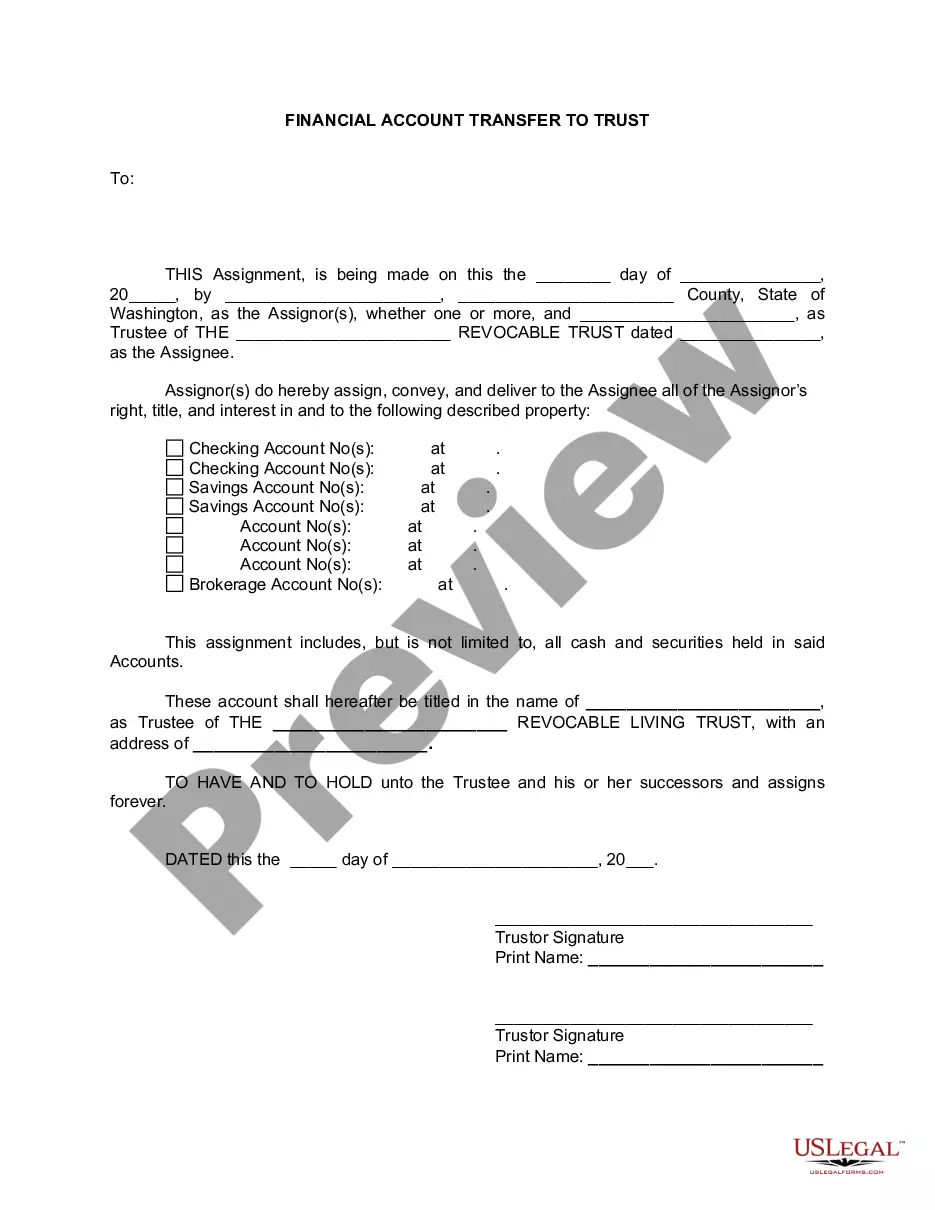

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Renton Washington Financial Account Transfer to Living Trust ensures a seamless and efficient transfer of your financial assets to a trust, providing you with enhanced control over the management and distribution of your estate. Whether you are a resident of Renton, Washington, or own financial accounts within the city, this process offers several benefits, including avoiding probate, reducing estate taxes, maintaining privacy, and facilitating smooth asset distribution to beneficiaries. When it comes to Renton Washington Financial Account Transfer to Living Trust, there are different types available to cater to specific needs and circumstances. These may include: 1. Revocable Living Trust: This type of trust allows you to retain control over your assets during your lifetime while designating beneficiaries to receive them after your passing. With a revocable living trust, you can make changes or revoke the trust at any time. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be altered or revoked once it is established. It offers greater protection against estate taxes and creditors, making it a popular option for those looking to secure their assets. 3. Testamentary Trust: This type of trust is established through a will and becomes effective upon the testator's death. Testamentary trusts are designed to manage and distribute assets on behalf of beneficiaries as outlined in the will. 4. Special Needs Trust: A special needs trust is created to provide financial support and care for individuals with disabilities while protecting their eligibility for government assistance programs such as Medicaid and Supplemental Security Income (SSI). 5. Charitable Remainder Trust: This trust allows you to donate assets to a charity while still benefiting from them during your lifetime. You can receive an income stream or use the assets, and upon your passing, the remaining assets are transferred to the designated charity or charities. Renton Washington Financial Account Transfer to Living Trust involves a series of steps to ensure a successful transition of assets. These steps typically include identifying the financial accounts to transfer, updating account ownership and beneficiary designations, obtaining asset valuations, preparing legal documentation, and working with a qualified estate planning attorney or financial advisor to guide you through the process. By opting for a Renton Washington Financial Account Transfer to Living Trust, you can gain peace of mind, knowing that your financial assets will be managed according to your wishes, while reducing the complexity and potential costs associated with probate. This process allows you to create a solid foundation for your estate planning, protecting your wealth and securing a legacy for your loved ones.Renton Washington Financial Account Transfer to Living Trust ensures a seamless and efficient transfer of your financial assets to a trust, providing you with enhanced control over the management and distribution of your estate. Whether you are a resident of Renton, Washington, or own financial accounts within the city, this process offers several benefits, including avoiding probate, reducing estate taxes, maintaining privacy, and facilitating smooth asset distribution to beneficiaries. When it comes to Renton Washington Financial Account Transfer to Living Trust, there are different types available to cater to specific needs and circumstances. These may include: 1. Revocable Living Trust: This type of trust allows you to retain control over your assets during your lifetime while designating beneficiaries to receive them after your passing. With a revocable living trust, you can make changes or revoke the trust at any time. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable living trust cannot be altered or revoked once it is established. It offers greater protection against estate taxes and creditors, making it a popular option for those looking to secure their assets. 3. Testamentary Trust: This type of trust is established through a will and becomes effective upon the testator's death. Testamentary trusts are designed to manage and distribute assets on behalf of beneficiaries as outlined in the will. 4. Special Needs Trust: A special needs trust is created to provide financial support and care for individuals with disabilities while protecting their eligibility for government assistance programs such as Medicaid and Supplemental Security Income (SSI). 5. Charitable Remainder Trust: This trust allows you to donate assets to a charity while still benefiting from them during your lifetime. You can receive an income stream or use the assets, and upon your passing, the remaining assets are transferred to the designated charity or charities. Renton Washington Financial Account Transfer to Living Trust involves a series of steps to ensure a successful transition of assets. These steps typically include identifying the financial accounts to transfer, updating account ownership and beneficiary designations, obtaining asset valuations, preparing legal documentation, and working with a qualified estate planning attorney or financial advisor to guide you through the process. By opting for a Renton Washington Financial Account Transfer to Living Trust, you can gain peace of mind, knowing that your financial assets will be managed according to your wishes, while reducing the complexity and potential costs associated with probate. This process allows you to create a solid foundation for your estate planning, protecting your wealth and securing a legacy for your loved ones.