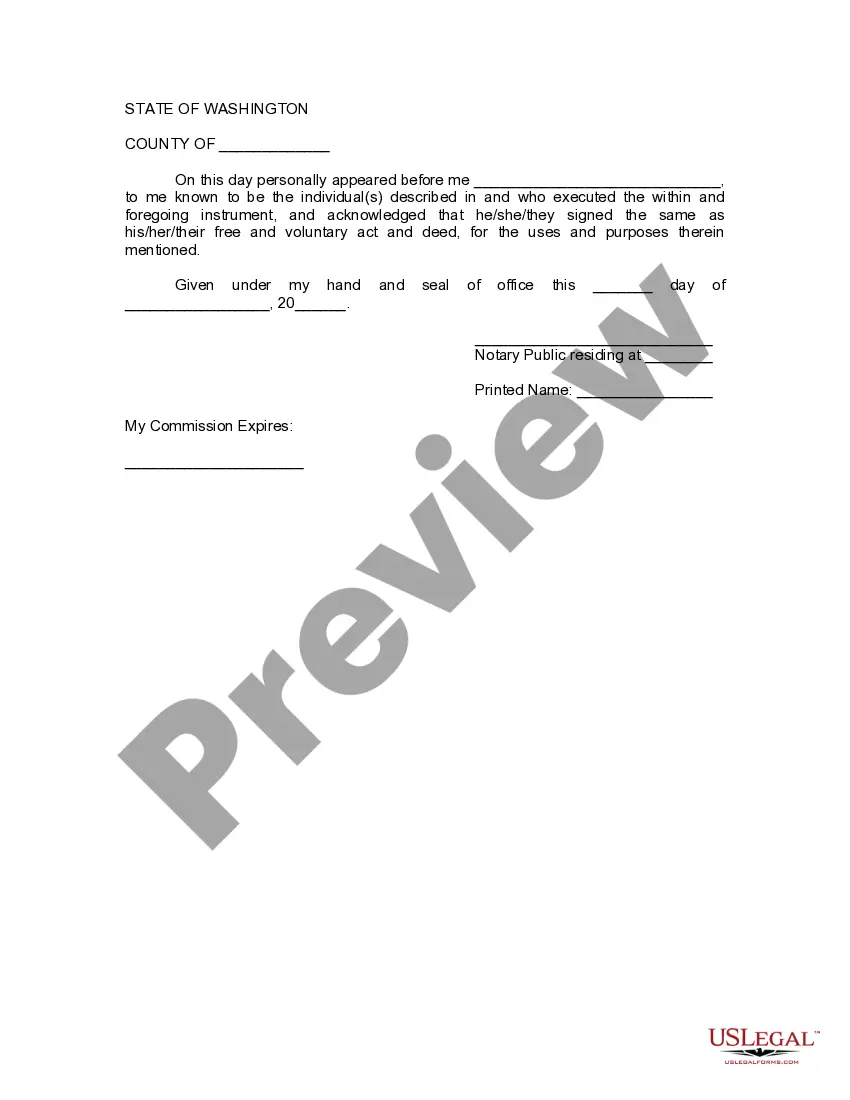

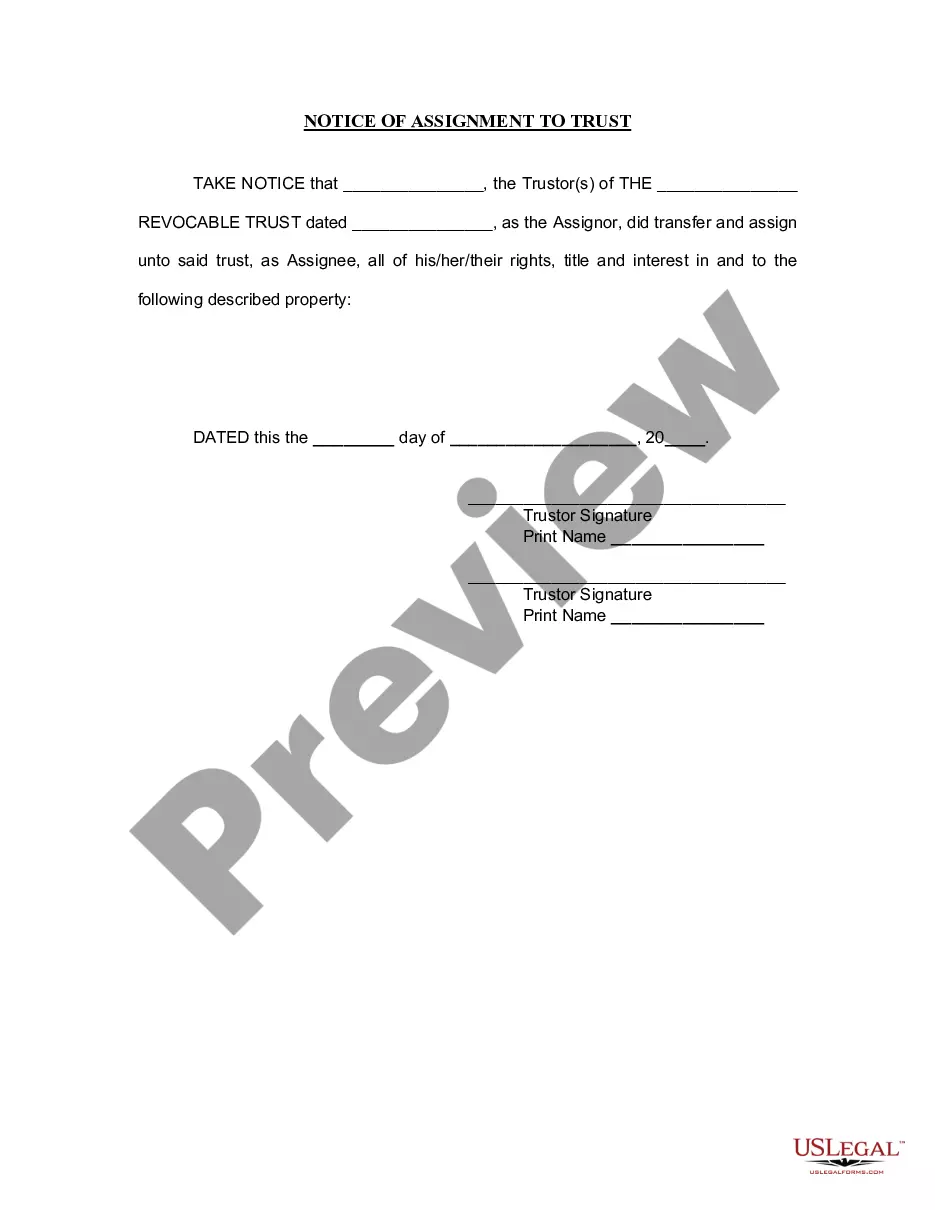

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Vancouver Washington Assignment to Living Trust

Description

How to fill out Washington Assignment To Living Trust?

Locating confirmed templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms collection.

This is an online repository of over 85,000 legal documents for both personal and business needs as well as various real-life scenarios.

All the files are appropriately categorized by area of application and jurisdictional areas, making the search for the Vancouver Washington Assignment to Living Trust as straightforward and simple as 1-2-3.

Maintaining documents organized and adhering to legal standards is extremely important. Utilize the US Legal Forms library to always have essential document templates for any requirements right at your fingertips!

- Examine the Preview mode and form description.

- Ensure you’ve chosen the right one that satisfies your criteria and completely aligns with your local jurisdiction requirements.

- Search for another template, if necessary.

- Should you notice any discrepancy, use the Search tab above to find the correct one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

To put your house in a trust, you'll first need to select the type of trust that suits your needs. In the case of the Vancouver Washington Assignment to Living Trust, you will work with a legal professional who understands the requirements for your specific location. Next, you'll need to draft a trust document that outlines how the property will be managed and distributed. Finally, transfer the title of your home into the trust by executing a property deed that names the trust as the new owner.

In the UK, a significant mistake parents make when setting up a trust fund is not considering the tax implications or potential future changes in tax laws. Much like in a Vancouver Washington Assignment to Living Trust, parents should be diligent and proactive in understanding the financial landscape. Engaging a qualified professional can help families navigate these complexities effectively.

To put property in a trust in Canada, you typically need to draft a trust declaration or deed, specifically outlining the property and the beneficiaries. While the Vancouver Washington Assignment to Living Trust offers guidelines, Canadian laws may differ. It's wise to consult a legal expert familiar with Canadian trust law for the best approach.

Common pitfalls when setting up a trust include not funding the trust properly or failing to update it as circumstances change. For a successful Vancouver Washington Assignment to Living Trust, parents must ensure that all intended assets are transferred and that the trust reflects their current wishes. Regular reviews can prevent these mistakes and ensure the trust adapts to life changes.

Setting up a living trust in Washington involves creating a legal document that outlines the terms of the trust, naming the trustee, and identifying the beneficiaries. You'll need to transfer your assets into the trust to make it effective, which is where a Vancouver Washington Assignment to Living Trust can be particularly beneficial. Utilizing resources like USLegalForms can simplify this process and provide needed templates.

To transfer property into a trust in Washington state, you’ll need to draft a deed that transfers ownership from you to the trust. It's crucial that you follow the procedures required for a Vancouver Washington Assignment to Living Trust to ensure proper documentation. Consulting an attorney or using a reliable platform like USLegalForms can streamline this process and ensure you meet all requirements.

The negative side of a trust lies in the possibility of misunderstandings or misinterpretations of the trust's terms. In a Vancouver Washington Assignment to Living Trust, if the language is vague, beneficiaries may feel confused or slighted. Ensuring clear, specific language can mitigate these issues and lead to smoother transitions.

A family trust, while beneficial, can have disadvantages such as costs and complexities in management. In a Vancouver Washington Assignment to Living Trust, families might incur legal fees and administrative costs that can add up over time. Moreover, failing to properly manage the trust can lead to unintended tax implications.

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly define their intentions. It's essential to understand how a Vancouver Washington Assignment to Living Trust operates and to communicate those goals to everyone involved. This clarity prevents future disputes and ensures that the trust meets the family's needs.

Transferring property to a living trust in Washington state involves changing the property title to reflect the living trust as the owner. You'll need to complete the necessary paperwork, including a deed transfer, to formally assign your property to the trust. Additionally, keep records of the transfer for future reference. A well-structured Vancouver Washington Assignment to Living Trust ensures that your property is effectively managed and passed on according to your wishes.