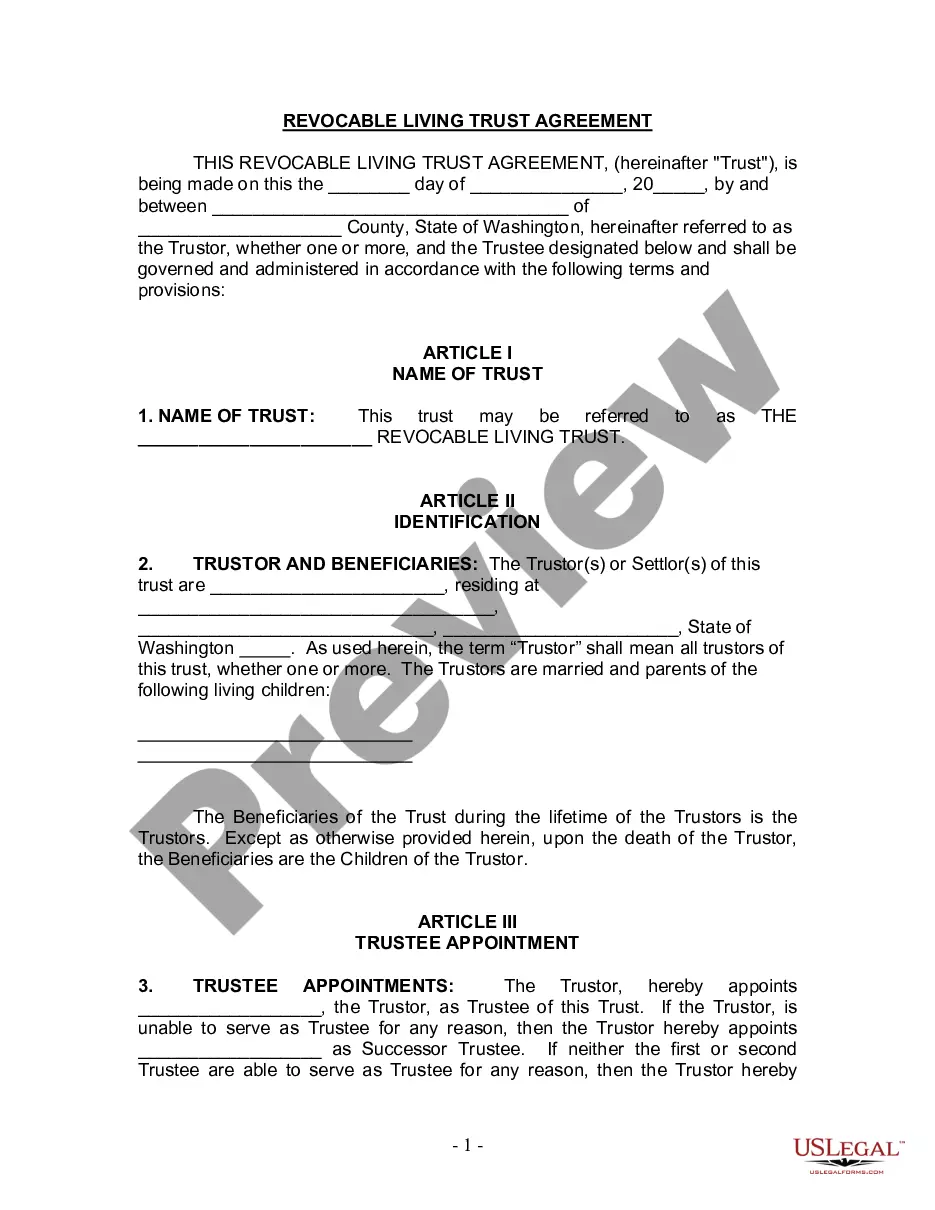

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Bellevue Washington Living Trust for Husband and Wife with One Child, also referred to as a joint living trust, is a legal document that allows married couples with a single child to protect and manage their assets during their lifetime and ensure a smooth transfer of those assets to their child upon their passing. 1. "Bellevue Washington Living Trust for Husband and Wife with One Child": This is the basic form of a living trust that encompasses most couples with one child living in Bellevue, Washington. It serves as a comprehensive estate planning tool that provides control, privacy, and flexibility over their assets. 2. "Revocable Living Trust with Testamentary Provision": This particular type of living trust offers the flexibility to make changes or revoke the trust during the lifetime of the spouses. It also includes a testamentary provision that allows the trust to disburse assets to the child upon the death of both spouses. 3. "Irrevocable Living Trust for Asset Protection": An irrevocable living trust is created when the spouses want to protect their assets from potential creditors or lawsuits. Once assets are transferred to this trust, they no longer belong to the spouses and are protected from claims against them. 4. "Special Needs Trust for Disabled or Dependent Child": If the couple has a child with special needs, a special needs trust can be established to ensure their child's financial needs are met without jeopardizing their eligibility for government assistance programs such as Medicaid or Supplemental Security Income (SSI). 5. "Charitable Remainder Trust": This type of trust allows the couple to contribute a portion of their assets to a charitable organization while still retaining income generated by those assets throughout their lifetime. Upon their passing, the remaining trust assets are transferred to the specified charity. 6. "Dynasty Trust for Multi-Generational Wealth Preservation": A dynasty trust is created to protect and preserve family wealth for future generations. It allows the couple to transfer assets into the trust and direct how those assets should be managed and distributed over multiple generations without incurring excessive estate taxes. By establishing a Bellevue Washington Living Trust for Husband and Wife with One Child, couples can gain peace of mind knowing that their assets are protected, their wishes will be followed, and their child's financial well-being is ensured. Consultation with an experienced estate planning attorney is highly recommended determining which type of trust best suits the couple's unique needs and goals.