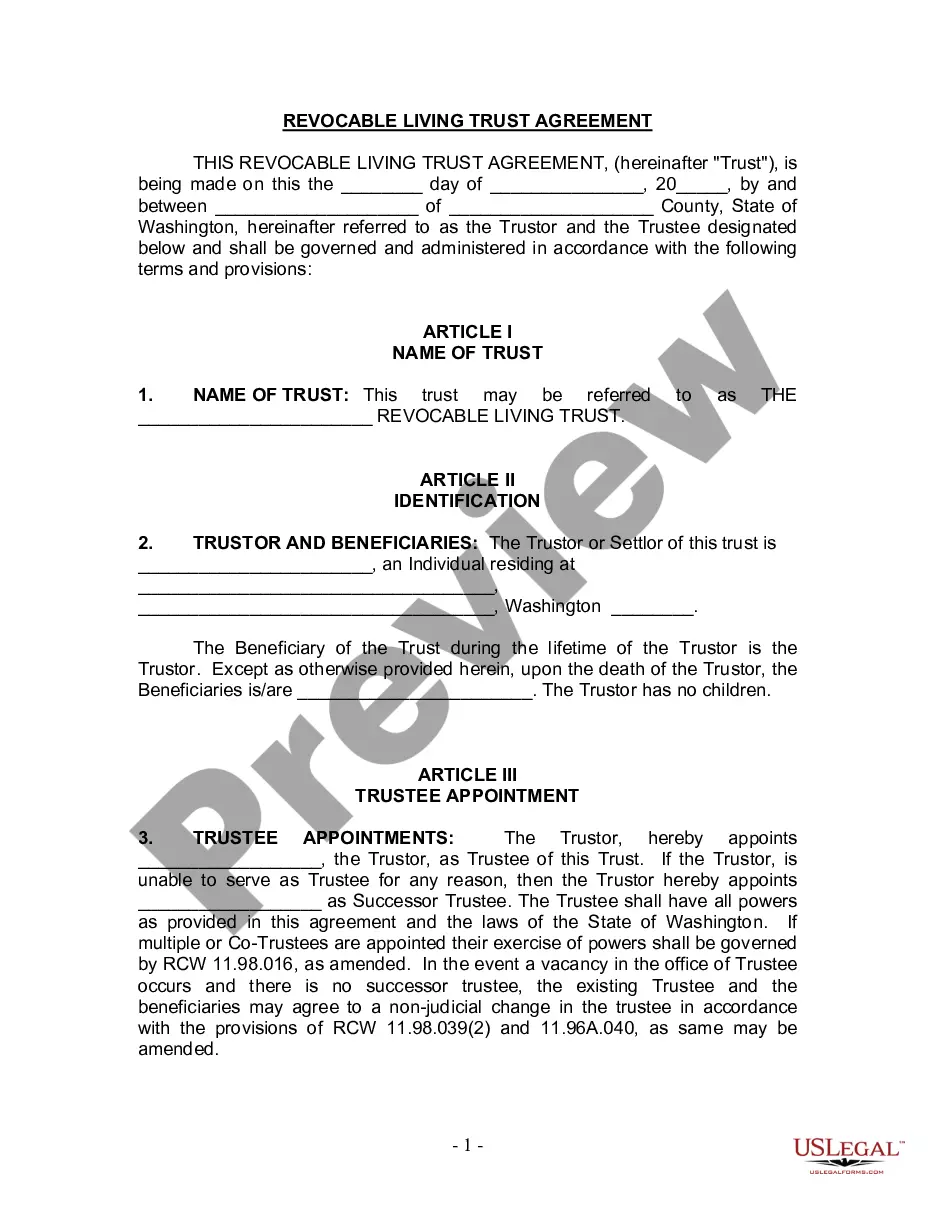

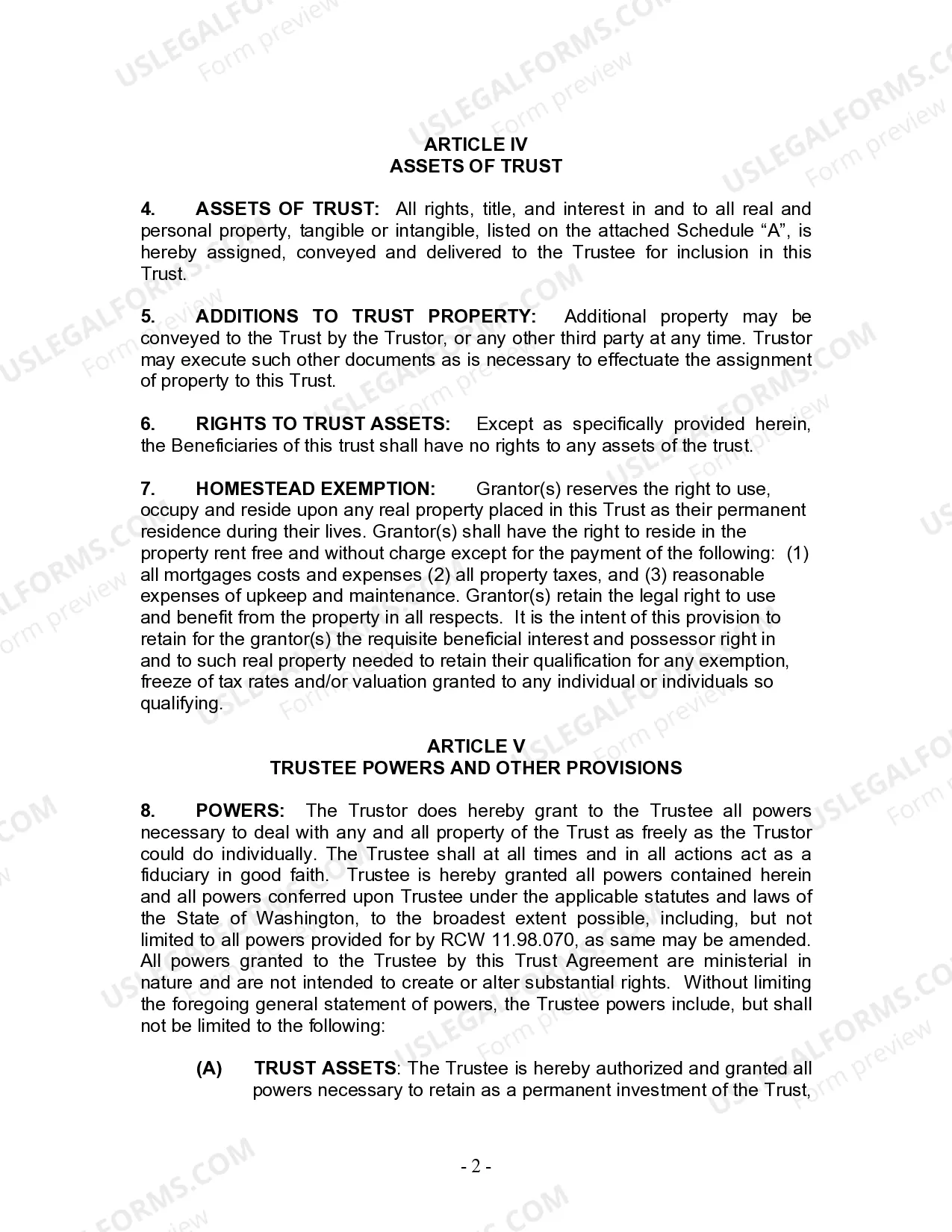

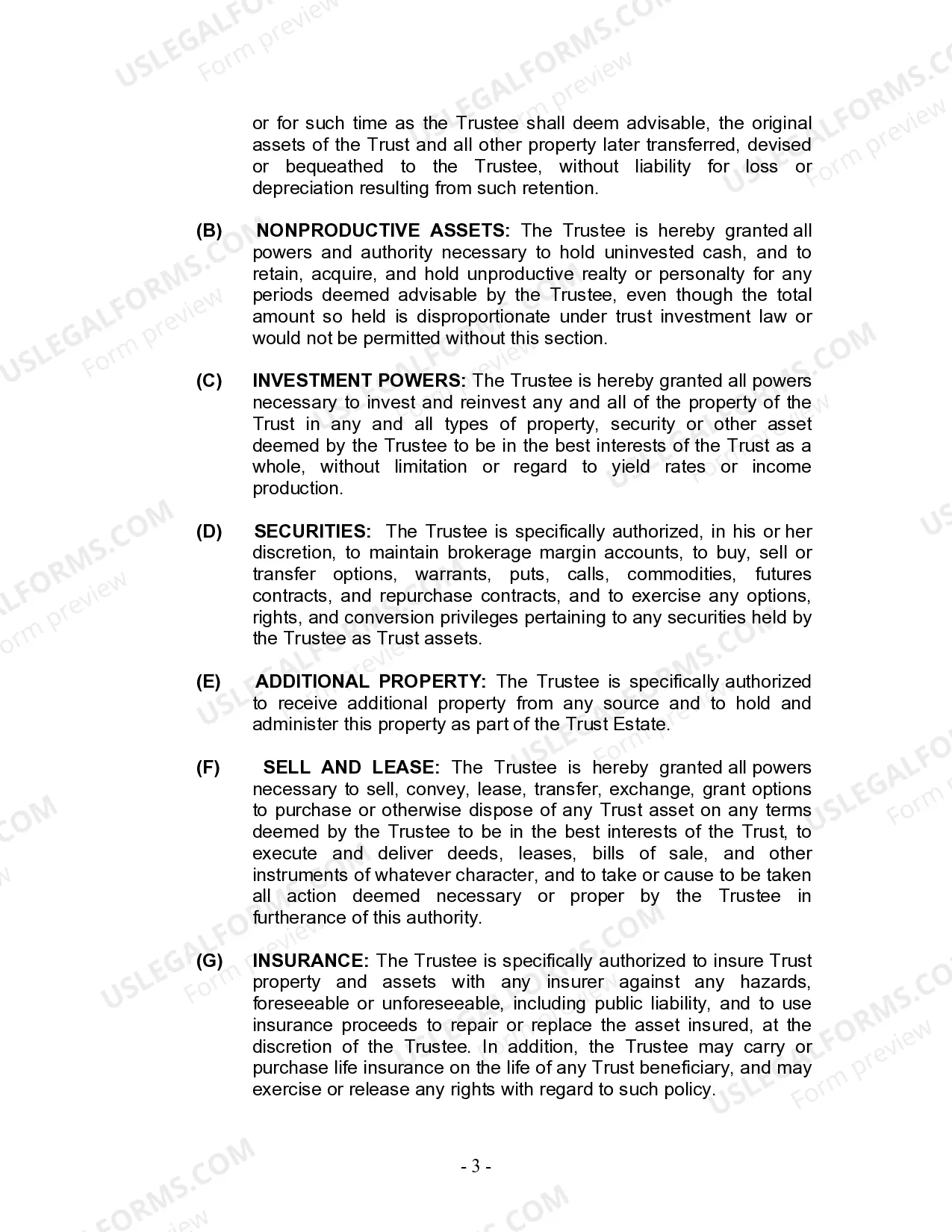

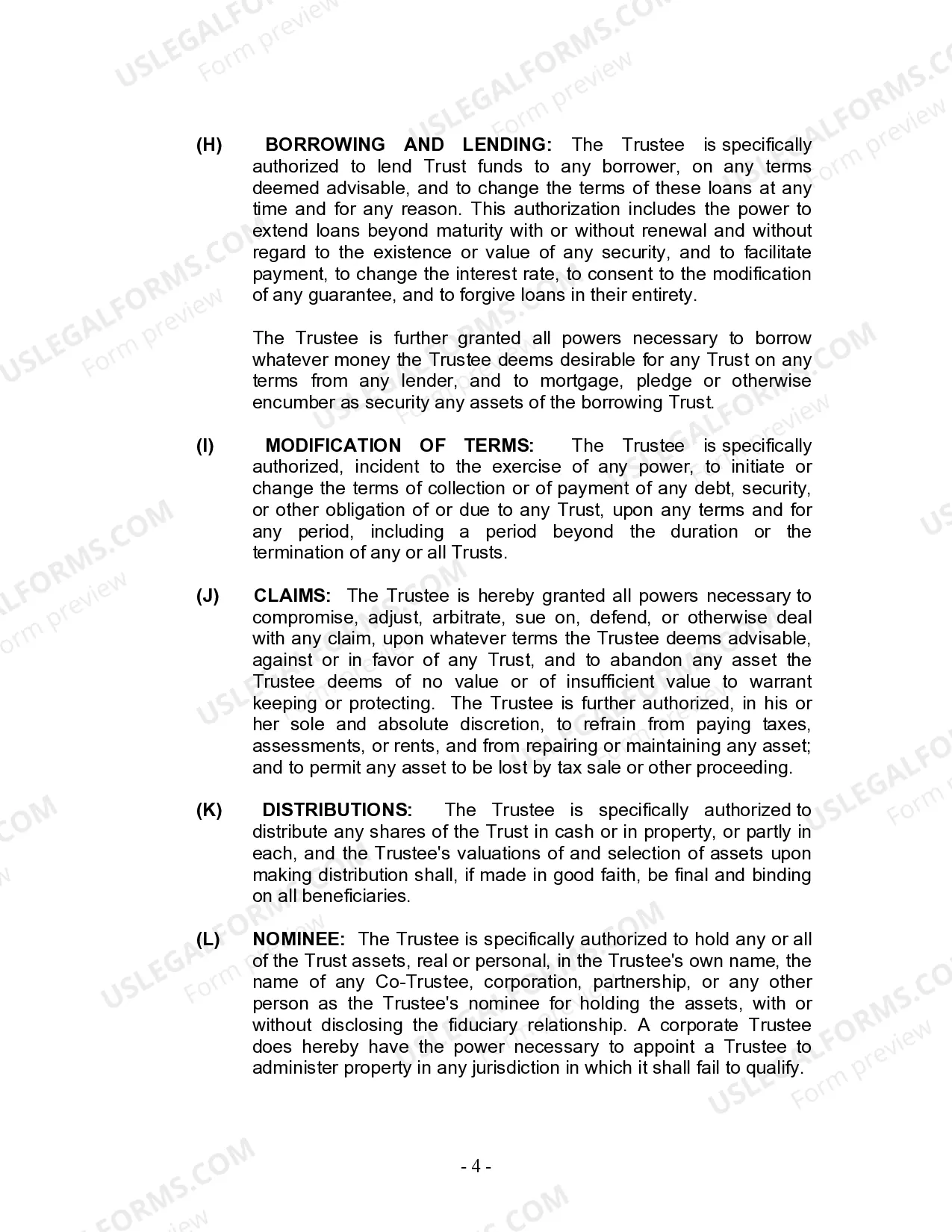

This Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Everett Washington Living Trust for Singles, Divorced individuals, and Widow(er’s with No Children For individuals who are single, divorced, or widowed with no children, a living trust is an important tool for estate planning and asset protection. A living trust is a legal document that allows you to establish a plan for managing and distributing your assets during your lifetime and after your death. Everett Washington provides several types of living trusts tailored specifically for individuals in these circumstances. 1. Single Living Trust: A Single Living Trust is ideal for unmarried individuals who want to ensure their assets are protected and distributed according to their wishes. It enables you to maintain control over your assets, designate beneficiaries, and appoint a trusted person, known as a trustee, to manage and distribute your assets upon your death or incapacitation. 2. Divorced Individual Living Trust: A Divorced Individual Living Trust is designed for individuals who have gone through a divorce but do not have children. It allows you to protect and manage your assets independently of your former spouse, ensuring your assets are distributed as you wish. By creating a living trust, you can prevent your ex-spouse from inheriting or gaining control over your assets, while also providing for other beneficiaries or charities. 3. Widow(er) Living Trust: A Widow(er) Living Trust is specifically designed for individuals who have lost their spouse and have no children. This type of trust enables you to retain control over your assets, ensuring they are distributed according to your wishes after your death. You can appoint a trustee to manage your assets during your lifetime and designate beneficiaries who will receive your assets upon your passing. The advantages of creating a living trust for single, divorced, or widowed individuals with no children include avoiding probate, maintaining privacy, reducing estate taxes, and ensuring a smooth transition of assets. By establishing a living trust, your assets are held in a trust, bypassing the probate process, which can be time-consuming and expensive. This ensures a faster distribution of assets to your chosen beneficiaries. Additionally, a living trust offers privacy as it does not become a part of public record like a will. Through the trust document, you can specify how your assets will be distributed, ensuring your intentions are clear and avoiding potential disputes between family members. Moreover, a living trust can help minimize estate taxes, as assets held in the trust are not included in the taxable estate upon your passing, potentially saving your beneficiaries significant amounts of money. In conclusion, for individuals in Everett, Washington who are single, divorced, or widowed with no children, creating a living trust is an essential step towards protecting and managing your assets. Whether you choose a Single Living Trust, a Divorced Individual Living Trust, or a Widow(er) Living Trust, consulting with an experienced estate planning attorney is crucial to ensure the trust is drafted to meet your specific needs and wishes.Everett Washington Living Trust for Singles, Divorced individuals, and Widow(er’s with No Children For individuals who are single, divorced, or widowed with no children, a living trust is an important tool for estate planning and asset protection. A living trust is a legal document that allows you to establish a plan for managing and distributing your assets during your lifetime and after your death. Everett Washington provides several types of living trusts tailored specifically for individuals in these circumstances. 1. Single Living Trust: A Single Living Trust is ideal for unmarried individuals who want to ensure their assets are protected and distributed according to their wishes. It enables you to maintain control over your assets, designate beneficiaries, and appoint a trusted person, known as a trustee, to manage and distribute your assets upon your death or incapacitation. 2. Divorced Individual Living Trust: A Divorced Individual Living Trust is designed for individuals who have gone through a divorce but do not have children. It allows you to protect and manage your assets independently of your former spouse, ensuring your assets are distributed as you wish. By creating a living trust, you can prevent your ex-spouse from inheriting or gaining control over your assets, while also providing for other beneficiaries or charities. 3. Widow(er) Living Trust: A Widow(er) Living Trust is specifically designed for individuals who have lost their spouse and have no children. This type of trust enables you to retain control over your assets, ensuring they are distributed according to your wishes after your death. You can appoint a trustee to manage your assets during your lifetime and designate beneficiaries who will receive your assets upon your passing. The advantages of creating a living trust for single, divorced, or widowed individuals with no children include avoiding probate, maintaining privacy, reducing estate taxes, and ensuring a smooth transition of assets. By establishing a living trust, your assets are held in a trust, bypassing the probate process, which can be time-consuming and expensive. This ensures a faster distribution of assets to your chosen beneficiaries. Additionally, a living trust offers privacy as it does not become a part of public record like a will. Through the trust document, you can specify how your assets will be distributed, ensuring your intentions are clear and avoiding potential disputes between family members. Moreover, a living trust can help minimize estate taxes, as assets held in the trust are not included in the taxable estate upon your passing, potentially saving your beneficiaries significant amounts of money. In conclusion, for individuals in Everett, Washington who are single, divorced, or widowed with no children, creating a living trust is an essential step towards protecting and managing your assets. Whether you choose a Single Living Trust, a Divorced Individual Living Trust, or a Widow(er) Living Trust, consulting with an experienced estate planning attorney is crucial to ensure the trust is drafted to meet your specific needs and wishes.