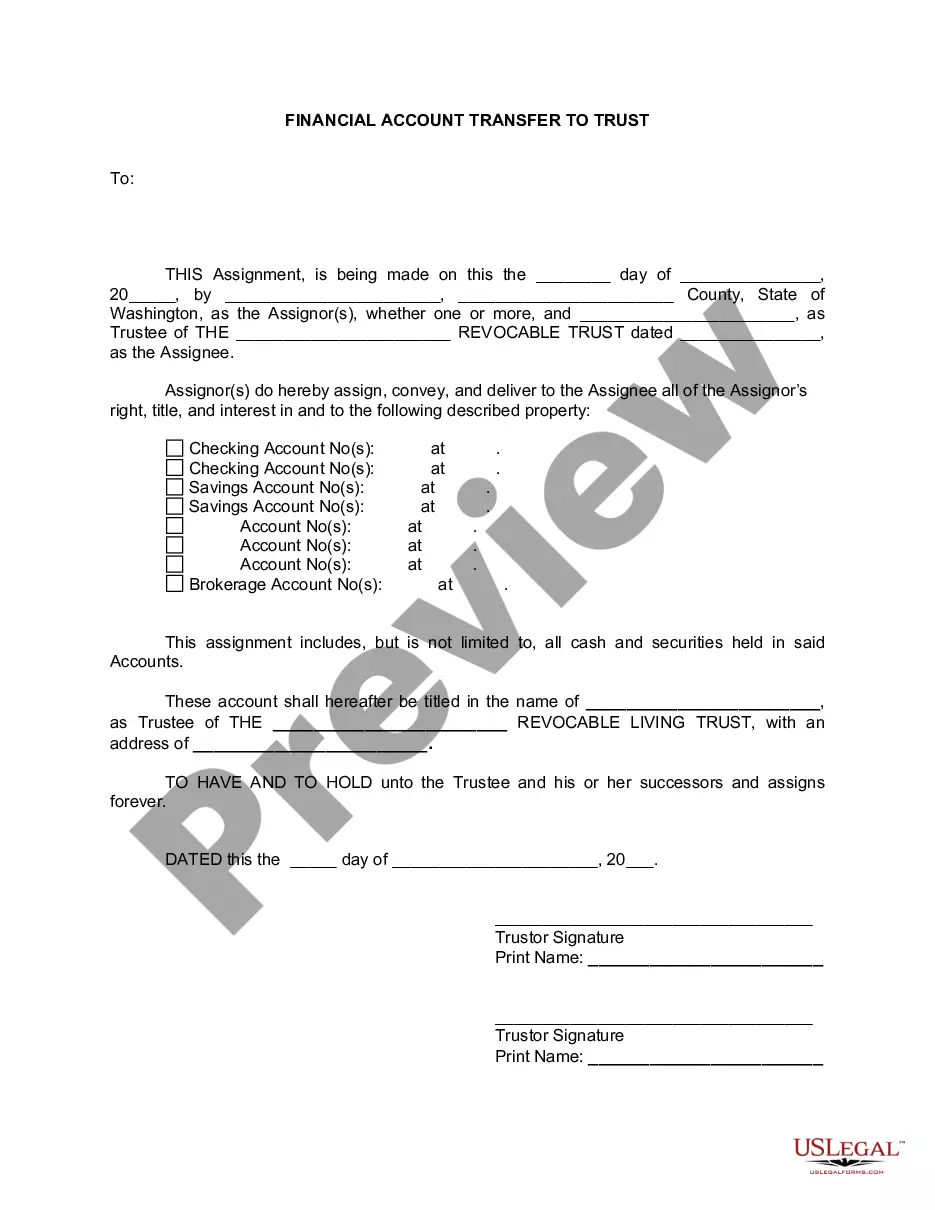

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Bellevue Washington Financial Account Transfer to Living Trust: A Comprehensive Overview In Bellevue, Washington, financial account transfer to a living trust offers individuals an effective tool for estate planning and seamless wealth management. This process enables individuals to protect and distribute their assets, avoid probate, minimize taxes, and maintain control over their financial affairs during their lifetime and beyond. This detailed description will delve into the concept of a financial account transfer to a living trust in Bellevue, highlighting its benefits, key considerations, and different types. Key Benefits of Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Avoidance of Probate: By transferring financial accounts to a living trust, individuals can bypass the probate process, which can be time-consuming, costly, and public. This ensures a smooth distribution of assets to beneficiaries without the interference of the court. 2. Privacy and Confidentiality: Unlike a will, which becomes a public record upon probate, a living trust allows individuals to maintain confidentiality. This ensures that personal financial information remains private, protecting the sensitive details of an individual's estate. 3. Asset Protection: Transferring financial accounts to a living trust can shield assets from potential creditors and lawsuits. This protection ensures that beneficiaries receive the intended assets without them being vulnerable to claims from third parties. 4. Incapacity Planning: A living trust enables individuals to plan for potential incapacity. In the event of cognitive decline or disability, a designated successor trustee can seamlessly manage the trust, ensuring continuous financial management and care throughout the individual's lifetime. Key Considerations for Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Consultation with Professionals: Before initiating a financial account transfer to a living trust, it is crucial to consult with an estate planning attorney and a financial advisor experienced in living trusts. These professionals will guide individuals through the process, considering their unique financial circumstances and legal requirements. 2. Legal Documentation: Accurate and legally binding documentation is essential for a successful financial account transfer. This process typically involves obtaining the necessary forms from financial institutions, creating a trust agreement, and properly titling the accounts within the trust's name. 3. Ongoing Management: Once the financial accounts are transferred to the living trust, individuals must actively manage the trust to ensure its effectiveness. This includes funding the trust with any new accounts or assets acquired and regularly reviewing and updating the trust's provisions as needed. Types of Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Bank and Brokerage Accounts: Individuals can transfer various accounts, such as checking, savings, money market, and investment accounts, to their living trusts. This encompasses individual and joint accounts, enabling efficient consolidation and management of financial assets. 2. Retirement Accounts: Depending on specific circumstances and applicable laws, certain retirement accounts like Individual Retirement Accounts (IRAs) or 401(k)s can be transferred to a living trust. However, it is crucial to consult with professionals to understand the tax implications and compliance with retirement account regulations. In conclusion, a Bellevue Washington Financial Account Transfer to Living Trust grants individuals the opportunity to efficiently protect and manage their assets, streamline estate distribution, avoid probate, and plan for potential incapacity. By considering the benefits, key considerations, and different types of financial accounts eligible for transfer, individuals can navigate the estate planning process confidently, ensuring the preservation of their financial legacy and the security of their loved ones.Bellevue Washington Financial Account Transfer to Living Trust: A Comprehensive Overview In Bellevue, Washington, financial account transfer to a living trust offers individuals an effective tool for estate planning and seamless wealth management. This process enables individuals to protect and distribute their assets, avoid probate, minimize taxes, and maintain control over their financial affairs during their lifetime and beyond. This detailed description will delve into the concept of a financial account transfer to a living trust in Bellevue, highlighting its benefits, key considerations, and different types. Key Benefits of Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Avoidance of Probate: By transferring financial accounts to a living trust, individuals can bypass the probate process, which can be time-consuming, costly, and public. This ensures a smooth distribution of assets to beneficiaries without the interference of the court. 2. Privacy and Confidentiality: Unlike a will, which becomes a public record upon probate, a living trust allows individuals to maintain confidentiality. This ensures that personal financial information remains private, protecting the sensitive details of an individual's estate. 3. Asset Protection: Transferring financial accounts to a living trust can shield assets from potential creditors and lawsuits. This protection ensures that beneficiaries receive the intended assets without them being vulnerable to claims from third parties. 4. Incapacity Planning: A living trust enables individuals to plan for potential incapacity. In the event of cognitive decline or disability, a designated successor trustee can seamlessly manage the trust, ensuring continuous financial management and care throughout the individual's lifetime. Key Considerations for Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Consultation with Professionals: Before initiating a financial account transfer to a living trust, it is crucial to consult with an estate planning attorney and a financial advisor experienced in living trusts. These professionals will guide individuals through the process, considering their unique financial circumstances and legal requirements. 2. Legal Documentation: Accurate and legally binding documentation is essential for a successful financial account transfer. This process typically involves obtaining the necessary forms from financial institutions, creating a trust agreement, and properly titling the accounts within the trust's name. 3. Ongoing Management: Once the financial accounts are transferred to the living trust, individuals must actively manage the trust to ensure its effectiveness. This includes funding the trust with any new accounts or assets acquired and regularly reviewing and updating the trust's provisions as needed. Types of Financial Account Transfer to Living Trust in Bellevue, Washington: 1. Bank and Brokerage Accounts: Individuals can transfer various accounts, such as checking, savings, money market, and investment accounts, to their living trusts. This encompasses individual and joint accounts, enabling efficient consolidation and management of financial assets. 2. Retirement Accounts: Depending on specific circumstances and applicable laws, certain retirement accounts like Individual Retirement Accounts (IRAs) or 401(k)s can be transferred to a living trust. However, it is crucial to consult with professionals to understand the tax implications and compliance with retirement account regulations. In conclusion, a Bellevue Washington Financial Account Transfer to Living Trust grants individuals the opportunity to efficiently protect and manage their assets, streamline estate distribution, avoid probate, and plan for potential incapacity. By considering the benefits, key considerations, and different types of financial accounts eligible for transfer, individuals can navigate the estate planning process confidently, ensuring the preservation of their financial legacy and the security of their loved ones.