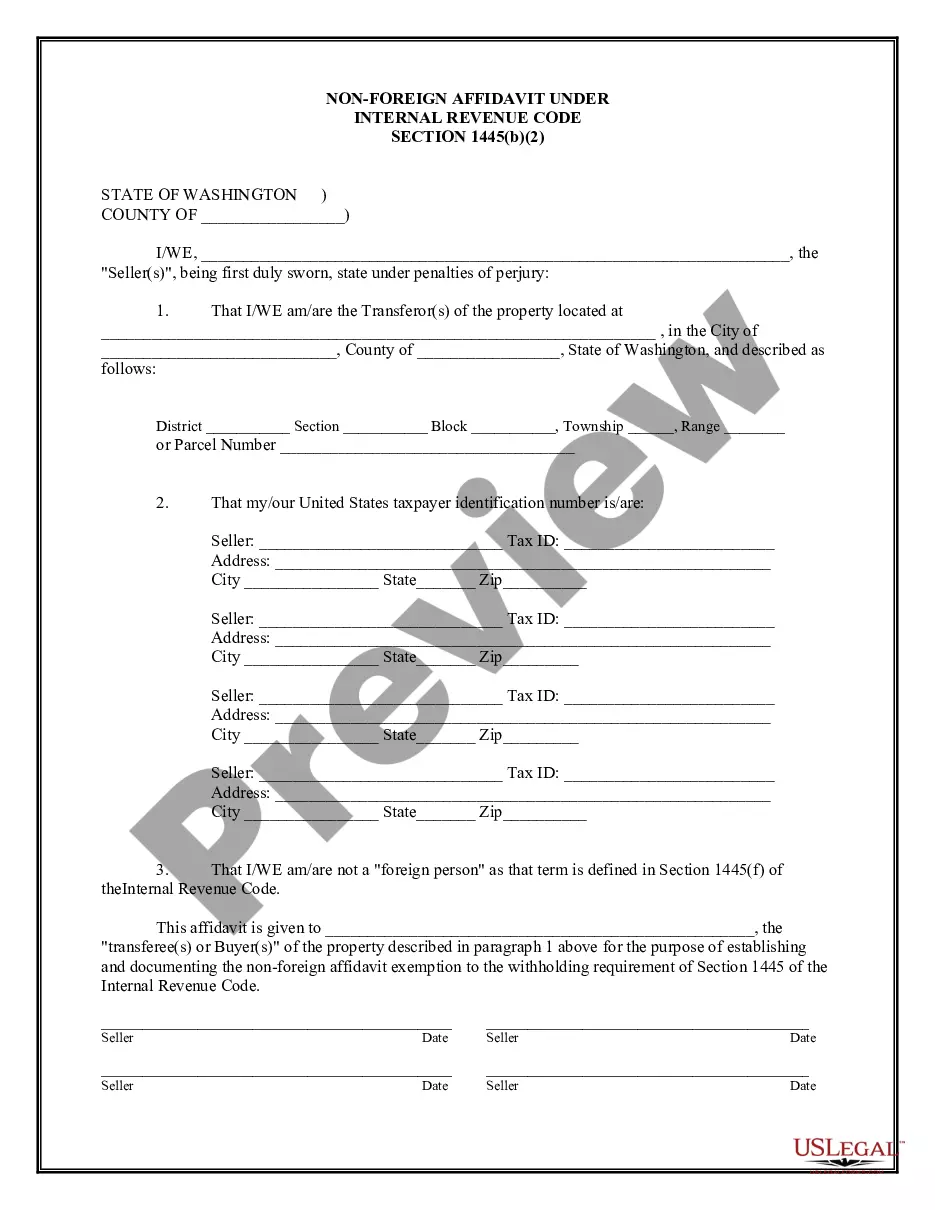

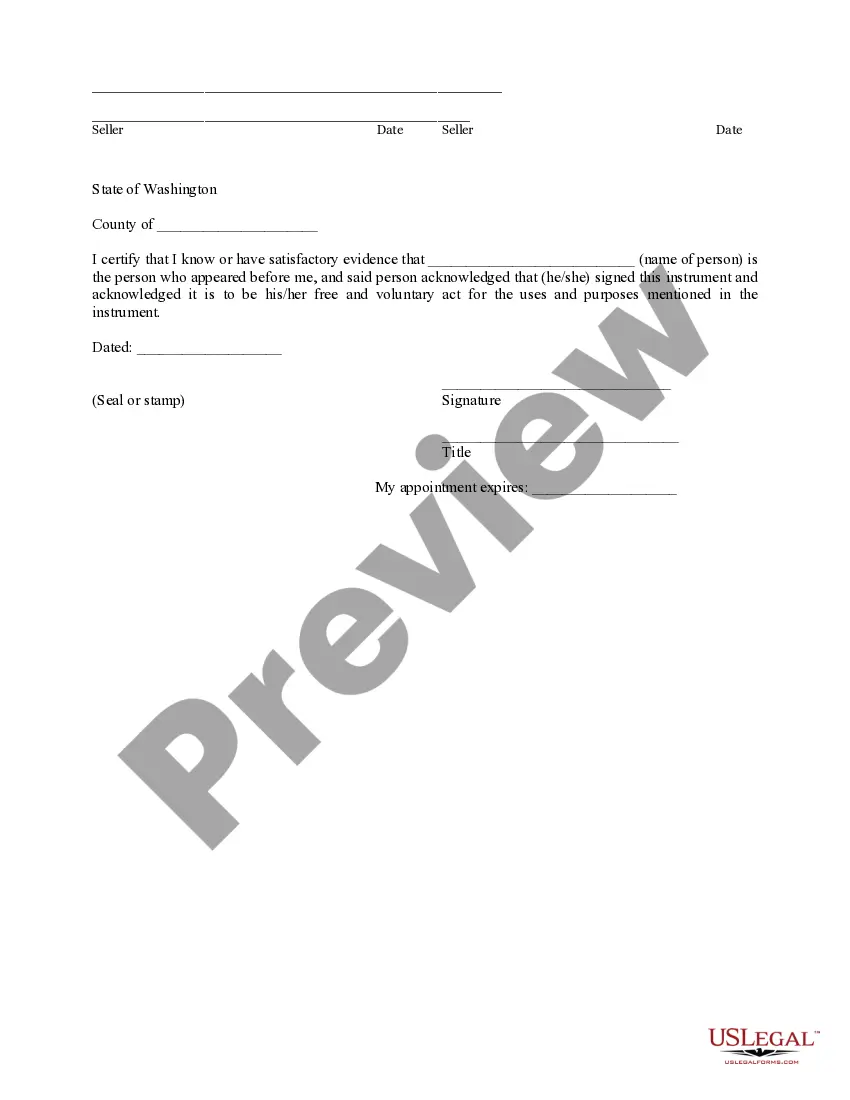

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Everett Washington Non-Foreign Affidavit Under IRC 1445: A Detailed Description The Everett Washington Non-Foreign Affidavit Under IRC 1445 is a legal document that serves a crucial purpose in real estate transactions involving non-foreign sellers. It is essential to understand the intricacies of this affidavit to ensure compliance with tax regulations and smooth property transfers. Under the Internal Revenue Code (IRC) Section 1445, the U.S. government imposes withholding requirements on the disposition of U.S. real property interests by foreign individuals or entities. These requirements aim to capture any potential taxable gains earned by non-U.S. taxpayers from the sale or transfer of real property located within the United States. However, not all sellers of U.S. real property interests are subject to these withholding requirements. To confirm that a seller is considered non-foreign and exempt from withholding, the Everett Washington Non-Foreign Affidavit Under IRC 1445 comes into play. This affidavit is typically completed by the seller (individual or entity) and presented to the buyer or designated agent during the transaction. The Everett Washington Non-Foreign Affidavit Under IRC 1445 includes essential details about the seller, such as their name, address, taxpayer identification number (TIN), and other relevant identifying information necessary for tax purposes. This document serves as a representation by the seller that they are not a foreign person according to the criteria specified under the IRC. By signing this affidavit, the seller declares, under the penalty of perjury, that they are a U.S. citizen, resident alien, domestic partnership, corporation, or any other non-foreign entity described under the IRC. They also attest that they are not a foreign corporation, foreign partnership, foreign estate, foreign trust, or any other type of foreign individual or entity subject to the withholding requirements. It is important to note that different types of Everett Washington Non-Foreign Affidavit Under IRC 1445 may exist, depending on the specific requirements or preferences of local jurisdictions, title companies, or lenders involved in the real estate transaction. The main variations typically revolve around the structure and formatting of the affidavit, but the core purpose remains to confirm the non-foreign status of the seller, as mandated by IRC Section 1445. In conclusion, the Everett Washington Non-Foreign Affidavit Under IRC 1445 is a critical document used in real estate transactions to establish that the seller is not a foreign person or entity subject to withholding requirements under the IRC. This affidavit safeguards compliance with tax regulations and ensures a smooth transfer of property ownership, providing confidence to buyers, sellers, and all parties involved in the transaction.Everett Washington Non-Foreign Affidavit Under IRC 1445: A Detailed Description The Everett Washington Non-Foreign Affidavit Under IRC 1445 is a legal document that serves a crucial purpose in real estate transactions involving non-foreign sellers. It is essential to understand the intricacies of this affidavit to ensure compliance with tax regulations and smooth property transfers. Under the Internal Revenue Code (IRC) Section 1445, the U.S. government imposes withholding requirements on the disposition of U.S. real property interests by foreign individuals or entities. These requirements aim to capture any potential taxable gains earned by non-U.S. taxpayers from the sale or transfer of real property located within the United States. However, not all sellers of U.S. real property interests are subject to these withholding requirements. To confirm that a seller is considered non-foreign and exempt from withholding, the Everett Washington Non-Foreign Affidavit Under IRC 1445 comes into play. This affidavit is typically completed by the seller (individual or entity) and presented to the buyer or designated agent during the transaction. The Everett Washington Non-Foreign Affidavit Under IRC 1445 includes essential details about the seller, such as their name, address, taxpayer identification number (TIN), and other relevant identifying information necessary for tax purposes. This document serves as a representation by the seller that they are not a foreign person according to the criteria specified under the IRC. By signing this affidavit, the seller declares, under the penalty of perjury, that they are a U.S. citizen, resident alien, domestic partnership, corporation, or any other non-foreign entity described under the IRC. They also attest that they are not a foreign corporation, foreign partnership, foreign estate, foreign trust, or any other type of foreign individual or entity subject to the withholding requirements. It is important to note that different types of Everett Washington Non-Foreign Affidavit Under IRC 1445 may exist, depending on the specific requirements or preferences of local jurisdictions, title companies, or lenders involved in the real estate transaction. The main variations typically revolve around the structure and formatting of the affidavit, but the core purpose remains to confirm the non-foreign status of the seller, as mandated by IRC Section 1445. In conclusion, the Everett Washington Non-Foreign Affidavit Under IRC 1445 is a critical document used in real estate transactions to establish that the seller is not a foreign person or entity subject to withholding requirements under the IRC. This affidavit safeguards compliance with tax regulations and ensures a smooth transfer of property ownership, providing confidence to buyers, sellers, and all parties involved in the transaction.