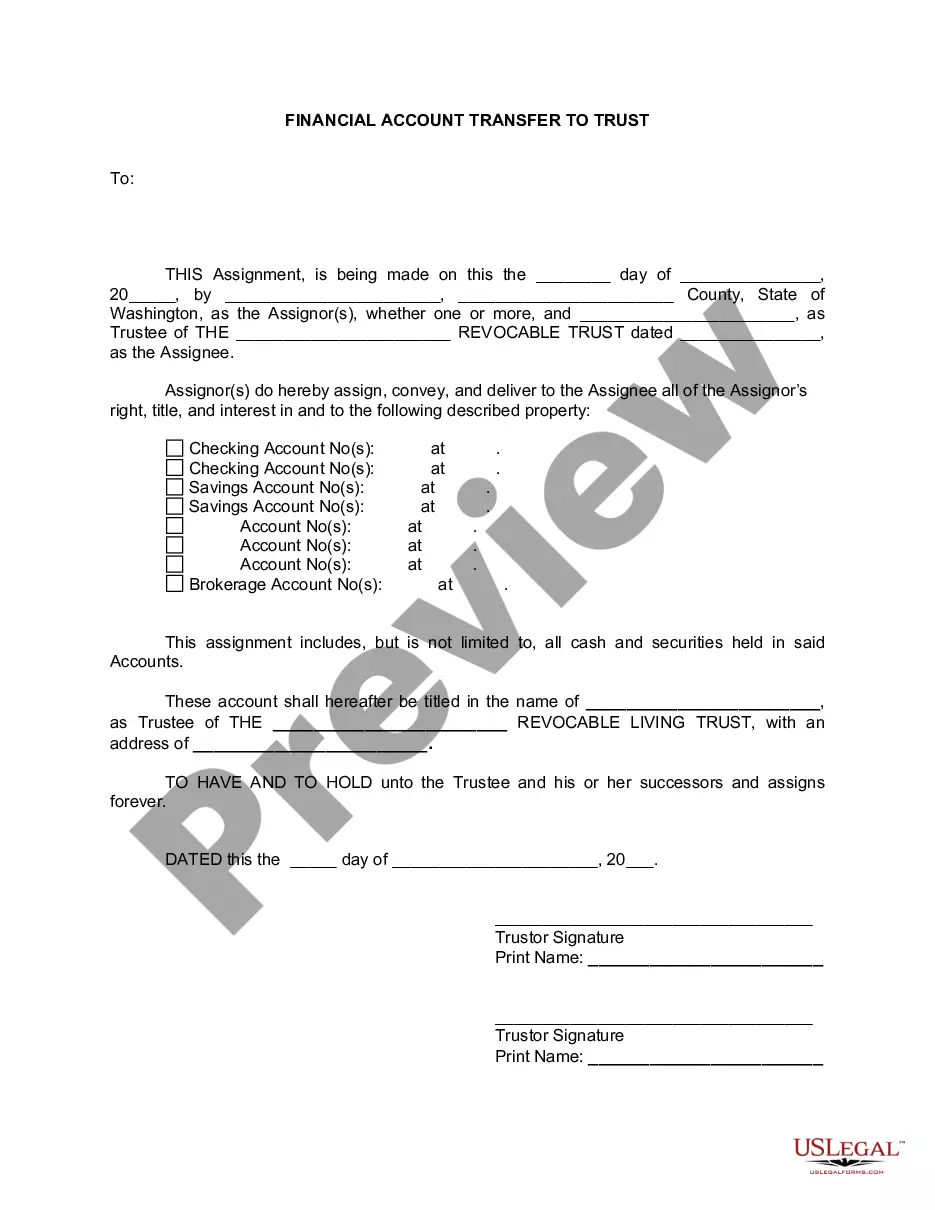

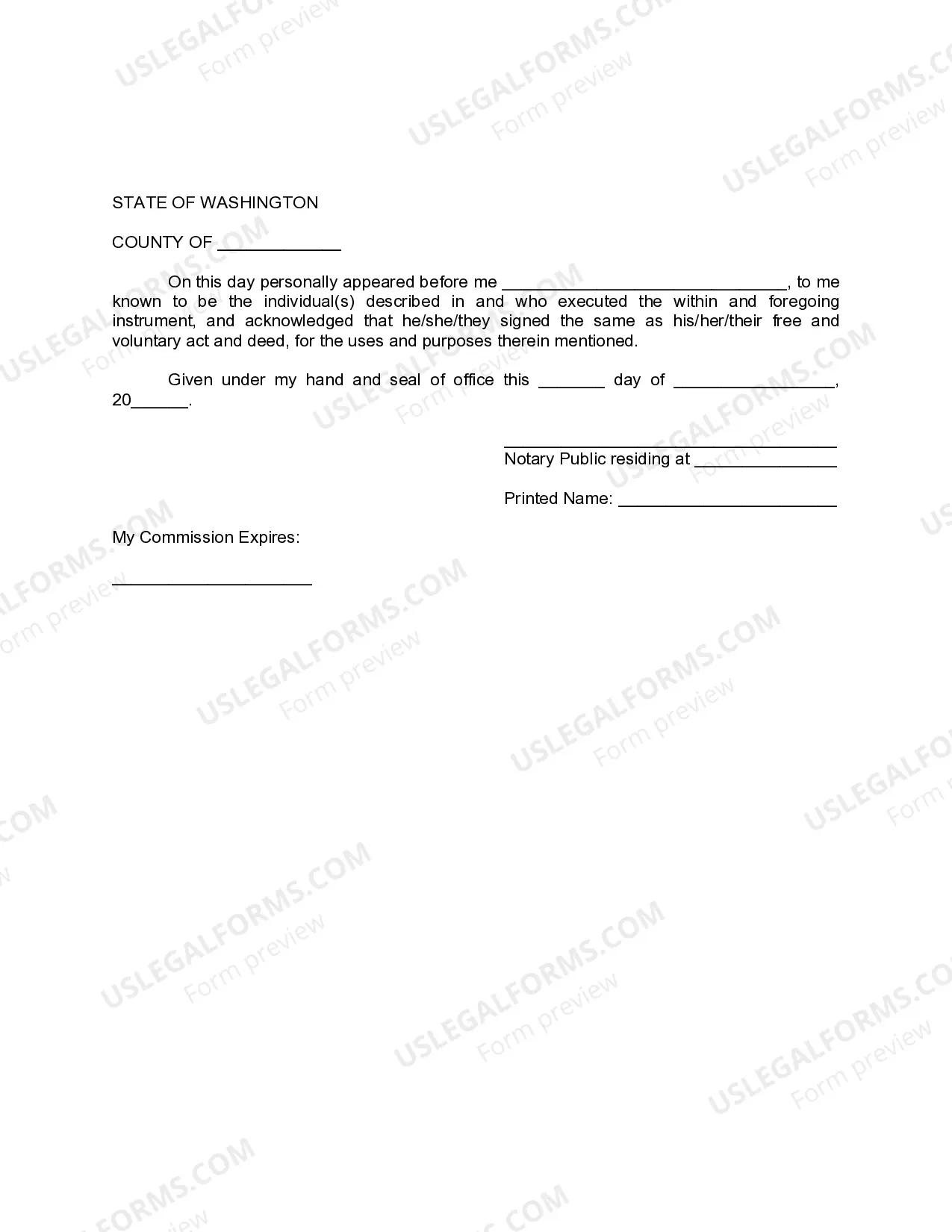

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Tacoma Washington Financial Account Transfer to Living Trust is a legal process that involves transferring ownership of financial accounts to a living trust based in Tacoma, Washington. This type of transfer offers individuals an effective means of protecting and managing their assets during their lifetime and beyond. One key advantage of transferring financial accounts to a living trust in Tacoma, Washington, is the ability to avoid probate. Probate is a lengthy and costly legal process that occurs after an individual's death and involves the distribution of their assets. By transferring financial accounts to a living trust, individuals can bypass this cumbersome process, allowing for a smooth transition of their assets to their chosen beneficiaries. There are different types of financial accounts that can be transferred to a living trust in Tacoma, Washington. These include bank accounts, such as savings accounts, checking accounts, and money-market accounts. Additionally, investment accounts like brokerage accounts, individual retirement accounts (IRAs), and annuities can also be transferred. To initiate the Tacoma Washington Financial Account Transfer to Living Trust, individuals need to follow a specific procedure. Firstly, they would establish a living trust by drafting a comprehensive trust document with the help of a trusted attorney specializing in estate planning. This document outlines how the assets held in the trust will be managed and distributed. Once the trust is established, individuals would need to retitle their financial accounts, changing the ownership from personal names to the name of the trust. Financial institutions may require the presentation of the trust document, along with relevant identification, to facilitate the transfer. It is crucial to update beneficiary designations on retirement accounts and life insurance policies to ensure they align with the trust's beneficiaries. Transferring financial accounts to a living trust in Tacoma, Washington, ensures that the assets remain protected and managed according to the individual's wishes. This process not only streamlines the distribution of assets but also offers privacy by avoiding public probate proceedings. In summary, Tacoma Washington Financial Account Transfer to Living Trust is a vital estate planning tool that enables individuals to safeguard and manage their financial accounts during their lifetime and facilitates a seamless transfer of assets to designated beneficiaries upon their death. By bypassing probate, individuals can save time, reduce costs, and maintain the privacy of their financial affairs.Tacoma Washington Financial Account Transfer to Living Trust is a legal process that involves transferring ownership of financial accounts to a living trust based in Tacoma, Washington. This type of transfer offers individuals an effective means of protecting and managing their assets during their lifetime and beyond. One key advantage of transferring financial accounts to a living trust in Tacoma, Washington, is the ability to avoid probate. Probate is a lengthy and costly legal process that occurs after an individual's death and involves the distribution of their assets. By transferring financial accounts to a living trust, individuals can bypass this cumbersome process, allowing for a smooth transition of their assets to their chosen beneficiaries. There are different types of financial accounts that can be transferred to a living trust in Tacoma, Washington. These include bank accounts, such as savings accounts, checking accounts, and money-market accounts. Additionally, investment accounts like brokerage accounts, individual retirement accounts (IRAs), and annuities can also be transferred. To initiate the Tacoma Washington Financial Account Transfer to Living Trust, individuals need to follow a specific procedure. Firstly, they would establish a living trust by drafting a comprehensive trust document with the help of a trusted attorney specializing in estate planning. This document outlines how the assets held in the trust will be managed and distributed. Once the trust is established, individuals would need to retitle their financial accounts, changing the ownership from personal names to the name of the trust. Financial institutions may require the presentation of the trust document, along with relevant identification, to facilitate the transfer. It is crucial to update beneficiary designations on retirement accounts and life insurance policies to ensure they align with the trust's beneficiaries. Transferring financial accounts to a living trust in Tacoma, Washington, ensures that the assets remain protected and managed according to the individual's wishes. This process not only streamlines the distribution of assets but also offers privacy by avoiding public probate proceedings. In summary, Tacoma Washington Financial Account Transfer to Living Trust is a vital estate planning tool that enables individuals to safeguard and manage their financial accounts during their lifetime and facilitates a seamless transfer of assets to designated beneficiaries upon their death. By bypassing probate, individuals can save time, reduce costs, and maintain the privacy of their financial affairs.