their assets are held in a trust for the benefit of a specific individual or organization, such as a sibling, a close friend, or a favorite charity. 5. Durable Power of Attorney: Although not technically a part of the will, including a durable power of attorney can be beneficial for unmarried couples. This document designates a trusted person to make financial or healthcare decisions on behalf of the individual in case of incapacitation. By utilizing Vancouver Washington Mutual Wills for Unmarried Persons living together with No Children, couples can gain peace of mind knowing that their wishes and intentions will be honored after their passing. Consulting with an experienced estate planning attorney is recommended to ensure that the will is comprehensive, legally binding, and tailored to their specific needs and circumstances.