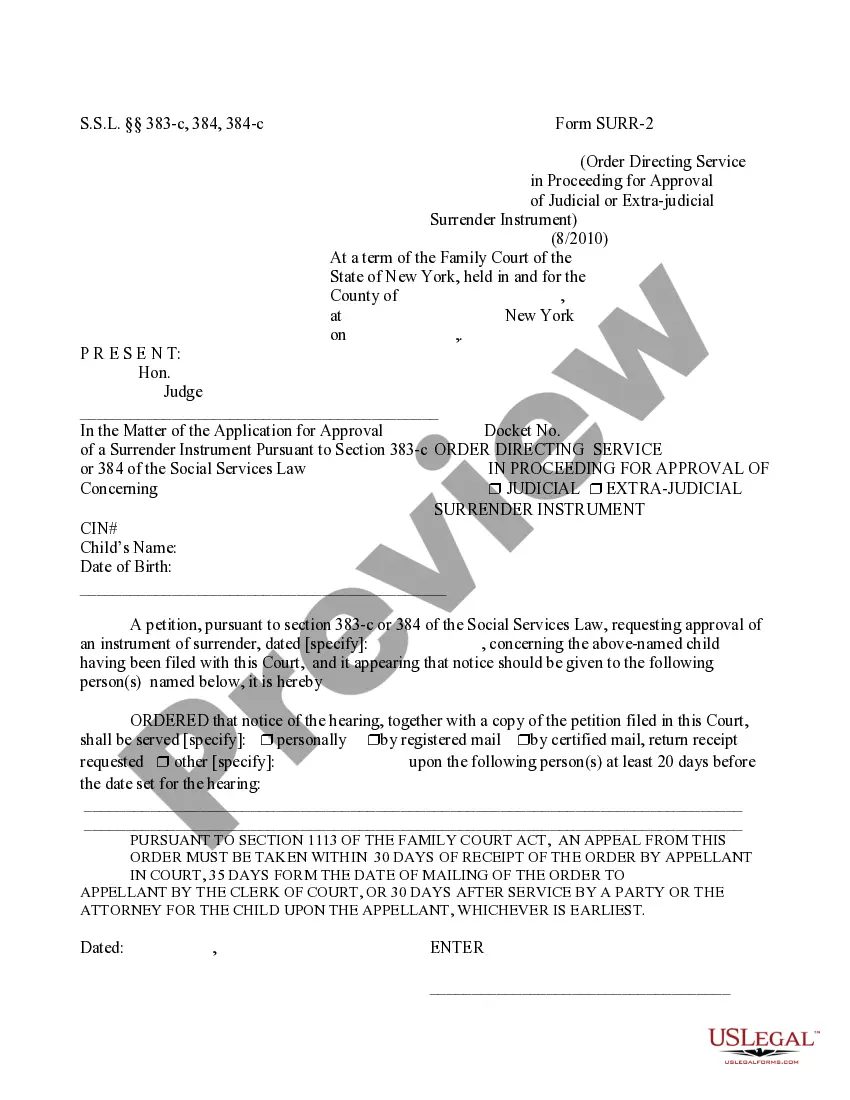

This is an official Washington court form, a Partial Release of Mortgage (with individual acknowledgment).

Title: Understanding the Seattle Washington Partial Release of Mortgage with Individual Acknowledgment Introduction: In Seattle, Washington, partial releases of mortgage with individual acknowledgment serve a crucial role in the real estate market. This legal document allows borrowers to release a specific portion of their property from a mortgage lien, alleviating financial pressure for the involved parties. In this article, we will delve into the intricacies of the Seattle Washington Partial Release of Mortgage with Individual Acknowledgment, exploring its types, purpose, and importance. 1. What is a Partial Release of Mortgage with Individual Acknowledgment? A Seattle Washington Partial Release of Mortgage with Individual Acknowledgment is a legal instrument that permits a borrower to release specific portions or parcels of their property from an existing mortgage lien while keeping the remaining property still subject to the lien. This document is executed between the borrower (mortgagor), the lender (mortgagee), and any other parties with a vested interest in the property. 2. Purpose and Importance: The primary purpose of a Seattle Washington Partial Release of Mortgage with Individual Acknowledgment is to allow borrowers who own large properties or multiple parcels to release specific portions and use them as collateral for other loans or property development. By providing flexibility, this type of release offers borrowers the ability to leverage their property's value without having to refinance or fully pay off their existing mortgage. 3. Types of Seattle Washington Partial Release of Mortgage with Individual Acknowledgment: a) Partial Release of a Single Parcel: This type of release allows for the removal of a single parcel or lot from the mortgage lien. It is commonly used when the borrower wants to sell, lease, or develop a distinct part of the property while keeping the remaining land under the original mortgage. b) Partial Release of Multiple Parcels: In cases where a borrower owns a property with multiple parcels, this type of release allows them to release specific parcels while keeping the others encumbered by the mortgage. This proves advantageous when owners wish to sell particular parcels, transfer ownership, or obtain separate loans for specific sections. c) Partial Release with Individual Acknowledgment: The "individual acknowledgment" component signifies that each party involved acknowledges and understands the terms and conditions of the release. This legally-binding document ensures that all stakeholders comprehend their rights and responsibilities, reducing the potential for disputes or misunderstanding. 4. Key Elements of the Seattle Washington Partial Release of Mortgage with Individual Acknowledgment: a) Clear Identification: The document must precisely identify the mortgage being partially released, referencing relevant information such as loan number, property address, and legal description. b) Description of Released Parcels: The partial release should provide a detailed description of the parcels being released, including their legal descriptions, lot numbers, or other identification methods. c) Signatures and Acknowledgment: The document requires signatures from all parties involved, including the borrower, lender, and any other individuals or entities with an interest in the property. Acknowledgment typically involves a notary public witnessing the parties' signatures. Conclusion: A Seattle Washington Partial Release of Mortgage with Individual Acknowledgment provides borrowers with the flexibility to release specific portions of their property from a mortgage lien. Whether it's a single parcel or multiple parcels, this legal instrument empowers property owners to engage in transactions, transfers, or financing options involving distinct sections of their property. By understanding the intricacies of this document, borrowers and lenders can navigate their real estate transactions effectively.Title: Understanding the Seattle Washington Partial Release of Mortgage with Individual Acknowledgment Introduction: In Seattle, Washington, partial releases of mortgage with individual acknowledgment serve a crucial role in the real estate market. This legal document allows borrowers to release a specific portion of their property from a mortgage lien, alleviating financial pressure for the involved parties. In this article, we will delve into the intricacies of the Seattle Washington Partial Release of Mortgage with Individual Acknowledgment, exploring its types, purpose, and importance. 1. What is a Partial Release of Mortgage with Individual Acknowledgment? A Seattle Washington Partial Release of Mortgage with Individual Acknowledgment is a legal instrument that permits a borrower to release specific portions or parcels of their property from an existing mortgage lien while keeping the remaining property still subject to the lien. This document is executed between the borrower (mortgagor), the lender (mortgagee), and any other parties with a vested interest in the property. 2. Purpose and Importance: The primary purpose of a Seattle Washington Partial Release of Mortgage with Individual Acknowledgment is to allow borrowers who own large properties or multiple parcels to release specific portions and use them as collateral for other loans or property development. By providing flexibility, this type of release offers borrowers the ability to leverage their property's value without having to refinance or fully pay off their existing mortgage. 3. Types of Seattle Washington Partial Release of Mortgage with Individual Acknowledgment: a) Partial Release of a Single Parcel: This type of release allows for the removal of a single parcel or lot from the mortgage lien. It is commonly used when the borrower wants to sell, lease, or develop a distinct part of the property while keeping the remaining land under the original mortgage. b) Partial Release of Multiple Parcels: In cases where a borrower owns a property with multiple parcels, this type of release allows them to release specific parcels while keeping the others encumbered by the mortgage. This proves advantageous when owners wish to sell particular parcels, transfer ownership, or obtain separate loans for specific sections. c) Partial Release with Individual Acknowledgment: The "individual acknowledgment" component signifies that each party involved acknowledges and understands the terms and conditions of the release. This legally-binding document ensures that all stakeholders comprehend their rights and responsibilities, reducing the potential for disputes or misunderstanding. 4. Key Elements of the Seattle Washington Partial Release of Mortgage with Individual Acknowledgment: a) Clear Identification: The document must precisely identify the mortgage being partially released, referencing relevant information such as loan number, property address, and legal description. b) Description of Released Parcels: The partial release should provide a detailed description of the parcels being released, including their legal descriptions, lot numbers, or other identification methods. c) Signatures and Acknowledgment: The document requires signatures from all parties involved, including the borrower, lender, and any other individuals or entities with an interest in the property. Acknowledgment typically involves a notary public witnessing the parties' signatures. Conclusion: A Seattle Washington Partial Release of Mortgage with Individual Acknowledgment provides borrowers with the flexibility to release specific portions of their property from a mortgage lien. Whether it's a single parcel or multiple parcels, this legal instrument empowers property owners to engage in transactions, transfers, or financing options involving distinct sections of their property. By understanding the intricacies of this document, borrowers and lenders can navigate their real estate transactions effectively.