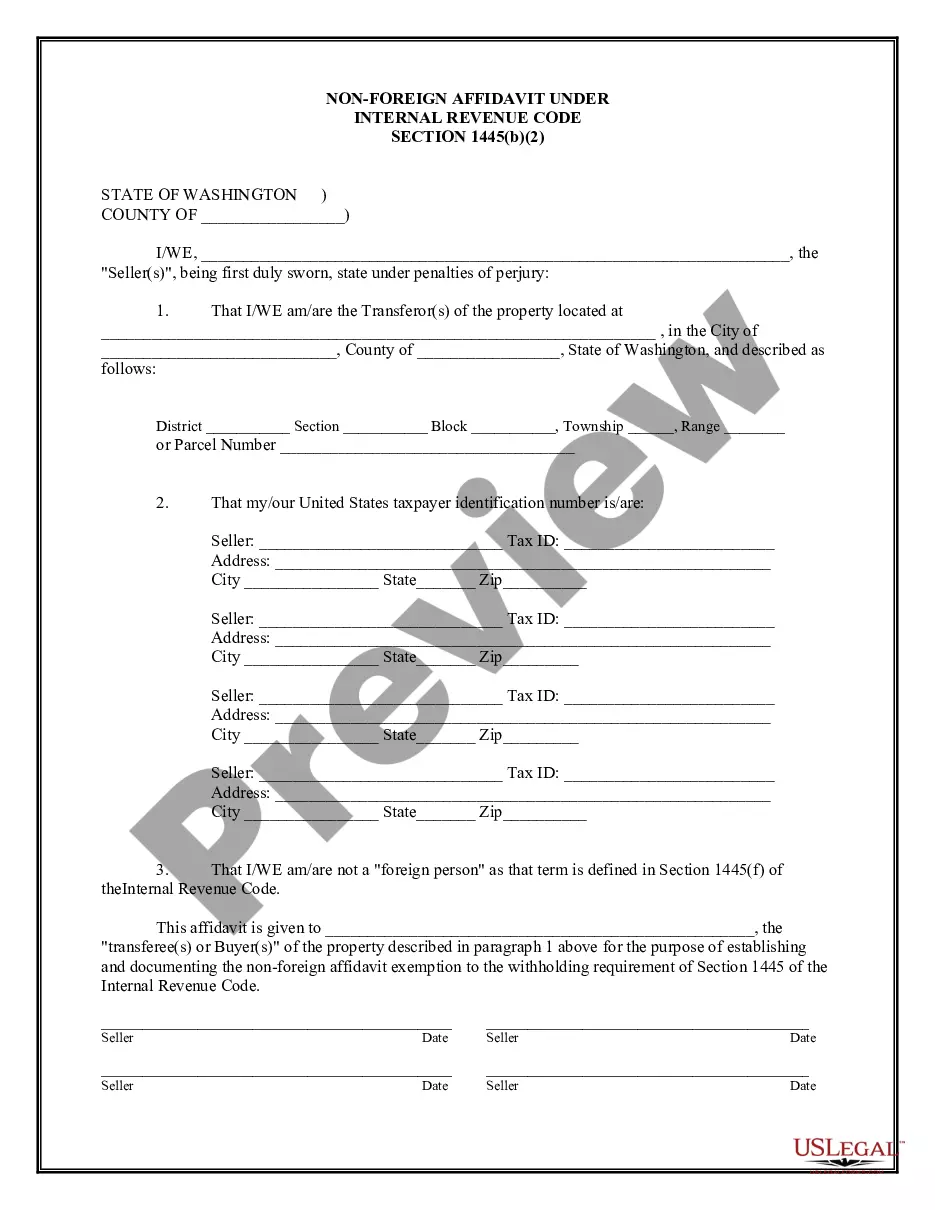

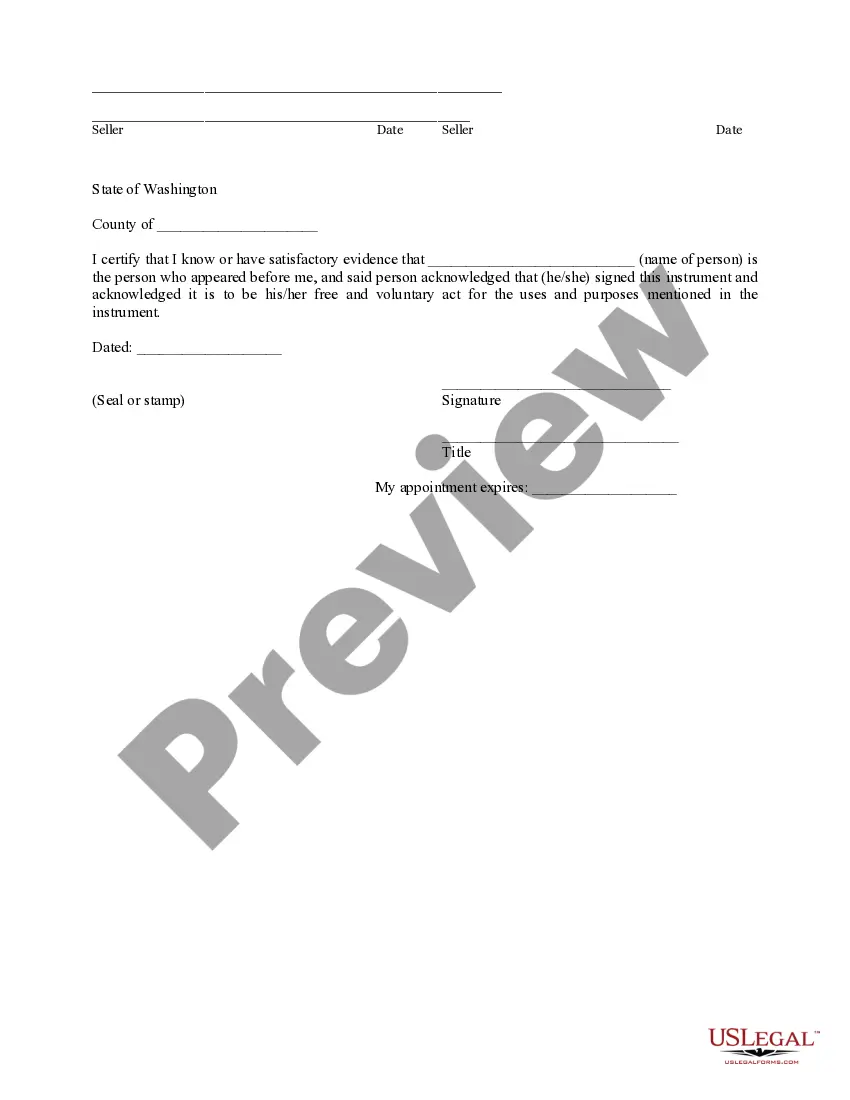

This Non-Foreign Affidavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Vancouver Washington Non-Foreign Affidavit Under IRC 1445 is a legal document that serves as proof of a seller's non-foreign status in the United States for tax purposes. It is specifically related to the withholding of tax on dispositions of the United States real property interests by foreign persons. When a non-U.S. individual sells a property located in the United States, the Internal Revenue Service (IRS) requires the buyer (or the buyer's agent) to withhold a certain percentage of the total amount paid to the seller as a form of tax payment. This is done to ensure that any potential tax liabilities are covered by the withheld amount before the seller receives their proceeds. However, if the seller can establish that they are a non-foreigner, meaning they are either a U.S. citizen, resident alien, or domestic entity, they may be exempt from the withholding requirement. In order to claim this exemption, the seller must complete and submit a Vancouver Washington Non-Foreign Affidavit Under IRC 1445 to the buyer or buyer's agent. The affidavit typically includes the following information: 1. Identification of the seller: This includes the seller's full legal name, address, and taxpayer identification number (such as a Social Security Number or Employer Identification Number). 2. Property details: The affidavit should specify the property being sold, including the full address and any other relevant identifying information. 3. Certification of non-foreign status: The seller must explicitly certify, under penalties of perjury, that they are a non-foreigner as defined by the IRS guidelines. 4. Supporting documentation: The affidavit may require the seller to provide additional documentation to support their non-foreign status, such as a U.S. passport, green card, or proof of domestic entity formation. It's important to note that there may be variations of the Vancouver Washington Non-Foreign Affidavit Under IRC 1445, depending on the specific requirements of the state or jurisdiction. These variations pertain to the local regulations and practices that govern real property transactions and tax obligations in that particular area. By submitting a valid Vancouver Washington Non-Foreign Affidavit Under IRC 1445, the seller affirms their eligibility for exemption from the withholding requirement. This allows the buyer to proceed with the property transaction without withholding any part of the seller's proceeds for tax purposes. It is advisable for sellers to consult a real estate attorney or tax professional to ensure they comply with all relevant regulations and complete the affidavit accurately. Failure to properly complete and submit the affidavit may result in the buyer withholding the required tax amount or potential penalties and fines imposed by the IRS.A Vancouver Washington Non-Foreign Affidavit Under IRC 1445 is a legal document that serves as proof of a seller's non-foreign status in the United States for tax purposes. It is specifically related to the withholding of tax on dispositions of the United States real property interests by foreign persons. When a non-U.S. individual sells a property located in the United States, the Internal Revenue Service (IRS) requires the buyer (or the buyer's agent) to withhold a certain percentage of the total amount paid to the seller as a form of tax payment. This is done to ensure that any potential tax liabilities are covered by the withheld amount before the seller receives their proceeds. However, if the seller can establish that they are a non-foreigner, meaning they are either a U.S. citizen, resident alien, or domestic entity, they may be exempt from the withholding requirement. In order to claim this exemption, the seller must complete and submit a Vancouver Washington Non-Foreign Affidavit Under IRC 1445 to the buyer or buyer's agent. The affidavit typically includes the following information: 1. Identification of the seller: This includes the seller's full legal name, address, and taxpayer identification number (such as a Social Security Number or Employer Identification Number). 2. Property details: The affidavit should specify the property being sold, including the full address and any other relevant identifying information. 3. Certification of non-foreign status: The seller must explicitly certify, under penalties of perjury, that they are a non-foreigner as defined by the IRS guidelines. 4. Supporting documentation: The affidavit may require the seller to provide additional documentation to support their non-foreign status, such as a U.S. passport, green card, or proof of domestic entity formation. It's important to note that there may be variations of the Vancouver Washington Non-Foreign Affidavit Under IRC 1445, depending on the specific requirements of the state or jurisdiction. These variations pertain to the local regulations and practices that govern real property transactions and tax obligations in that particular area. By submitting a valid Vancouver Washington Non-Foreign Affidavit Under IRC 1445, the seller affirms their eligibility for exemption from the withholding requirement. This allows the buyer to proceed with the property transaction without withholding any part of the seller's proceeds for tax purposes. It is advisable for sellers to consult a real estate attorney or tax professional to ensure they comply with all relevant regulations and complete the affidavit accurately. Failure to properly complete and submit the affidavit may result in the buyer withholding the required tax amount or potential penalties and fines imposed by the IRS.