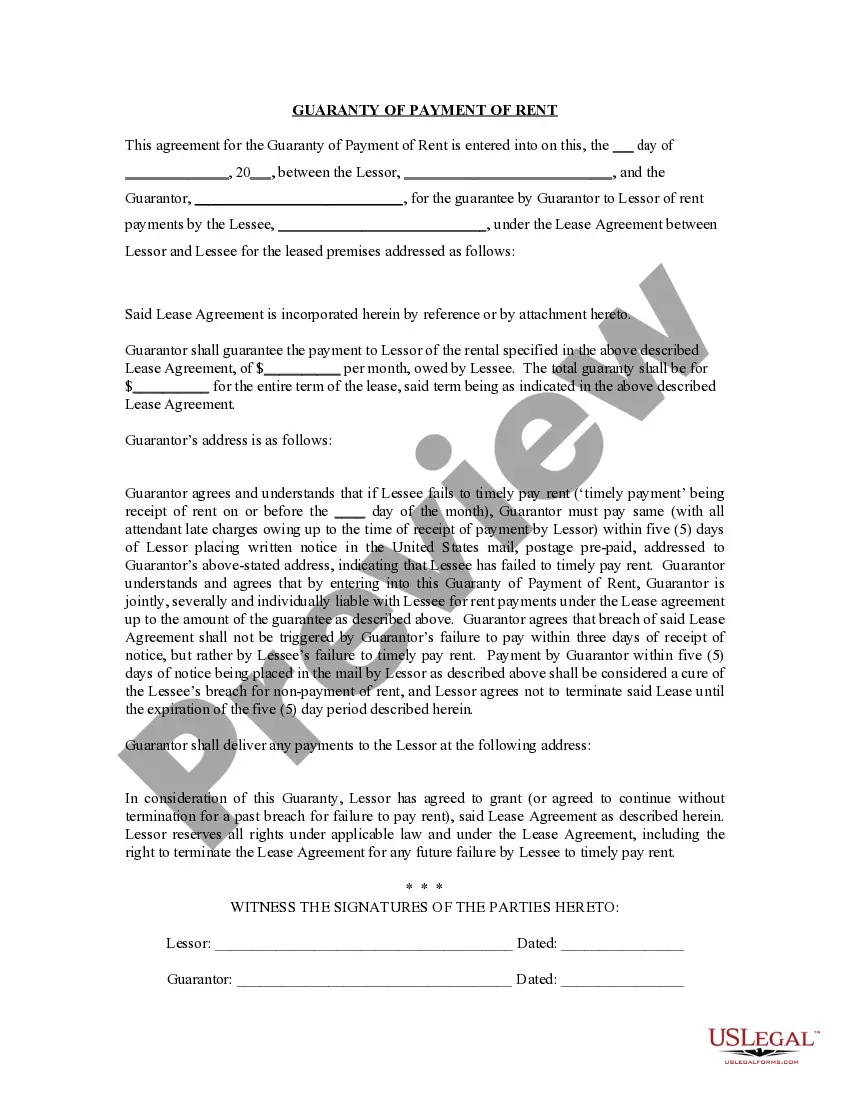

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Seattle Washington Guaranty or Guarantee of Payment of Rent is a legal agreement designed to provide an additional layer of financial security for landlords by ensuring that the rent will be paid in full and on time. This guarantee serves as a protection for property owners in the vibrant city of Seattle, Washington, and minimizes the risks associated with rental property management. There are different types of Seattle Washington Guaranty or Guarantee of Payment of Rent agreements that cater to specific landlord needs and situations: 1. Individual Guaranty: This agreement involves a third party, typically an individual, who agrees to assume responsibility for the rent payments in case the tenant defaults. The guarantor's creditworthiness and financial stability are the primary factors used to evaluate their eligibility as a guarantor. 2. Corporate Guaranty: In this type of agreement, a corporate entity takes on the responsibility of guaranteeing the payment of rent. Landlords often prefer this option when dealing with business tenants or larger rental properties. 3. Partial Guaranty: A partial guaranty limits the financial responsibility of the guarantor to a specified portion of the rent amount. This type of agreement is suitable for landlords who seek additional protection without burdening the guarantor with the full rental obligation. 4. Limited Guaranty: Limited guaranties are commonly used when multiple tenants share a rental unit. Each tenant may have a separate guarantor, and the liability of the guarantors is limited to their respective tenant's portion of the rent. The Seattle Washington Guaranty or Guarantee of Payment of Rent agreement typically outlines the terms and conditions under which the guarantor will be held accountable for rent payments. Key elements typically included in the agreement are the names of the parties involved, the rental property address, the duration of the guarantee, and any specific obligations of the guarantor. Landlords may require potential tenants to secure a guarantor or guarantee of payment of rent as part of their rental application process to reduce the risk of non-payment. In such cases, the guarantor must provide the necessary financial documentation and undergo a thorough review to ensure their ability to meet their obligations under the agreement. By incorporating a Seattle Washington Guaranty or Guarantee of Payment of Rent agreement, landlords in Seattle can mitigate the financial risks associated with renting their property, ensuring uninterrupted cash flow and peace of mind.Seattle Washington Guaranty or Guarantee of Payment of Rent is a legal agreement designed to provide an additional layer of financial security for landlords by ensuring that the rent will be paid in full and on time. This guarantee serves as a protection for property owners in the vibrant city of Seattle, Washington, and minimizes the risks associated with rental property management. There are different types of Seattle Washington Guaranty or Guarantee of Payment of Rent agreements that cater to specific landlord needs and situations: 1. Individual Guaranty: This agreement involves a third party, typically an individual, who agrees to assume responsibility for the rent payments in case the tenant defaults. The guarantor's creditworthiness and financial stability are the primary factors used to evaluate their eligibility as a guarantor. 2. Corporate Guaranty: In this type of agreement, a corporate entity takes on the responsibility of guaranteeing the payment of rent. Landlords often prefer this option when dealing with business tenants or larger rental properties. 3. Partial Guaranty: A partial guaranty limits the financial responsibility of the guarantor to a specified portion of the rent amount. This type of agreement is suitable for landlords who seek additional protection without burdening the guarantor with the full rental obligation. 4. Limited Guaranty: Limited guaranties are commonly used when multiple tenants share a rental unit. Each tenant may have a separate guarantor, and the liability of the guarantors is limited to their respective tenant's portion of the rent. The Seattle Washington Guaranty or Guarantee of Payment of Rent agreement typically outlines the terms and conditions under which the guarantor will be held accountable for rent payments. Key elements typically included in the agreement are the names of the parties involved, the rental property address, the duration of the guarantee, and any specific obligations of the guarantor. Landlords may require potential tenants to secure a guarantor or guarantee of payment of rent as part of their rental application process to reduce the risk of non-payment. In such cases, the guarantor must provide the necessary financial documentation and undergo a thorough review to ensure their ability to meet their obligations under the agreement. By incorporating a Seattle Washington Guaranty or Guarantee of Payment of Rent agreement, landlords in Seattle can mitigate the financial risks associated with renting their property, ensuring uninterrupted cash flow and peace of mind.