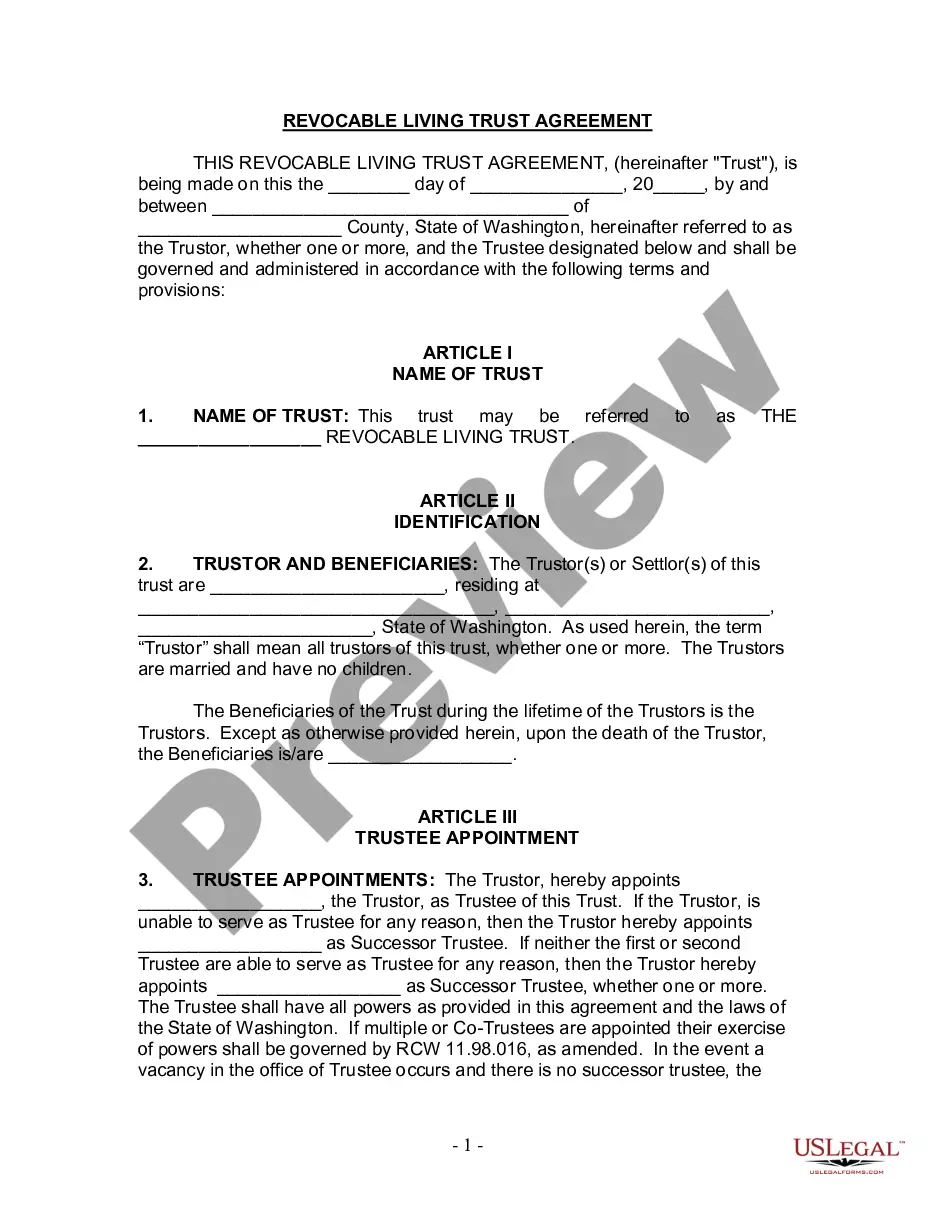

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Seattle Washington Living Trust for Husband and Wife with No Children is a critical legal document that allows a married couple to protect and manage their assets during their lifetime and ensure seamless transfer of their estate after their demise. By establishing a living trust, spouses can avoid probate, maintain privacy, and have more control over their assets. In Seattle, there are primarily two types of living trusts for husband and wife with no children: the revocable living trust and the irrevocable living trust. 1. Revocable Living Trust: A revocable living trust is the most common type of living trust for couples without children in Seattle. It allows the couple to retain full control and ownership of their assets during their lifetime. They can modify or revoke the trust at any time and can serve as the trustees, managing their assets as usual. In case of death or incapacity, a successor trustee takes over the management of the trust, ensuring a smooth transition and avoiding the need for probate. Keywords: Seattle living trust, living trust for husband and wife, revocable living trust, assets, probate, trustees, successor trustee, estate planning. 2. Irrevocable Living Trust: An irrevocable living trust provides more asset protection and tax benefits but comes with limited control and flexibility. Once the couple creates the trust, they cannot make changes or revoke it without the consent of the beneficiaries. This type of trust is often used for specific purposes like Medicaid planning or charitable giving. Keywords: Seattle living trust, irrevocable living trust, asset protection, tax benefits, beneficiaries, Medicaid planning, charitable giving. Regardless of the type chosen, a Seattle Washington Living Trust for Husband and Wife with No Children offers numerous advantages. It allows the couple to: 1. Bypass Probate: A living trust avoids the often lengthy and costly probate process, ensuring a faster distribution of assets to beneficiaries after the couple's passing. 2. Provide Continuity of Management: Should one spouse become incapacitated, the trust provides clear instructions for the transition of asset management to a successor trustee, ensuring the couple's finances are taken care of efficiently. 3. Maintain Privacy: Unlike wills, living trusts are not made public through probate proceedings, thus allowing for increased confidentiality regarding the couple's assets and intended distribution. 4. Minimize Estate Taxes: Through careful planning, a living trust for husband and wife can help reduce or eliminate estate taxes, ensuring more of the couple's wealth goes to their intended beneficiaries. 5. Protect Assets: A living trust can shield assets from creditors, lawsuits, or future spouses in case of remarriage after one spouse's death. Overall, a Seattle Washington Living Trust for Husband and Wife with No Children provides flexibility, control, and peace of mind, enabling couples to efficiently manage and protect their assets during their lifetime and ensure a smooth transfer of their estate to chosen beneficiaries.A Seattle Washington Living Trust for Husband and Wife with No Children is a critical legal document that allows a married couple to protect and manage their assets during their lifetime and ensure seamless transfer of their estate after their demise. By establishing a living trust, spouses can avoid probate, maintain privacy, and have more control over their assets. In Seattle, there are primarily two types of living trusts for husband and wife with no children: the revocable living trust and the irrevocable living trust. 1. Revocable Living Trust: A revocable living trust is the most common type of living trust for couples without children in Seattle. It allows the couple to retain full control and ownership of their assets during their lifetime. They can modify or revoke the trust at any time and can serve as the trustees, managing their assets as usual. In case of death or incapacity, a successor trustee takes over the management of the trust, ensuring a smooth transition and avoiding the need for probate. Keywords: Seattle living trust, living trust for husband and wife, revocable living trust, assets, probate, trustees, successor trustee, estate planning. 2. Irrevocable Living Trust: An irrevocable living trust provides more asset protection and tax benefits but comes with limited control and flexibility. Once the couple creates the trust, they cannot make changes or revoke it without the consent of the beneficiaries. This type of trust is often used for specific purposes like Medicaid planning or charitable giving. Keywords: Seattle living trust, irrevocable living trust, asset protection, tax benefits, beneficiaries, Medicaid planning, charitable giving. Regardless of the type chosen, a Seattle Washington Living Trust for Husband and Wife with No Children offers numerous advantages. It allows the couple to: 1. Bypass Probate: A living trust avoids the often lengthy and costly probate process, ensuring a faster distribution of assets to beneficiaries after the couple's passing. 2. Provide Continuity of Management: Should one spouse become incapacitated, the trust provides clear instructions for the transition of asset management to a successor trustee, ensuring the couple's finances are taken care of efficiently. 3. Maintain Privacy: Unlike wills, living trusts are not made public through probate proceedings, thus allowing for increased confidentiality regarding the couple's assets and intended distribution. 4. Minimize Estate Taxes: Through careful planning, a living trust for husband and wife can help reduce or eliminate estate taxes, ensuring more of the couple's wealth goes to their intended beneficiaries. 5. Protect Assets: A living trust can shield assets from creditors, lawsuits, or future spouses in case of remarriage after one spouse's death. Overall, a Seattle Washington Living Trust for Husband and Wife with No Children provides flexibility, control, and peace of mind, enabling couples to efficiently manage and protect their assets during their lifetime and ensure a smooth transfer of their estate to chosen beneficiaries.