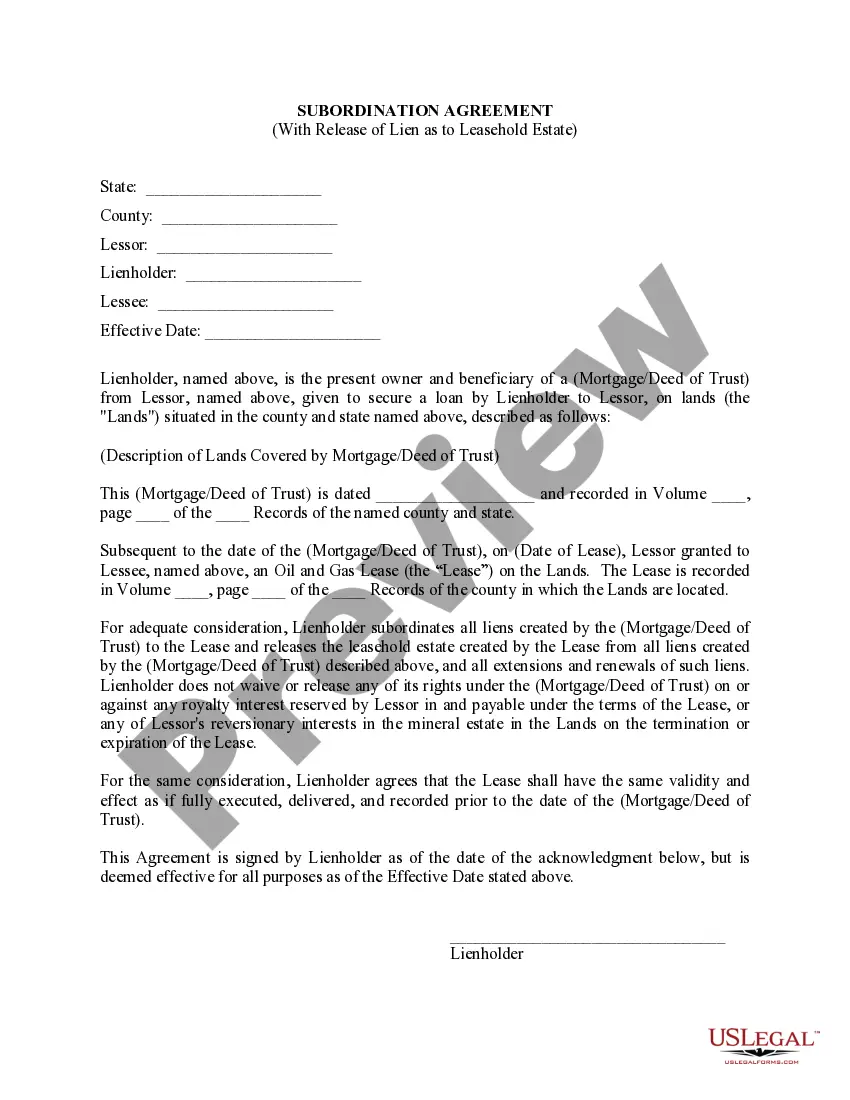

This Lease Subordination Agreement is a lienholder's lien that was created by a (Mortgage/Deed of Trust) and is subordinated to a mineral/oil/gas lease and lienholder releases, said Leasehold from all liens created by said (Mortgage/Deed of Trust), and all extensions and renewals of such liens. Lienholder retains all rights under the (Mortgage/Deed of Trust) against any royalty interest reserved by the lessor in and payable under the terms of the lease, or any of lessor's reversionary interests on the termination or expiration of the lease.

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.

Everett Washington Lease Subordination Agreement is a legal contract that establishes the hierarchy of leasehold interests in a property located within Everett, Washington. It outlines the terms and conditions by which a tenant agrees to subordinate or lower their lease rights to those of another party, typically a lender that holds a mortgage on the property. In real estate financing, lease subordination agreements are commonly used when a property owner seeks additional financing or refinancing and the lender requires priority position over existing leases. By entering into a lease subordination agreement, the tenant accepts that the lender's mortgage or lien takes precedence over their lease rights if foreclosure were to occur. The agreement ensures that the lender has a first claim on the property before the tenant's lease rights are considered. There are various types of Everett Washington Lease Subordination Agreements, depending on the specific circumstances and parties involved: 1. Commercial Lease Subordination Agreement: This type of subordination agreement applies to commercial properties, such as office buildings, retail spaces, or warehouses. It governs the relationship between the lender, tenant, and property owner related to subordinate lease rights. 2. Residential Lease Subordination Agreement: This agreement type applies to residential properties, such as apartments, houses, or condominiums. It establishes the priority of the lender's rights over residential lease interests. 3. Master Lease Subordination Agreement: When a property owner has multiple lease agreements with different tenants, a master lease subordination agreement may be used. This type of agreement subordinates all individual leases to the primary lender, providing a unified approach. The Everett Washington Lease Subordination Agreement typically includes provisions such as the property description, names of involved parties, term of subordination, lender's rights, tenant's obligations, and any additional conditions agreed upon. It is crucial for tenants to carefully review the agreement and seek legal counsel to ensure their rights and obligations are adequately protected. In summary, the Everett Washington Lease Subordination Agreement is a legally binding document used to prioritize the interests of lenders over tenants' lease rights in the event of foreclosure or default. It helps property owners secure additional financing while ensuring lenders have the highest claim on the property. Various types of lease subordination agreements exist, including commercial, residential, and master lease subordination agreements, each catering to specific property types and scenarios.Everett Washington Lease Subordination Agreement is a legal contract that establishes the hierarchy of leasehold interests in a property located within Everett, Washington. It outlines the terms and conditions by which a tenant agrees to subordinate or lower their lease rights to those of another party, typically a lender that holds a mortgage on the property. In real estate financing, lease subordination agreements are commonly used when a property owner seeks additional financing or refinancing and the lender requires priority position over existing leases. By entering into a lease subordination agreement, the tenant accepts that the lender's mortgage or lien takes precedence over their lease rights if foreclosure were to occur. The agreement ensures that the lender has a first claim on the property before the tenant's lease rights are considered. There are various types of Everett Washington Lease Subordination Agreements, depending on the specific circumstances and parties involved: 1. Commercial Lease Subordination Agreement: This type of subordination agreement applies to commercial properties, such as office buildings, retail spaces, or warehouses. It governs the relationship between the lender, tenant, and property owner related to subordinate lease rights. 2. Residential Lease Subordination Agreement: This agreement type applies to residential properties, such as apartments, houses, or condominiums. It establishes the priority of the lender's rights over residential lease interests. 3. Master Lease Subordination Agreement: When a property owner has multiple lease agreements with different tenants, a master lease subordination agreement may be used. This type of agreement subordinates all individual leases to the primary lender, providing a unified approach. The Everett Washington Lease Subordination Agreement typically includes provisions such as the property description, names of involved parties, term of subordination, lender's rights, tenant's obligations, and any additional conditions agreed upon. It is crucial for tenants to carefully review the agreement and seek legal counsel to ensure their rights and obligations are adequately protected. In summary, the Everett Washington Lease Subordination Agreement is a legally binding document used to prioritize the interests of lenders over tenants' lease rights in the event of foreclosure or default. It helps property owners secure additional financing while ensuring lenders have the highest claim on the property. Various types of lease subordination agreements exist, including commercial, residential, and master lease subordination agreements, each catering to specific property types and scenarios.