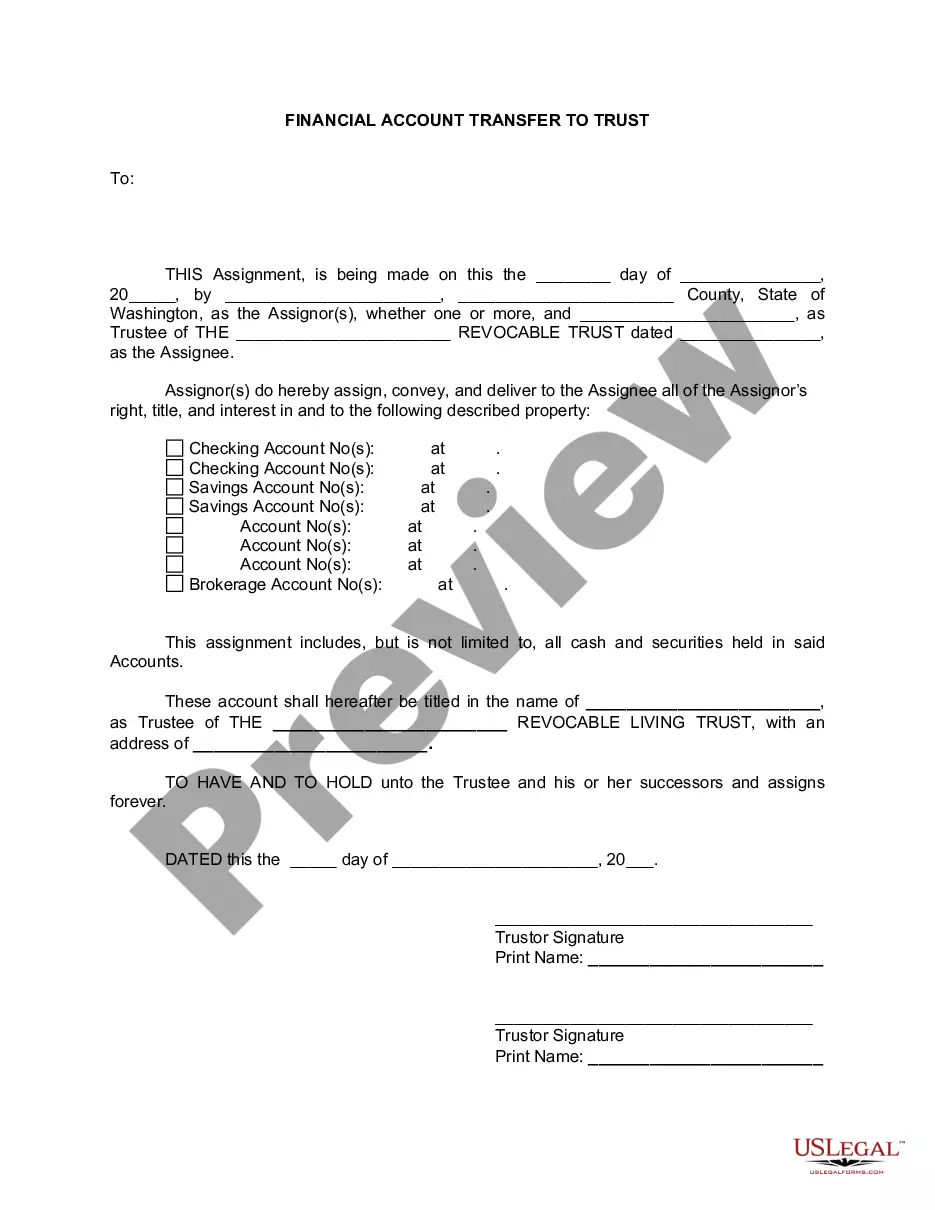

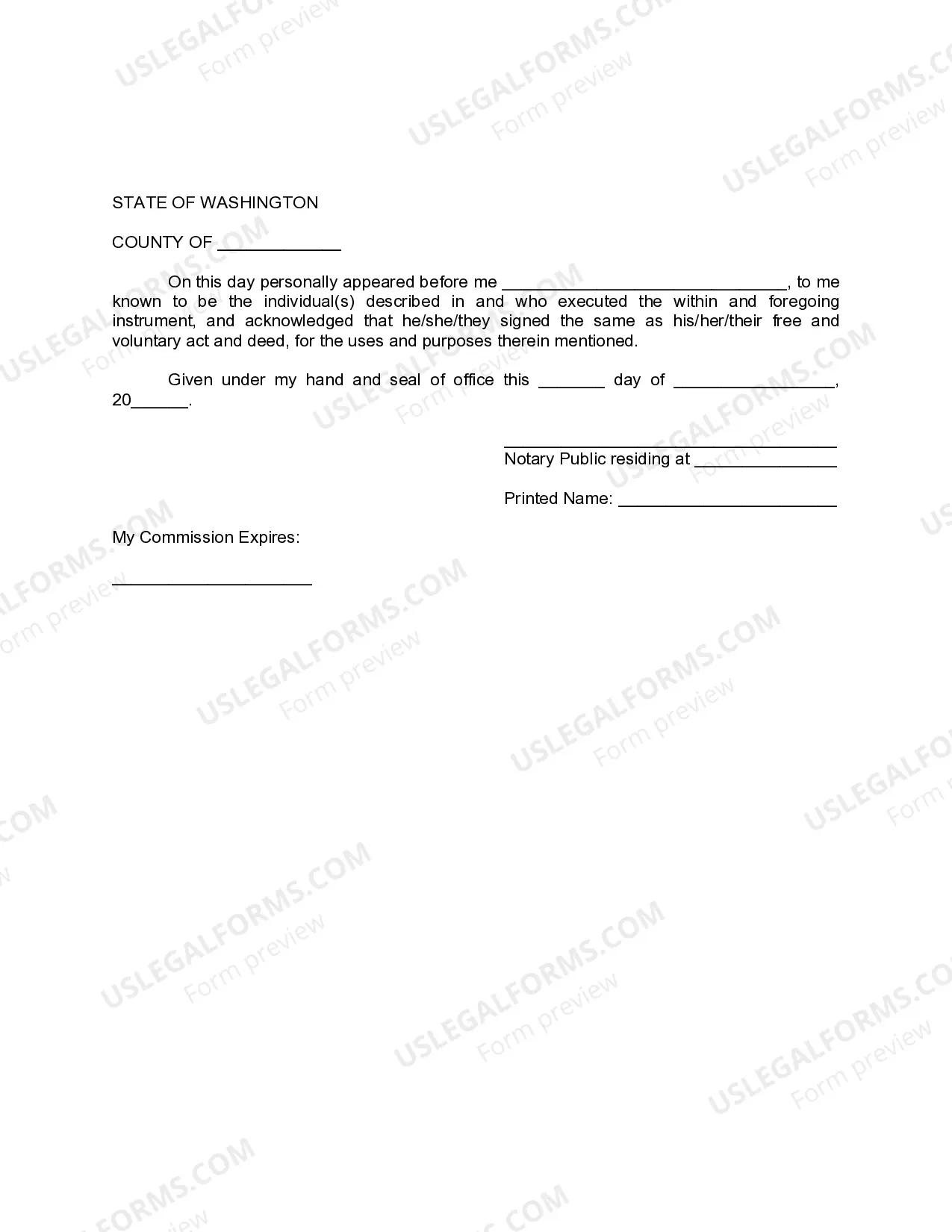

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Title: Everett Washington Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Everett, Washington, residents have the option to transfer their financial accounts to a living trust as part of an effective estate planning strategy. By understanding the intricacies of this process, individuals can better protect their assets, minimize probate costs, and ensure a smooth distribution of their financial resources after their passing. This article explores the details of Everett Washington Financial Account Transfer to Living Trust, its benefits, and the various types available. Key Points: 1. Definition of Living Trust: A living trust, also known as an inter vivos trust, is a legal document that allows individuals to transfer their assets, including financial accounts, into a trust to be managed for their benefit during their lifetime and transferred seamlessly to beneficiaries upon their passing. 2. Benefits of Living Trusts: a. Probate avoidance: When financial accounts are held within a living trust, they bypass the probate process, saving time, expense, and privacy concerns. b. Asset protection: A living trust safeguards financial accounts from potential creditors, lawsuits, and divorce proceedings, reinforcing protection for loved ones. c. Incapacity planning: Living trusts ensure that if the account holder becomes mentally or physically incapacitated, a designated successor trustee can step in to manage the accounts without the need for court intervention. 3. Types of Everett Washington Financial Account Transfer to Living Trust: a. Bank Account Transfer: This involves transferring checking, savings, money market, or any other bank accounts held by the individual into the trust's name. The trustee gains the authority to manage and distribute funds. b. Investment Account Transfer: Individuals can transfer their brokerage, Individual Retirement Accounts (IRAs), stocks, bonds, mutual funds, and other investment accounts into their living trust, giving the trustee control over investment decisions. c. Life Insurance and Annuities Account Transfer: An account holder can name their living trust as the primary or contingent beneficiary of life insurance policies and annuities, ensuring the appropriate utilization and distribution of the funds. 4. Establishing a Living Trust: a. Consultation with an Estate Planning Attorney: Seek professional guidance from an attorney experienced in estate planning and living trusts. They will help draft the necessary legal documents and ensure compliance with relevant laws. b. Funding the Trust: After the trust is established, transfer ownership of financial accounts into the trust by updating the account's title and beneficiary designation accordingly. c. Updating Beneficiary Designations: Review and update beneficiary designations on retirement accounts, life insurance policies, and annuities to align with the living trust's provisions. In Conclusion: Everett, Washington residents can benefit greatly from transferring their financial accounts to a living trust. By doing so, individuals can protect assets, streamline the distribution of funds, and plan for any unforeseen circumstances effectively. Understanding the various types of financial accounts that can be transferred to a living trust and seeking professional assistance in establishing and funding the trust ensures a comprehensive and successful estate planning strategy.Title: Everett Washington Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction: In Everett, Washington, residents have the option to transfer their financial accounts to a living trust as part of an effective estate planning strategy. By understanding the intricacies of this process, individuals can better protect their assets, minimize probate costs, and ensure a smooth distribution of their financial resources after their passing. This article explores the details of Everett Washington Financial Account Transfer to Living Trust, its benefits, and the various types available. Key Points: 1. Definition of Living Trust: A living trust, also known as an inter vivos trust, is a legal document that allows individuals to transfer their assets, including financial accounts, into a trust to be managed for their benefit during their lifetime and transferred seamlessly to beneficiaries upon their passing. 2. Benefits of Living Trusts: a. Probate avoidance: When financial accounts are held within a living trust, they bypass the probate process, saving time, expense, and privacy concerns. b. Asset protection: A living trust safeguards financial accounts from potential creditors, lawsuits, and divorce proceedings, reinforcing protection for loved ones. c. Incapacity planning: Living trusts ensure that if the account holder becomes mentally or physically incapacitated, a designated successor trustee can step in to manage the accounts without the need for court intervention. 3. Types of Everett Washington Financial Account Transfer to Living Trust: a. Bank Account Transfer: This involves transferring checking, savings, money market, or any other bank accounts held by the individual into the trust's name. The trustee gains the authority to manage and distribute funds. b. Investment Account Transfer: Individuals can transfer their brokerage, Individual Retirement Accounts (IRAs), stocks, bonds, mutual funds, and other investment accounts into their living trust, giving the trustee control over investment decisions. c. Life Insurance and Annuities Account Transfer: An account holder can name their living trust as the primary or contingent beneficiary of life insurance policies and annuities, ensuring the appropriate utilization and distribution of the funds. 4. Establishing a Living Trust: a. Consultation with an Estate Planning Attorney: Seek professional guidance from an attorney experienced in estate planning and living trusts. They will help draft the necessary legal documents and ensure compliance with relevant laws. b. Funding the Trust: After the trust is established, transfer ownership of financial accounts into the trust by updating the account's title and beneficiary designation accordingly. c. Updating Beneficiary Designations: Review and update beneficiary designations on retirement accounts, life insurance policies, and annuities to align with the living trust's provisions. In Conclusion: Everett, Washington residents can benefit greatly from transferring their financial accounts to a living trust. By doing so, individuals can protect assets, streamline the distribution of funds, and plan for any unforeseen circumstances effectively. Understanding the various types of financial accounts that can be transferred to a living trust and seeking professional assistance in establishing and funding the trust ensures a comprehensive and successful estate planning strategy.