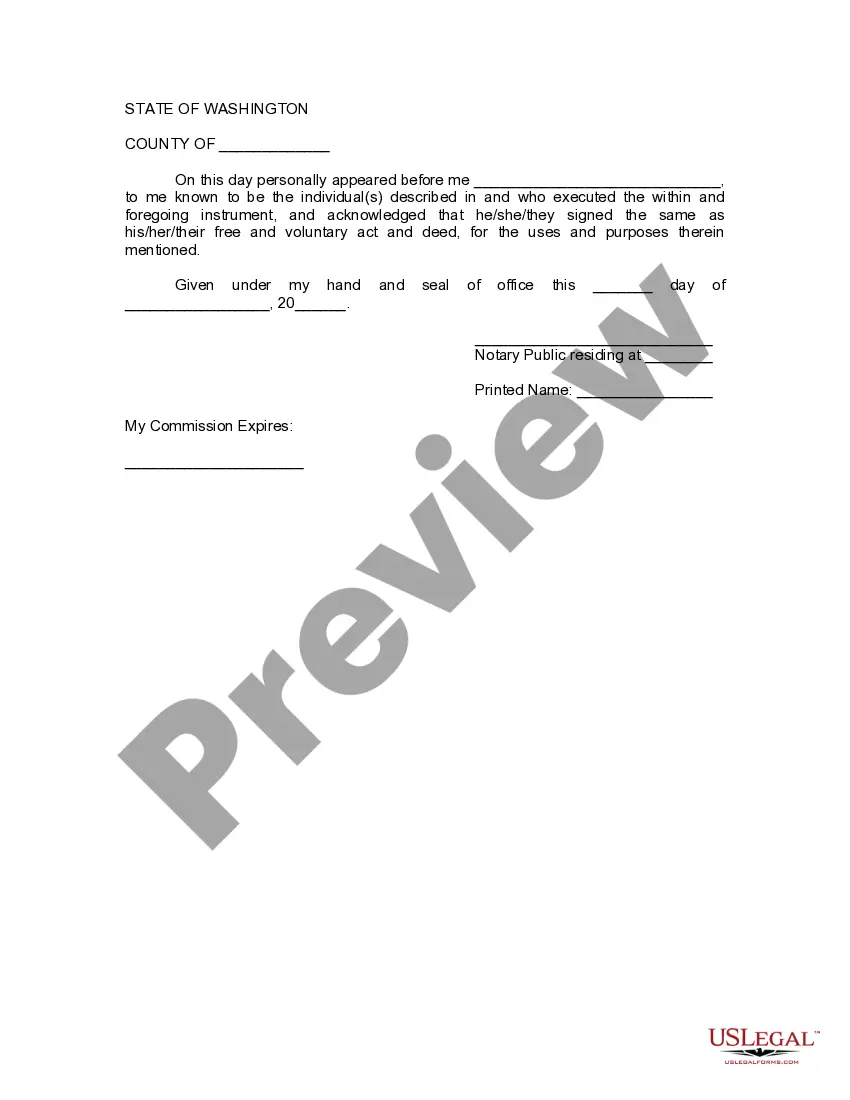

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Renton Washington Assignment to Living Trust: A Detailed Description Renton, Washington, is a vibrant city located in King County, known for its beautiful parks, thriving economy, and a strong sense of community. For those residing in Renton who wish to ensure the seamless transfer of their assets and minimize probate proceedings, the Renton Washington Assignment to Living Trust provides an efficient and effective estate planning solution. This legal document allows individuals to transfer ownership of their assets into a trust, managed by a trustee, to secure future financial interests and benefits for their beneficiaries. Living trusts are primarily established to bypass the probate process, which often involves lengthy court procedures and can be both time-consuming and costly. By assigning assets to a living trust, individuals can ensure that the transfer of their assets to their beneficiaries can occur quickly and privately, without the need for court intervention. This can provide peace of mind for individuals who wish to protect the privacy of their estate and provide a smooth transition for their loved ones. There are different types of Renton Washington Assignment to Living Trusts available, each tailored to meet the unique needs of individuals and families. Some commonly used ones include: 1. Revocable Living Trust: This type of trust allows individuals to retain control over their assets during their lifetime. The trust can be modified or revoked entirely if circumstances change or individuals wish to alter their beneficiaries. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be modified or revoked once established. This type of trust provides added asset protection and tax benefits, but individuals forfeit control over the trust assets. 3. Testamentary Trust: This living trust is created within a will and only takes effect upon the individual's death. It enables individuals to designate trustees and beneficiaries, providing flexibility and control over the distribution of assets. Renton Washington Assignment to Living Trusts can encompass a variety of assets, including real estate, financial accounts, investments, personal property, and business interests. Individuals can work with experienced attorneys specializing in estate planning to draft personalized trust documents that align with their unique circumstances and goals. It is essential to consult with legal professionals to ensure that all legal requirements are met and that the trust is properly funded, thus maximizing the benefits that living trusts provide. In conclusion, Renton Washington Assignment to Living Trusts offer an effective estate planning tool for individuals seeking to secure their assets and streamline the transfer of wealth to their loved ones. By establishing a living trust, Renton residents can avoid probate delays, maintain privacy, and provide for the efficient management and distribution of their assets according to their wishes.Renton Washington Assignment to Living Trust: A Detailed Description Renton, Washington, is a vibrant city located in King County, known for its beautiful parks, thriving economy, and a strong sense of community. For those residing in Renton who wish to ensure the seamless transfer of their assets and minimize probate proceedings, the Renton Washington Assignment to Living Trust provides an efficient and effective estate planning solution. This legal document allows individuals to transfer ownership of their assets into a trust, managed by a trustee, to secure future financial interests and benefits for their beneficiaries. Living trusts are primarily established to bypass the probate process, which often involves lengthy court procedures and can be both time-consuming and costly. By assigning assets to a living trust, individuals can ensure that the transfer of their assets to their beneficiaries can occur quickly and privately, without the need for court intervention. This can provide peace of mind for individuals who wish to protect the privacy of their estate and provide a smooth transition for their loved ones. There are different types of Renton Washington Assignment to Living Trusts available, each tailored to meet the unique needs of individuals and families. Some commonly used ones include: 1. Revocable Living Trust: This type of trust allows individuals to retain control over their assets during their lifetime. The trust can be modified or revoked entirely if circumstances change or individuals wish to alter their beneficiaries. 2. Irrevocable Living Trust: In contrast to a revocable living trust, an irrevocable trust cannot be modified or revoked once established. This type of trust provides added asset protection and tax benefits, but individuals forfeit control over the trust assets. 3. Testamentary Trust: This living trust is created within a will and only takes effect upon the individual's death. It enables individuals to designate trustees and beneficiaries, providing flexibility and control over the distribution of assets. Renton Washington Assignment to Living Trusts can encompass a variety of assets, including real estate, financial accounts, investments, personal property, and business interests. Individuals can work with experienced attorneys specializing in estate planning to draft personalized trust documents that align with their unique circumstances and goals. It is essential to consult with legal professionals to ensure that all legal requirements are met and that the trust is properly funded, thus maximizing the benefits that living trusts provide. In conclusion, Renton Washington Assignment to Living Trusts offer an effective estate planning tool for individuals seeking to secure their assets and streamline the transfer of wealth to their loved ones. By establishing a living trust, Renton residents can avoid probate delays, maintain privacy, and provide for the efficient management and distribution of their assets according to their wishes.