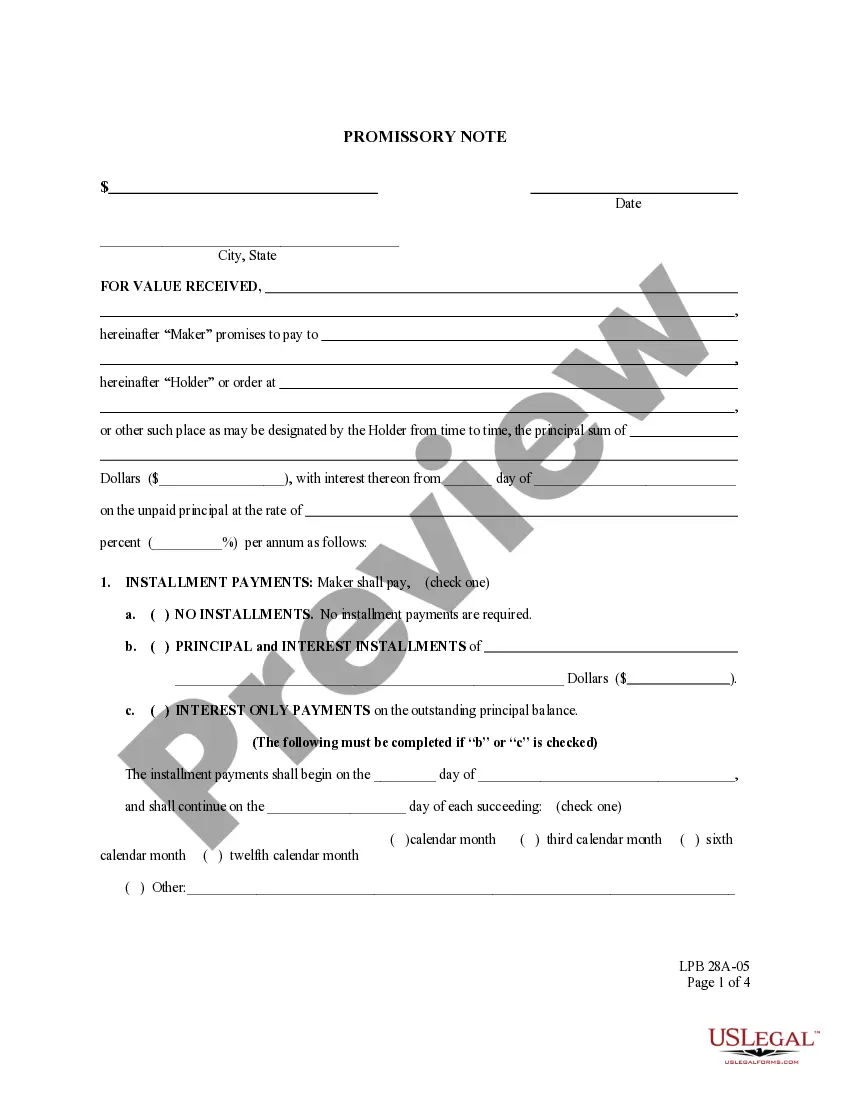

This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

How to fill out Washington Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

We consistently endeavor to reduce or evade legal repercussions when handling intricate legal or financial matters.

To achieve this, we enlist legal representation that is frequently quite costly.

Nonetheless, not every legal challenge is equally intricate; many can be managed independently.

US Legal Forms serves as an online repository of current self-service legal documents covering anything from wills and powers of attorney to incorporation articles and dissolution petitions.

Just Log In to your account and click the Get button adjacent to it. If you misplace the document, it can always be re-downloaded from the My documents tab. The procedure is equally simple even if you are new to the website! You can establish your account within a few minutes. Ensure to verify that the Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate aligns with the laws and regulations of your state and area. Additionally, it is essential to review the form's description (if available), and if you notice any inconsistencies with your initial requirements, search for an alternative form. Once you are confident that the Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate suits your needs, you can select the subscription plan and move on to payment. You can then download the document in any convenient format. Over the last 24 years, we have aided millions by offering readily customizable and current legal forms. Utilize US Legal Forms now to conserve time and resources!

- Our collection empowers you to manage your own affairs without the necessity of legal representation.

- We provide access to legal document templates that are not always readily accessible to the public.

- Our templates are tailored to specific states and regions, significantly easing the search process.

- Take advantage of US Legal Forms whenever you need to obtain and download the Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate or any other document promptly and securely.

Form popularity

FAQ

In Washington State, a promissory note's validity can depend on the terms outlined within the document. Generally, if no specific term is stated, the note may remain valid for an extended period, often several years. For a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, it's prudent to outline clear expiration terms to avoid potential legal ambiguities.

Absolutely, a promissory note can specify when and how it is payable. This flexibility allows borrowers and lenders to structure repayment terms that suit both parties. When crafting a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, clear terms regarding payment schedules can facilitate smoother transactions.

Most commercial real estate loans offer a variety of terms, but many borrowers lean towards fixed-rate loans for risk management. Fixed-rate options allow for predictable budgeting over time, making them favorable for planning future investments. For those interested in a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, a fixed rate can deliver peace of mind in an often fluctuating market.

A promissory note is generally considered a negotiable instrument, making it transferable under certain conditions. This means you can sell or assign the note to another party, which can provide flexibility in managing financial agreements. For a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, this transferability can be a valuable feature to keep in mind.

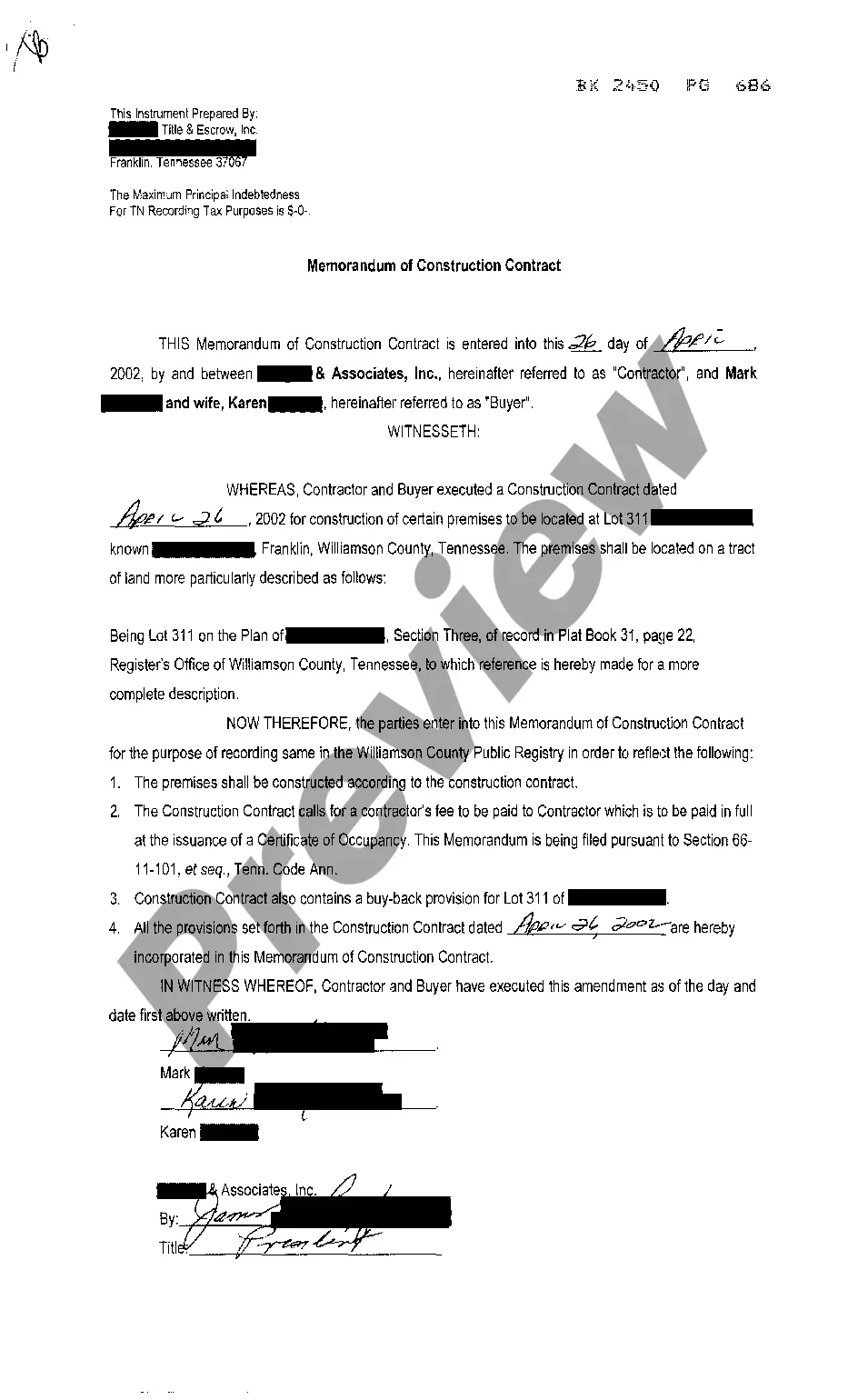

Yes, a Promissory Note can certainly be secured by collateral, such as commercial real estate. This form of security gives lenders reassurance that they have a claim to specific assets if the borrower defaults. Hence, when opting for a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you enhance your negotiating power with the lender.

While notarization is not a strict requirement for promissory notes, it can significantly enhance the enforceability of the document. For a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, having the document notarized may help avoid disputes later on. Consider using USLegalForms to ensure your note includes all necessary provisions and to explore optional notarization.

A promissory note is often secured by collateral, which can vary based on the agreement. In the case of a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, the commercial property acts as the collateral backing the note. This means that if the borrower fails to meet payment obligations, the lender may claim the property to recover losses. Utilizing services like USLegalForms can help you understand how to structure these agreements correctly.

Buying promissory notes typically involves identifying a seller and negotiating terms like interest rates and payment schedules. For those interested in a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, consider researching the market for available notes that meet your investment criteria. Platforms such as USLegalForms can provide resources and legal guidance necessary for this process.

Creating a promissory note for payment involves outlining key details such as the amount owed, payment terms, and the interest rate. For a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, include specific clauses that detail how and when payments will be made. Templates from services like USLegalForms can simplify the process, ensuring that all vital elements are included in your document.

Filling out a promissory note involves providing accurate information for each required section. In the case of a Vancouver Washington Installments Fixed Rate Promissory Note Secured by Commercial Real Estate, you will fill in names, amounts, terms, and the collateral used. It's important to clearly express your intentions regarding repayment to avoid any ambiguity. For guidance and templates, consider using resources from US Legal Forms to streamline this task.