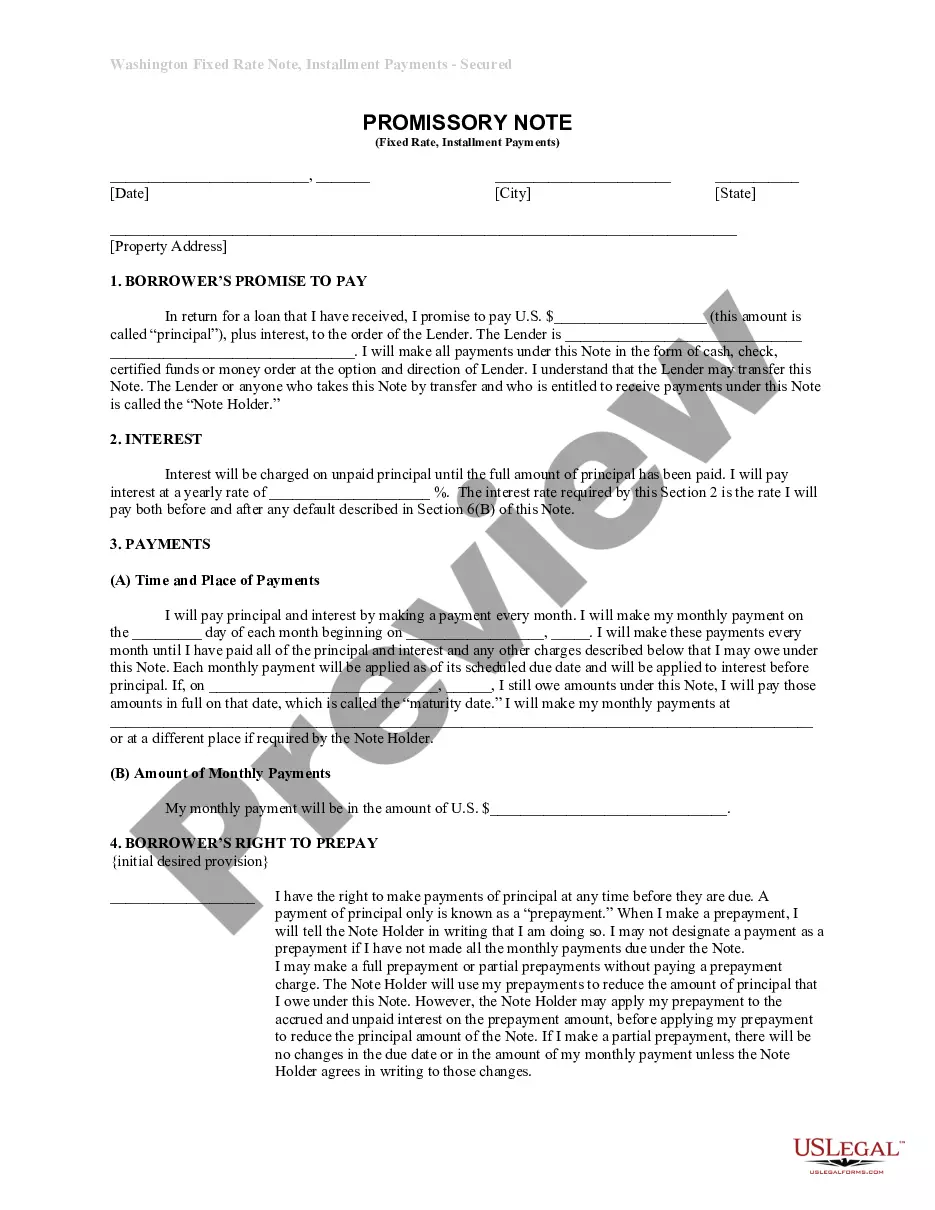

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Everett Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Everett, Washington. This note is specifically secured by residential real estate, providing additional security for the lender. The Everett Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate serves as evidence of the borrower's promise to repay the loan amount borrowed, along with any accrued interest, in equal installments over a predetermined period. This type of loan agreement is commonly used in real estate transactions, where the borrower needs funds for various purposes such as buying a new property, renovating an existing one, or debt consolidation. One of the key features of this promissory note is the fixed interest rate, which means that the interest rate remains constant throughout the loan term. This fixed rate provides stability and predictability for both the lender and the borrower, ensuring that the monthly loan payments remain consistent and manageable. In Everett, Washington, there may be various types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate available, including: 1. Purchase Loan: This type of promissory note is used when a borrower in Everett, Washington needs financing to purchase a residential property. The note specifies the loan amount, interest rate, repayment terms, and the property that will serve as collateral for the loan. 2. Home Equity Loan: If a homeowner in Everett, Washington wishes to tap into the equity of their residential real estate, they can opt for a Home Equity Loan. This type of promissory note allows the borrower to borrow against the appraised value of their property, utilizing it as collateral. 3. Construction Loan: Property developers or individuals looking to build a new residential property in Everett, Washington may require a Construction Loan. This type of promissory note provides financing for the construction process, with the residential real estate serving as security. 4. Refinance Loan: Homeowners in Everett, Washington who want to take advantage of lower interest rates or extend the loan term can opt for a Refinance Loan. This promissory note allows borrowers to replace an existing loan with a new one, often resulting in reduced monthly payments. It's important to note that each type of Everett Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate may have specific terms and conditions tailored to the individual borrower's needs and the lender's requirements. It is always recommended seeking legal advice before entering into any promissory note agreements to ensure that all parties involved are protected and understand the obligations and rights outlined in the document.Everett Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Everett, Washington. This note is specifically secured by residential real estate, providing additional security for the lender. The Everett Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate serves as evidence of the borrower's promise to repay the loan amount borrowed, along with any accrued interest, in equal installments over a predetermined period. This type of loan agreement is commonly used in real estate transactions, where the borrower needs funds for various purposes such as buying a new property, renovating an existing one, or debt consolidation. One of the key features of this promissory note is the fixed interest rate, which means that the interest rate remains constant throughout the loan term. This fixed rate provides stability and predictability for both the lender and the borrower, ensuring that the monthly loan payments remain consistent and manageable. In Everett, Washington, there may be various types of Installments Fixed Rate Promissory Notes Secured by Residential Real Estate available, including: 1. Purchase Loan: This type of promissory note is used when a borrower in Everett, Washington needs financing to purchase a residential property. The note specifies the loan amount, interest rate, repayment terms, and the property that will serve as collateral for the loan. 2. Home Equity Loan: If a homeowner in Everett, Washington wishes to tap into the equity of their residential real estate, they can opt for a Home Equity Loan. This type of promissory note allows the borrower to borrow against the appraised value of their property, utilizing it as collateral. 3. Construction Loan: Property developers or individuals looking to build a new residential property in Everett, Washington may require a Construction Loan. This type of promissory note provides financing for the construction process, with the residential real estate serving as security. 4. Refinance Loan: Homeowners in Everett, Washington who want to take advantage of lower interest rates or extend the loan term can opt for a Refinance Loan. This promissory note allows borrowers to replace an existing loan with a new one, often resulting in reduced monthly payments. It's important to note that each type of Everett Washington Installments Fixed Rate Promissory Note Secured by Residential Real Estate may have specific terms and conditions tailored to the individual borrower's needs and the lender's requirements. It is always recommended seeking legal advice before entering into any promissory note agreements to ensure that all parties involved are protected and understand the obligations and rights outlined in the document.