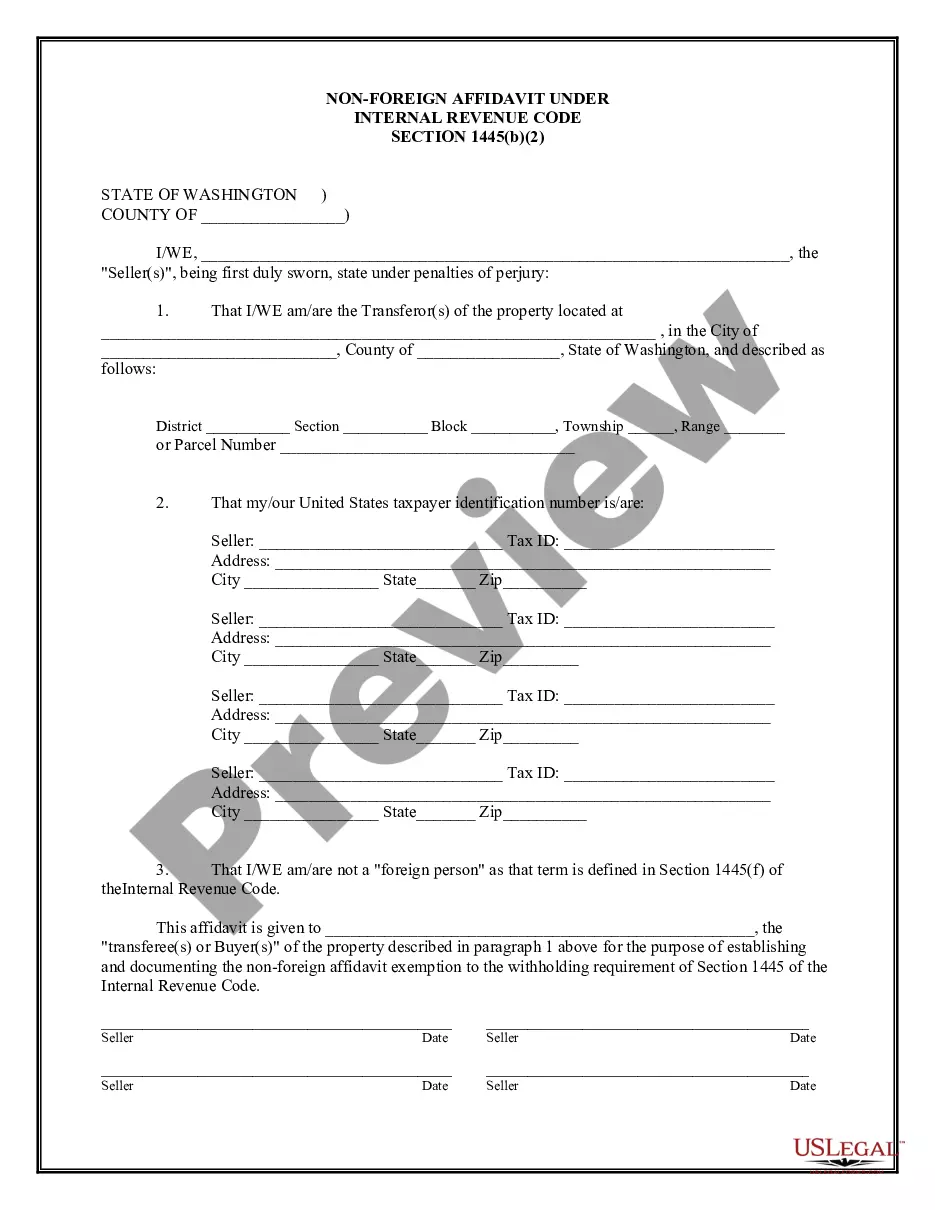

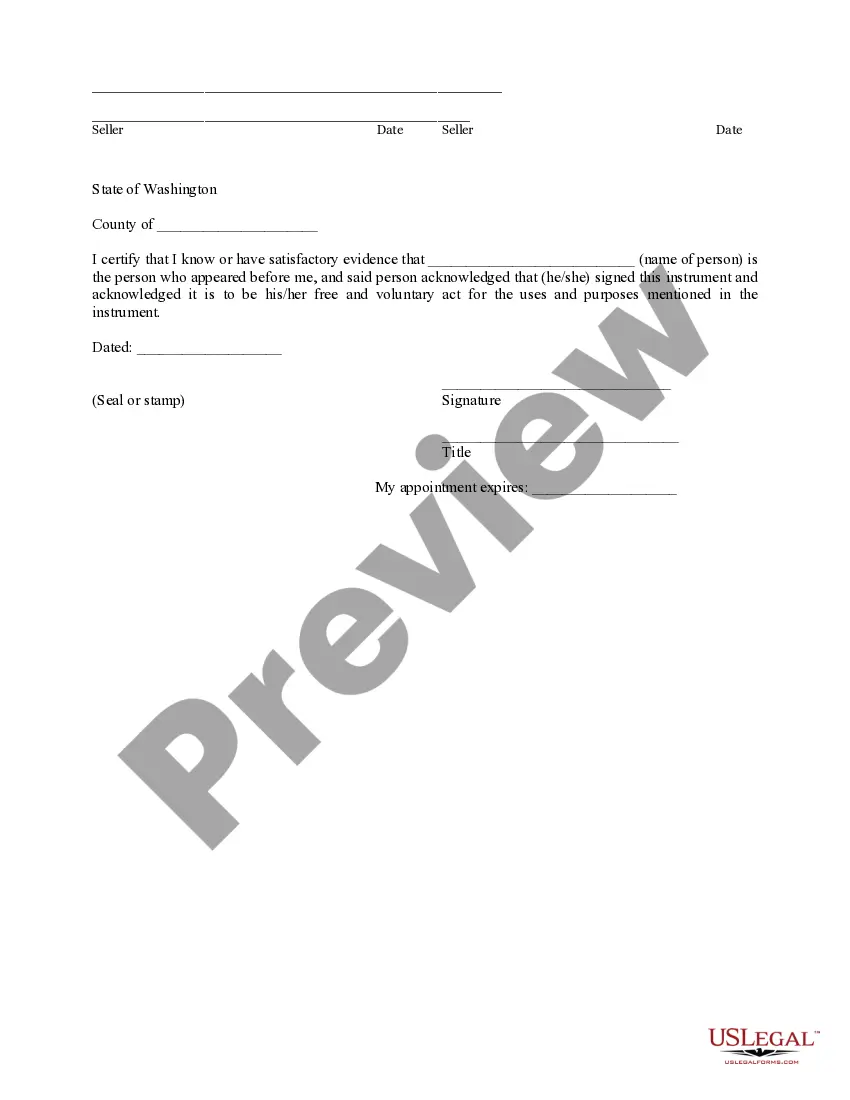

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Spokane Valley Washington Non-Foreign Affidavit Under IRC 1445 is a crucial document often required during real estate transactions in Spokane Valley, Washington. This affidavit is specifically related to withholding taxes under section 1445 of the Internal Revenue Code (IRC) for non-foreign individuals selling their interest in U.S. real property. By providing this affidavit, sellers confirm their status as a non-foreigner and agree to comply with the tax obligations set forth in IRC 1445. This affidavit is a legal declaration that helps the buyer or the buyer's agent fulfill their withholding obligations as prescribed by the Internal Revenue Service (IRS). It certifies that the seller, as a non-foreign individual, is exempt from withholding a certain percentage of the sales proceeds as a safeguard for the IRS against potential tax liabilities. The affidavit provides assurances to the buyer that they are not required to withhold any amount from the sale proceeds for tax purposes. Spokane Valley Washington Non-Foreign Affidavit Under IRC 1445 may have different types based on the specific scenario or circumstances of the real estate transaction. Some notable variations may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual seller, who is a U.S. citizen or resident, is selling their interest in a property located in Spokane Valley, Washington. It certifies the seller's non-foreign status and confirms their eligibility for exemption from withholding under IRC 1445. 2. Trust or Estate Non-Foreign Affidavit: When a trust or estate is the seller in a real estate transaction, this type of affidavit is required. It ensures that the trust or estate is considered a non-foreign entity for tax purposes and meets the requirements for exemption from withholding under IRC 1445. 3. U.S. Corporation Non-Foreign Affidavit: If the seller is a U.S. corporation selling its interest in a Spokane Valley property, a U.S. Corporation Non-Foreign Affidavit is used. This affidavit confirms the non-foreign status of the corporation and exempts it from withholding taxes according to IRC 1445. It is important to note that specific forms and templates for these affidavits may be provided by the IRS or the Spokane Valley jurisdiction. Consulting with a tax professional or real estate attorney is recommended to ensure compliance with relevant laws and regulations when dealing with Non-Foreign Affidavit Under IRC 1445 in Spokane Valley, Washington.A Spokane Valley Washington Non-Foreign Affidavit Under IRC 1445 is a crucial document often required during real estate transactions in Spokane Valley, Washington. This affidavit is specifically related to withholding taxes under section 1445 of the Internal Revenue Code (IRC) for non-foreign individuals selling their interest in U.S. real property. By providing this affidavit, sellers confirm their status as a non-foreigner and agree to comply with the tax obligations set forth in IRC 1445. This affidavit is a legal declaration that helps the buyer or the buyer's agent fulfill their withholding obligations as prescribed by the Internal Revenue Service (IRS). It certifies that the seller, as a non-foreign individual, is exempt from withholding a certain percentage of the sales proceeds as a safeguard for the IRS against potential tax liabilities. The affidavit provides assurances to the buyer that they are not required to withhold any amount from the sale proceeds for tax purposes. Spokane Valley Washington Non-Foreign Affidavit Under IRC 1445 may have different types based on the specific scenario or circumstances of the real estate transaction. Some notable variations may include: 1. Individual Non-Foreign Affidavit: This type of affidavit is used when an individual seller, who is a U.S. citizen or resident, is selling their interest in a property located in Spokane Valley, Washington. It certifies the seller's non-foreign status and confirms their eligibility for exemption from withholding under IRC 1445. 2. Trust or Estate Non-Foreign Affidavit: When a trust or estate is the seller in a real estate transaction, this type of affidavit is required. It ensures that the trust or estate is considered a non-foreign entity for tax purposes and meets the requirements for exemption from withholding under IRC 1445. 3. U.S. Corporation Non-Foreign Affidavit: If the seller is a U.S. corporation selling its interest in a Spokane Valley property, a U.S. Corporation Non-Foreign Affidavit is used. This affidavit confirms the non-foreign status of the corporation and exempts it from withholding taxes according to IRC 1445. It is important to note that specific forms and templates for these affidavits may be provided by the IRS or the Spokane Valley jurisdiction. Consulting with a tax professional or real estate attorney is recommended to ensure compliance with relevant laws and regulations when dealing with Non-Foreign Affidavit Under IRC 1445 in Spokane Valley, Washington.