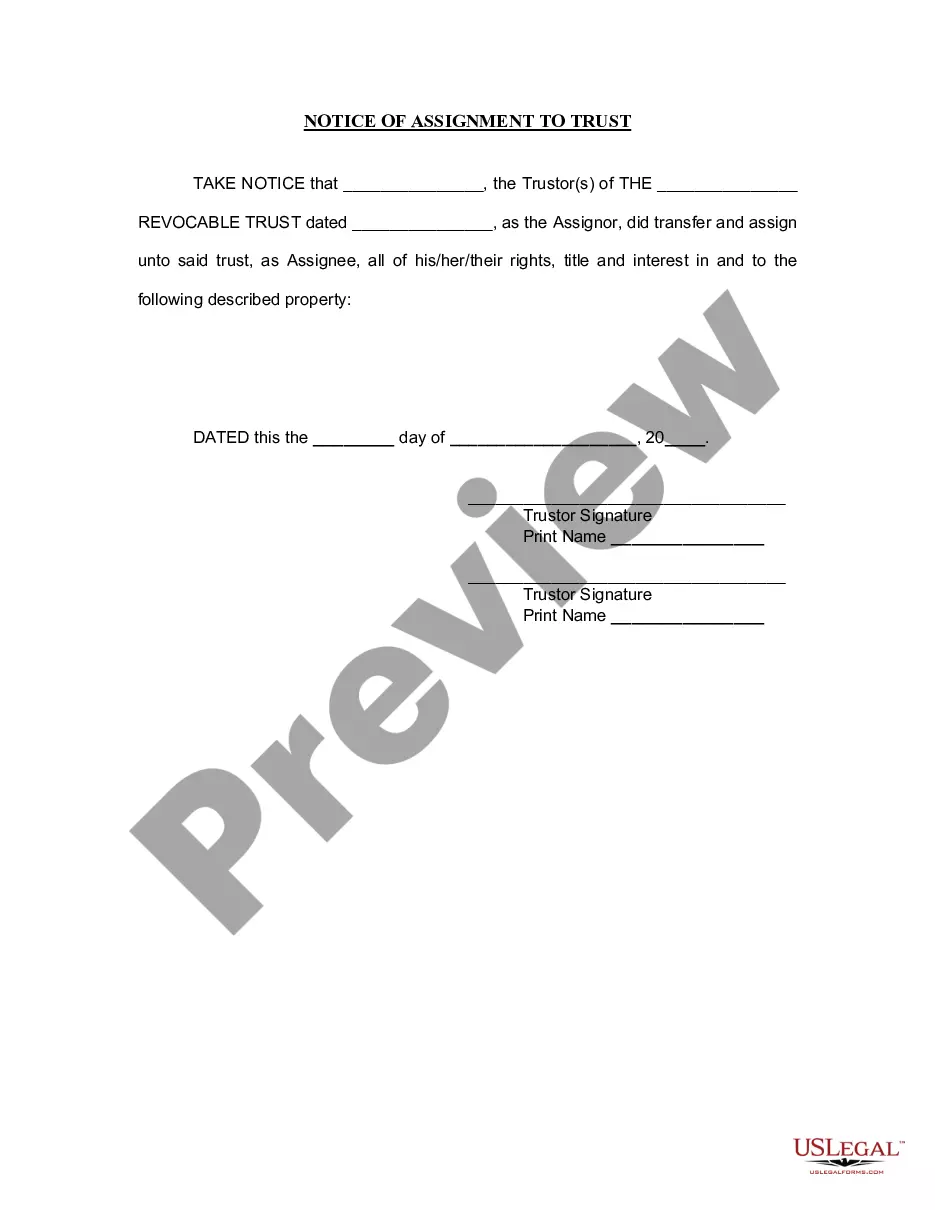

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Title: Understanding the Everett Washington Notice of Assignment to Living Trust Introduction: The Everett Washington Notice of Assignment to Living Trust serves as a crucial legal document that allows individuals to transfer their assets into a living trust. By doing so, this document ensures a seamless and efficient management of assets during their lifetime and after their demise. In this article, we will provide a detailed description of the Everett Washington Notice of Assignment to Living Trust, its purpose, procedure, and various types available. 1. Purpose of the Everett Washington Notice of Assignment to Living Trust: The purpose of this notice is to establish the formal transfer of assets from an individual's name to their living trust. By reassigning ownership of assets to a trust, individuals can ensure control, protection, and effective distribution of their estate in line with their wishes. 2. Key Elements of the Everett Washington Notice of Assignment to Living Trust: a. Identification of the Granter: The person who creates the living trust and assigns the assets. b. Identification of the Trustee: The designated individual or entity who manages and administers the trust. c. Description of the Assets: A comprehensive list of assets being assigned to the trust, including real estate, financial accounts, stocks, bonds, personal property, etc. d. Legal Language: The notice contains specific legal jargon to adequately transfer ownership from the individual to the trust. 3. Procedure for Completing the Everett Washington Notice of Assignment to Living Trust: a. Consult an Attorney: Seek advice from a qualified attorney familiar with Washington State laws regarding trusts and estates. b. Asset Evaluation: Enumerate and evaluate all assets that will be assigned to the living trust. c. Draft and Review the Notice: Prepare the Notice of Assignment to Living Trust, ensuring accuracy and completeness. d. Sign and Notarize: The notice must be signed and notarized, confirming the granter's intention to assign the assets to the trust. e. Distribute Copies: Provide copies of the notice to the granter, trustee, and any other pertinent parties involved. Types of Everett Washington Notice of Assignment to Living Trust: 1. Real Estate Assignment: This type of notice primarily involves the transfer of real estate properties to the living trust. 2. Financial Account Assignment: This notice is used when assigning bank accounts, insurance policies, retirement accounts, and investments to the living trust. 3. Personal Property Assignment: This category includes the transfer of vehicles, jewelry, artwork, furniture, and other personal assets into the living trust. Conclusion: By utilizing the Everett Washington Notice of Assignment to Living Trust, individuals can ensure that their assets are protected, managed, and distributed according to their wishes during their lifetime and after. It is crucial to consult an attorney experienced in Washington State trust laws to ensure a comprehensive and legally sound process.

Title: Understanding the Everett Washington Notice of Assignment to Living Trust Introduction: The Everett Washington Notice of Assignment to Living Trust serves as a crucial legal document that allows individuals to transfer their assets into a living trust. By doing so, this document ensures a seamless and efficient management of assets during their lifetime and after their demise. In this article, we will provide a detailed description of the Everett Washington Notice of Assignment to Living Trust, its purpose, procedure, and various types available. 1. Purpose of the Everett Washington Notice of Assignment to Living Trust: The purpose of this notice is to establish the formal transfer of assets from an individual's name to their living trust. By reassigning ownership of assets to a trust, individuals can ensure control, protection, and effective distribution of their estate in line with their wishes. 2. Key Elements of the Everett Washington Notice of Assignment to Living Trust: a. Identification of the Granter: The person who creates the living trust and assigns the assets. b. Identification of the Trustee: The designated individual or entity who manages and administers the trust. c. Description of the Assets: A comprehensive list of assets being assigned to the trust, including real estate, financial accounts, stocks, bonds, personal property, etc. d. Legal Language: The notice contains specific legal jargon to adequately transfer ownership from the individual to the trust. 3. Procedure for Completing the Everett Washington Notice of Assignment to Living Trust: a. Consult an Attorney: Seek advice from a qualified attorney familiar with Washington State laws regarding trusts and estates. b. Asset Evaluation: Enumerate and evaluate all assets that will be assigned to the living trust. c. Draft and Review the Notice: Prepare the Notice of Assignment to Living Trust, ensuring accuracy and completeness. d. Sign and Notarize: The notice must be signed and notarized, confirming the granter's intention to assign the assets to the trust. e. Distribute Copies: Provide copies of the notice to the granter, trustee, and any other pertinent parties involved. Types of Everett Washington Notice of Assignment to Living Trust: 1. Real Estate Assignment: This type of notice primarily involves the transfer of real estate properties to the living trust. 2. Financial Account Assignment: This notice is used when assigning bank accounts, insurance policies, retirement accounts, and investments to the living trust. 3. Personal Property Assignment: This category includes the transfer of vehicles, jewelry, artwork, furniture, and other personal assets into the living trust. Conclusion: By utilizing the Everett Washington Notice of Assignment to Living Trust, individuals can ensure that their assets are protected, managed, and distributed according to their wishes during their lifetime and after. It is crucial to consult an attorney experienced in Washington State trust laws to ensure a comprehensive and legally sound process.