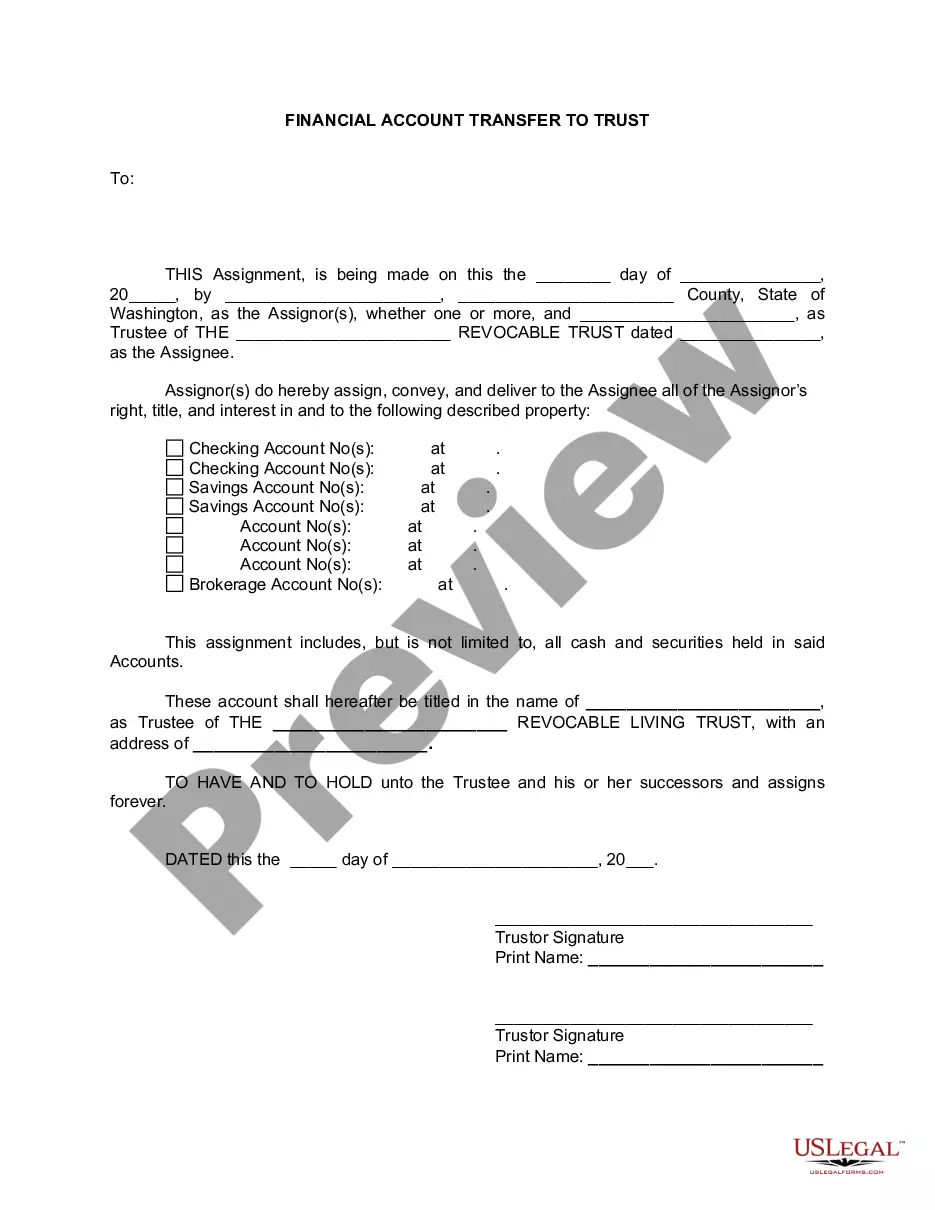

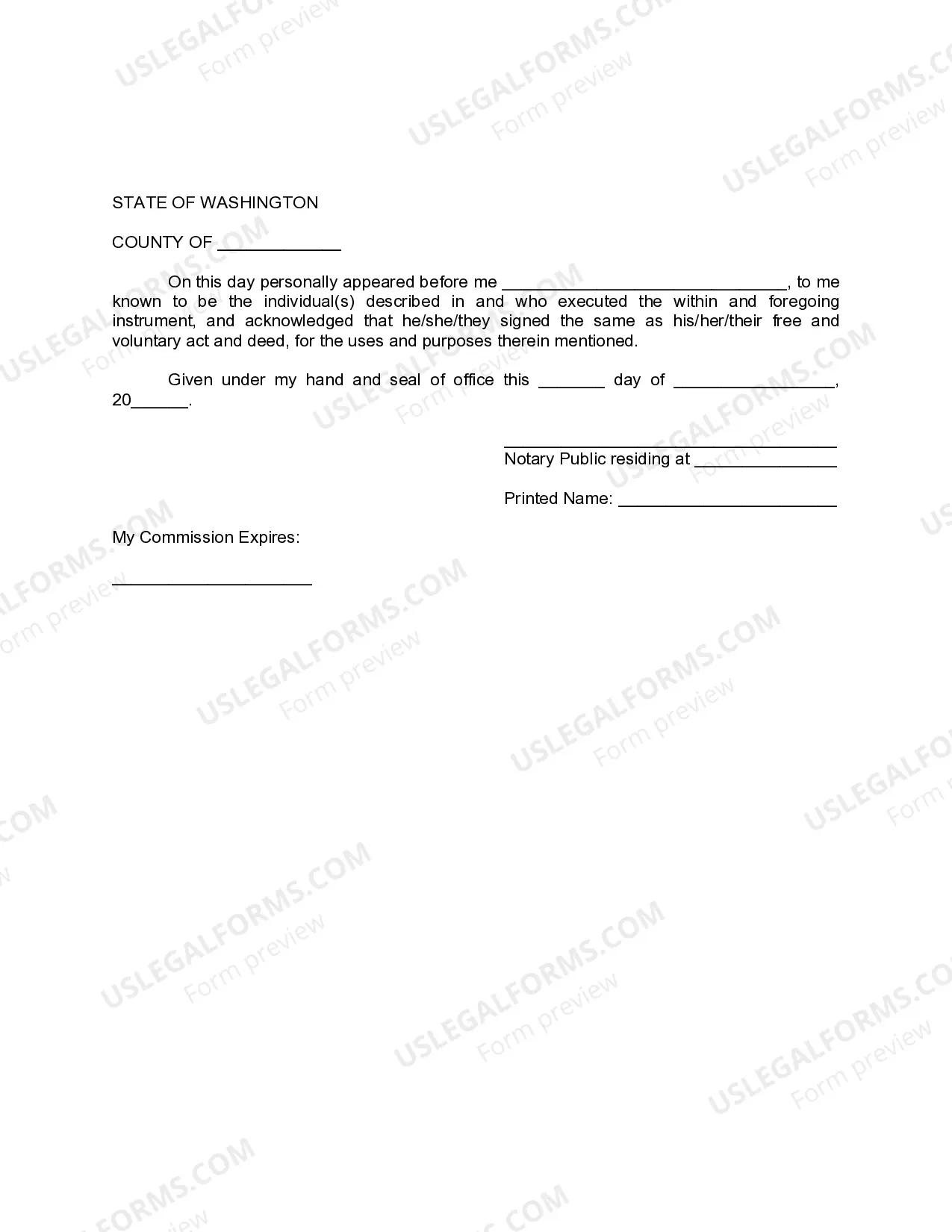

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Seattle Washington Financial Account Transfer to Living Trust

Description

How to fill out Washington Financial Account Transfer To Living Trust?

Take advantage of US Legal Forms and gain immediate access to any document you require.

Our convenient platform with a vast selection of papers streamlines the process of locating and acquiring almost any document template you may need.

You can export, complete, and endorse the Seattle Washington Financial Account Transfer to Living Trust in just minutes instead of spending hours online searching for the correct template.

Utilizing our collection is a great approach to enhance the security of your document submissions.

US Legal Forms is likely the most comprehensive and reliable document library available online.

Our team is always prepared to assist you in any legal process, even if it’s simply downloading the Seattle Washington Financial Account Transfer to Living Trust.

- Our skilled legal professionals routinely examine all documents to ensure their suitability for specific jurisdictions and adherence to new legislation.

- How can you obtain the Seattle Washington Financial Account Transfer to Living Trust? If you possess a subscription, simply Log In to your account.

- The Download button will be activated on all documents you view. Additionally, all your previously saved documents can be found in the My documents section.

- If you haven't yet created an account, follow the steps outlined below.

- Locate the form you need. Ensure that it matches what you intended to find: review its title and description, and utilize the Preview option if available. Otherwise, use the Search box to discover the correct one.

- Initiate the saving process. Click Buy Now and choose the pricing option that fits you best. Then, register for an account and complete your order using a credit card or PayPal.

- Download the file. Select the format to obtain the Seattle Washington Financial Account Transfer to Living Trust and edit and complete, or sign it as per your needs.

Form popularity

FAQ

You cannot put your individual retirement account (IRA) in a trust while you are living. You can, however, name a trust as the beneficiary of your IRA and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

The settlor establishes the trust by transferring the property. The trustee is the person in charge of managing the trust. The beneficiary is the one who will benefit from the trust. As the new legal owner of the property, the trustee manages it according to the settlor's wishes outlined in the deed.

If the trust is revocable, for tax purposes you are considered to be the owner. This means that a transfer has no tax effect. You would not incur capital gains and the property's tax basis would not be adjusted. This is also true of a transfer of the property to a nominee trust of which you are the beneficiary.

The trustee must register the trust by filing with the clerk of the court in any county where venue lies for the trust under RCW 11.96A.

Property is often transferred into a trust as part of inheritance tax planning however the trust needs to meet certain conditions and to be set up correctly by a solicitor. By putting a property into trust rather than making an outright gift, you are able to control how the property is used after it is given away.

The Cons. While there are many benefits to putting your home in a trust, there are also a few disadvantages. For one, establishing a trust is time-consuming and can be expensive. The person establishing the trust must file additional legal paperwork and pay corresponding legal fees.

The price of creating a living trust in Washington depends on how you go about making it. The first option is to use an online service and draw the trust up yourself. This will cost a few hundred dollars at most. The other option is to hire an attorney, which could cost more than $1,000.

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.

The beneficiary can (where there is one beneficiary or if there are several beneficiaries and all of them agree) direct the trustee to transfer the trust property to him (if there are several beneficiaries to all of them) or to such other person as the beneficiary (or the beneficiaries may desire).

To create a living trust in Washington, prepare a written trust document and sign it before a notary public. To finalize the trust and make it effective, you must transfer ownership of your assets into it. A living trust is an effective tool that can provide you with the flexibility and privacy you seek.