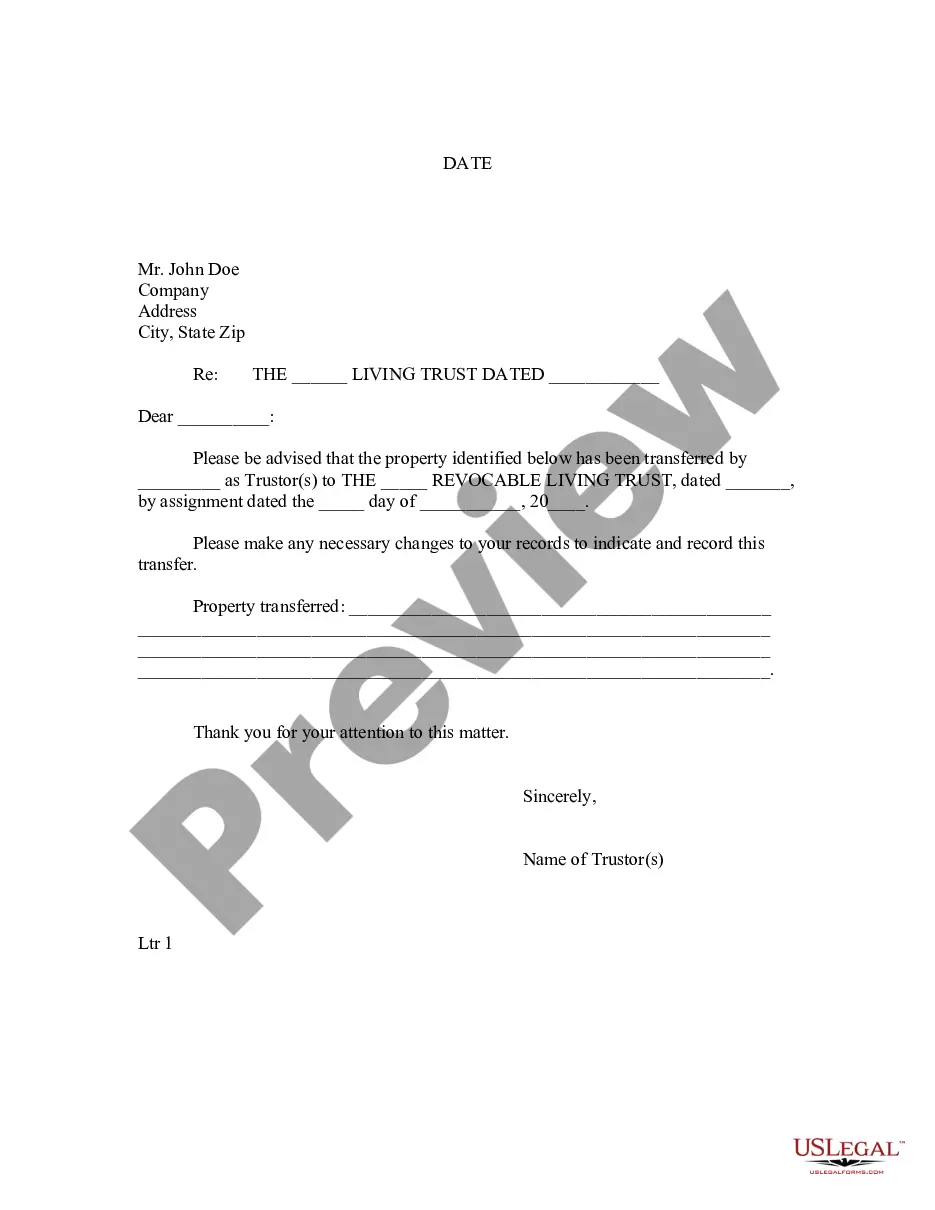

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

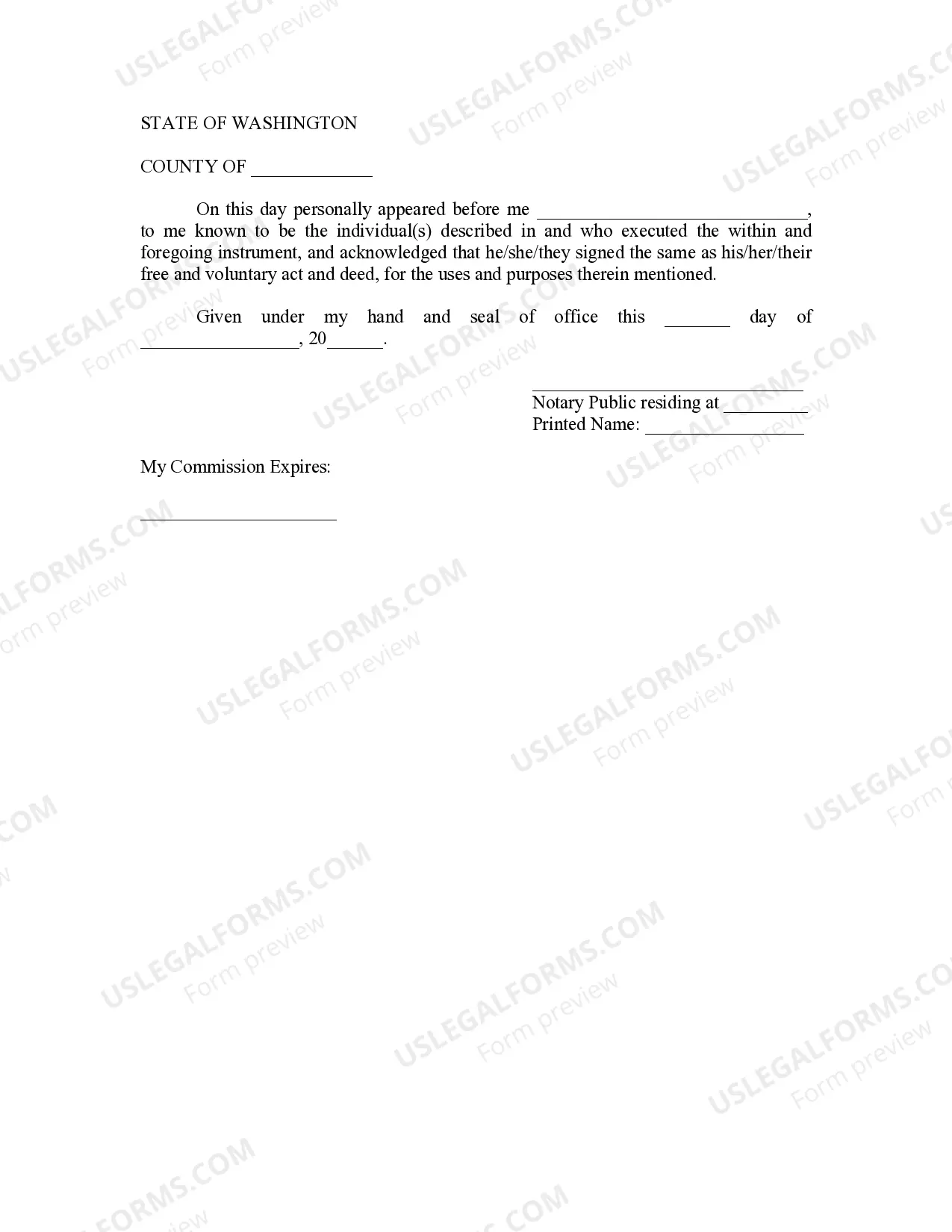

Title: King Washington Letter to Lien holder to Notify of Trust: A Comprehensive Guide for Establishing Trust Agreements Keywords: King Washington Letter, Lien holder, Notify of Trust, Trust Agreement, Trustee, Beneficiary, Revocable Trust, Irrevocable Trust, Testamentary Trust, Living Trust Introduction: A King Washington Letter to Lien holder to Notify of Trust is a formal document used to inform a lien holder, such as a financial institution, of the establishment of a trust agreement. This essential step is necessary to protect the rights and interests of the trust's beneficiary and ensure the smooth administration of assets held within the trust. In this article, we will delve into the details of King Washington Letters to Lien holders and explore different types of trust agreements. 1. Understanding the King Washington Letter to Lien holder: A King Washington Letter to Lien holder serves as a notice, officially informing the lien holder that property or assets subject to a lien have been placed into a trust for the benefit of a designated beneficiary. This notification helps protect the trustee's powers and authority over trust assets and assists the lien holder in managing potential conflicts with the trust. 2. Types of Trust Agreements: — Revocable Trust: Also known as a living trust, a revocable trust can be altered or terminated by the granter during their lifetime. The King Washington Letter informs the lien holder of this type of trust's existence and ensures a smooth transition of control over assets to the beneficiary. — Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be altered or revoked without the consent of all involved parties. The King Washington Letter alerts the lien holder to the binding nature of this trust, providing legal protection for trust assets and beneficiary rights. — Testamentary Trust: This trust is established through a last will and testament and becomes effective upon the granter's death. The King Washington Letter is sent to the lien holder to notify them of the testamentary trust's activation, ensuring the appropriate distribution of assets to the designated beneficiaries. 3. Key Components of a King Washington Letter to Lien holder: To effectively notify the lien holder of the trust, a King Washington Letter should include essential information such as: — Thgranteror's name and contact details — Trustee's identification and contact information — Beneficiary's name and relevant identification information — Description of the trust agreement, specifying its type (revocable, irrevocable, testamentary) — An explicit statement affirming the existence of the trust and date of creation — DetailAtheneesoldererer's interests and involvement — Instructionbotheredesoldererer should proceed with any future transactions involving the trust assets. Conclusion: The King Washington Letter to Lien holder to Notify of Trust plays a crucial role in safeguarding the interests of trust beneficiaries and ensuring effective communication between lien holders and trustees. By understanding the various types of trust agreements and providing accurate information in the letter, granters can establish the necessary legal foundation for the smooth administration of their trusts.Title: King Washington Letter to Lien holder to Notify of Trust: A Comprehensive Guide for Establishing Trust Agreements Keywords: King Washington Letter, Lien holder, Notify of Trust, Trust Agreement, Trustee, Beneficiary, Revocable Trust, Irrevocable Trust, Testamentary Trust, Living Trust Introduction: A King Washington Letter to Lien holder to Notify of Trust is a formal document used to inform a lien holder, such as a financial institution, of the establishment of a trust agreement. This essential step is necessary to protect the rights and interests of the trust's beneficiary and ensure the smooth administration of assets held within the trust. In this article, we will delve into the details of King Washington Letters to Lien holders and explore different types of trust agreements. 1. Understanding the King Washington Letter to Lien holder: A King Washington Letter to Lien holder serves as a notice, officially informing the lien holder that property or assets subject to a lien have been placed into a trust for the benefit of a designated beneficiary. This notification helps protect the trustee's powers and authority over trust assets and assists the lien holder in managing potential conflicts with the trust. 2. Types of Trust Agreements: — Revocable Trust: Also known as a living trust, a revocable trust can be altered or terminated by the granter during their lifetime. The King Washington Letter informs the lien holder of this type of trust's existence and ensures a smooth transition of control over assets to the beneficiary. — Irrevocable Trust: In contrast to a revocable trust, an irrevocable trust cannot be altered or revoked without the consent of all involved parties. The King Washington Letter alerts the lien holder to the binding nature of this trust, providing legal protection for trust assets and beneficiary rights. — Testamentary Trust: This trust is established through a last will and testament and becomes effective upon the granter's death. The King Washington Letter is sent to the lien holder to notify them of the testamentary trust's activation, ensuring the appropriate distribution of assets to the designated beneficiaries. 3. Key Components of a King Washington Letter to Lien holder: To effectively notify the lien holder of the trust, a King Washington Letter should include essential information such as: — Thgranteror's name and contact details — Trustee's identification and contact information — Beneficiary's name and relevant identification information — Description of the trust agreement, specifying its type (revocable, irrevocable, testamentary) — An explicit statement affirming the existence of the trust and date of creation — DetailAtheneesoldererer's interests and involvement — Instructionbotheredesoldererer should proceed with any future transactions involving the trust assets. Conclusion: The King Washington Letter to Lien holder to Notify of Trust plays a crucial role in safeguarding the interests of trust beneficiaries and ensuring effective communication between lien holders and trustees. By understanding the various types of trust agreements and providing accurate information in the letter, granters can establish the necessary legal foundation for the smooth administration of their trusts.