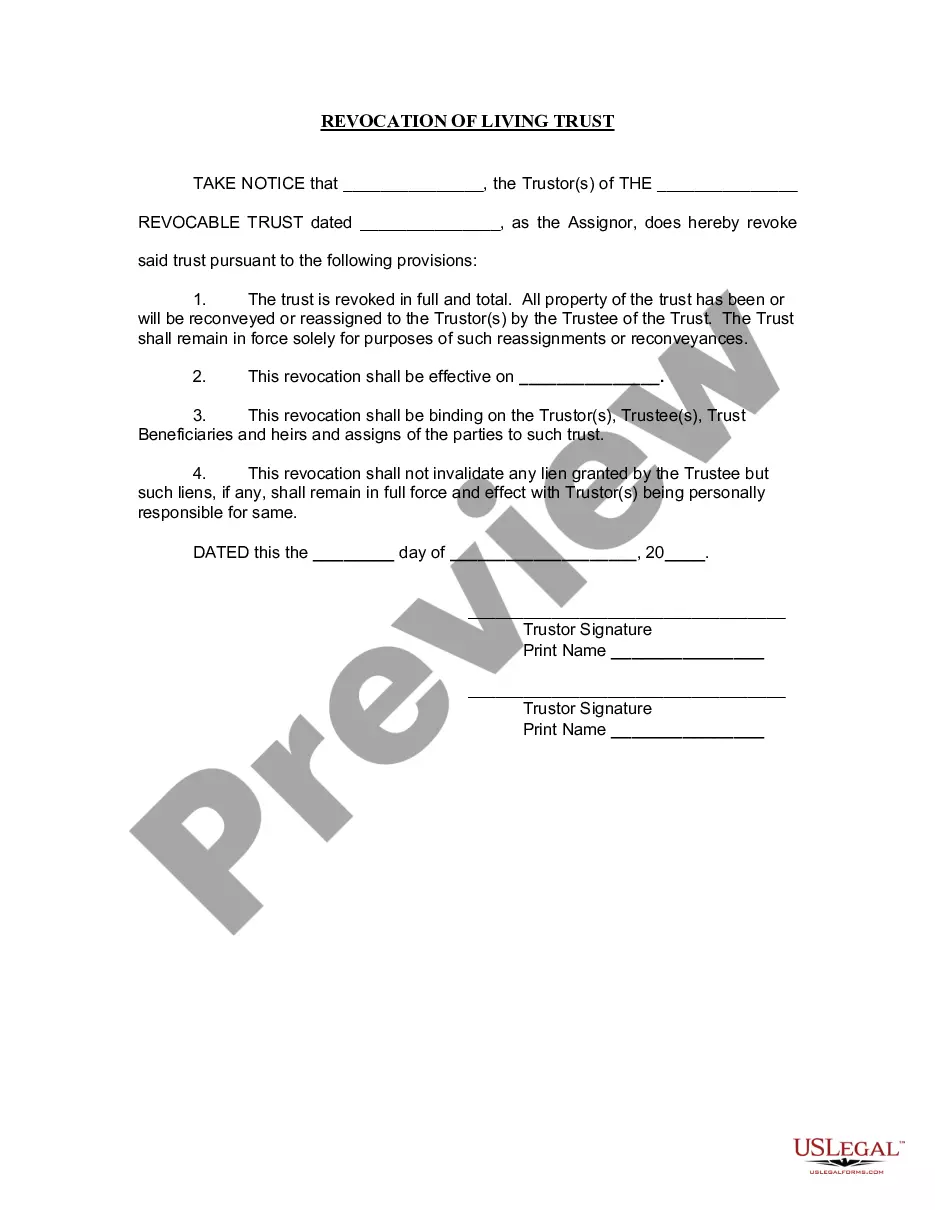

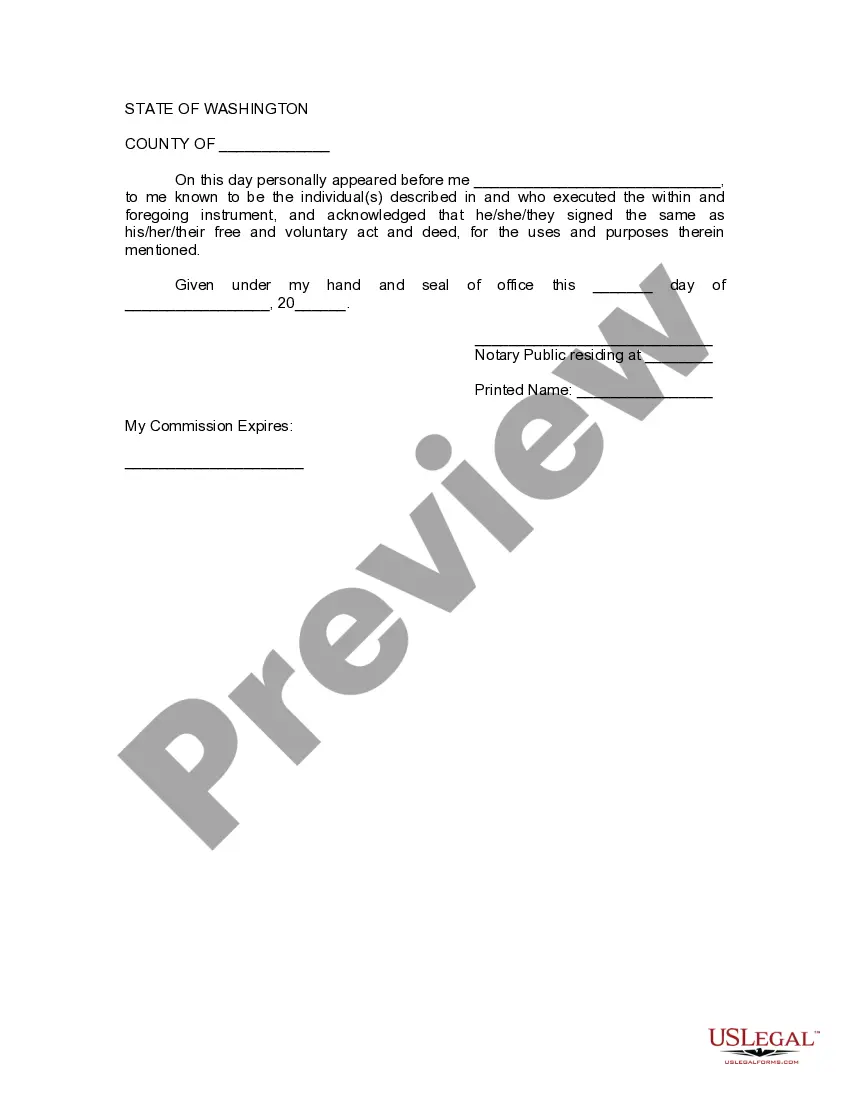

This Revocation of Living Trust form is to revoke a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form declares a full and total revocation of a specific living trust, allows for return of trust property to trustors and includes an effective date. This revocation must be signed before a notary public.

Everett Washington Revocation of Living Trust

Description

How to fill out Washington Revocation Of Living Trust?

If you are looking for an authentic document template, it’s challenging to locate a more user-friendly service than the US Legal Forms website – one of the largest online collections.

Here, you can discover a vast array of form examples for business and personal use categorized by types and states, or search terms. With our sophisticated search capability, locating the latest Everett Washington Revocation of Living Trust is as simple as 1-2-3.

Moreover, the accuracy of every single document is verified by a group of experienced attorneys who consistently review the templates on our platform and refresh them according to the most current state and county regulations.

Access the document. Choose the format and download it onto your device.

Modify as necessary. Complete, alter, print, and sign the received Everett Washington Revocation of Living Trust.

- If you already know about our platform and possess a registered account, all you need to obtain the Everett Washington Revocation of Living Trust is to Log In to your account and select the Download option.

- If this is your initial time using US Legal Forms, simply adhere to the instructions outlined below.

- Ensure you have located the form you require. Review its description and use the Preview function to inspect its content. If it doesn’t fulfill your needs, utilize the Search bar at the top of the screen to find the appropriate document.

- Confirm your choice. Click the Buy now option. Then, select the desired subscription plan and provide details to create an account.

- Complete the payment process. Use your credit card or PayPal account to finish the registration step.

Form popularity

FAQ

A form to dissolve a revocable trust is a legal document that officially terminates the trust. In Everett Washington, revocation of a living trust requires a clear expression of your intent to dissolve the trust, and this form helps ensure that your wishes are documented correctly. It is essential to follow the legal requirements in your state, and options are available through platforms like US Legal Forms to guide you through the process. By using the right form, you can facilitate a smooth transition away from your Everett Washington revocation of living trust.

An example of a trust revocation would be an individual formally declaring that their existing living trust is no longer valid. This can occur, for instance, when someone decides to create a new trust or change beneficiaries. The process typically involves issuing a written notice referencing the original trust, making it clear to all parties involved in the Everett Washington Revocation of Living Trust that the prior trust has been annulled.

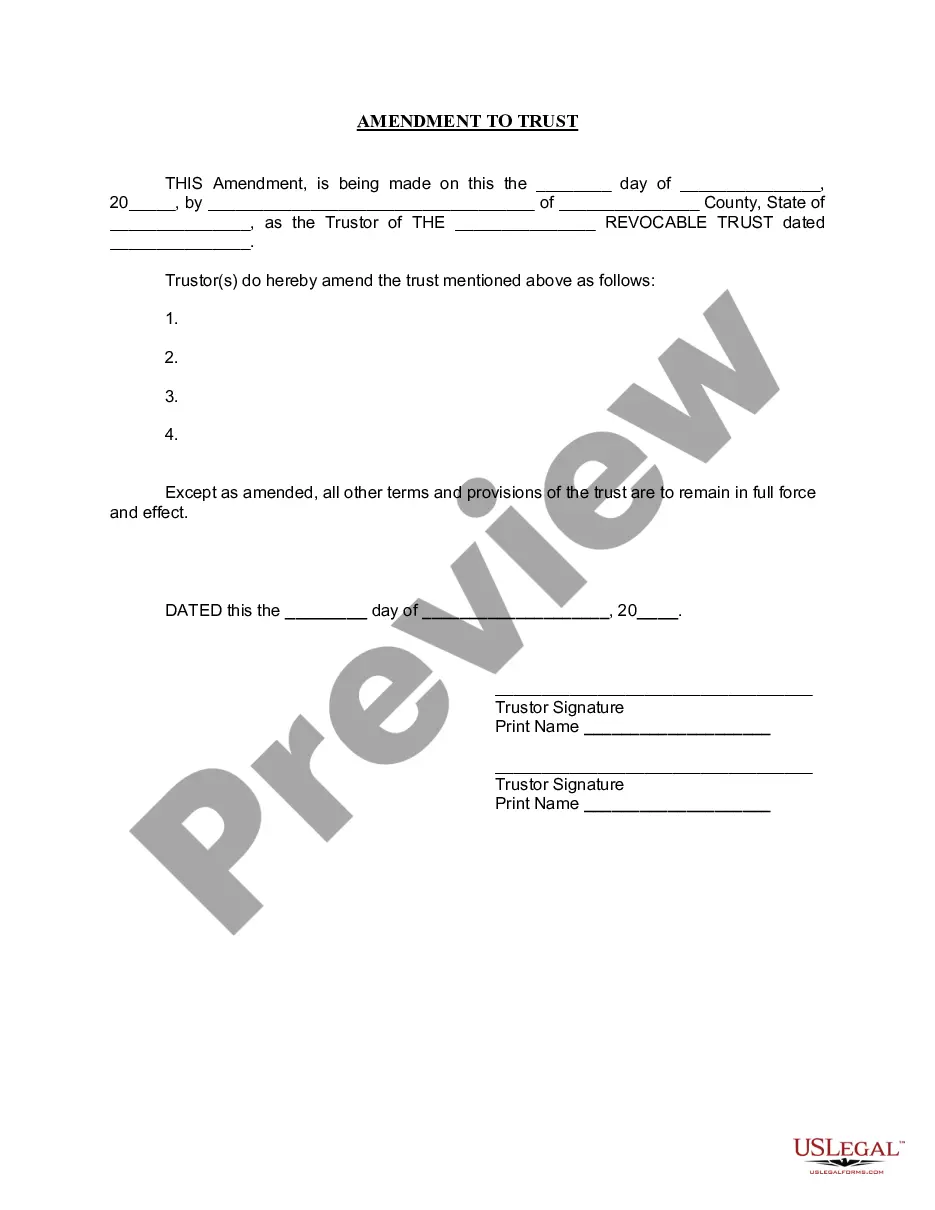

One of the biggest mistakes parents make when setting up a trust fund is failing to update the trust as life circumstances change. Changes like the birth of additional children, divorce, or changes in financial situation should prompt a review and possible amendment of the trust. Ignoring these updates can complicate the distribution of assets in an Everett Washington Revocation of Living Trust. Regularly reviewing your trust can help you avoid confusion and ensure your family's needs are met.

Revoking a revocable trust is generally straightforward. You need to follow the procedures outlined in your trust document or state laws, which may involve drafting a revocation declaration. If you use resources like US Legal Forms, the process becomes even easier, ensuring you follow legal standards for an Everett Washington Revocation of Living Trust. Always ensure your revocation is properly documented to avoid complications later.

A revocation clause in a trust document states that the trust can be revoked or terminated at any time. For example, it may say, 'This trust is revocable and may be revoked by the grantor at any time through a written notice.' Including a revocation clause is crucial for anyone establishing an Everett Washington Revocation of Living Trust, as it provides the flexibility to make changes as life circumstances evolve.

A trust revocation declaration usually states your intent to revoke a previously established living trust. It should include your name, a description of the original trust, and a clear statement of revocation. This declaration acts as a formal notice to all parties involved, ensuring that your wishes regarding the Everett Washington Revocation of Living Trust are clear and legally recognized.

To fill out a revocable living trust, start by gathering all necessary information about your assets, including property, bank accounts, and investments. Follow the template or format provided by a trusted source, like US Legal Forms, to ensure accuracy. You will typically need to name a trustee and outline how you want your assets distributed upon your passing. Consider consulting an estate planning attorney to finalize your documents and ensure you meet all legal requirements for the Everett Washington Revocation of Living Trust.

A trust becomes null and void when it lacks a valid purpose, does not meet legal requirements, or if the grantor is not legally competent to create one. Specific conditions outlined during the Everett Washington Revocation of Living Trust process can also lead to a trust being deemed invalid. Understanding these key elements protects against future disputes.

To revoke a revocable trust in Washington state, you must prepare a written revocation document that complies with state requirements. The Everett Washington Revocation of Living Trust includes signing the document, possibly having it notarized, and distributing copies to all relevant parties. This ensures everyone involved is informed of the changes.

When you revoke a living trust, all assets held in that trust revert to you, the grantor. This action essentially dissolves any terms associated with the trust, allowing for new estate planning opportunities. The Everett Washington Revocation of Living Trust process ensures that all legal formalities are observed for a smooth transition.