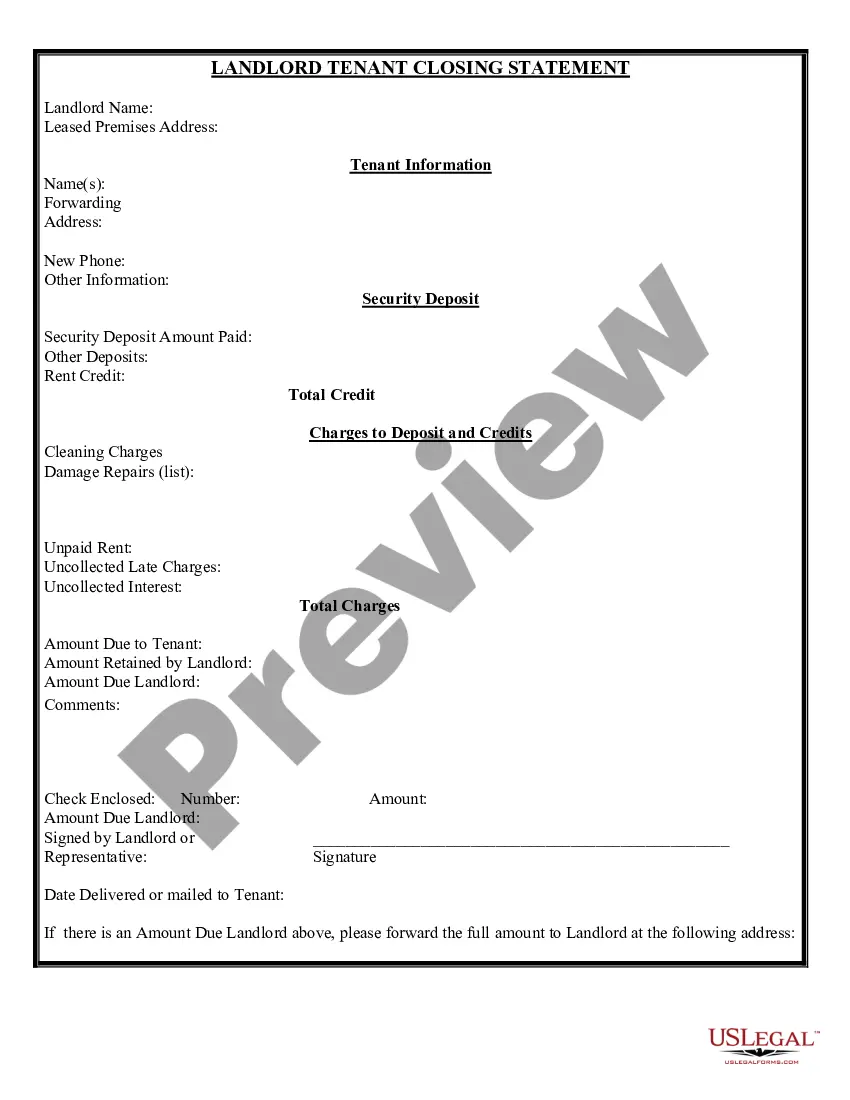

This is a Landlord Tenant Closing Statement - Reconcile Security Deposit, where the landlord records the deposits and credits, less deductions from the credits or security deposit for delivery to the tenant. It is used to document for the benefit of both parties the monies held by the landlord and due to the landlord.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Seattle Washington Landlord Tenant Closing Statement to Reconcile Security Deposit is a legal document that outlines the final reconciliation of the security deposit between a landlord and tenant at the end of a tenancy in Seattle, Washington. This statement is crucial for both parties to ensure transparency and fairness in the handling of the security deposit. The Seattle Washington Landlord Tenant Closing Statement to Reconcile Security Deposit includes several key sections: 1. Identification Details: This section provides information about the landlord, tenant, and rental property, such as names, addresses, lease start and end dates, and contact information. 2. Security Deposit Details: Here, the statement states the initial amount of the security deposit paid by the tenant at the beginning of the tenancy and any subsequent deposit additions or deductions that occurred during the rental period. 3. Itemized Deductions: In this section, the landlord lists all the deductions made from the security deposit. These deductions can include unpaid rent, utility bills, cleaning costs, repairs for damages beyond normal wear and tear, and any outstanding fees or charges agreed upon in the lease agreement. 4. Property Condition: The closing statement includes a detailed assessment of the property's condition at the end of the tenancy. This assessment may involve documenting the overall cleanliness, damages, and any necessary repairs needed to restore the property to its original condition. 5. Final Reconciliation: This part calculates the final amount to be refunded to the tenant or the remaining balance owed by the tenant. It takes into account the initial security deposit, any deductions made, and any interest earned on the deposit, as required by Seattle's rental laws. Different types of Seattle Washington Landlord Tenant Closing Statements to Reconcile Security Deposit may vary depending on the type of rental property, such as residential or commercial, and the specific lease agreement terms. However, the essential elements mentioned above generally remain the same. It is important to note that the Seattle Washington Landlord Tenant Closing Statement to Reconcile Security Deposit must comply with the local laws and regulations governing landlord-tenant relationships to ensure a fair and lawful process. It is advisable for landlords and tenants to consult the Washington State Landlord-Tenant Act or seek legal counsel for specific guidance.Seattle Washington Landlord Tenant Closing Statement to Reconcile Security Deposit is a legal document that outlines the final reconciliation of the security deposit between a landlord and tenant at the end of a tenancy in Seattle, Washington. This statement is crucial for both parties to ensure transparency and fairness in the handling of the security deposit. The Seattle Washington Landlord Tenant Closing Statement to Reconcile Security Deposit includes several key sections: 1. Identification Details: This section provides information about the landlord, tenant, and rental property, such as names, addresses, lease start and end dates, and contact information. 2. Security Deposit Details: Here, the statement states the initial amount of the security deposit paid by the tenant at the beginning of the tenancy and any subsequent deposit additions or deductions that occurred during the rental period. 3. Itemized Deductions: In this section, the landlord lists all the deductions made from the security deposit. These deductions can include unpaid rent, utility bills, cleaning costs, repairs for damages beyond normal wear and tear, and any outstanding fees or charges agreed upon in the lease agreement. 4. Property Condition: The closing statement includes a detailed assessment of the property's condition at the end of the tenancy. This assessment may involve documenting the overall cleanliness, damages, and any necessary repairs needed to restore the property to its original condition. 5. Final Reconciliation: This part calculates the final amount to be refunded to the tenant or the remaining balance owed by the tenant. It takes into account the initial security deposit, any deductions made, and any interest earned on the deposit, as required by Seattle's rental laws. Different types of Seattle Washington Landlord Tenant Closing Statements to Reconcile Security Deposit may vary depending on the type of rental property, such as residential or commercial, and the specific lease agreement terms. However, the essential elements mentioned above generally remain the same. It is important to note that the Seattle Washington Landlord Tenant Closing Statement to Reconcile Security Deposit must comply with the local laws and regulations governing landlord-tenant relationships to ensure a fair and lawful process. It is advisable for landlords and tenants to consult the Washington State Landlord-Tenant Act or seek legal counsel for specific guidance.