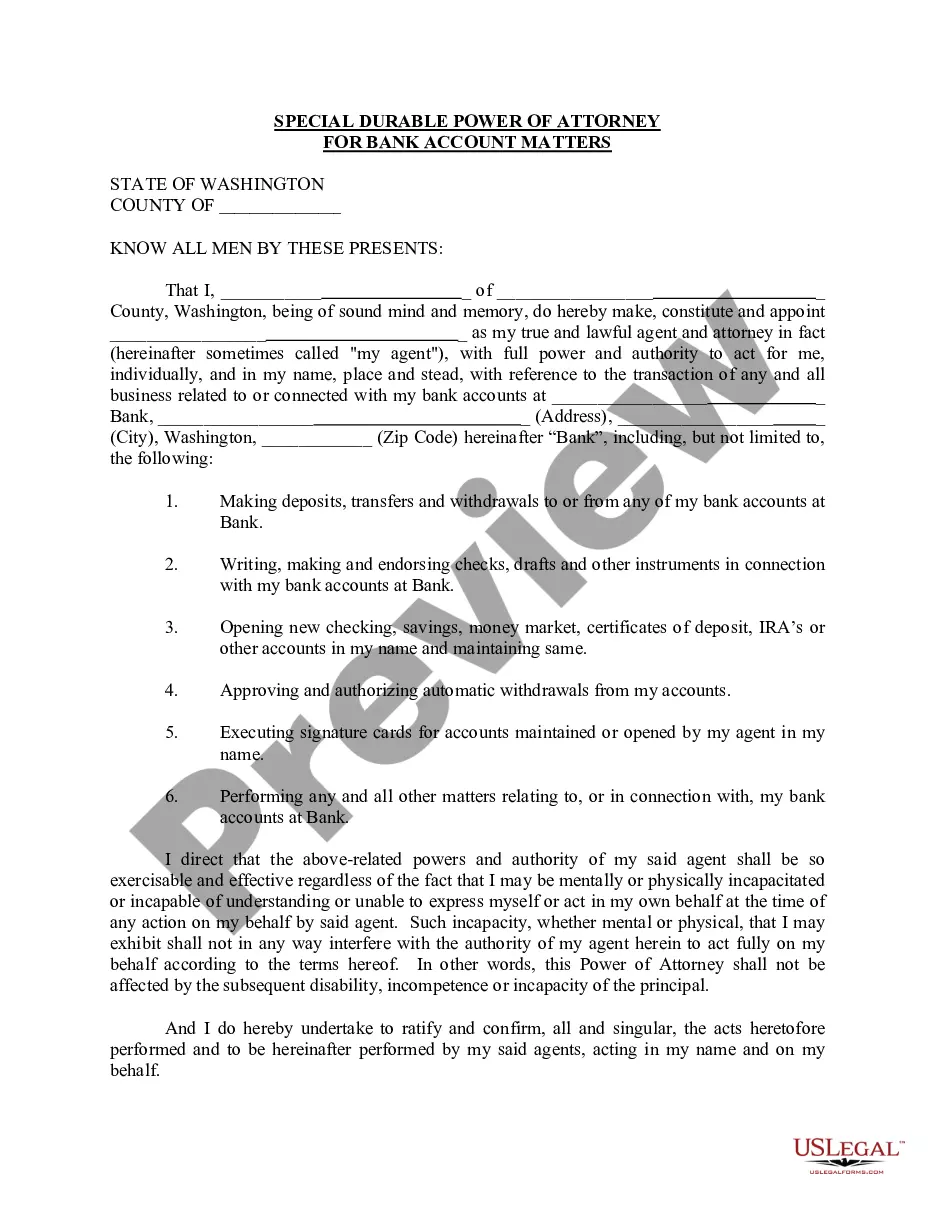

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

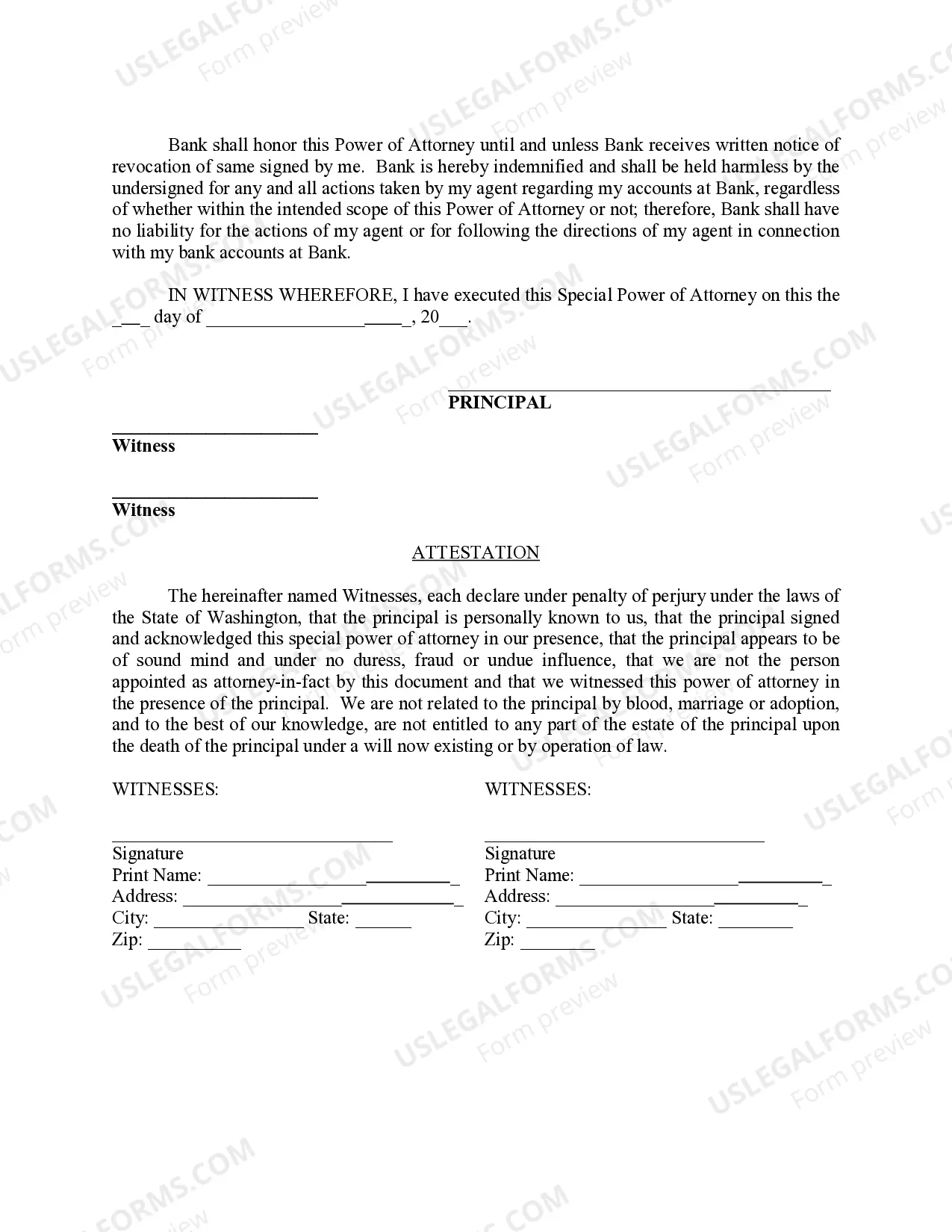

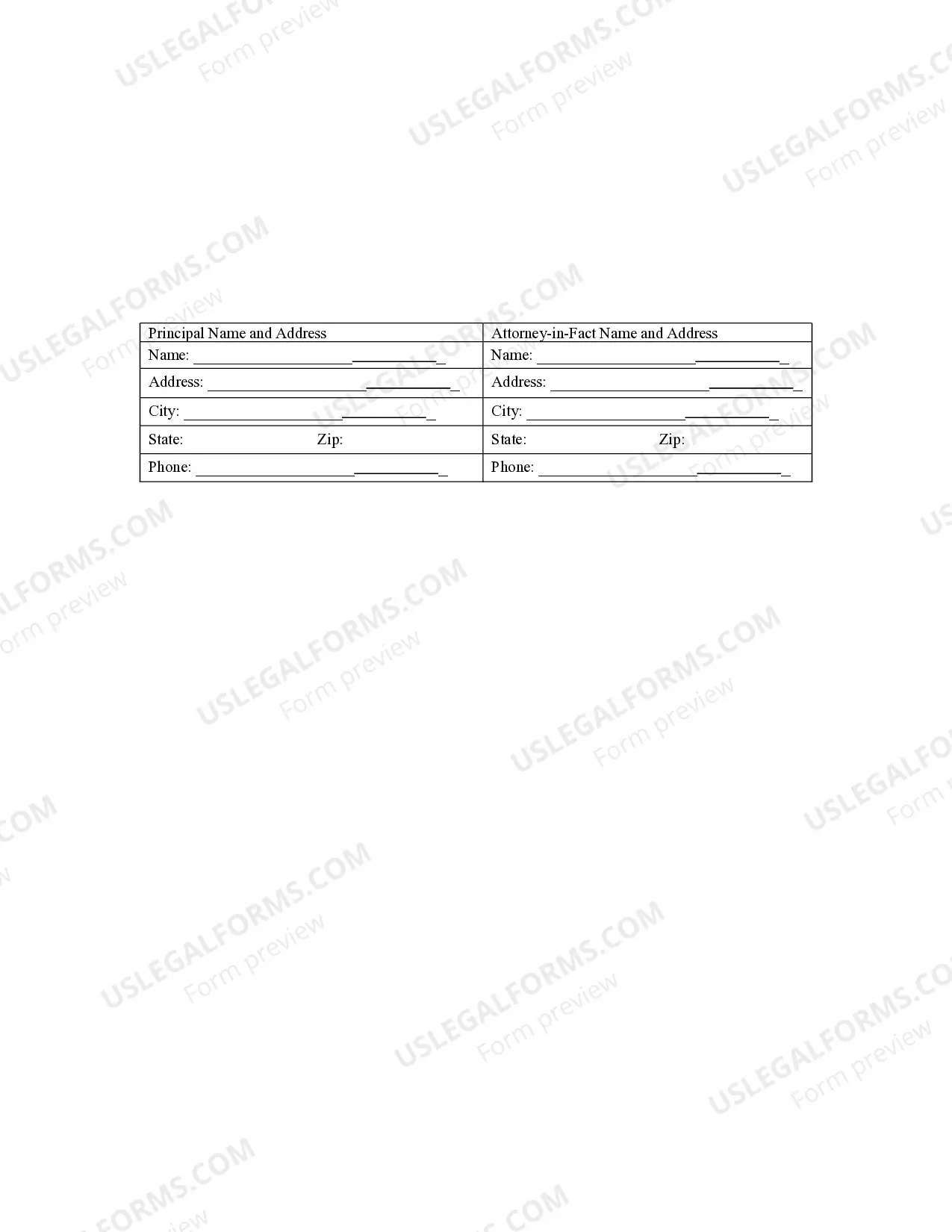

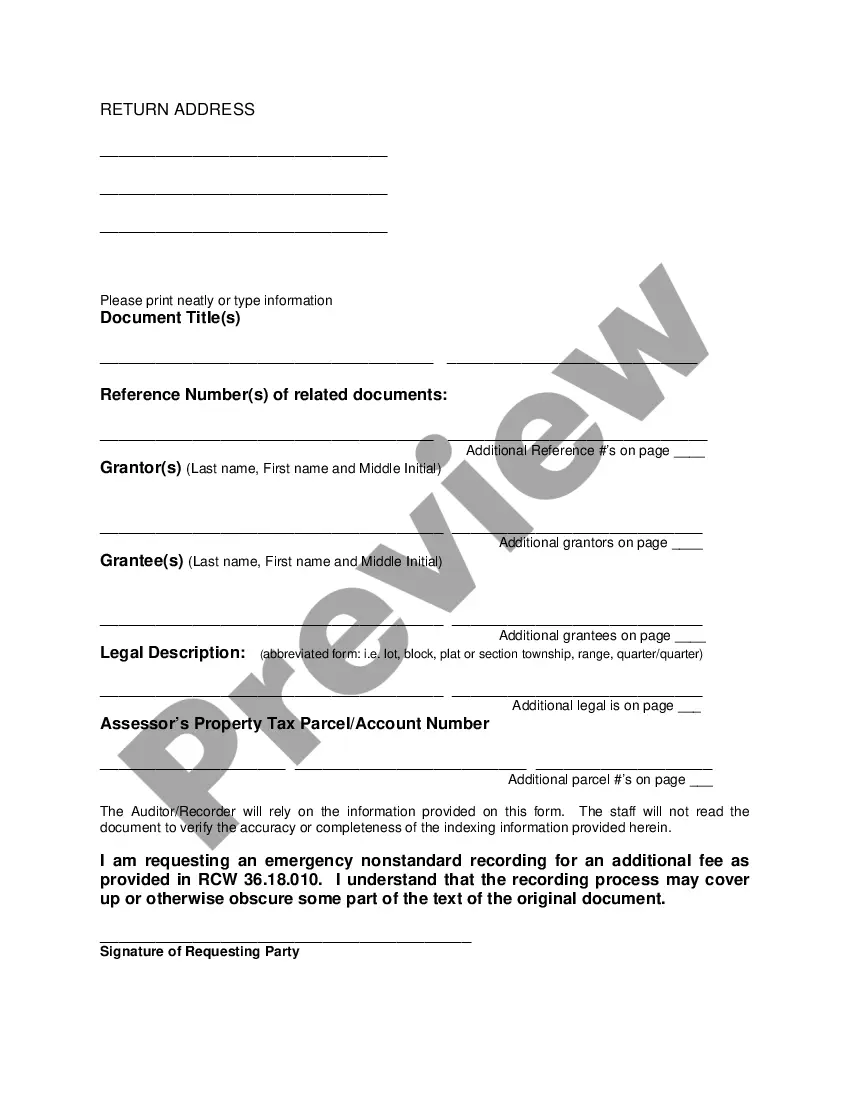

Title: Understanding the Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters Introduction: The Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters is a legal document that grants specific powers to an individual, known as the agent or attorney-in-fact, to handle important financial matters related to a person's bank accounts within the Spokane Valley region. This power of attorney ensures that someone trusted can manage financial affairs when an individual is unable or unwilling to do so themselves. Let's delve into the details of this specialized legal document. Types of Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants specific, limited powers to the agent who can only act on behalf of the principal (the person granting the power) for designated bank account matters. It comes with restrictions, allowing the agent to handle only the specified financial tasks detailed within the document. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, the general special durable power of attorney gives the agent broad authority over the principal's bank accounts and financial affairs. The agent can perform a range of tasks, such as making deposits, withdrawals, managing investments, paying bills, and dealing with financial institutions on behalf of the principal. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney is one that becomes effective only under certain conditions, typically when the principal becomes incapacitated or unable to manage their own finances. This type of durable power of attorney ensures that the agent steps in to handle the bank account matters when necessary. Key Aspects of Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters: 1. Durability: The power of attorney remains in effect even if the principal becomes incapacitated. It provides the agent with the authority to manage the principal's bank accounts without requiring additional legal steps or court intervention. 2. Specialization: The power of attorney is tailored specifically to bank account matters within the Spokane Valley region. It enables the agent to conduct financial transactions, monitor accounts, and handle associated tasks on behalf of the principal. 3. Decision-Making Authority: The agent has the power to make decisions related to the principal's bank accounts. This includes opening or closing accounts, managing investments, making purchases, signing checks, and conducting transactions within the parameters stipulated in the power of attorney document. 4. Revocability: The principal possesses the right to revoke or modify the power of attorney at any time, as long as they are mentally competent and able to express their wishes. It ensures that the principal maintains control and can change or terminate the power granted to the agent if circumstances change. Conclusion: The Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters allows individuals to designate a trusted agent to handle their financial affairs with respect to their bank accounts. Whether it be a limited, general, or springing power of attorney, this legal document has various types to cater to specific needs. Granting this power ensures that competent and responsible individuals manage the bank account matters in compliance with the desires and interests of the principal.Title: Understanding the Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters Introduction: The Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters is a legal document that grants specific powers to an individual, known as the agent or attorney-in-fact, to handle important financial matters related to a person's bank accounts within the Spokane Valley region. This power of attorney ensures that someone trusted can manage financial affairs when an individual is unable or unwilling to do so themselves. Let's delve into the details of this specialized legal document. Types of Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants specific, limited powers to the agent who can only act on behalf of the principal (the person granting the power) for designated bank account matters. It comes with restrictions, allowing the agent to handle only the specified financial tasks detailed within the document. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, the general special durable power of attorney gives the agent broad authority over the principal's bank accounts and financial affairs. The agent can perform a range of tasks, such as making deposits, withdrawals, managing investments, paying bills, and dealing with financial institutions on behalf of the principal. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney is one that becomes effective only under certain conditions, typically when the principal becomes incapacitated or unable to manage their own finances. This type of durable power of attorney ensures that the agent steps in to handle the bank account matters when necessary. Key Aspects of Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters: 1. Durability: The power of attorney remains in effect even if the principal becomes incapacitated. It provides the agent with the authority to manage the principal's bank accounts without requiring additional legal steps or court intervention. 2. Specialization: The power of attorney is tailored specifically to bank account matters within the Spokane Valley region. It enables the agent to conduct financial transactions, monitor accounts, and handle associated tasks on behalf of the principal. 3. Decision-Making Authority: The agent has the power to make decisions related to the principal's bank accounts. This includes opening or closing accounts, managing investments, making purchases, signing checks, and conducting transactions within the parameters stipulated in the power of attorney document. 4. Revocability: The principal possesses the right to revoke or modify the power of attorney at any time, as long as they are mentally competent and able to express their wishes. It ensures that the principal maintains control and can change or terminate the power granted to the agent if circumstances change. Conclusion: The Spokane Valley Washington Special Durable Power of Attorney for Bank Account Matters allows individuals to designate a trusted agent to handle their financial affairs with respect to their bank accounts. Whether it be a limited, general, or springing power of attorney, this legal document has various types to cater to specific needs. Granting this power ensures that competent and responsible individuals manage the bank account matters in compliance with the desires and interests of the principal.