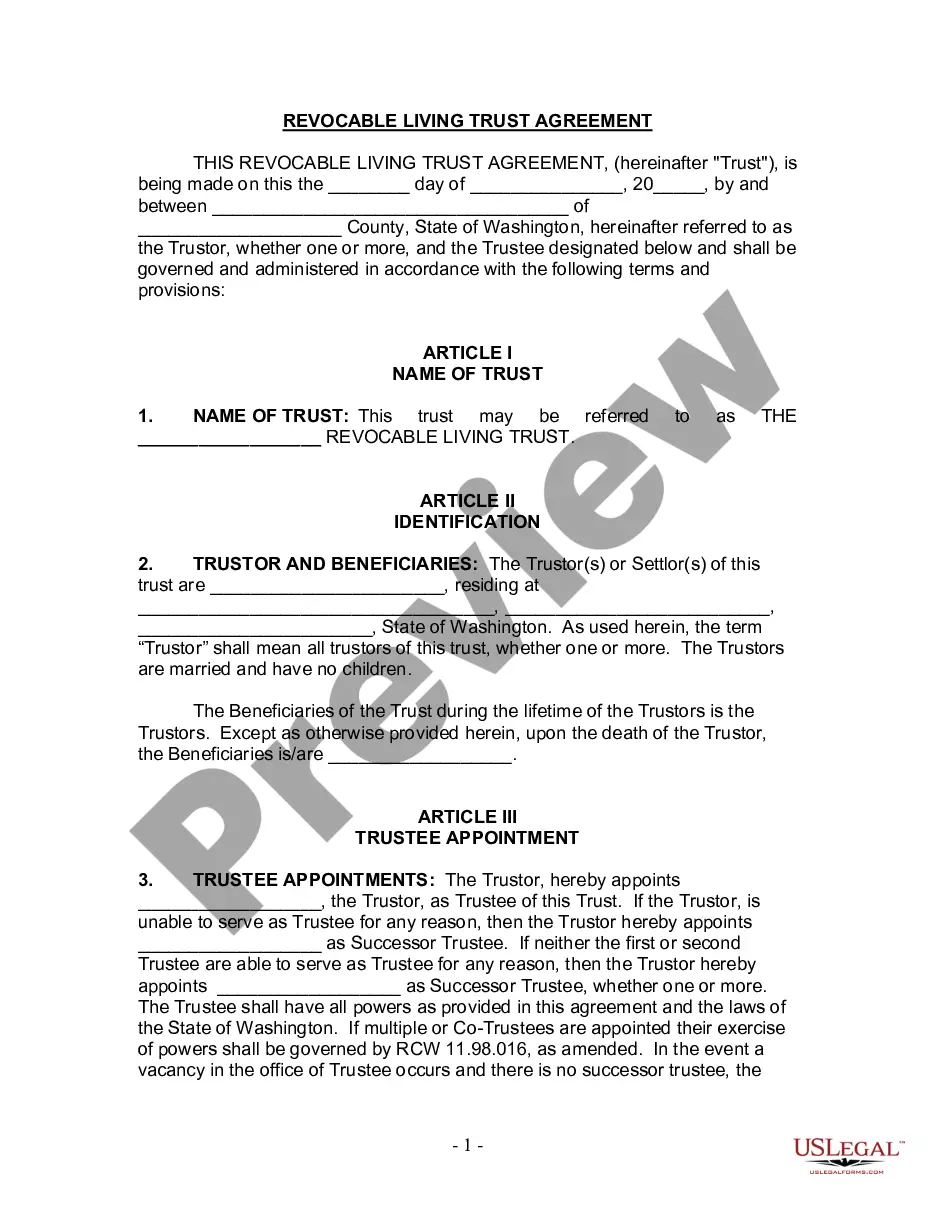

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

King Washington Living Trust for Husband and Wife with No Children is a legal arrangement that allows a married couple with no children to protect and distribute their assets upon their death. This type of trust ensures that the couple's wishes regarding their assets are carried out while providing several advantages, including avoiding probate, maintaining privacy, and minimizing estate taxes. The King Washington Living Trust for Husband and Wife with No Children can be either revocable or irrevocable. A revocable trust allows the couple to make changes to the trust during their lifetime, while an irrevocable trust cannot be changed or revoked once established. One of the significant benefits of this living trust is the ability to avoid probate. Probate is a legal process where the court oversees the distribution of assets. By placing their assets in a trust, the couple can bypass this process, saving time, money, and maintaining the privacy of their estate. Another advantage is the potential to minimize estate taxes. With careful estate planning, a living trust can be structured to reduce the tax burden for a surviving spouse or other beneficiaries. This can ensure maximum wealth preservation for the loved ones. The King Washington Living Trust for Husband and Wife with No Children also allows the couple to maintain control over their assets during their lifetime. They can act as trustees, managing and using their assets as they wish. In the event of incapacity or death, a successor trustee named in the trust takes over the management and distribution of assets, according to the couple's instructions. It's important for couples with no children to consider the specific circumstances that apply to them when establishing a living trust. Factors such as the size of the estate, individual and joint assets, and charitable intentions may influence the setup and terms of the trust. In conclusion, the King Washington Living Trust for Husband and Wife with No Children is an estate planning tool that enables a married couple to protect, manage, and distribute their assets efficiently. By utilizing a living trust, they can avoid probate, maintain privacy, minimize estate taxes, and retain control over their assets throughout their lifetime.King Washington Living Trust for Husband and Wife with No Children is a legal arrangement that allows a married couple with no children to protect and distribute their assets upon their death. This type of trust ensures that the couple's wishes regarding their assets are carried out while providing several advantages, including avoiding probate, maintaining privacy, and minimizing estate taxes. The King Washington Living Trust for Husband and Wife with No Children can be either revocable or irrevocable. A revocable trust allows the couple to make changes to the trust during their lifetime, while an irrevocable trust cannot be changed or revoked once established. One of the significant benefits of this living trust is the ability to avoid probate. Probate is a legal process where the court oversees the distribution of assets. By placing their assets in a trust, the couple can bypass this process, saving time, money, and maintaining the privacy of their estate. Another advantage is the potential to minimize estate taxes. With careful estate planning, a living trust can be structured to reduce the tax burden for a surviving spouse or other beneficiaries. This can ensure maximum wealth preservation for the loved ones. The King Washington Living Trust for Husband and Wife with No Children also allows the couple to maintain control over their assets during their lifetime. They can act as trustees, managing and using their assets as they wish. In the event of incapacity or death, a successor trustee named in the trust takes over the management and distribution of assets, according to the couple's instructions. It's important for couples with no children to consider the specific circumstances that apply to them when establishing a living trust. Factors such as the size of the estate, individual and joint assets, and charitable intentions may influence the setup and terms of the trust. In conclusion, the King Washington Living Trust for Husband and Wife with No Children is an estate planning tool that enables a married couple to protect, manage, and distribute their assets efficiently. By utilizing a living trust, they can avoid probate, maintain privacy, minimize estate taxes, and retain control over their assets throughout their lifetime.