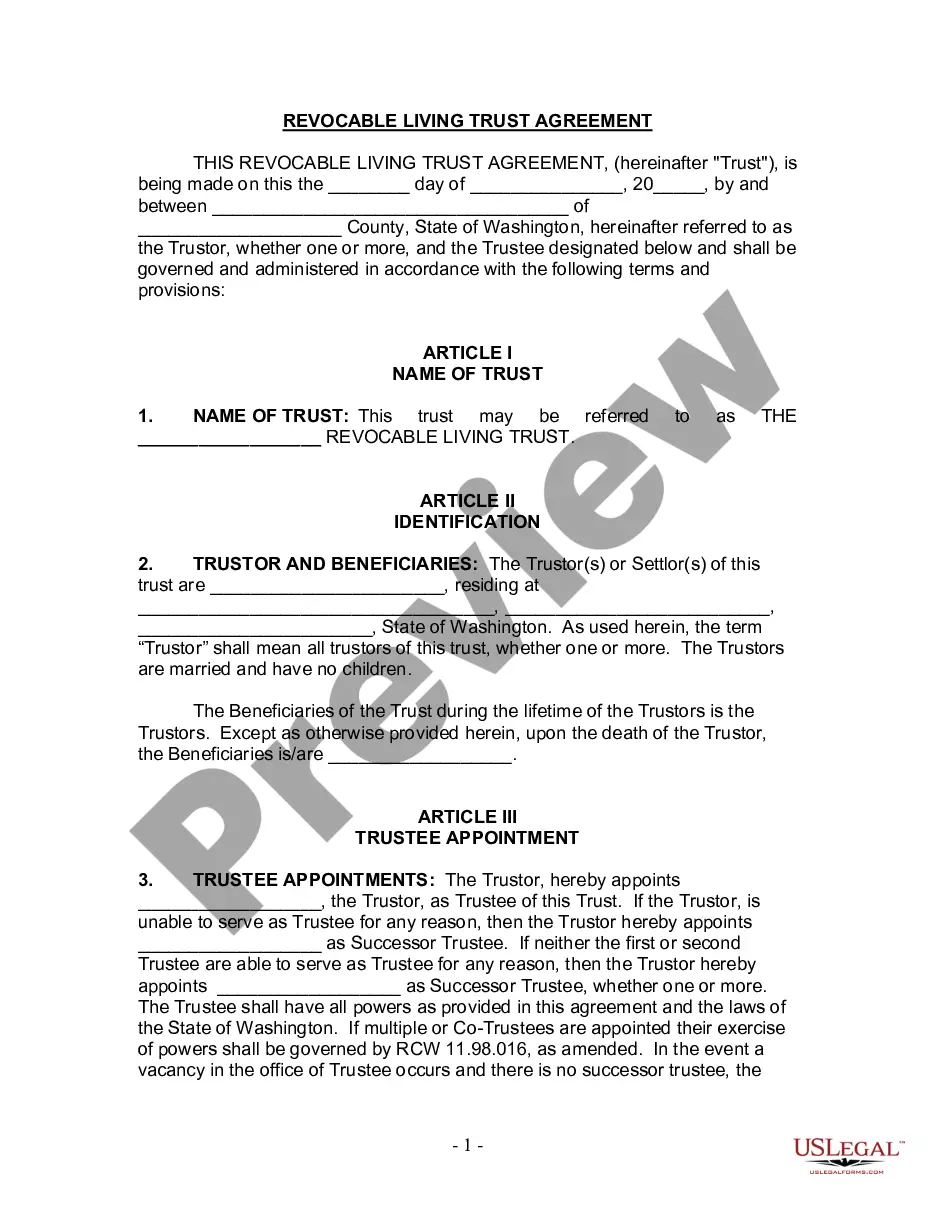

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Renton Washington Living Trust for Husband and Wife with No Children: A Comprehensive Guide A living trust is one of the most effective estate planning tools available for individuals and families, particularly for husbands and wives who have no children. Renton, Washington offers various types of living trusts tailored to the specific needs and circumstances of couples without children. Below, we will provide a detailed description of Renton Washington Living Trust for Husband and Wife with No Children, along with its benefits and potential variants. Living Trust for Husband and Wife with No Children — Overview: A living trust is a legal arrangement wherein a person's assets and property are transferred into a trust to be managed during their lifetime and eventually distributed to beneficiaries after their passing. For couples without children, establishing a living trust can alleviate concerns regarding the management and distribution of their assets and provide a solid plan for their financial future. Benefits of a Renton Washington Living Trust for Husband and Wife with No Children: 1. Asset Management: A living trust allows couples to establish guidelines for managing their assets, ensuring they are properly handled according to their wishes during their lifetime and beyond. 2. Probate Avoidance: Living trusts enable couples to bypass the probate process, saving time, money, and reducing the potential for disputes. This also ensures a smoother transfer of assets to the chosen beneficiaries. 3. Privacy: Since living trusts do not go through probate, they offer a higher level of privacy as compared to wills. The details of the trust remain confidential, providing a more discreet arrangement for the couple's estate. 4. Incapacity Protection: A living trust incorporates provisions for incapacity, allowing appointed successor trustees to manage the couple’s affairs and assets if either spouse becomes incapacitated. This ensures a seamless transition without the need for court-appointed guardianship. Types of Renton Washington Living Trust for Husband and Wife with No Children: 1. Revocable Living Trust: A revocable living trust is the most common type and offers flexibility during the lifetime of the couple. As the name suggests, it can be modified, amended, or revoked entirely by the couple as long as they are mentally competent. This trust becomes irrevocable upon the death of either spouse, and its assets are then distributed according to the couple's predetermined plan. 2. Testamentary Living Trust: Sometimes, couples may decide to establish a testamentary living trust, which is created within their wills. This type of trust becomes effective only after both spouses have passed away. Testamentary living trusts allow couples to dictate how their assets will be distributed, ensuring they align with their desires and avoiding the need for probate. 3. Joint Living Trust: A joint living trust merges the assets of both spouses into a single trust. This type of trust is suitable for couples who wish to simplify asset management and streamline the distribution process. Similar to a revocable living trust, a joint living trust can be modified during the couple's lifetime and becomes irrevocable after the passing of either spouse. In conclusion, a Renton Washington Living Trust for Husband and Wife with No Children serves as an invaluable estate planning tool, providing couples without children with a comprehensive way to manage and distribute their assets. By offering numerous benefits and options, Renton, Washington ensures that these couples have access to tailored living trusts that suit their unique needs and priorities.Renton Washington Living Trust for Husband and Wife with No Children: A Comprehensive Guide A living trust is one of the most effective estate planning tools available for individuals and families, particularly for husbands and wives who have no children. Renton, Washington offers various types of living trusts tailored to the specific needs and circumstances of couples without children. Below, we will provide a detailed description of Renton Washington Living Trust for Husband and Wife with No Children, along with its benefits and potential variants. Living Trust for Husband and Wife with No Children — Overview: A living trust is a legal arrangement wherein a person's assets and property are transferred into a trust to be managed during their lifetime and eventually distributed to beneficiaries after their passing. For couples without children, establishing a living trust can alleviate concerns regarding the management and distribution of their assets and provide a solid plan for their financial future. Benefits of a Renton Washington Living Trust for Husband and Wife with No Children: 1. Asset Management: A living trust allows couples to establish guidelines for managing their assets, ensuring they are properly handled according to their wishes during their lifetime and beyond. 2. Probate Avoidance: Living trusts enable couples to bypass the probate process, saving time, money, and reducing the potential for disputes. This also ensures a smoother transfer of assets to the chosen beneficiaries. 3. Privacy: Since living trusts do not go through probate, they offer a higher level of privacy as compared to wills. The details of the trust remain confidential, providing a more discreet arrangement for the couple's estate. 4. Incapacity Protection: A living trust incorporates provisions for incapacity, allowing appointed successor trustees to manage the couple’s affairs and assets if either spouse becomes incapacitated. This ensures a seamless transition without the need for court-appointed guardianship. Types of Renton Washington Living Trust for Husband and Wife with No Children: 1. Revocable Living Trust: A revocable living trust is the most common type and offers flexibility during the lifetime of the couple. As the name suggests, it can be modified, amended, or revoked entirely by the couple as long as they are mentally competent. This trust becomes irrevocable upon the death of either spouse, and its assets are then distributed according to the couple's predetermined plan. 2. Testamentary Living Trust: Sometimes, couples may decide to establish a testamentary living trust, which is created within their wills. This type of trust becomes effective only after both spouses have passed away. Testamentary living trusts allow couples to dictate how their assets will be distributed, ensuring they align with their desires and avoiding the need for probate. 3. Joint Living Trust: A joint living trust merges the assets of both spouses into a single trust. This type of trust is suitable for couples who wish to simplify asset management and streamline the distribution process. Similar to a revocable living trust, a joint living trust can be modified during the couple's lifetime and becomes irrevocable after the passing of either spouse. In conclusion, a Renton Washington Living Trust for Husband and Wife with No Children serves as an invaluable estate planning tool, providing couples without children with a comprehensive way to manage and distribute their assets. By offering numerous benefits and options, Renton, Washington ensures that these couples have access to tailored living trusts that suit their unique needs and priorities.