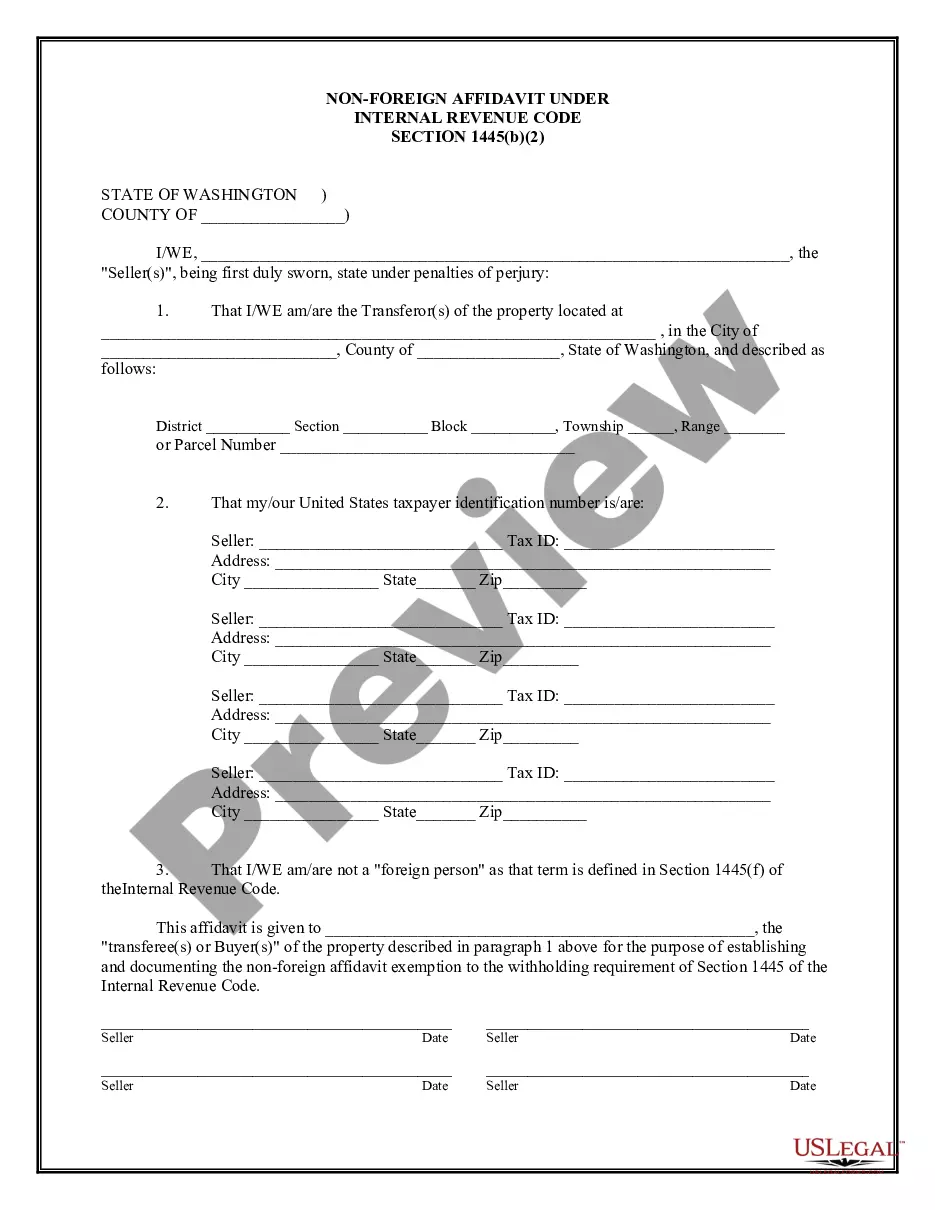

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Renton Washington Non-Foreign Affidavit Under IRC 1445 is a legal document required in specific real estate transactions involving the sale, exchange, or disposition of U.S. property. This affidavit aims to establish the non-foreign status of the seller or transferor, ensuring compliance with the provisions specified in the Internal Revenue Code (IRC) Section 1445. Renton, Washington, like any other jurisdiction in the United States, imposes certain regulations and requirements when it comes to real estate transactions involving non-U.S. citizens or foreign entities. The Renton Washington Non-Foreign Affidavit serves as a declaration by the seller or transferor that they are not a foreign person as defined by the IRC Section 1445. The purposes of this affidavit are twofold: first, to determine whether the transaction is subject to withholding tax obligations imposed by the IRS on foreign individuals or entities selling U.S. property, and second, to certify the transferor's non-foreign status to the purchaser, closing agent, and relevant authorities. Failure to comply with the requirements outlined in the Renton Washington Non-Foreign Affidavit Under IRC 1445 can result in complications, delays, or even legal consequences of the real estate transaction process. Therefore, it is essential for all parties involved, including sellers, transferors, purchasers, and closing agents, to thoroughly understand and properly execute this document. Different types of Renton Washington Non-Foreign Affidavits Under IRC 1445 may include variations based on the nature of the transaction or specific circumstances. For instance, a separate form or affidavit may be required when dealing with different types of properties (residential, commercial, agricultural), and when the transaction involves individuals, corporations, partnerships, trusts, or other legal entities. Additionally, the Renton Washington Non-Foreign Affidavit may be tailored to accommodate specific requirements imposed by the Renton jurisdiction. It is crucial to consult with a qualified attorney or real estate professional familiar with the local regulations to ensure compliance and accuracy when completing the affidavit. To summarize, the Renton Washington Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions involving non-U.S. citizens or foreign entities. Its purpose is to establish the non-foreign status of the transferor, ensuring compliance with IRC Section 1445 and avoiding potential withholding tax obligations. As there may be variations or additional requirements based on the specific transaction and property type, it is recommended to seek professional guidance to accurately complete this affidavit.Renton Washington Non-Foreign Affidavit Under IRC 1445 is a legal document required in specific real estate transactions involving the sale, exchange, or disposition of U.S. property. This affidavit aims to establish the non-foreign status of the seller or transferor, ensuring compliance with the provisions specified in the Internal Revenue Code (IRC) Section 1445. Renton, Washington, like any other jurisdiction in the United States, imposes certain regulations and requirements when it comes to real estate transactions involving non-U.S. citizens or foreign entities. The Renton Washington Non-Foreign Affidavit serves as a declaration by the seller or transferor that they are not a foreign person as defined by the IRC Section 1445. The purposes of this affidavit are twofold: first, to determine whether the transaction is subject to withholding tax obligations imposed by the IRS on foreign individuals or entities selling U.S. property, and second, to certify the transferor's non-foreign status to the purchaser, closing agent, and relevant authorities. Failure to comply with the requirements outlined in the Renton Washington Non-Foreign Affidavit Under IRC 1445 can result in complications, delays, or even legal consequences of the real estate transaction process. Therefore, it is essential for all parties involved, including sellers, transferors, purchasers, and closing agents, to thoroughly understand and properly execute this document. Different types of Renton Washington Non-Foreign Affidavits Under IRC 1445 may include variations based on the nature of the transaction or specific circumstances. For instance, a separate form or affidavit may be required when dealing with different types of properties (residential, commercial, agricultural), and when the transaction involves individuals, corporations, partnerships, trusts, or other legal entities. Additionally, the Renton Washington Non-Foreign Affidavit may be tailored to accommodate specific requirements imposed by the Renton jurisdiction. It is crucial to consult with a qualified attorney or real estate professional familiar with the local regulations to ensure compliance and accuracy when completing the affidavit. To summarize, the Renton Washington Non-Foreign Affidavit Under IRC 1445 is a vital document in real estate transactions involving non-U.S. citizens or foreign entities. Its purpose is to establish the non-foreign status of the transferor, ensuring compliance with IRC Section 1445 and avoiding potential withholding tax obligations. As there may be variations or additional requirements based on the specific transaction and property type, it is recommended to seek professional guidance to accurately complete this affidavit.