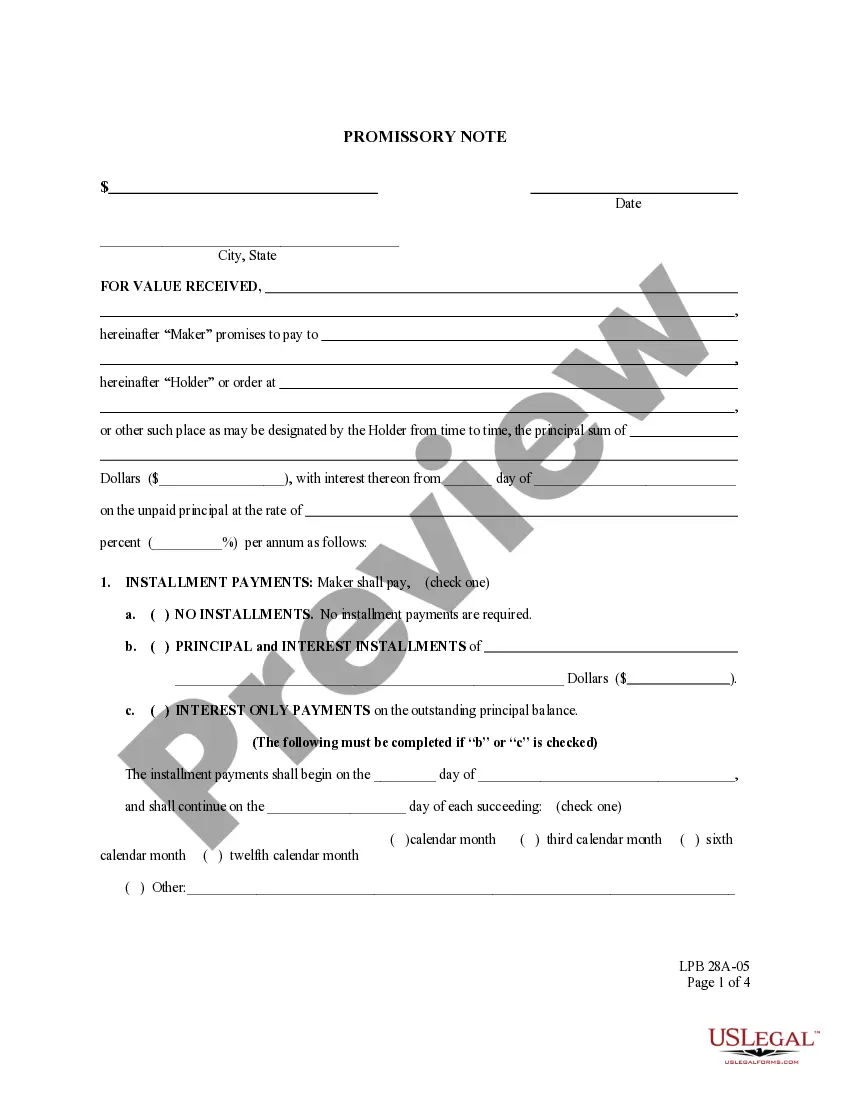

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Washington Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Locating authenticated templates pertinent to your regional regulations can be arduous unless you utilize the US Legal Forms repository.

It is a digital collection of over 85,000 legal documents for both individual and professional requirements along with various real-world situations.

All the paperwork is meticulously organized by usage area and jurisdiction, making the search for the Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate as straightforward as pie.

Maintaining documents orderly and compliant with legal stipulations is crucial. Leverage the US Legal Forms library to always have necessary document templates readily available for any requirements!

- Examine the Preview mode and form synopsis.

- Ensure you’ve selected the accurate one that matches your specifications and fully aligns with your local jurisdiction requirements.

- Look for another template if required.

- If you identify any discrepancies, make use of the Search tab above to locate the correct one. If it meets your needs, proceed to the next step.

- Acquisition of the document.

Form popularity

FAQ

An installment note is a specific type of promissory note that details a series of payments at regular intervals. Conversely, a standard promissory note can include various terms, including a lump sum repayment. For a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the installment note emphasizes scheduled payments, making it easier for borrowers to understand their financial obligations. Utilizing tools from platforms like uslegalforms can aid you in drafting and managing these legal documents efficiently.

An installment refers to the regular payments made over time to repay a debt, while a promissory note is the document that outlines the promise to make those payments. In a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the relationship between the two becomes clear: the note describes the terms, while the installments represent the execution of those terms. Engaging with a structured payment system can help both lenders and borrowers stay on track.

A valid promissory note includes the amount borrowed, the interest rate, and the repayment schedule. For a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it should also mention the property serving as collateral. A clear and complete example ensures that all parties know what to expect, minimizing misunderstandings. You can find templates and resources at uslegalforms to help you create your valid note.

Writing a simple promissory note involves listing the borrower's and lender's names, the amount borrowed, and the repayment schedule. In the context of a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it's essential to mention the collateral details. Keep the language straightforward, and ensure both parties understand and agree on the terms. Be sure to sign the document to finalize the agreement.

In Washington state, a promissory note does not necessarily need to be notarized to be legally valid. However, notarization can provide additional security and proof of authenticity in case of disputes. If you're exploring a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, consider having your document notarized for added protection and legitimacy.

To write a promissory note with collateral, begin by including all essential information, such as the borrower's name, the amount, and repayment terms. Next, describe the collateral being offered, ensuring it is detailed enough to identify it clearly. For a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you can rely on platforms like USLegalForms to guide you through the process, ensuring all legal requirements are met.

Yes, promissory notes can indeed be backed by collateral. This additional security provides peace of mind to lenders, knowing that they have rights to the collateral if the borrower defaults. When dealing with a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, tying the note to real estate can make it a more attractive option for securing loans.

Yes, a promissory note can hold up in court if it meets legal requirements. The document must clearly state the terms of the agreement and be signed by both parties. If you are using a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it is important to ensure that all details are properly documented to enhance its enforceability.

Yes, a promissory note can be secured by real property, which is often referred to as a secured promissory note. In the case of a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the property serves as collateral, protecting the lender's investment. Securing the note with real estate enhances trust between parties and minimizes risk.

Accounting for a promissory note involves recording it as an asset for the lender and a liability for the borrower. For a Bellevue Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the note's terms, including interest rate and repayment schedule, dictate its financial impact. Proper tracking ensures clarity in financial statements and compliance with accounting standards.