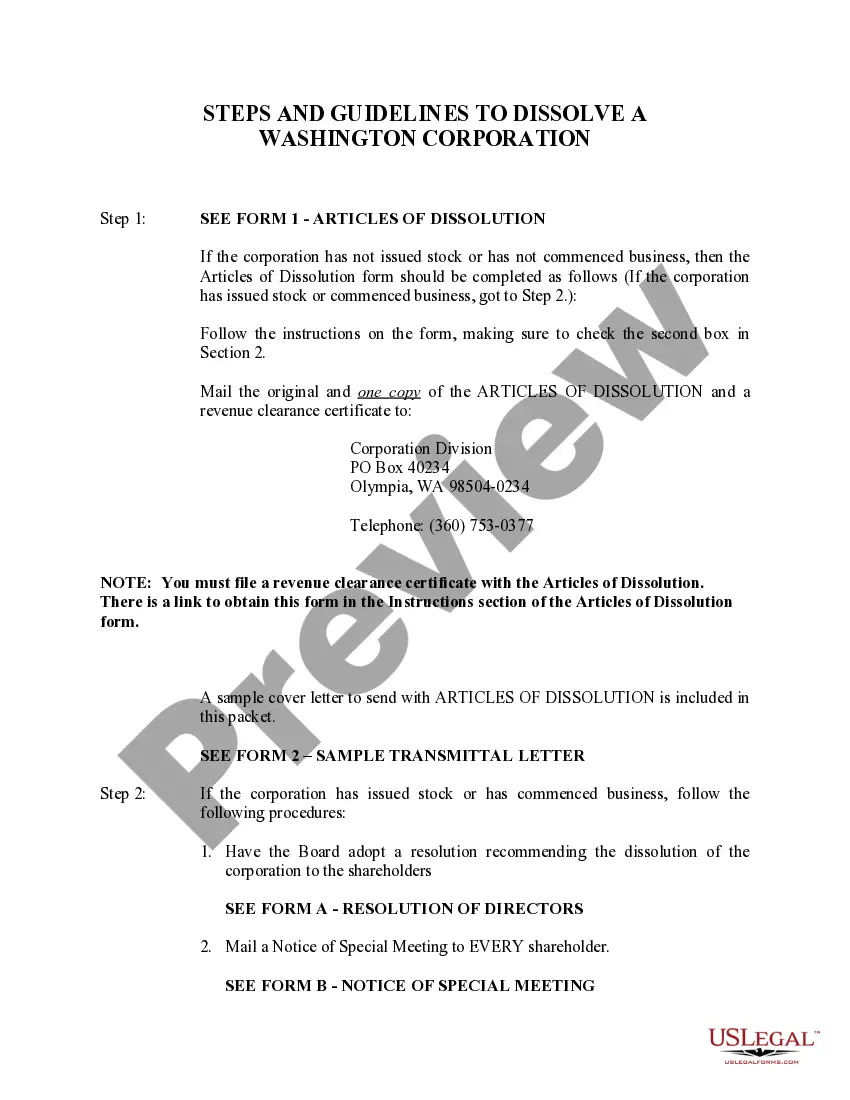

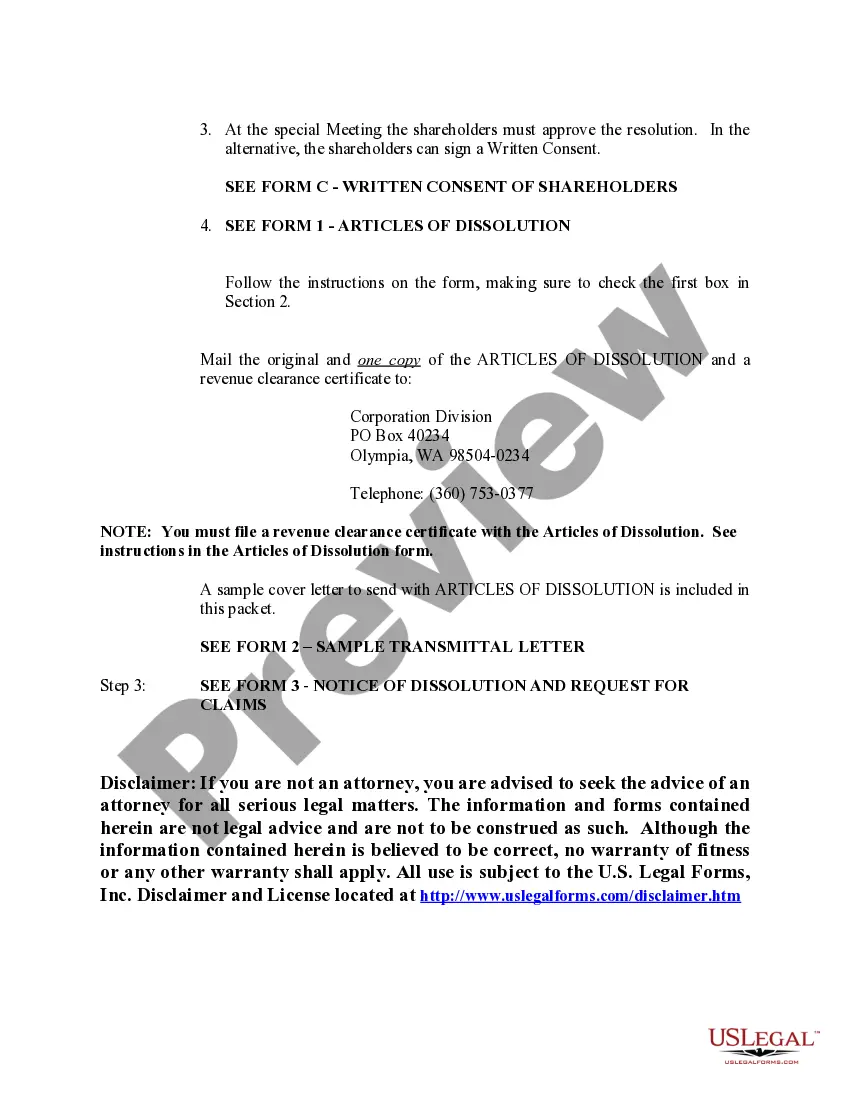

The dissolution of a corporation package contains all forms to dissolve a corporation in Washington, step by step instructions, addresses, transmittal letters, and other information.

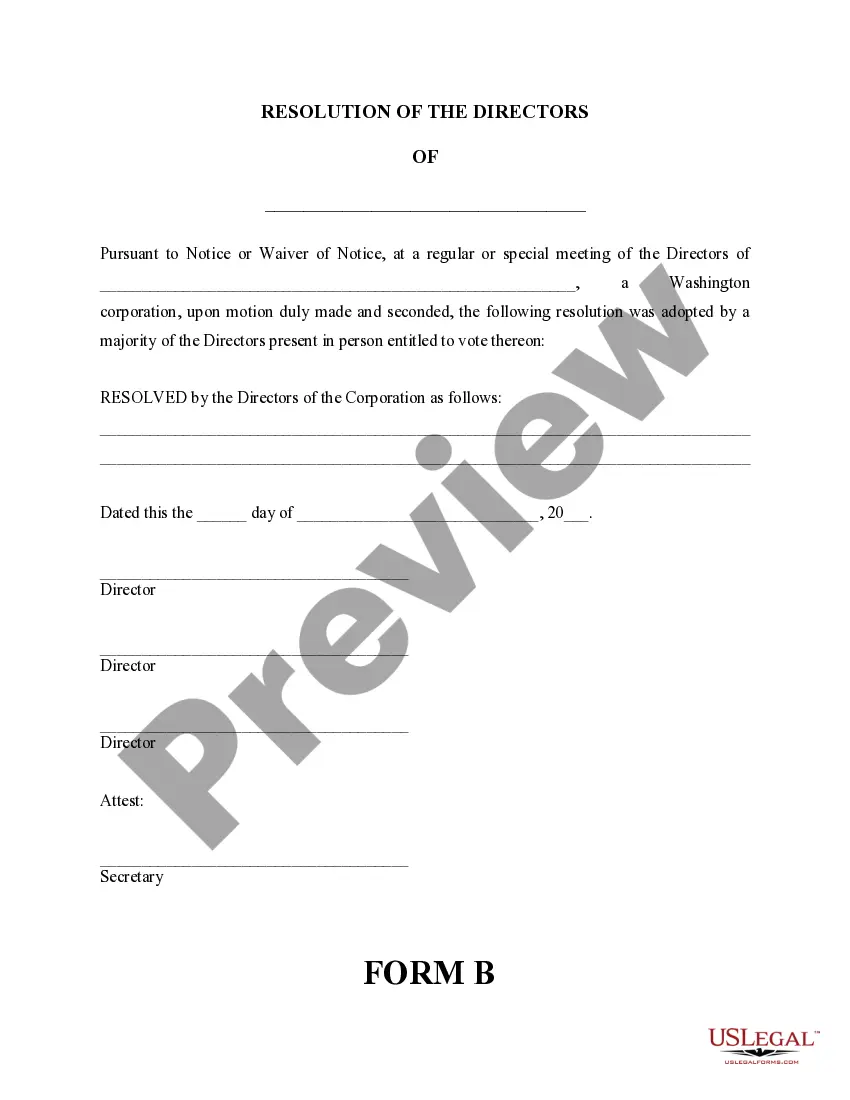

The Seattle Washington Dissolution Package is a comprehensive set of legal documents and forms designed to assist corporations in the process of winding up their business operations and legally dissolving their entity in the state of Washington. This package provides step-by-step guidance and all the necessary paperwork to ensure a smooth and compliant dissolution process. The main purpose of the Seattle Washington Dissolution Package is to help corporations terminate their legal existence in a legally recognized manner, ensuring that all outstanding obligations, debts, and liabilities are properly addressed and resolved. By following the procedures outlined in these documents, businesses can effectively cease their operations and limit any potential future legal or financial liabilities. The different types of Seattle Washington Dissolution Packages available to dissolve a corporation may vary based on the specific needs and circumstances of the business. However, the core elements of this package generally include: 1. Certificate of Dissolution: This document formally notifies the state of Washington that the corporation has decided to dissolve and provides essential information about the business, such as its name, registered agent, and principal place of business. 2. Articles of Dissolution: These legal documents contain detailed information regarding the reasons for dissolution, a statement of assets and liabilities, and any other relevant information required by the state. 3. Notice to Creditors: This document is necessary to inform any outstanding creditors of the corporation's decision to dissolve and provide them with instructions to submit any outstanding claims. 4. Distribution Plan: A distribution plan outlines how the corporation's assets, after paying off all outstanding debts and liabilities, will be distributed among its shareholders or stakeholders. 5. Tax Filings: Depending on the corporation's status, it may need to file final tax returns with the Internal Revenue Service (IRS) and the Washington Department of Revenue, ensuring compliance with all tax obligations before dissolution. 6. Dissolution Checklist: This checklist serves as a comprehensive guide, outlining all the necessary steps to be completed during the dissolution process, ensuring no important requirement is overlooked. Additionally, there might be variations or additional documents based on the corporation's specific circumstances, such as whether the corporation is a for-profit or non-profit entity or if there are any complex legal issues to address during dissolution. It is important to consult with an attorney or legal professional familiar with Washington state laws and regulations to ensure the correct and timely completion of all required documents within the Seattle Washington Dissolution Package. This will help ensure a legally binding and hassle-free dissolution of the corporation.The Seattle Washington Dissolution Package is a comprehensive set of legal documents and forms designed to assist corporations in the process of winding up their business operations and legally dissolving their entity in the state of Washington. This package provides step-by-step guidance and all the necessary paperwork to ensure a smooth and compliant dissolution process. The main purpose of the Seattle Washington Dissolution Package is to help corporations terminate their legal existence in a legally recognized manner, ensuring that all outstanding obligations, debts, and liabilities are properly addressed and resolved. By following the procedures outlined in these documents, businesses can effectively cease their operations and limit any potential future legal or financial liabilities. The different types of Seattle Washington Dissolution Packages available to dissolve a corporation may vary based on the specific needs and circumstances of the business. However, the core elements of this package generally include: 1. Certificate of Dissolution: This document formally notifies the state of Washington that the corporation has decided to dissolve and provides essential information about the business, such as its name, registered agent, and principal place of business. 2. Articles of Dissolution: These legal documents contain detailed information regarding the reasons for dissolution, a statement of assets and liabilities, and any other relevant information required by the state. 3. Notice to Creditors: This document is necessary to inform any outstanding creditors of the corporation's decision to dissolve and provide them with instructions to submit any outstanding claims. 4. Distribution Plan: A distribution plan outlines how the corporation's assets, after paying off all outstanding debts and liabilities, will be distributed among its shareholders or stakeholders. 5. Tax Filings: Depending on the corporation's status, it may need to file final tax returns with the Internal Revenue Service (IRS) and the Washington Department of Revenue, ensuring compliance with all tax obligations before dissolution. 6. Dissolution Checklist: This checklist serves as a comprehensive guide, outlining all the necessary steps to be completed during the dissolution process, ensuring no important requirement is overlooked. Additionally, there might be variations or additional documents based on the corporation's specific circumstances, such as whether the corporation is a for-profit or non-profit entity or if there are any complex legal issues to address during dissolution. It is important to consult with an attorney or legal professional familiar with Washington state laws and regulations to ensure the correct and timely completion of all required documents within the Seattle Washington Dissolution Package. This will help ensure a legally binding and hassle-free dissolution of the corporation.