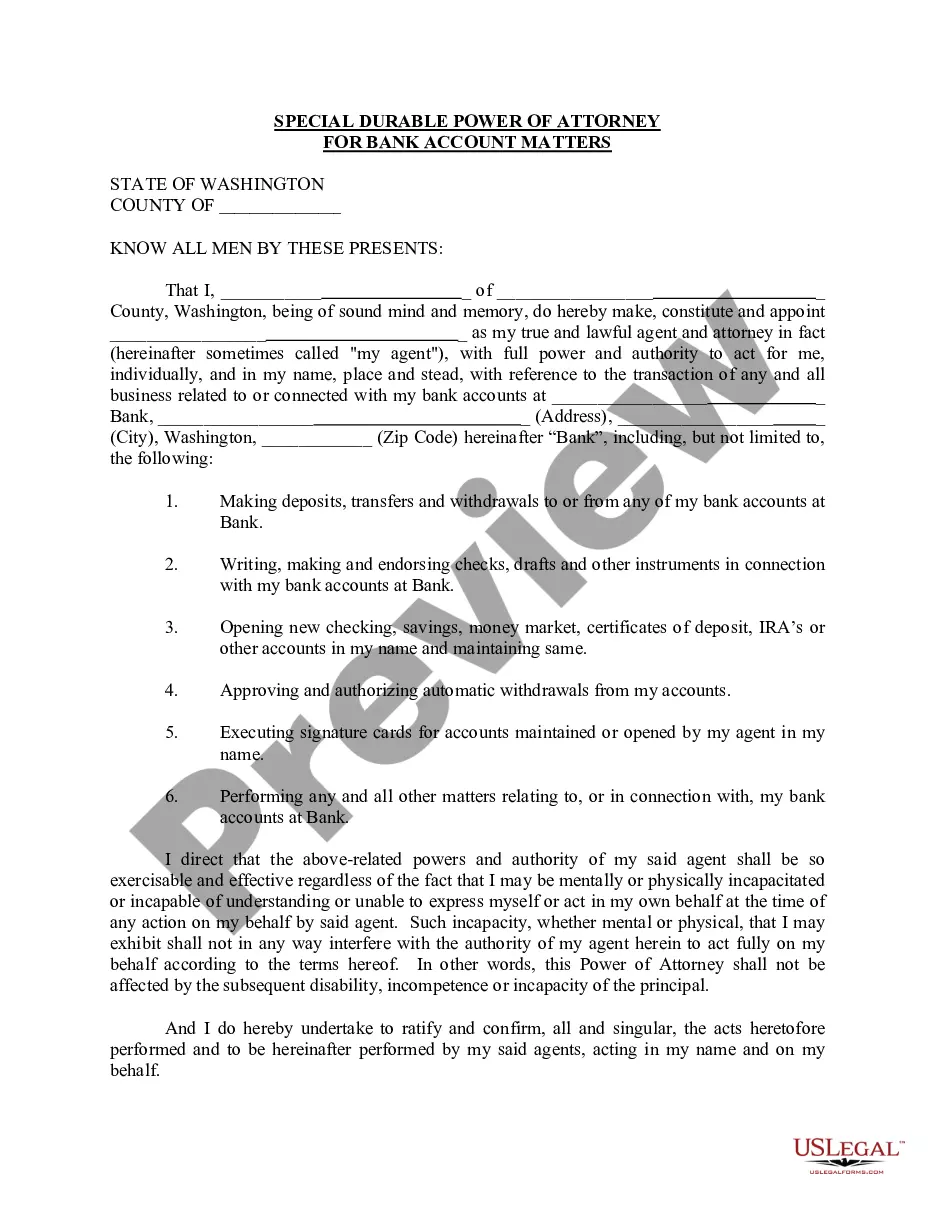

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

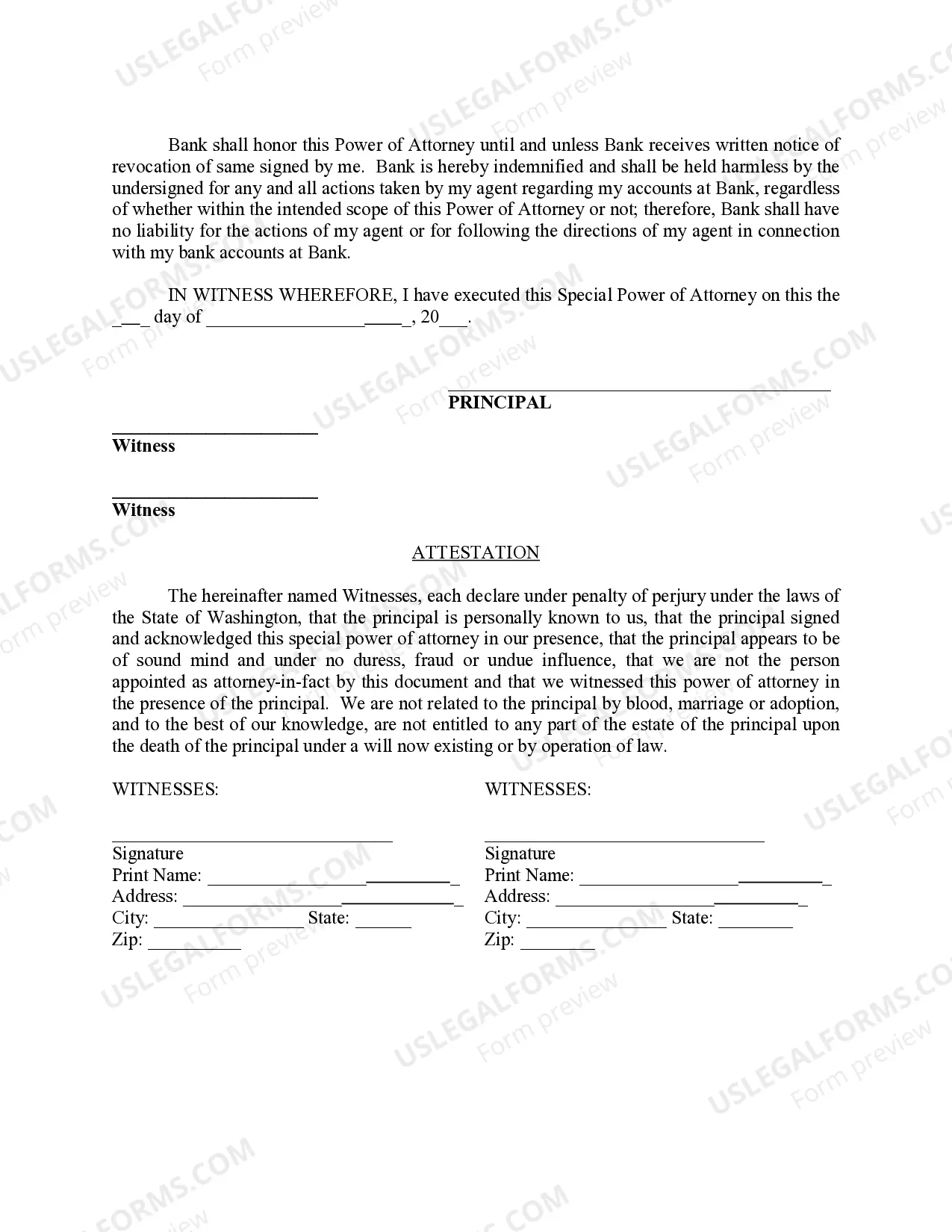

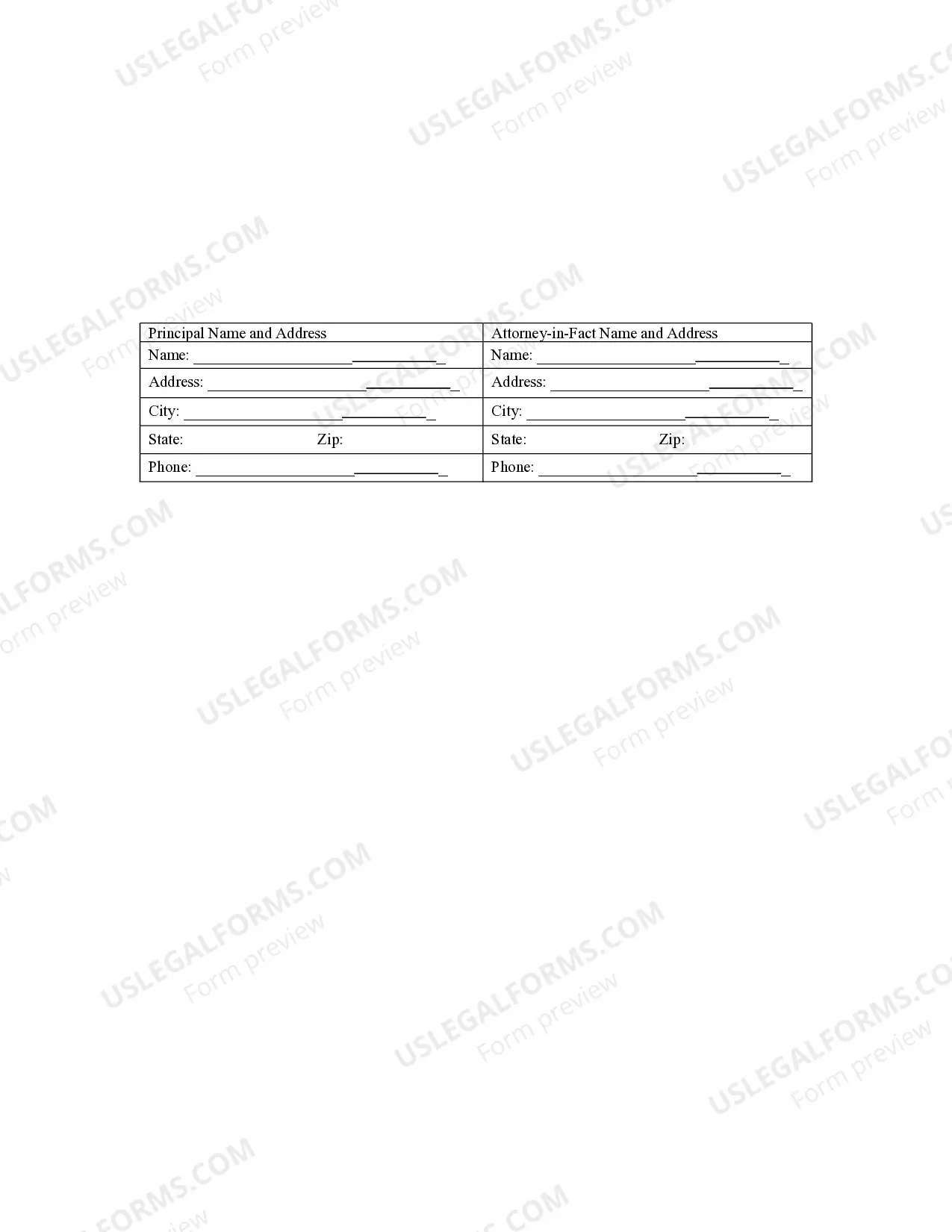

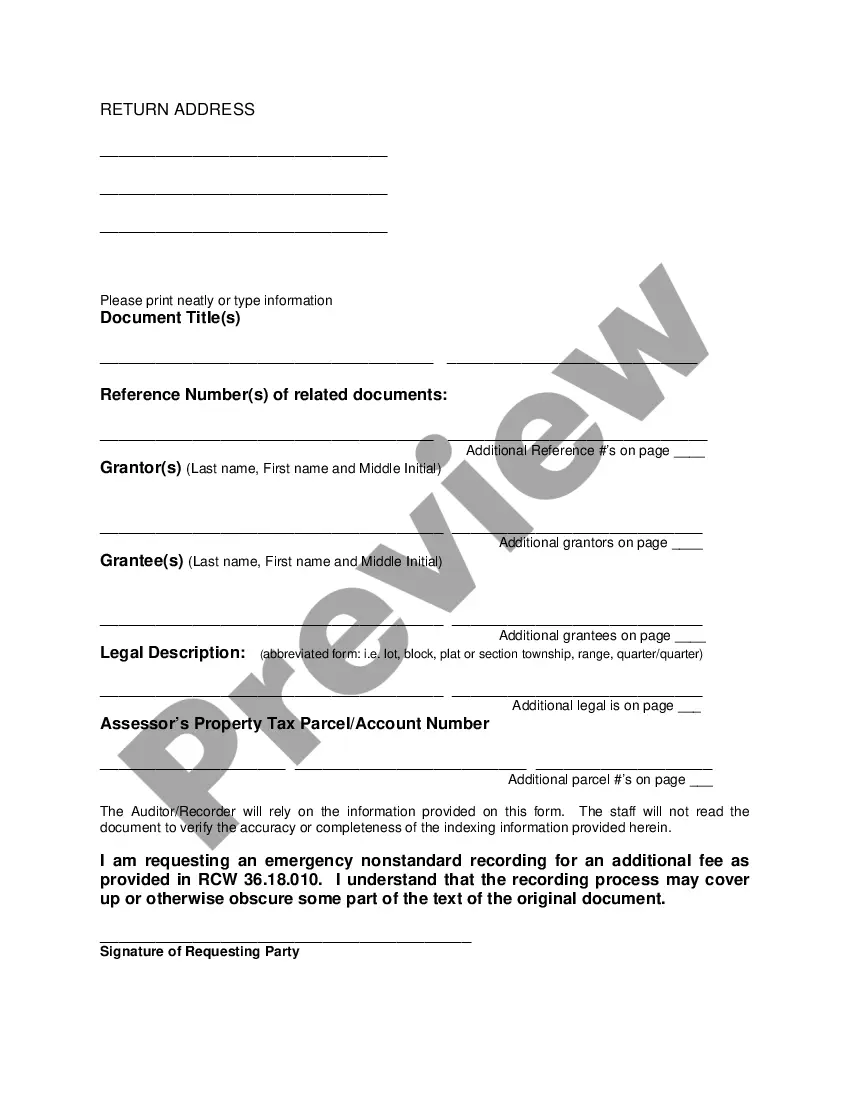

The King Washington Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an authorized agent or attorney-in-fact the power to manage and make decisions regarding a specific individual's bank accounts in the state of Washington. This type of power of attorney is designed to provide the agent with the authority to handle various financial matters on behalf of the principal. This document is particularly useful for individuals who may be unable to personally manage their bank accounts due to physical or mental incapacity, absence, or any other reason. By appointing a trusted agent, the principal can ensure that their bank accounts are properly managed and protected. The King Washington Special Durable Power of Attorney for Bank Account Matters empowers the agent to perform a wide range of tasks relating to the principal's bank accounts. These tasks may include, but are not limited to: 1. Depositing and withdrawing funds: The agent can access the principal's accounts to make deposits, withdrawals, and other necessary transactions. 2. Paying bills and expenses: The agent can use the funds in the principal's accounts to pay bills, mortgage payments, medical expenses, and any other financial obligations. 3. Managing investments: If authorized, the agent can handle investment-related matters, such as buying or selling stocks, bonds, or other securities on behalf of the principal. 4. Opening and closing accounts: The agent has the authority to open new accounts or close existing ones, as needed. 5. Accessing account information: The agent can obtain bank statements, account balances, and other relevant information to effectively manage the principal's accounts. It's important to note that a King Washington Special Durable Power of Attorney for Bank Account Matters can be tailored to meet specific needs and requirements of the principal. The document can include limitations, restrictions, or any additional provisions that the principal wishes to impose. Although the term "King Washington Special Durable Power of Attorney for Bank Account Matters" does not specifically refer to different types or variations of the power of attorney, it is possible to modify or customize this document to address specific requirements or scenarios. For instance, a principal may choose to limit the agent's powers to only certain types of accounts, or grant authority for a specific period of time. These modifications can be made in consultation with a legal professional to ensure compliance with state laws and individual circumstances.The King Washington Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an authorized agent or attorney-in-fact the power to manage and make decisions regarding a specific individual's bank accounts in the state of Washington. This type of power of attorney is designed to provide the agent with the authority to handle various financial matters on behalf of the principal. This document is particularly useful for individuals who may be unable to personally manage their bank accounts due to physical or mental incapacity, absence, or any other reason. By appointing a trusted agent, the principal can ensure that their bank accounts are properly managed and protected. The King Washington Special Durable Power of Attorney for Bank Account Matters empowers the agent to perform a wide range of tasks relating to the principal's bank accounts. These tasks may include, but are not limited to: 1. Depositing and withdrawing funds: The agent can access the principal's accounts to make deposits, withdrawals, and other necessary transactions. 2. Paying bills and expenses: The agent can use the funds in the principal's accounts to pay bills, mortgage payments, medical expenses, and any other financial obligations. 3. Managing investments: If authorized, the agent can handle investment-related matters, such as buying or selling stocks, bonds, or other securities on behalf of the principal. 4. Opening and closing accounts: The agent has the authority to open new accounts or close existing ones, as needed. 5. Accessing account information: The agent can obtain bank statements, account balances, and other relevant information to effectively manage the principal's accounts. It's important to note that a King Washington Special Durable Power of Attorney for Bank Account Matters can be tailored to meet specific needs and requirements of the principal. The document can include limitations, restrictions, or any additional provisions that the principal wishes to impose. Although the term "King Washington Special Durable Power of Attorney for Bank Account Matters" does not specifically refer to different types or variations of the power of attorney, it is possible to modify or customize this document to address specific requirements or scenarios. For instance, a principal may choose to limit the agent's powers to only certain types of accounts, or grant authority for a specific period of time. These modifications can be made in consultation with a legal professional to ensure compliance with state laws and individual circumstances.