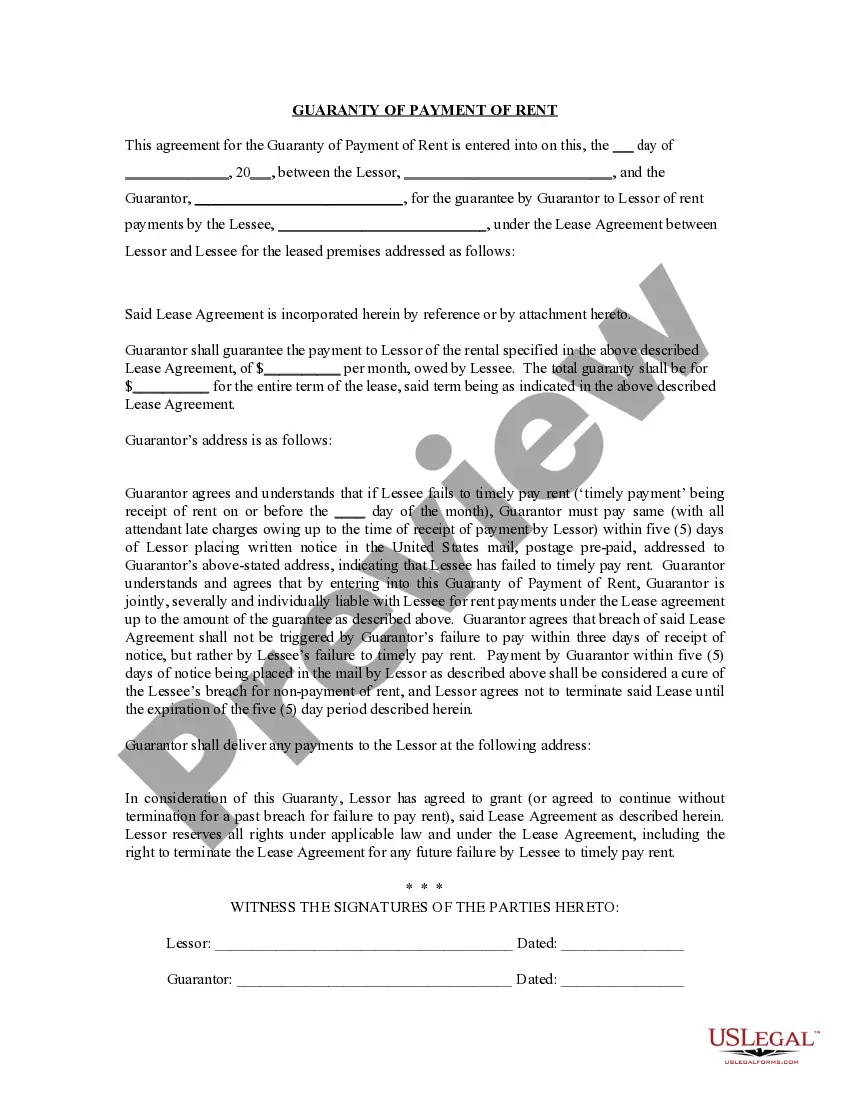

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

King Washington Guaranty or Guarantee of Payment of Rent is a form of legal agreement commonly used in commercial real estate transactions. It is designed to provide assurance to the landlord that the tenant will fulfill their financial obligations by making timely rent payments throughout the lease term. This guarantee acts as a safeguard for landlords and offers financial security, ensuring the tenant's financial capability to pay the rent. The King Washington Guaranty or Guarantee of Payment of Rent can take various forms, each with its unique characteristics. These types include: 1. Financial Guaranty: This type of guarantee usually involves a third-party individual or entity with a strong financial standing. They pledge to make the rent payment on behalf of the tenant if they fail to do so. Often, the guarantor is a parent company, a wealthy individual, or a financial institution. 2. Corporate Guaranty: In this scenario, a parent or sister company of the tenant guarantees the payment of rent. The parent company essentially backs the financial obligations of its subsidiaries, ensuring that the rent will be paid on time. 3. Personal Guaranty: Unlike the financial or corporate guaranty, a personal guaranty involves an individual, such as the tenant's owner or principal, who assumes personal liability for the rent payments. The guarantor's personal assets can be at risk in case of failure to fulfill the financial obligation. 4. Limited Guaranty: This type places certain limitations on the guarantor's liability. It might restrict the maximum amount the guarantor is responsible for or limit the duration of their guarantee. The purpose of offering the King Washington Guaranty or Guarantee of Payment of Rent is to mitigate the landlord's risk in case the tenant fails to meet their financial obligations. It can be a beneficial tool for both parties involved as it ensures the landlord's ability to collect rent and protects the tenant's occupancy rights. In conclusion, the King Washington Guaranty or Guarantee of Payment of Rent is a crucial legal agreement in the realm of commercial real estate. Its various forms provide reassurance to landlords, ensuring that the rent will be paid on time and in full, thereby establishing a stable and secure landlord-tenant relationship.King Washington Guaranty or Guarantee of Payment of Rent is a form of legal agreement commonly used in commercial real estate transactions. It is designed to provide assurance to the landlord that the tenant will fulfill their financial obligations by making timely rent payments throughout the lease term. This guarantee acts as a safeguard for landlords and offers financial security, ensuring the tenant's financial capability to pay the rent. The King Washington Guaranty or Guarantee of Payment of Rent can take various forms, each with its unique characteristics. These types include: 1. Financial Guaranty: This type of guarantee usually involves a third-party individual or entity with a strong financial standing. They pledge to make the rent payment on behalf of the tenant if they fail to do so. Often, the guarantor is a parent company, a wealthy individual, or a financial institution. 2. Corporate Guaranty: In this scenario, a parent or sister company of the tenant guarantees the payment of rent. The parent company essentially backs the financial obligations of its subsidiaries, ensuring that the rent will be paid on time. 3. Personal Guaranty: Unlike the financial or corporate guaranty, a personal guaranty involves an individual, such as the tenant's owner or principal, who assumes personal liability for the rent payments. The guarantor's personal assets can be at risk in case of failure to fulfill the financial obligation. 4. Limited Guaranty: This type places certain limitations on the guarantor's liability. It might restrict the maximum amount the guarantor is responsible for or limit the duration of their guarantee. The purpose of offering the King Washington Guaranty or Guarantee of Payment of Rent is to mitigate the landlord's risk in case the tenant fails to meet their financial obligations. It can be a beneficial tool for both parties involved as it ensures the landlord's ability to collect rent and protects the tenant's occupancy rights. In conclusion, the King Washington Guaranty or Guarantee of Payment of Rent is a crucial legal agreement in the realm of commercial real estate. Its various forms provide reassurance to landlords, ensuring that the rent will be paid on time and in full, thereby establishing a stable and secure landlord-tenant relationship.