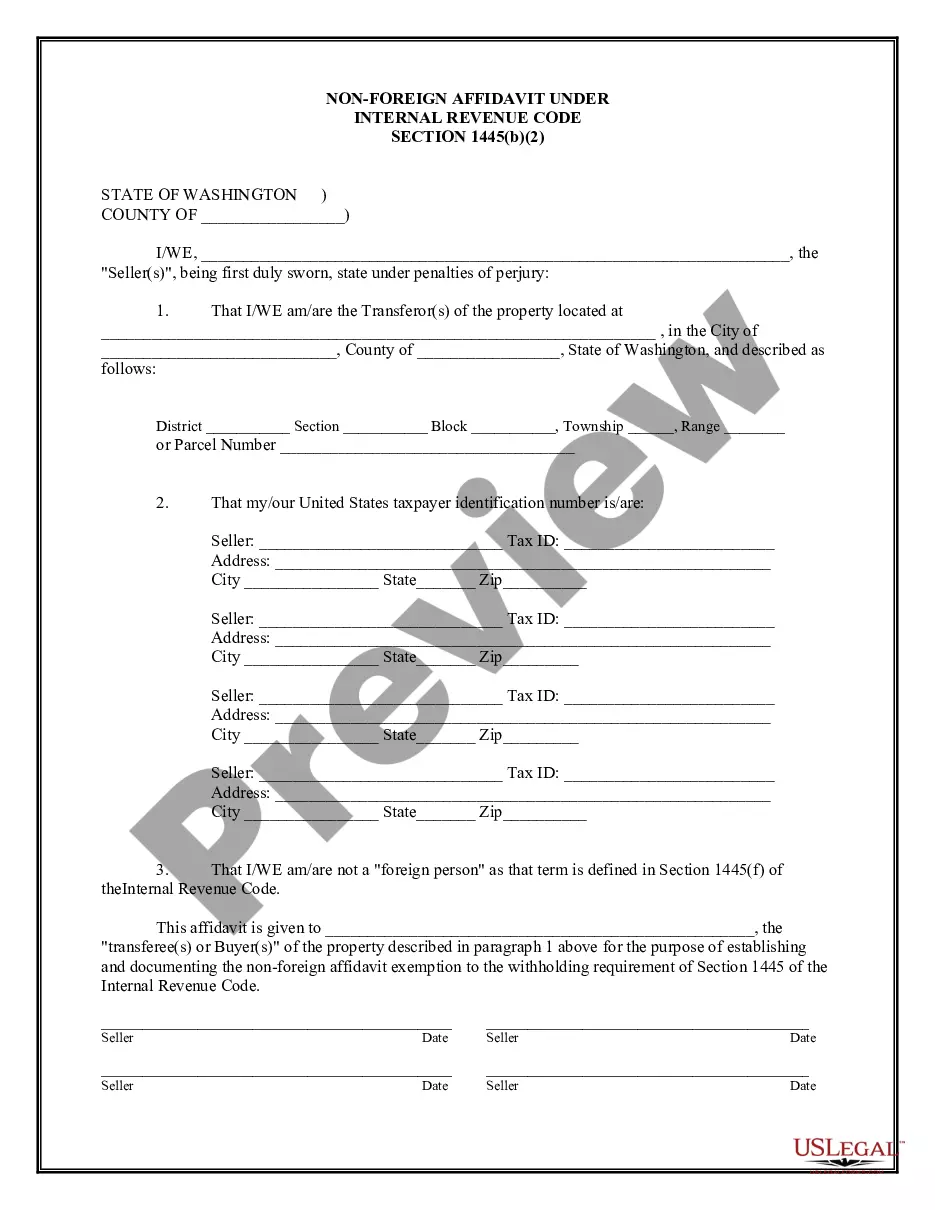

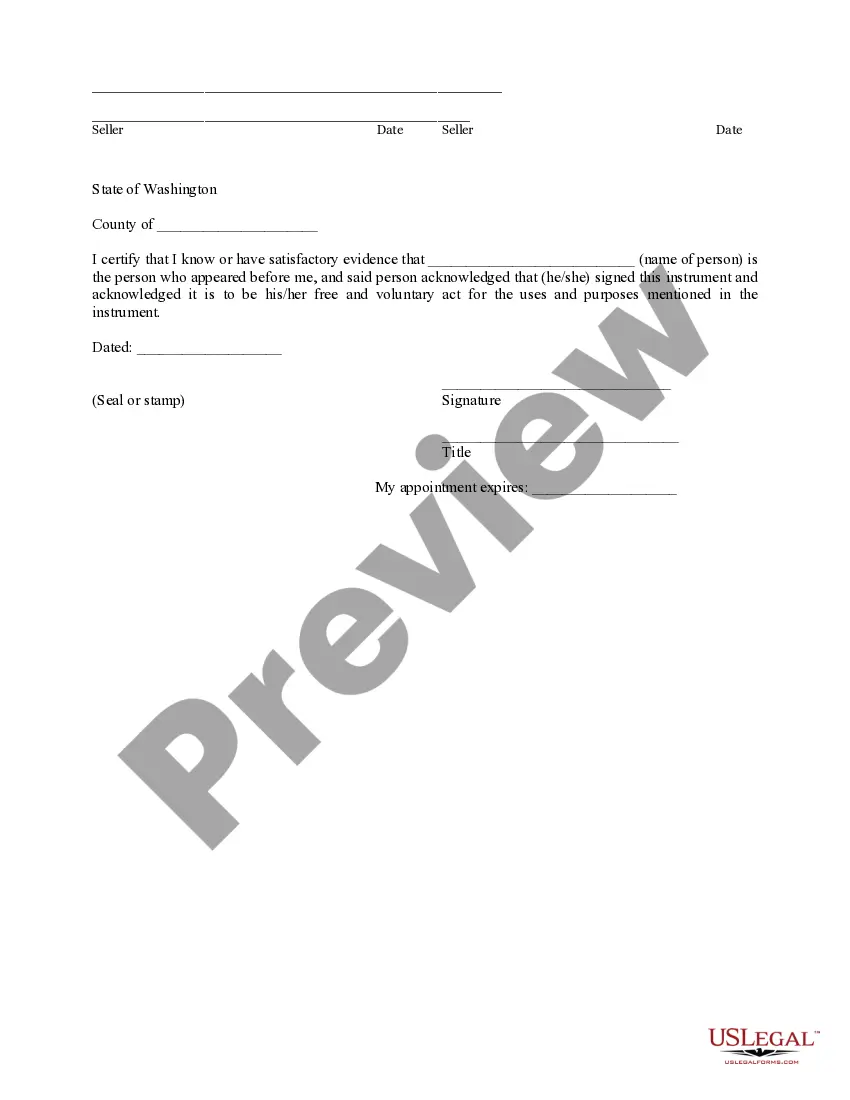

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Bellevue Washington Non-Foreign Affidavit Under IRC 1445 is a legal document that pertains to the requirements and regulations related to the withholding of tax on the disposal of U.S. real property interests by foreign persons. This affidavit is specifically used in the city of Bellevue, Washington, and is governed by the Internal Revenue Code (IRC) Section 1445. The Bellevue Washington Non-Foreign Affidavit Under IRC 1445 is crucial in situations where a foreign individual or entity is involved in a real estate transaction within Bellevue, Washington. The affidavit serves as a declaration made under penalty of perjury by the transferor (seller) to the transferee (buyer) that they are not a foreign person as defined by the IRC and therefore not subject to withholding tax obligations. The affidavit includes essential information such as the transferor's name, address, and taxpayer identification number (TIN), along with a statement indicating the transferor's non-foreign status. By signing this affidavit, the transferor affirms that they are a U.S. citizen, U.S. resident alien, U.S. corporation, U.S. partnership, or any other entity that is considered a U.S. person under the IRC. In Bellevue, Washington, there are various types of Bellevue Washington Non-Foreign Affidavits Under IRC 1445 that may be used in different scenarios. These may include: 1. Individual Non-Foreign Affidavit: This affidavit is used when an individual homeowner or transferor who is a U.S. citizen or U.S. resident alien is selling their property in Bellevue, Washington. 2. Corporate Non-Foreign Affidavit: When a U.S. corporation is involved in a real estate transaction in Bellevue, Washington, this type of affidavit is used to establish the corporate entity's non-foreign status under IRC 1445. 3. Partnership Non-Foreign Affidavit: In cases where a partnership entity falls under the definition of a U.S. person, they would utilize this affidavit to declare their non-foreign status. 4. Trust Non-Foreign Affidavit: If a trust, being a U.S. person, is transferring a property within Bellevue, Washington, this affidavit is employed to affirm their non-foreign status under IRC 1445. It is important to note that the specific format and details required in a Bellevue Washington Non-Foreign Affidavit Under IRC 1445 may vary depending on the situation and the preferences of the parties involved. It is advisable to consult a legal professional or tax expert to ensure compliance with all applicable laws and regulations.Bellevue Washington Non-Foreign Affidavit Under IRC 1445 is a legal document that pertains to the requirements and regulations related to the withholding of tax on the disposal of U.S. real property interests by foreign persons. This affidavit is specifically used in the city of Bellevue, Washington, and is governed by the Internal Revenue Code (IRC) Section 1445. The Bellevue Washington Non-Foreign Affidavit Under IRC 1445 is crucial in situations where a foreign individual or entity is involved in a real estate transaction within Bellevue, Washington. The affidavit serves as a declaration made under penalty of perjury by the transferor (seller) to the transferee (buyer) that they are not a foreign person as defined by the IRC and therefore not subject to withholding tax obligations. The affidavit includes essential information such as the transferor's name, address, and taxpayer identification number (TIN), along with a statement indicating the transferor's non-foreign status. By signing this affidavit, the transferor affirms that they are a U.S. citizen, U.S. resident alien, U.S. corporation, U.S. partnership, or any other entity that is considered a U.S. person under the IRC. In Bellevue, Washington, there are various types of Bellevue Washington Non-Foreign Affidavits Under IRC 1445 that may be used in different scenarios. These may include: 1. Individual Non-Foreign Affidavit: This affidavit is used when an individual homeowner or transferor who is a U.S. citizen or U.S. resident alien is selling their property in Bellevue, Washington. 2. Corporate Non-Foreign Affidavit: When a U.S. corporation is involved in a real estate transaction in Bellevue, Washington, this type of affidavit is used to establish the corporate entity's non-foreign status under IRC 1445. 3. Partnership Non-Foreign Affidavit: In cases where a partnership entity falls under the definition of a U.S. person, they would utilize this affidavit to declare their non-foreign status. 4. Trust Non-Foreign Affidavit: If a trust, being a U.S. person, is transferring a property within Bellevue, Washington, this affidavit is employed to affirm their non-foreign status under IRC 1445. It is important to note that the specific format and details required in a Bellevue Washington Non-Foreign Affidavit Under IRC 1445 may vary depending on the situation and the preferences of the parties involved. It is advisable to consult a legal professional or tax expert to ensure compliance with all applicable laws and regulations.