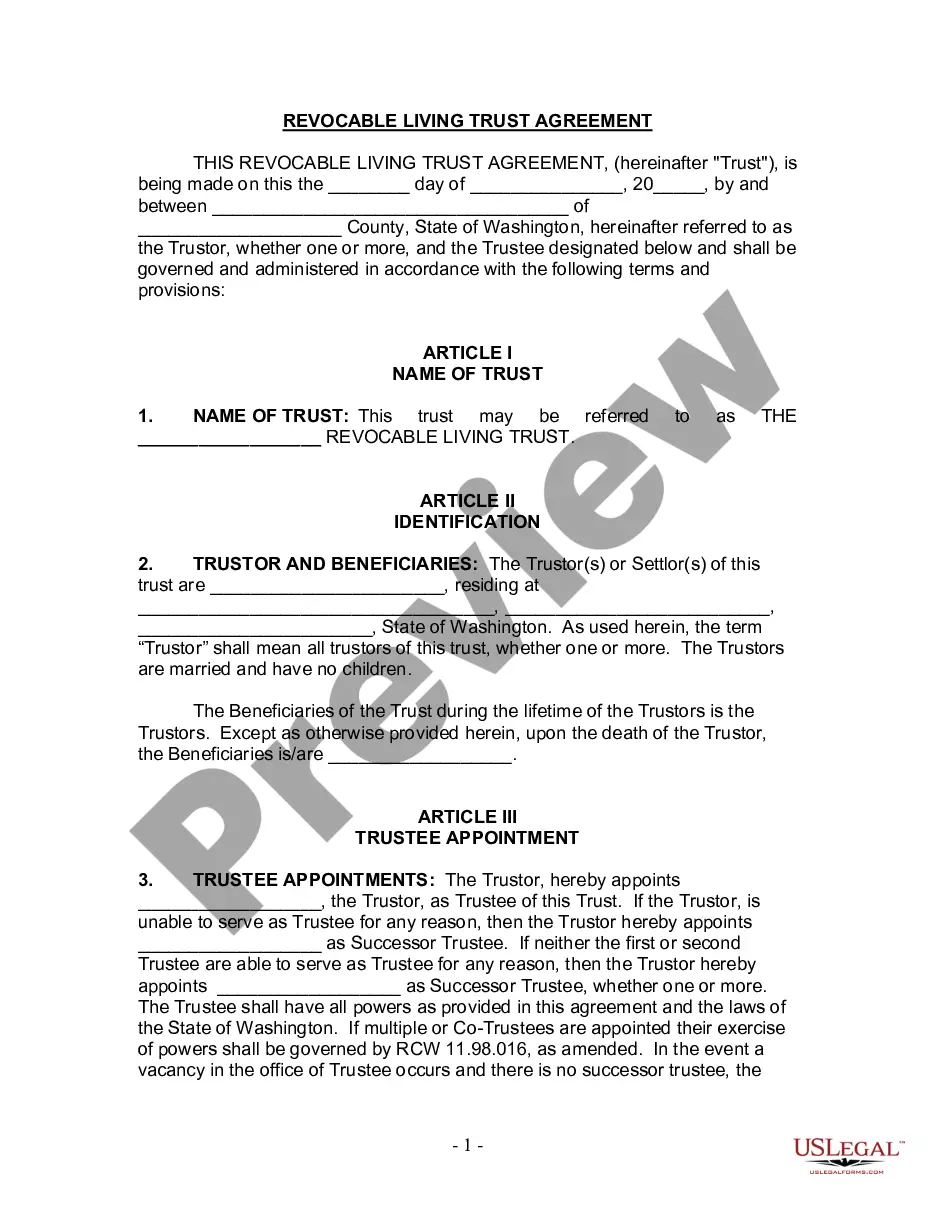

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Bellevue Washington living trust for husband and wife with no children is a legal instrument that allows a married couple to protect and manage their assets during their lifetime and ensure a seamless transfer of ownership upon their death. This type of trust is specifically designed for couples who do not have children and want to establish a comprehensive estate plan. Bellevue Washington residents have several options when it comes to creating a living trust tailored to their unique needs. The most common types include: 1. Revocable Living Trust: A revocable living trust in Bellevue Washington allows the granters (husband and wife) to maintain control over their assets while alive, with the flexibility to make changes or revoke the trust if needed. This type of trust provides a seamless transition of assets upon the granters' death without the need for probate court involvement. 2. Testamentary Trust: A testamentary trust becomes effective upon the death of the granters and is established through a will. In the case of a husband and wife with no children, the trust can be set up to distribute the remaining assets to specific beneficiaries or charitable organizations according to the granters' wishes. 3. Joint Living Trust: A joint living trust is created by the husband and wife together and allows them to consolidate their assets into a single trust. This type of trust is especially beneficial when both spouses want their assets to pass directly to each other upon death, while still ensuring a smooth transfer to other beneficiaries or charitable organizations. 4. Irrevocable Living Trust: An irrevocable living trust cannot be modified or revoked once established, and it provides additional asset protection benefits. While not as common for married couples with no children, this trust type can be an option for couples looking to safeguard certain assets from creditors or potential lawsuits. In Bellevue, Washington, creating a living trust for husband and wife with no children ensures that the couple's wishes for asset distribution and management are carried out efficiently, while minimizing potential estate taxes and avoiding probate court proceedings. It is essential to consult with an experienced estate planning attorney in Bellevue who can guide you through the process, taking into account your specific circumstances and goals.A Bellevue Washington living trust for husband and wife with no children is a legal instrument that allows a married couple to protect and manage their assets during their lifetime and ensure a seamless transfer of ownership upon their death. This type of trust is specifically designed for couples who do not have children and want to establish a comprehensive estate plan. Bellevue Washington residents have several options when it comes to creating a living trust tailored to their unique needs. The most common types include: 1. Revocable Living Trust: A revocable living trust in Bellevue Washington allows the granters (husband and wife) to maintain control over their assets while alive, with the flexibility to make changes or revoke the trust if needed. This type of trust provides a seamless transition of assets upon the granters' death without the need for probate court involvement. 2. Testamentary Trust: A testamentary trust becomes effective upon the death of the granters and is established through a will. In the case of a husband and wife with no children, the trust can be set up to distribute the remaining assets to specific beneficiaries or charitable organizations according to the granters' wishes. 3. Joint Living Trust: A joint living trust is created by the husband and wife together and allows them to consolidate their assets into a single trust. This type of trust is especially beneficial when both spouses want their assets to pass directly to each other upon death, while still ensuring a smooth transfer to other beneficiaries or charitable organizations. 4. Irrevocable Living Trust: An irrevocable living trust cannot be modified or revoked once established, and it provides additional asset protection benefits. While not as common for married couples with no children, this trust type can be an option for couples looking to safeguard certain assets from creditors or potential lawsuits. In Bellevue, Washington, creating a living trust for husband and wife with no children ensures that the couple's wishes for asset distribution and management are carried out efficiently, while minimizing potential estate taxes and avoiding probate court proceedings. It is essential to consult with an experienced estate planning attorney in Bellevue who can guide you through the process, taking into account your specific circumstances and goals.