The dissolution package contains all forms to dissolve a LLC or PLLC in Washington, step by step instructions, addresses, transmittal letters, and other information.

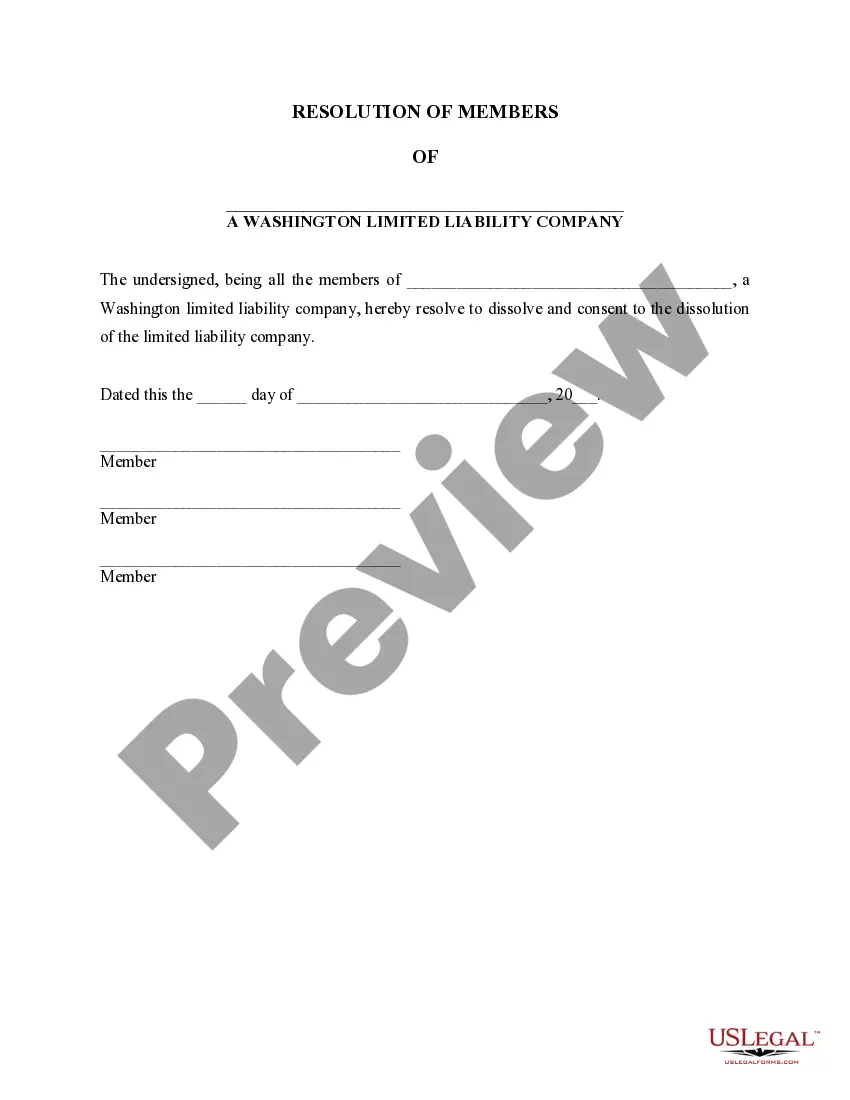

Spokane Valley Washington Dissolution Package to Dissolve Limited Liability Company LLC is a comprehensive set of forms, instructions, and guidelines designed to assist business owners in legally ending the existence of their limited liability company (LLC) in Spokane Valley, Washington. This dissolution package provides all the necessary documentation and information needed to complete the dissolution process smoothly and in compliance with applicable state laws and regulations. The package contains various key components that cater to different aspects of LLC dissolution. Firstly, it includes the necessary forms and templates required by the Washington Secretary of State's office. These forms typically include the Certificate of Dissolution, Articles of Dissolution, and any additional supporting documents specific to the LLC's circumstances. The provided forms are customized to align with Spokane Valley requirements and ensure accurate completion. Accompanying these forms, the dissolution package also includes a detailed set of instructions that guide business owners through each step of the dissolution process. It outlines the information to be provided, the filing procedures, and any relevant fees associated with the dissolution. Additionally, the instructions may provide insights on post-dissolution tasks like tax obligations, notifying creditors, and distributing remaining assets to members. Depending on the nature and structure of the LLC, there may be different types of Spokane Valley Washington Dissolution Packages to Dissolve Limited Liability Company LLC available. Some of these variations could include: 1. Standard Dissolution Package: This is the general package suitable for most LCS. It covers the standard dissolution process and includes all necessary forms and instructions to dissolve an LLC in Spokane Valley, Washington. 2. Expedited Dissolution Package: Designed for LCS aiming for a quicker dissolution, this package may include expedited filing options. It provides additional forms and instructions to ensure a faster resolution, although there may be an extra fee associated with the expedited service. 3. Dissolution Package with Tax Guidelines: Ideal for LCS with complex tax situations, this package not only covers the dissolution process but also provides guidelines and resources for fulfilling tax obligations during and after dissolution. It helps business owners navigate tax-related challenges that may arise during the dissolution process. In conclusion, the Spokane Valley Washington Dissolution Package to Dissolve Limited Liability Company LLC is a versatile and comprehensive resource for LLC owners seeking to dissolve their businesses in Spokane Valley. It offers tailored forms, clear instructions, and optional add-ons like expedited filing or tax guidelines to accommodate the specific needs of different LCS. By utilizing the dissolution package, business owners can efficiently and legally terminate their LCS while adhering to the requirements set forth by the state of Washington.Spokane Valley Washington Dissolution Package to Dissolve Limited Liability Company LLC is a comprehensive set of forms, instructions, and guidelines designed to assist business owners in legally ending the existence of their limited liability company (LLC) in Spokane Valley, Washington. This dissolution package provides all the necessary documentation and information needed to complete the dissolution process smoothly and in compliance with applicable state laws and regulations. The package contains various key components that cater to different aspects of LLC dissolution. Firstly, it includes the necessary forms and templates required by the Washington Secretary of State's office. These forms typically include the Certificate of Dissolution, Articles of Dissolution, and any additional supporting documents specific to the LLC's circumstances. The provided forms are customized to align with Spokane Valley requirements and ensure accurate completion. Accompanying these forms, the dissolution package also includes a detailed set of instructions that guide business owners through each step of the dissolution process. It outlines the information to be provided, the filing procedures, and any relevant fees associated with the dissolution. Additionally, the instructions may provide insights on post-dissolution tasks like tax obligations, notifying creditors, and distributing remaining assets to members. Depending on the nature and structure of the LLC, there may be different types of Spokane Valley Washington Dissolution Packages to Dissolve Limited Liability Company LLC available. Some of these variations could include: 1. Standard Dissolution Package: This is the general package suitable for most LCS. It covers the standard dissolution process and includes all necessary forms and instructions to dissolve an LLC in Spokane Valley, Washington. 2. Expedited Dissolution Package: Designed for LCS aiming for a quicker dissolution, this package may include expedited filing options. It provides additional forms and instructions to ensure a faster resolution, although there may be an extra fee associated with the expedited service. 3. Dissolution Package with Tax Guidelines: Ideal for LCS with complex tax situations, this package not only covers the dissolution process but also provides guidelines and resources for fulfilling tax obligations during and after dissolution. It helps business owners navigate tax-related challenges that may arise during the dissolution process. In conclusion, the Spokane Valley Washington Dissolution Package to Dissolve Limited Liability Company LLC is a versatile and comprehensive resource for LLC owners seeking to dissolve their businesses in Spokane Valley. It offers tailored forms, clear instructions, and optional add-ons like expedited filing or tax guidelines to accommodate the specific needs of different LCS. By utilizing the dissolution package, business owners can efficiently and legally terminate their LCS while adhering to the requirements set forth by the state of Washington.