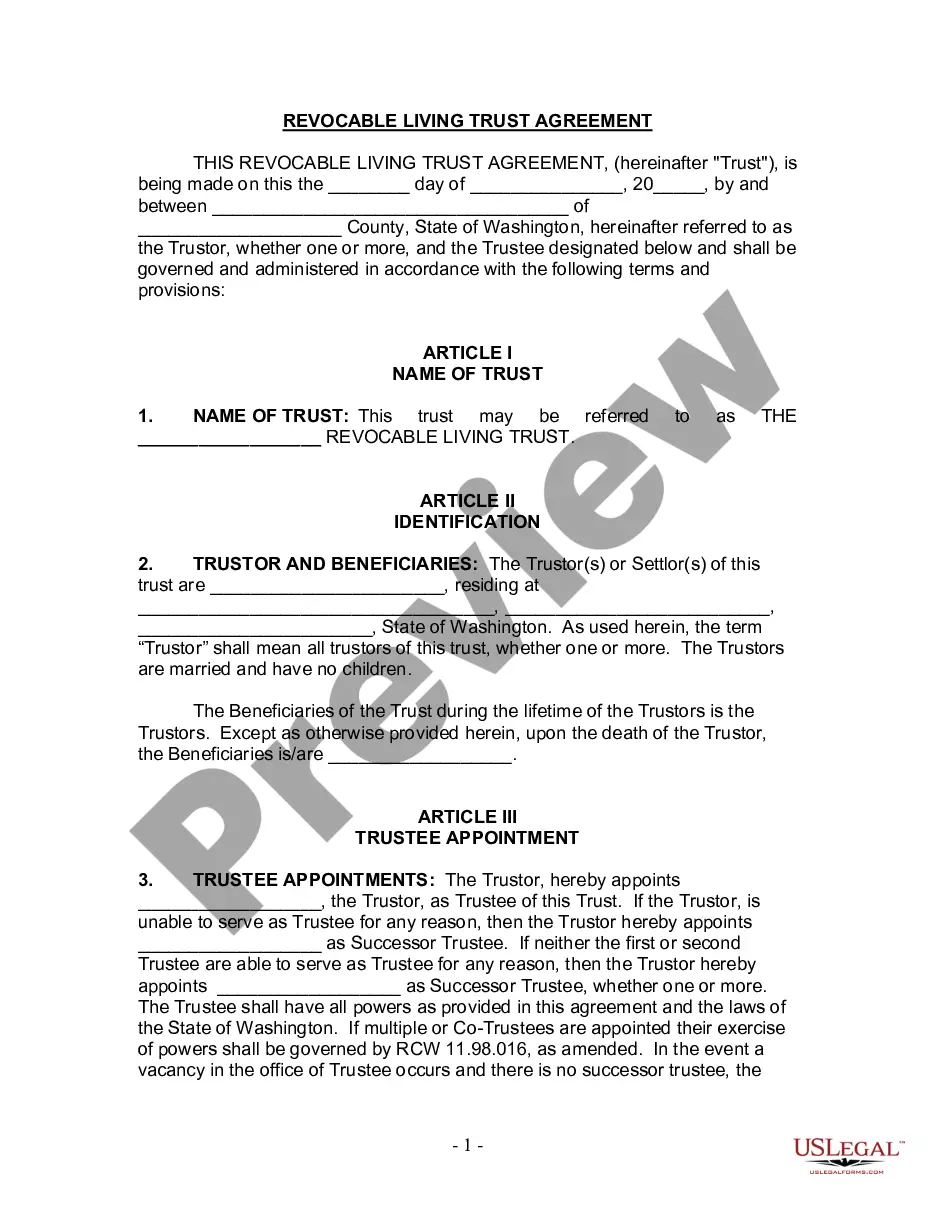

This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Spokane Valley Washington Living Trust for Husband and Wife with No Children: A Comprehensive Guide A living trust is a legal document that allows individuals, in this case, a husband and wife with no children, to protect and manage their assets during their lifetime and ensure a smooth transfer of these assets after their passing. In Spokane Valley, Washington, there are various types of living trusts available for couples without children. Let's explore them in detail: 1. Revocable Living Trust: A revocable living trust is the most common type of trust that provides flexibility and allows the creators (settlers) to make changes or revoke the trust during their lifetime. This trust enables the husband and wife to maintain complete control over their assets while alive. It also ensures that their property bypasses probate, saving time and costs for their loved ones. 2. Joint Living Trust: A joint living trust, also known as a shared trust or a marital trust, is established by a married couple together. It allows both spouses to pool their assets into one trust and simplifies the administration process. With a joint living trust, the couple can manage their property jointly and direct how it should be distributed upon their passing. 3. Testamentary Living Trust: A testamentary living trust is created through a will and becomes effective only after the death of the husband and wife. It allows them to control the distribution of their assets to beneficiaries. Testamentary trusts can be beneficial when additional estate planning provisions, such as charitable donations or staggered distributions, need to be implemented. 4. Irrevocable Living Trust: An irrevocable living trust is a trust that cannot be altered or revoked once established, except in exceptional circumstances with court approval. While the creators surrender control over the assets transferred, this type of trust offers unique tax advantages and protects assets from creditors. However, it should be carefully considered due to its permanent nature. 5. Special Needs Trust: If one or both spouses have special needs dependents, a special needs trust should be considered. This trust ensures the financial security of the special needs individual while maintaining eligibility for government benefits. It provides for their care and well-being without jeopardizing their access to crucial assistance programs. In Spokane Valley, Washington, a living trust for a husband and wife with no children can be customized based on their specific needs and goals. It is recommended to consult an experienced estate planning attorney to determine the most suitable type of trust, given their unique circumstances. Key benefits of establishing a living trust include avoiding probate, maintaining privacy, protecting assets, minimizing estate taxes, offering flexibility in asset management, and securing a smooth transfer of assets to chosen beneficiaries. To create a Spokane Valley Washington Living Trust for Husband and Wife with No Children, consult a trusted estate planning attorney. Ensure the selected attorney specializes in Washington state laws and has expertise in living trusts for personalized and reliable guidance.Spokane Valley Washington Living Trust for Husband and Wife with No Children: A Comprehensive Guide A living trust is a legal document that allows individuals, in this case, a husband and wife with no children, to protect and manage their assets during their lifetime and ensure a smooth transfer of these assets after their passing. In Spokane Valley, Washington, there are various types of living trusts available for couples without children. Let's explore them in detail: 1. Revocable Living Trust: A revocable living trust is the most common type of trust that provides flexibility and allows the creators (settlers) to make changes or revoke the trust during their lifetime. This trust enables the husband and wife to maintain complete control over their assets while alive. It also ensures that their property bypasses probate, saving time and costs for their loved ones. 2. Joint Living Trust: A joint living trust, also known as a shared trust or a marital trust, is established by a married couple together. It allows both spouses to pool their assets into one trust and simplifies the administration process. With a joint living trust, the couple can manage their property jointly and direct how it should be distributed upon their passing. 3. Testamentary Living Trust: A testamentary living trust is created through a will and becomes effective only after the death of the husband and wife. It allows them to control the distribution of their assets to beneficiaries. Testamentary trusts can be beneficial when additional estate planning provisions, such as charitable donations or staggered distributions, need to be implemented. 4. Irrevocable Living Trust: An irrevocable living trust is a trust that cannot be altered or revoked once established, except in exceptional circumstances with court approval. While the creators surrender control over the assets transferred, this type of trust offers unique tax advantages and protects assets from creditors. However, it should be carefully considered due to its permanent nature. 5. Special Needs Trust: If one or both spouses have special needs dependents, a special needs trust should be considered. This trust ensures the financial security of the special needs individual while maintaining eligibility for government benefits. It provides for their care and well-being without jeopardizing their access to crucial assistance programs. In Spokane Valley, Washington, a living trust for a husband and wife with no children can be customized based on their specific needs and goals. It is recommended to consult an experienced estate planning attorney to determine the most suitable type of trust, given their unique circumstances. Key benefits of establishing a living trust include avoiding probate, maintaining privacy, protecting assets, minimizing estate taxes, offering flexibility in asset management, and securing a smooth transfer of assets to chosen beneficiaries. To create a Spokane Valley Washington Living Trust for Husband and Wife with No Children, consult a trusted estate planning attorney. Ensure the selected attorney specializes in Washington state laws and has expertise in living trusts for personalized and reliable guidance.