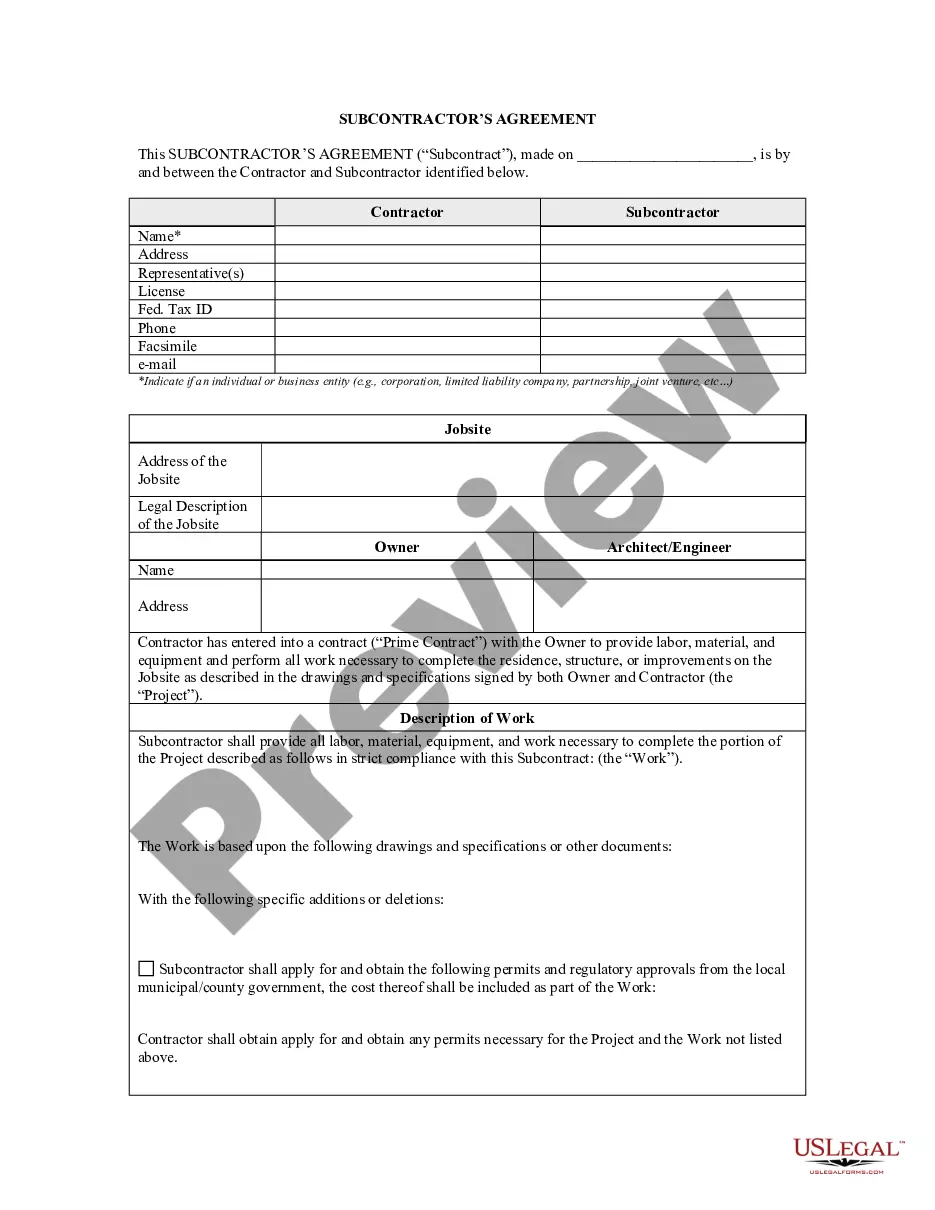

Agreement for assignment by Borrower to Lender of leases and rent therefrom in order to repay Borrower's debt to Lender. The assignee agrees to extend a loan to the assignor secured by a deed of trust and security agreement. The agreement will satisfy state statutory law.

An assignment is the transfer of a property right or title to some particular person or entity under an agreement, usually in writing. Unless an assignment is qualified in some way, it is generally considered to be a transfer of the transferor's entire interest in the estate, chattel, or other thing assigned. An assignment is distinguished from a grant in that an assignment is usually limited to the transfer of intangible rights, including contractual rights, choses in action, and rights in or connected with property, rather than, as in the case of a grant, the property itself. For example, the payee may assign his or her rights to collect the note payments to a bank.

Vancouver Washington Assignment of Lease and Rent from Borrower to Lender is a legal document that allows a borrower (also referred to as the tenant) to assign their lease agreement and rent payment obligations to a lender. This process typically occurs when the borrower has taken out a loan or received financial assistance from the lender using their lease as collateral. This assignment agreement grants the lender the right to step into the borrower's shoes and assume all rights, duties, and responsibilities outlined in the original lease agreement. It enables the lender to collect rent directly from the tenant and manage other aspects related to the leased property. There are several types of Vancouver Washington Assignment of Lease and Rent from Borrower to Lender that individuals may encounter: 1. Commercial Assignment of Lease and Rent: This type of assignment is commonly used for commercial properties where businesses lease space for office, retail, or industrial purposes. Lenders may require a commercial assignment of lease and rent as security for loans or lines of credit extended to business owners. 2. Residential Assignment of Lease and Rent: This type of assignment is applicable to residential properties, such as apartments or houses, where individuals or families lease the property for their living arrangements. Residential assignment of lease and rent allows borrowers seeking financial assistance to assign their lease and rent obligations to lenders. 3. Construction Assignment of Lease and Rent: This type of assignment is specific to construction projects in Vancouver, Washington. It allows borrowers who are involved in property development or construction to assign their lease agreement and corresponding rent payments to lenders as collateral for construction loans. 4. Sublease Assignment of Lease and Rent: In some cases, tenants may have already subleased a property to another individual or entity. In this scenario, the borrower may assign their rights and obligations as both the primary tenant and sublessor to the lender. This type of assignment typically requires consent from both the original landlord and the sublessee. Overall, Vancouver Washington Assignment of Lease and Rent from Borrower to Lender is a legal tool that provides security to lenders while allowing borrowers to use their lease agreements as collateral for loans or financial assistance. It is essential for both parties to thoroughly understand the terms and conditions outlined in the assignment agreement and seek legal advice if necessary to ensure a smooth and transparent transaction.Vancouver Washington Assignment of Lease and Rent from Borrower to Lender is a legal document that allows a borrower (also referred to as the tenant) to assign their lease agreement and rent payment obligations to a lender. This process typically occurs when the borrower has taken out a loan or received financial assistance from the lender using their lease as collateral. This assignment agreement grants the lender the right to step into the borrower's shoes and assume all rights, duties, and responsibilities outlined in the original lease agreement. It enables the lender to collect rent directly from the tenant and manage other aspects related to the leased property. There are several types of Vancouver Washington Assignment of Lease and Rent from Borrower to Lender that individuals may encounter: 1. Commercial Assignment of Lease and Rent: This type of assignment is commonly used for commercial properties where businesses lease space for office, retail, or industrial purposes. Lenders may require a commercial assignment of lease and rent as security for loans or lines of credit extended to business owners. 2. Residential Assignment of Lease and Rent: This type of assignment is applicable to residential properties, such as apartments or houses, where individuals or families lease the property for their living arrangements. Residential assignment of lease and rent allows borrowers seeking financial assistance to assign their lease and rent obligations to lenders. 3. Construction Assignment of Lease and Rent: This type of assignment is specific to construction projects in Vancouver, Washington. It allows borrowers who are involved in property development or construction to assign their lease agreement and corresponding rent payments to lenders as collateral for construction loans. 4. Sublease Assignment of Lease and Rent: In some cases, tenants may have already subleased a property to another individual or entity. In this scenario, the borrower may assign their rights and obligations as both the primary tenant and sublessor to the lender. This type of assignment typically requires consent from both the original landlord and the sublessee. Overall, Vancouver Washington Assignment of Lease and Rent from Borrower to Lender is a legal tool that provides security to lenders while allowing borrowers to use their lease agreements as collateral for loans or financial assistance. It is essential for both parties to thoroughly understand the terms and conditions outlined in the assignment agreement and seek legal advice if necessary to ensure a smooth and transparent transaction.